Filing Lien For Unpaid Work

Description

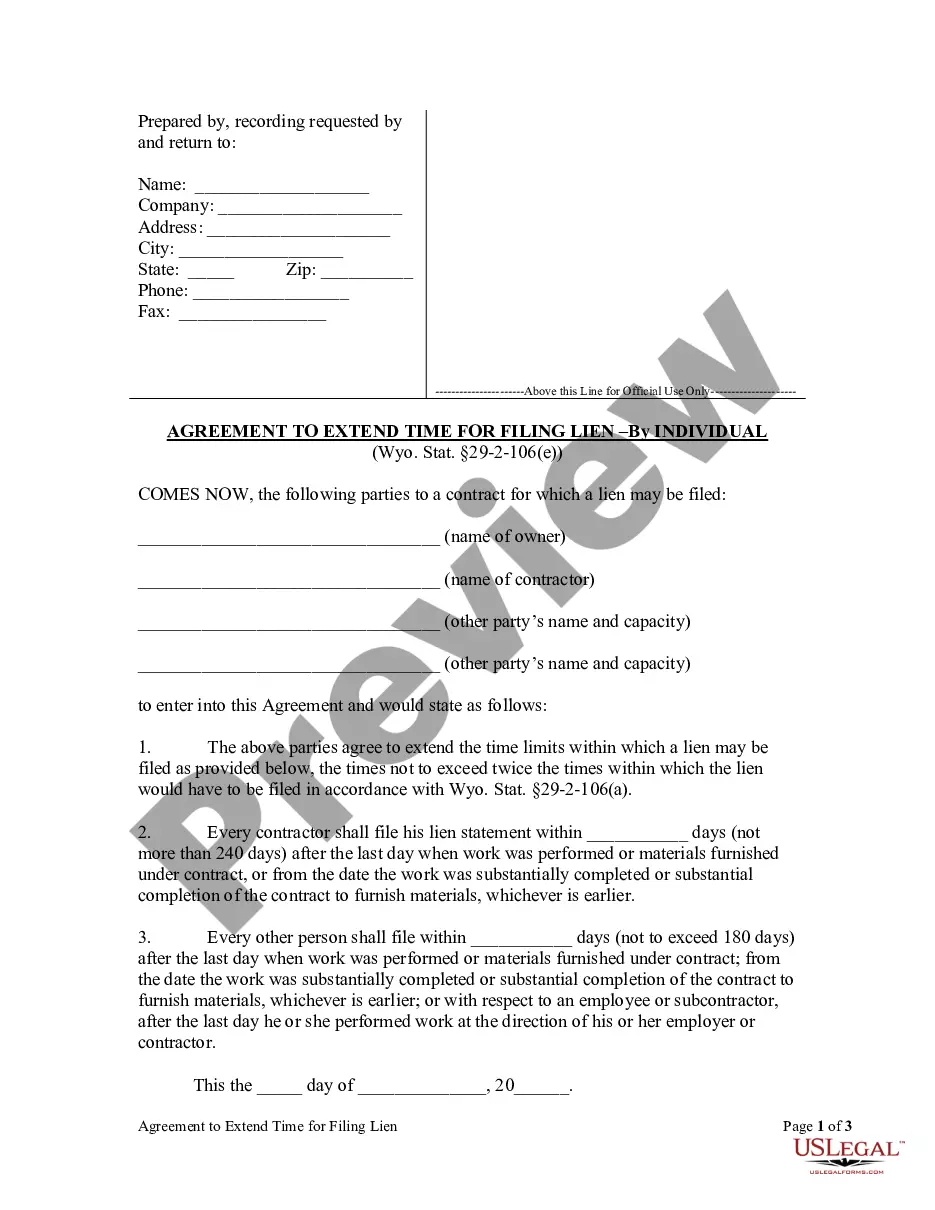

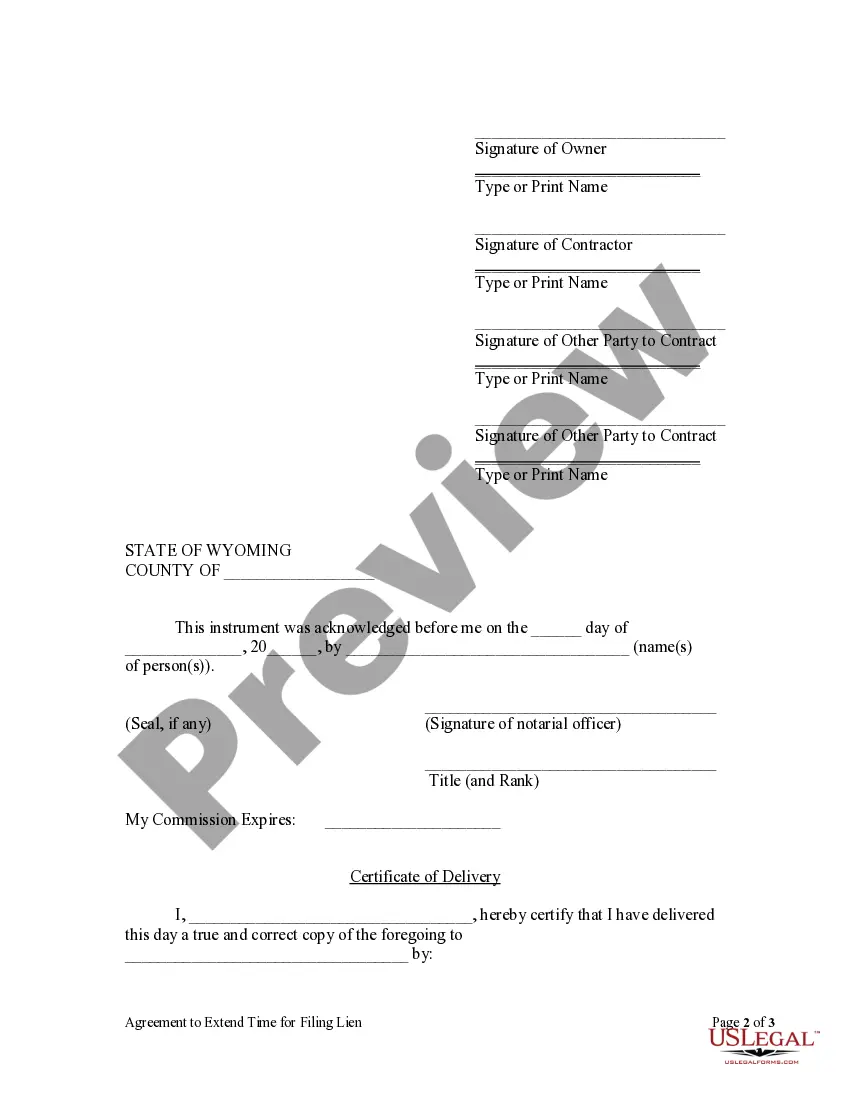

How to fill out Wyoming Agreement To Extend Time For Filing Lien - Individual?

- Log into your US Legal Forms account if you have used the service before. Verify your subscription remains active to access your saved forms.

- If you are new to US Legal Forms, start by browsing the extensive online library containing more than 85,000 editable legal documents. Use the search feature to find the specific lien form that meets your state and project requirements.

- Review the form description and preview mode to ensure that it aligns with your needs. Confirm that it complies with local jurisdiction regulations.

- Select the preferred subscription plan and click on the 'Buy Now' button. You will need to create an account if you haven't already.

- Finalize your payment using a credit card or your PayPal account, making sure to retain a copy of your transaction.

- Download the completed lien form to your device. You can access it later from the 'My Forms' section of your profile.

Completing these steps allows you to secure your payments effectively. US Legal Forms not only provides a vast collection of legal forms but also connects you with experts who can assist in ensuring that your documents are accurate and legally compliant.

Don't leave your payments to chance—take control and file your lien today! Visit US Legal Forms to get started.

Form popularity

FAQ

While it is possible to file a lien without a formal written contract, having documentation strengthens your case when filing a lien for unpaid work. In many instances, verbal agreements may not hold up in legal settings, so having some form of evidence supporting your claim is advisable. If you find yourself in this situation, consulting resources on platforms like US Legal Forms can help you understand your options.

To file a lien in Ohio, you need to gather specific details including a description of the debt, documentation supporting your claim, and a completed lien form. You may also need to provide proof of the unpaid work such as contracts, invoices, and communication records. Properly preparing these documents is key to a successful filing. You can rely on services like US Legal Forms to provide templates and assistance with the required paperwork.

In Ohio, you generally have six months to file a lien for unpaid work from the date you completed your services or provided materials. Missing this deadline means you forfeit your right to claim the lien and collect the debt. To protect your interests, prompt action is crucial to ensure that your claim is valid. Platforms like US Legal Forms can help you stay organized and informed about filing timelines.

The minimum amount required to file a lien in Ohio varies depending on the type of lien you are filing. Generally, there is no specific minimum amount set, but you need to ensure that the amount due justifies the filing. Filing a lien for unpaid work makes more financial sense when the amount owed covers your costs. You can check with local laws or platforms like US Legal Forms for more details.

To put a lien on a car title in Ohio, you need to complete the necessary forms and submit them to the appropriate title agency. You typically must provide a signed lien statement along with proof of the unpaid work that justifies the lien. Filing a lien for unpaid work on a car serves to notify others of your claim. You can use resources like US Legal Forms to access the right documents and get guidance through the process.

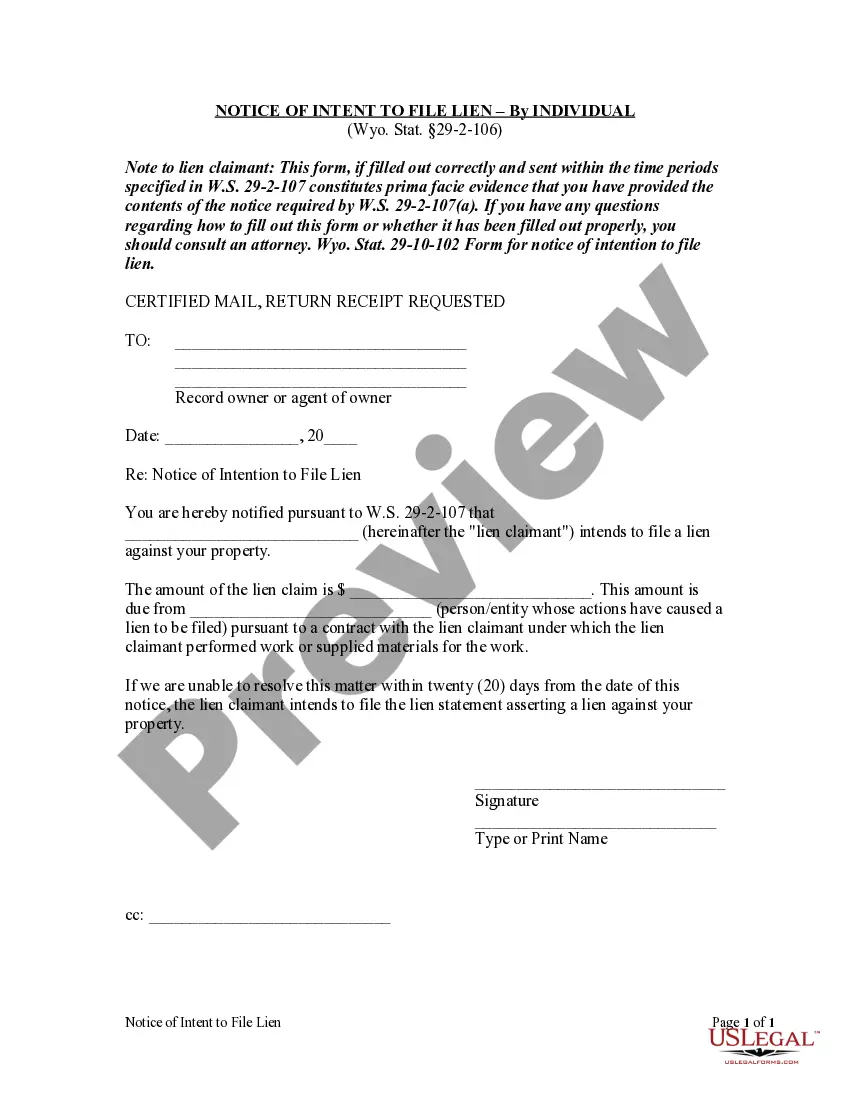

The conditions for filing a lien generally include the completion of work or delivery of goods, an outstanding payment owed, and proper notification to the property owner. Additionally, specific legal requirements may vary by state, so it's important to understand local laws. Filing a lien for unpaid work typically requires you to document the agreement and provide evidence of the unpaid amount. Following these guidelines can ensure that your lien is enforced effectively.

An unpaid lien occurs when a debt remains unsettled despite the existence of a legal claim against the property. In the context of filing a lien for unpaid work, this can arise when a service provider completes their work and the property owner fails to make payment. An unpaid lien can create significant difficulties for both the creditor and the debtor. Resolving unpaid liens promptly is essential to avoid further legal complications.

A person may put a lien on your house by filing the proper legal forms with the county recorder’s office, often without your immediate awareness. This usually happens when they believe they are owed for unpaid work. To prevent surprises, it is vital to stay vigilant about any services or work completed on your property. If you face potential liens, US Legal Forms offers valuable tools to help you address the situation proactively.

In Rhode Island, a lien for unpaid work typically remains effective for 10 years from the date of recording. It's essential to understand that this period can affect your property rights and your ability to sell or refinance your property. After this time, the lien can be removed through a legal process. If you need assistance navigating this process, US Legal Forms can provide resources to help you manage your lien effectively.

You can check for liens in Alabama by visiting your local county courthouse or accessing their online records. Most counties offer searchable databases where you can find information about existing liens. This process helps you stay informed before engaging in financial transactions that may be affected by other lien filings. Knowing the status of liens is crucial, especially when you plan to file a lien for unpaid work.