Wyoming Corporation Benefits Formation

Description

How to fill out Wyoming Pre-Incorporation Agreement, Shareholders Agreement And Confidentiality Agreement?

Drafting legal documents from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more affordable way of preparing Wyoming Corporation Benefits Formation or any other documents without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of more than 85,000 up-to-date legal forms covers almost every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant templates diligently put together for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can quickly find and download the Wyoming Corporation Benefits Formation. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to set it up and navigate the library. But before jumping directly to downloading Wyoming Corporation Benefits Formation, follow these tips:

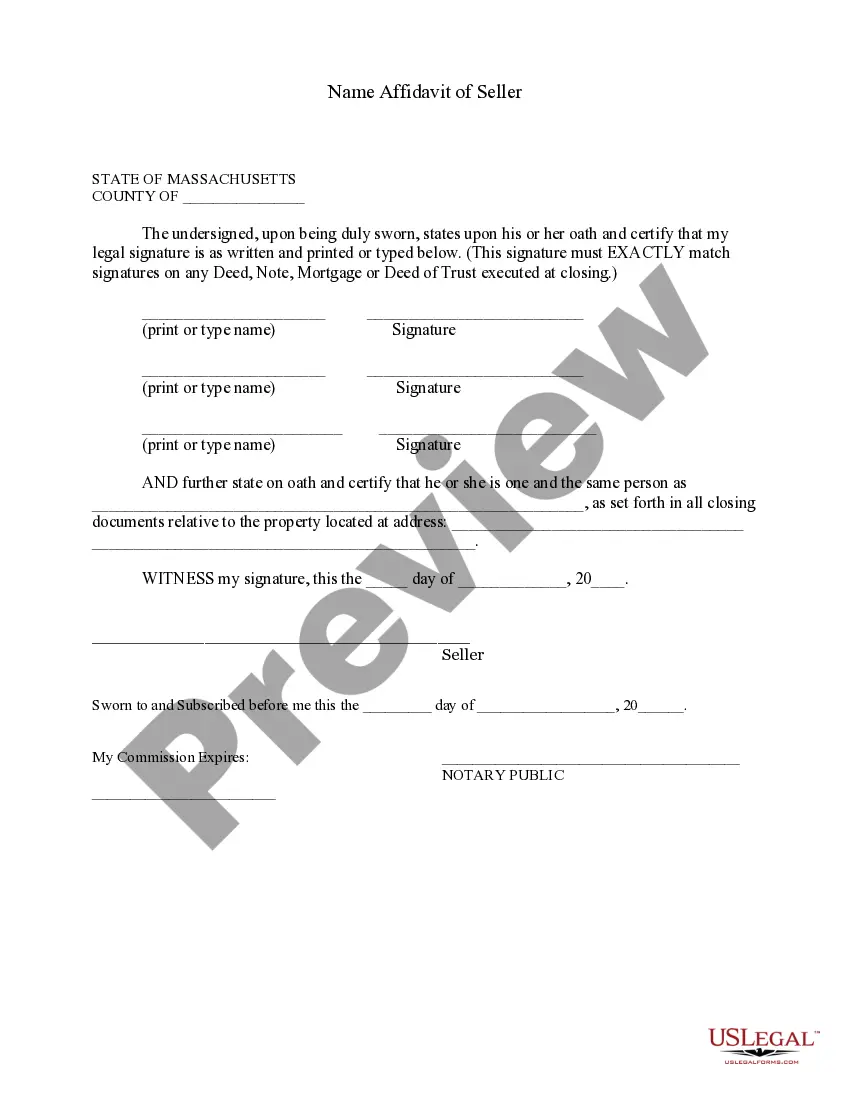

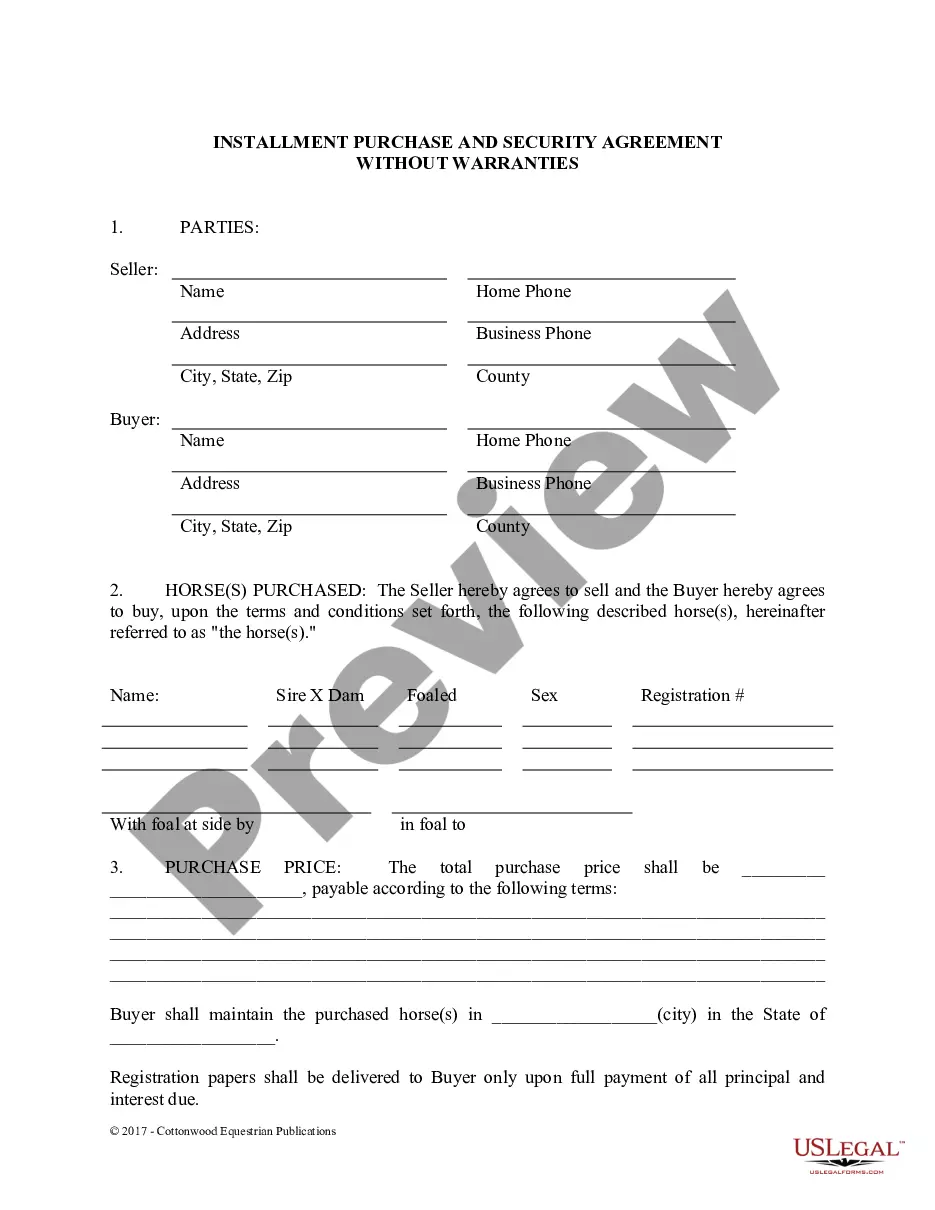

- Check the document preview and descriptions to make sure you are on the the document you are searching for.

- Make sure the form you choose conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to get the Wyoming Corporation Benefits Formation.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us now and turn form completion into something easy and streamlined!

Form popularity

FAQ

Wyoming offers the strongest asset protection law in the country. The charging order lien is the exclusive creditor remedy, even for single member (one owner) LLCs. Unlike California and other weak states, creditors cannot force a sale of your assets.

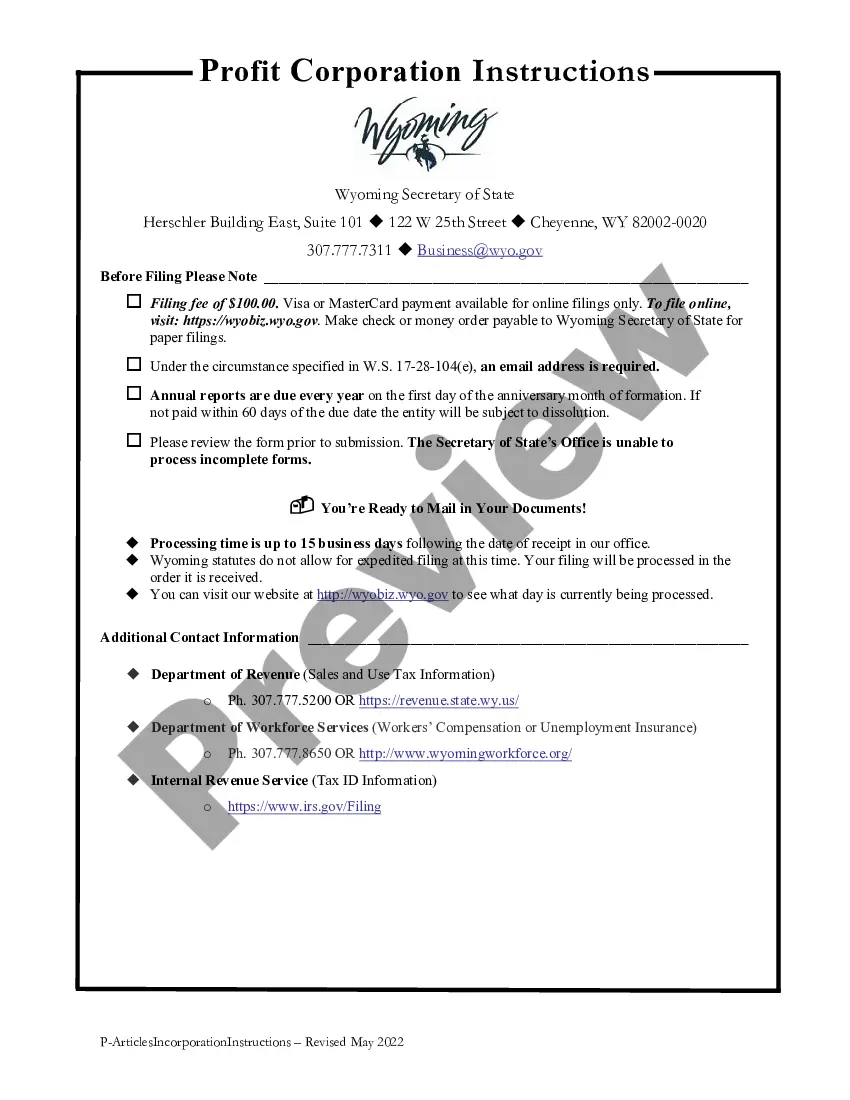

C Corporation ? For a business to incorporate in Wyoming, the state requires filing Articles of Incorporation, along with a Consent to Appointment by Registered Agent form, and paying a filing fee of $100. Profit Corporations in Wyoming must also appoint a Board of Directors and adopt bylaws.

Below are some of the pros to convince you to form an LLC in Wyoming. Privacy. Wyoming has strict privacy laws to protect the identities of LLC owners and managers. ... Legal Protection. ... Anonymous LLCs. ... Few Regulations and Formalities. ... Minimal Fees. ... Incomplete Anonymity. ... Asset Protection. ... Lack of Corporate Taxes.

Wyoming Corporation Benefits Liability: We offer nation-leading corporate veil protection. This combined with the privacy of a Wyoming corporation gives you safety from creditors. No Taxes: WY does not tax personal or corporate income. This means you are free from state income taxes.

Wyoming LLCs offer the traditional corporate veil which protects personal assets from business creditors. It also offers charging order protection, even for Single-Member LLCs, which protects business assets from personal creditors.