Wyoming Close Corporation With Irs

Description

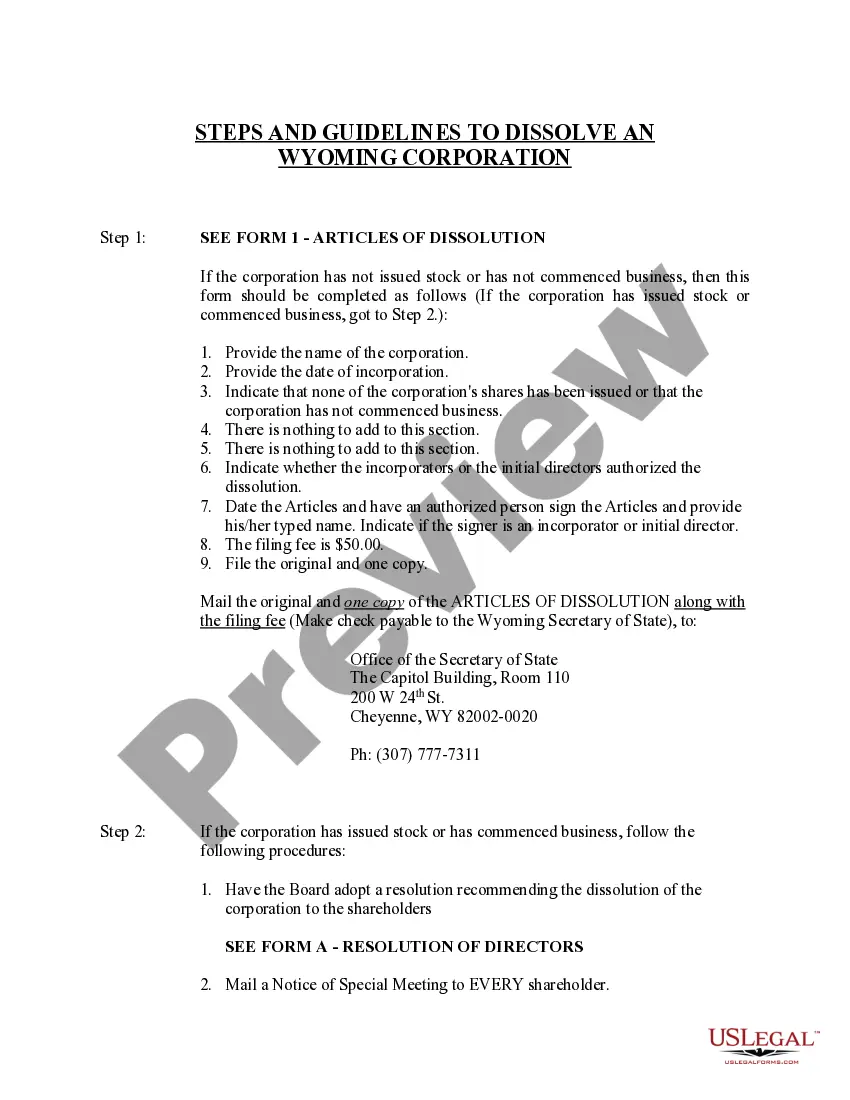

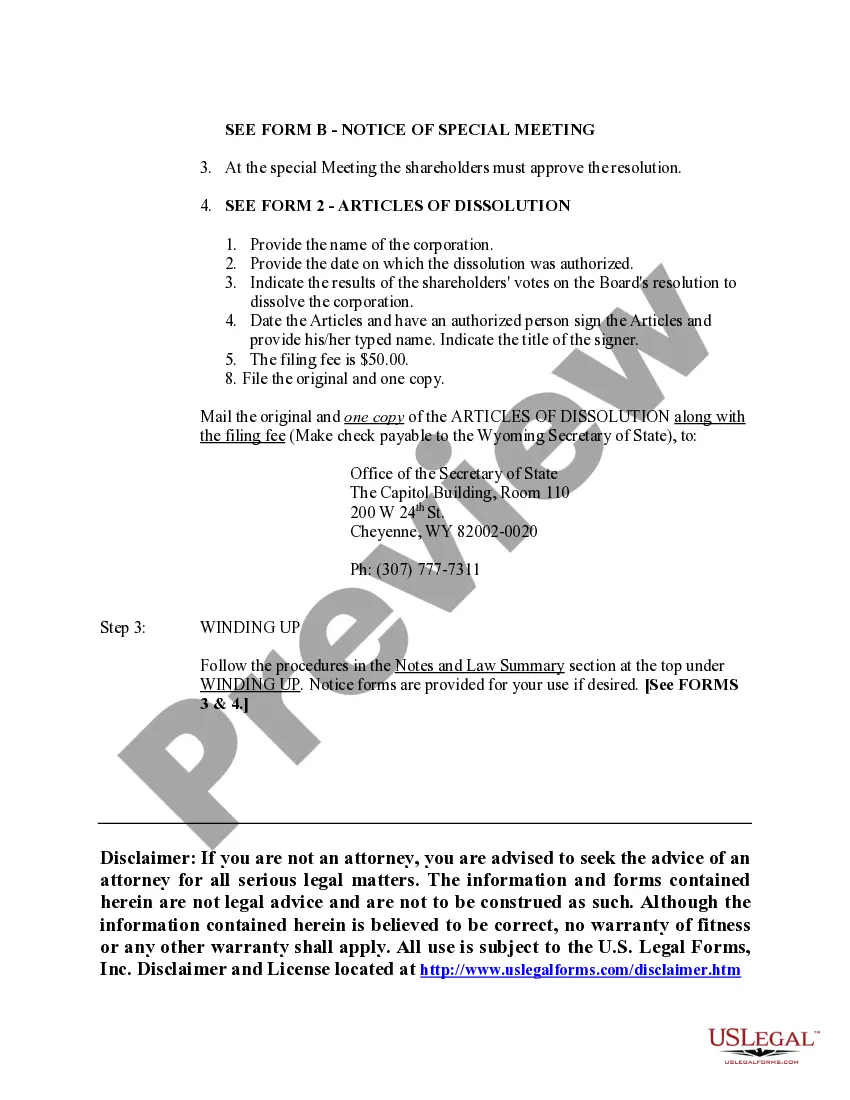

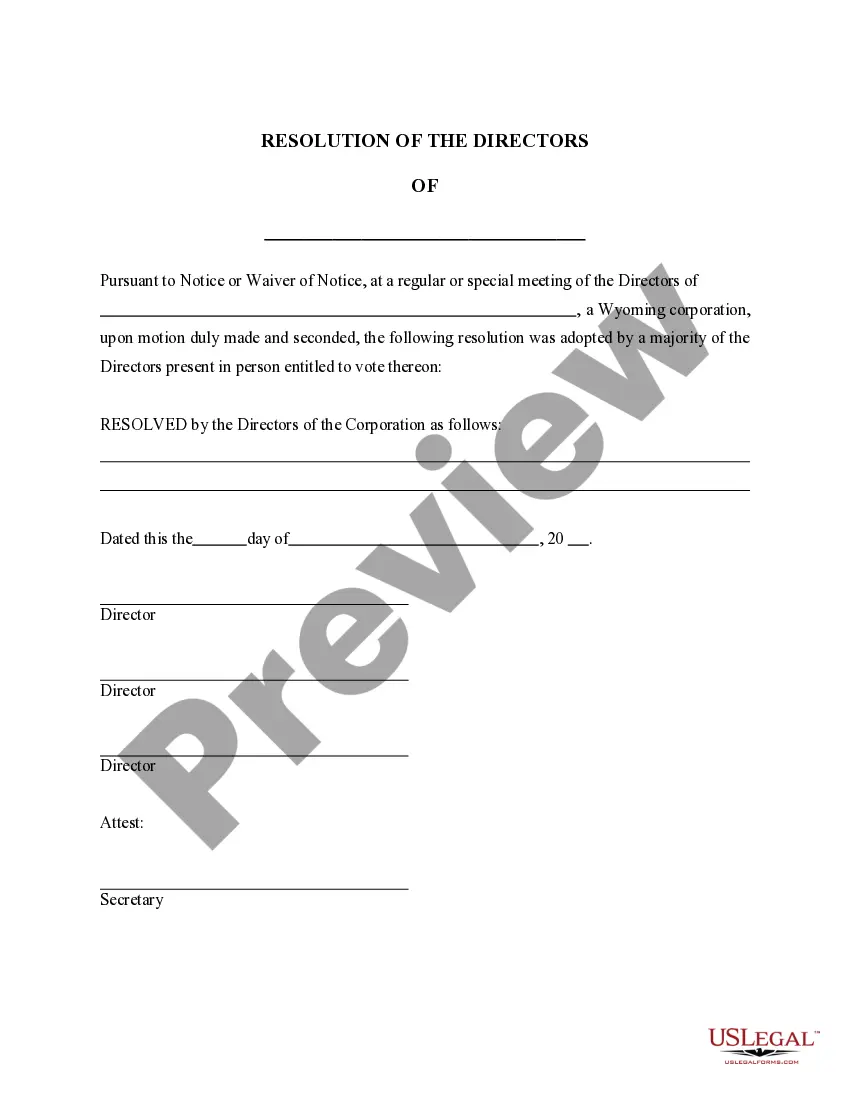

How to fill out Wyoming Dissolution Package To Dissolve Corporation?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and significant financial investment.

If you are looking for a more direct and budget-friendly method to formulate Wyoming Close Corporation With IRS or any other paperwork without excessive obstacles, US Legal Forms is always accessible to you.

Our online repository of more than 85,000 current legal documents encompasses nearly every element of your financial, legal, and personal affairs.

Before proceeding directly to download Wyoming Close Corporation With IRS, follow these recommendations: Check the form preview and descriptions to ensure you are on the correct document you seek. Verify that the form you select meets your state and county requirements. Choose the appropriate subscription plan to obtain the Wyoming Close Corporation With IRS. Download the form, then complete, certify, and print it. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make document execution a simple and efficient process!

- With just a few clicks, you can swiftly obtain state-specific and county-specific templates expertly crafted by our legal professionals.

- Utilize our platform whenever you require a dependable and trustworthy service to quickly find and download the Wyoming Close Corporation With IRS.

- If you are familiar with our services and have previously created an account with us, simply Log In, select the template, and download it or retrieve it anytime from the My documents section.

- Don't have an account? No worries. It only takes a few minutes to sign up and browse the catalog.

Form popularity

FAQ

To start a corporation in Wyoming, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State. You can file this document online or by mail. The articles cost $100 to file.

The Close LLC is designed with small businesses in mind. The Wyoming LLC Act allows close companies to sidestep onerous formalities while otherwise keeping the benefits of a Wyoming LLC. Generally, the designation is for single-member LLCs and for when members are close to one another, i.e. family and close friends.

It costs $199 to incorporate your business in Wyoming for the first year. Subsequent years will require a $52 annual report and our $59 Wyoming registered agent service. Every $199 corporation includes: State Filing Fee.

A formal dissolution requires submitting Articles of Dissolution and a $50 check to the Wyoming Secretary of State. Once received, there is a 3-5 day processing time before the documents are filed online and the company is formally closed.

Wyoming laws on close corps allow small corporations to forego many traditional corporate formalities, while still enjoying the benefits. A departure from regular business corporations, Close Corporations do not require a board of directors, this means ongoing operations generate less paperwork.