File Lien For Nonpayment

Description

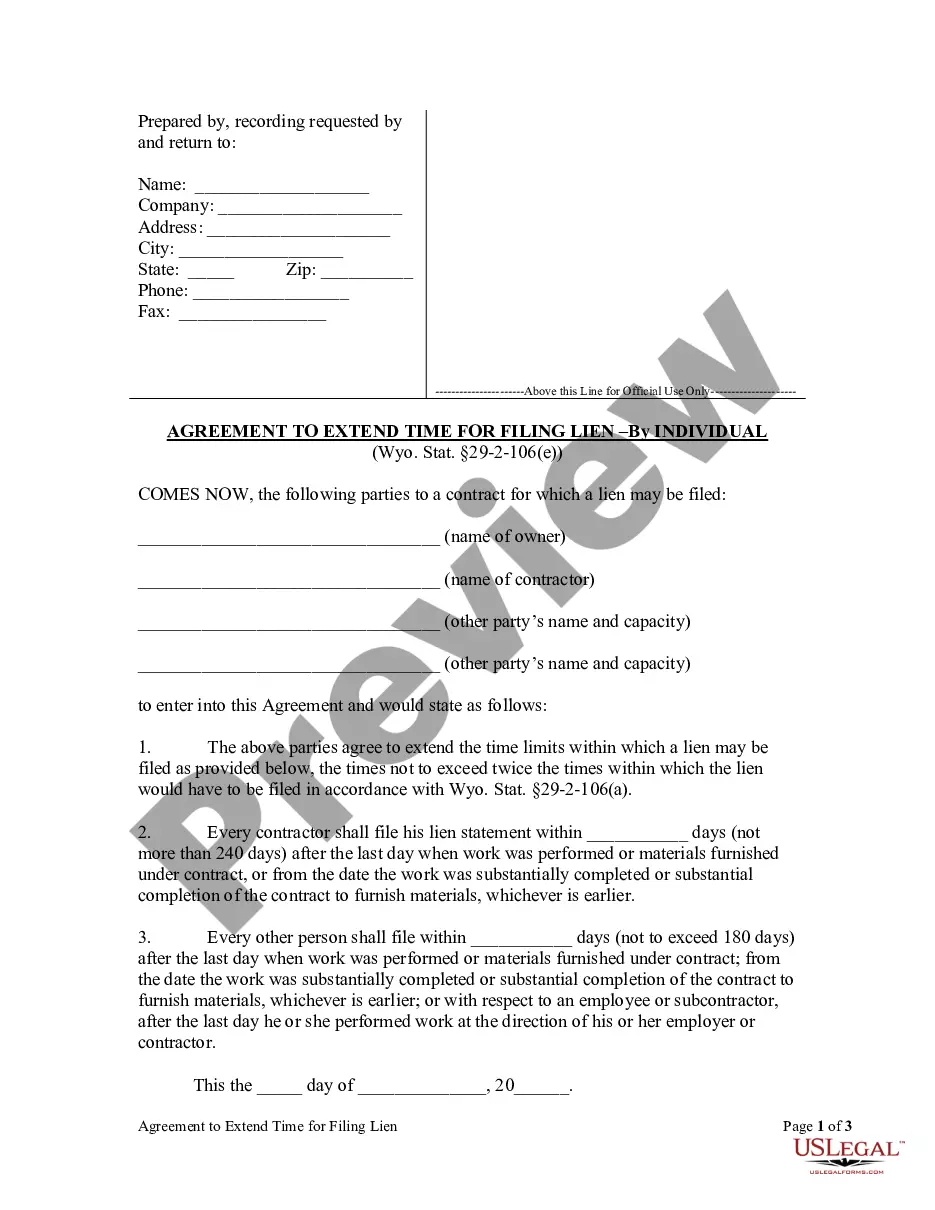

How to fill out Wyoming Agreement To Extend Time For Filing Lien - Individual?

- If you're a returning user, log into your account to access previous templates. Ensure your subscription is active; if not, renew it as per your payment plan.

- For first-time users, start by selecting the correct form. Utilize the Preview mode and review the form description to confirm it meets your local jurisdiction requirements.

- If you need a different template, use the Search tab at the top to locate a suitable option for your needs.

- Once you have the correct document, click on the Buy Now button and select a subscription plan that aligns with your requirements.

- Complete your purchase by entering your credit card information or opting for PayPal to finalize the transaction.

- After payment, download your form to your device. You can revisit it anytime from the My Forms section of your profile.

In conclusion, US Legal Forms provides a comprehensive solution for filing liens efficiently. Their extensive library, combined with access to premium experts, ensures that you have everything you need to create precise and legally sound documents.

Don’t hesitate—start using US Legal Forms today to streamline your lien-filing process!

Form popularity

FAQ

While filing a lien for nonpayment can be beneficial, there are some disadvantages to consider. A lien may impact the debtor’s credit score, which could lead to disputes or hostility. Additionally, pursuing a lien can require legal fees and time in some cases. It’s wise to evaluate all your options and consider consulting with a platform like US Legal Forms to assess the best course of action for your situation.

In Indiana, you generally have 90 days to file a lien for nonpayment once the payment due date has passed. This timeframe is crucial, as failing to file within this period could hinder your ability to claim your debt. Timely action ensures your security interest is protected under the law. Using services like US Legal Forms can help you keep track of deadlines and streamline your filing process.

Yes, you can file a lien online using platforms like US Legal Forms. This option allows you to complete the process conveniently from anywhere, saving you time and effort. It's a great way to file lien for nonpayment without navigating the complexities of traditional methods. By utilizing an online service, you can ensure you follow the correct procedures and requirements.

Limitations on a lien refer to the maximum time a creditor has to enforce their claim. Typically, a lien for nonpayment must be enforced within a certain timeframe, which varies by state. In many cases, failure to act within this time limit may result in losing the right to enforce the lien, making it essential to stay informed and proactive throughout the process.

The minimum amount required to file a lien can differ based on state laws and the type of debt. In many cases, there is no minimum amount stipulated, allowing you to file a lien for any unpaid balance. If you need assistance determining the specifics related to your situation, consider using uslegalforms to help navigate the requirements.

In Indiana, the timeframe to file a lien varies based on the type of lien. Typically, you have to file a lien for nonpayment within 90 days after the last date you provided your services or materials. It’s crucial to act quickly to protect your rights, so consider using platforms like uslegalforms for straightforward guidance on the process.

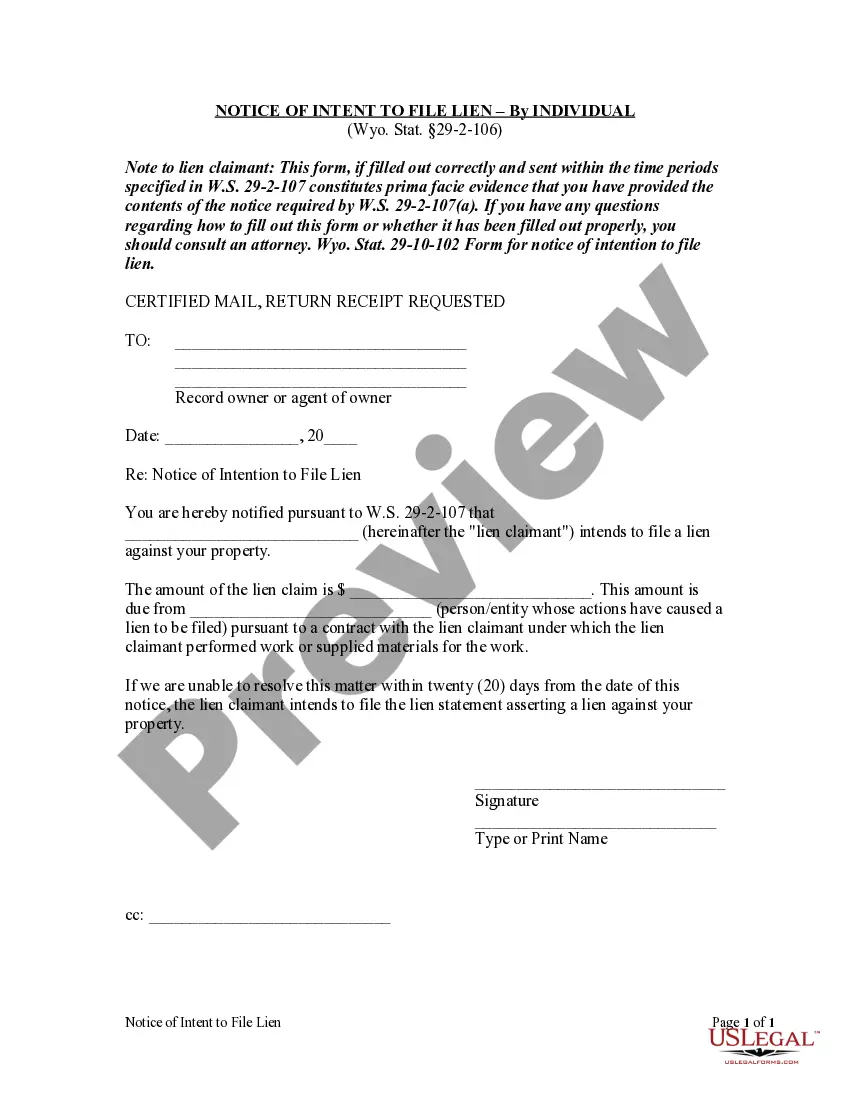

A lien serves as a legal claim against someone's property, ensuring that you have a right to payment for services or goods rendered. When you need to file a lien for nonpayment, it protects your interests by guaranteeing that any amount owed is secured by the property value. This mechanism encourages prompt payment, as the property owner may be motivated to settle their debts to avoid losing their assets.

In South Carolina, lien laws allow you to file a lien for nonpayment when a debt remains unpaid. This legal right ensures that you can secure an interest in property to recover the owed amount. To file a lien for nonpayment, you must follow specific procedures and deadlines, which can vary based on the nature of the debt. Utilizing platforms like US Legal Forms can simplify the process, providing you with the necessary documents and guidance to ensure compliance with state laws.

In some cases, it is possible to file a lien for nonpayment on your house without a formal contract. For instance, if goods or services were provided and payment was not made, a creditor can pursue a lien based on implied agreements. However, the specific requirements can vary by state, so it's essential to know your rights. Utilizing resources like USLegalForms can help clarify these requirements and provide necessary documentation.

The conditions for filing a lien for nonpayment typically involve a legal obligation or contract that has not been fulfilled. Creditors must demonstrate that a debt is owed and follow specific legal procedures to place the lien. Factors such as unpaid services, loans, or legal judgments usually apply. It is crucial to understand these conditions to recognize your rights and responsibilities.