Form A Wyoming Corporation Withholding

Description

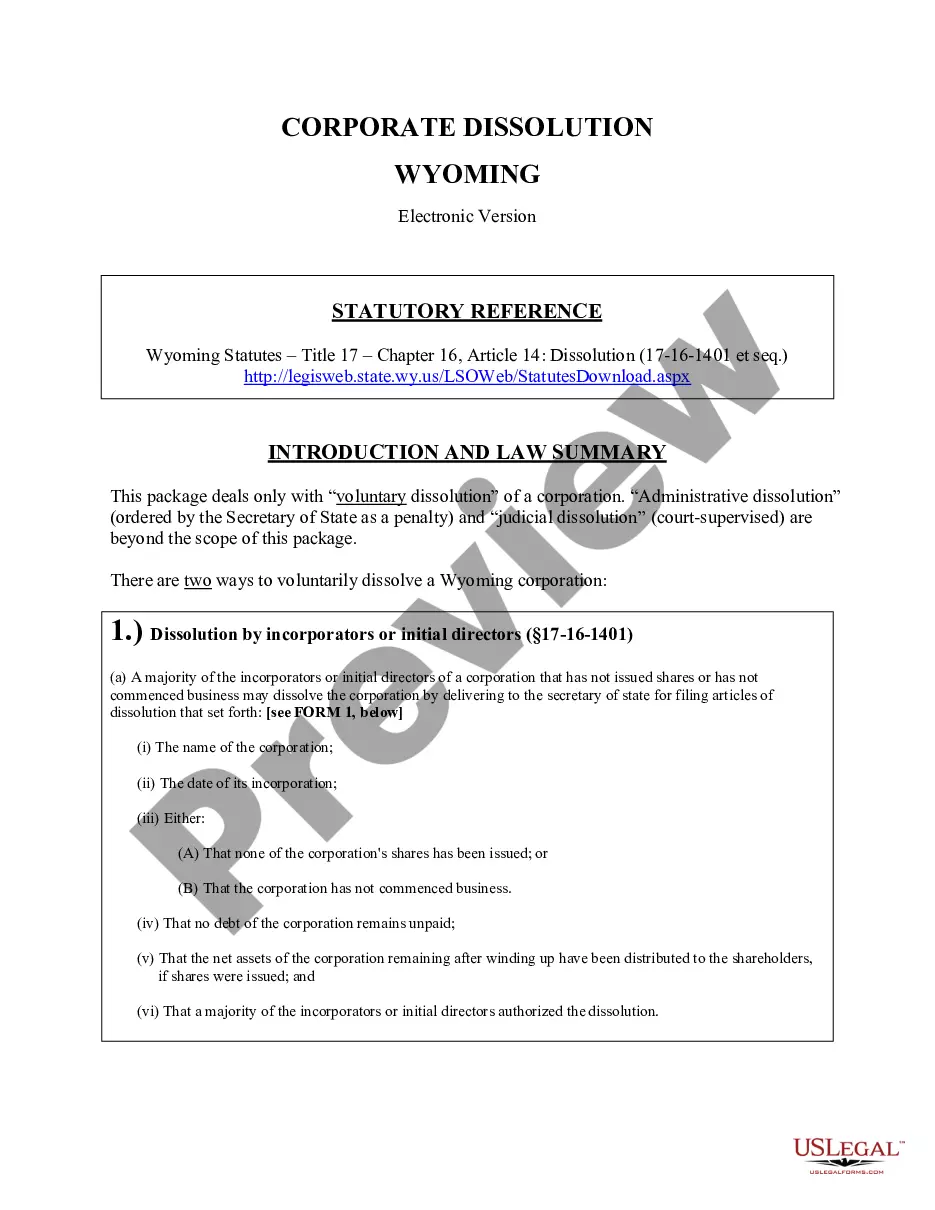

How to fill out Wyoming Business Incorporation Package To Incorporate Corporation?

Getting a go-to place to take the most recent and relevant legal samples is half the struggle of handling bureaucracy. Choosing the right legal files needs precision and attention to detail, which is why it is important to take samples of Form A Wyoming Corporation Withholding only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and check all the information about the document’s use and relevance for the situation and in your state or region.

Take the following steps to finish your Form A Wyoming Corporation Withholding:

- Use the catalog navigation or search field to locate your sample.

- View the form’s description to see if it fits the requirements of your state and region.

- View the form preview, if there is one, to make sure the form is definitely the one you are searching for.

- Resume the search and find the correct template if the Form A Wyoming Corporation Withholding does not fit your requirements.

- If you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your preferences.

- Go on to the registration to finalize your purchase.

- Complete your purchase by choosing a transaction method (bank card or PayPal).

- Choose the document format for downloading Form A Wyoming Corporation Withholding.

- When you have the form on your gadget, you can alter it using the editor or print it and complete it manually.

Remove the inconvenience that comes with your legal paperwork. Check out the comprehensive US Legal Forms catalog to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

Wyoming businesses that operate as C Corporations offer the highest degree of personal liability protection for their owners (shareholders). The C Corporation is a separate entity legally and for tax purposes. The C Corporation reports and pays federal income tax on its profits on its own tax return.

Wyoming C-corp Privacy S-Corporations are different from C-Corporations in that S-Corporations do not have to deal with double taxation and only file taxes annually. There is also a limit to how many shareholders the company may have.

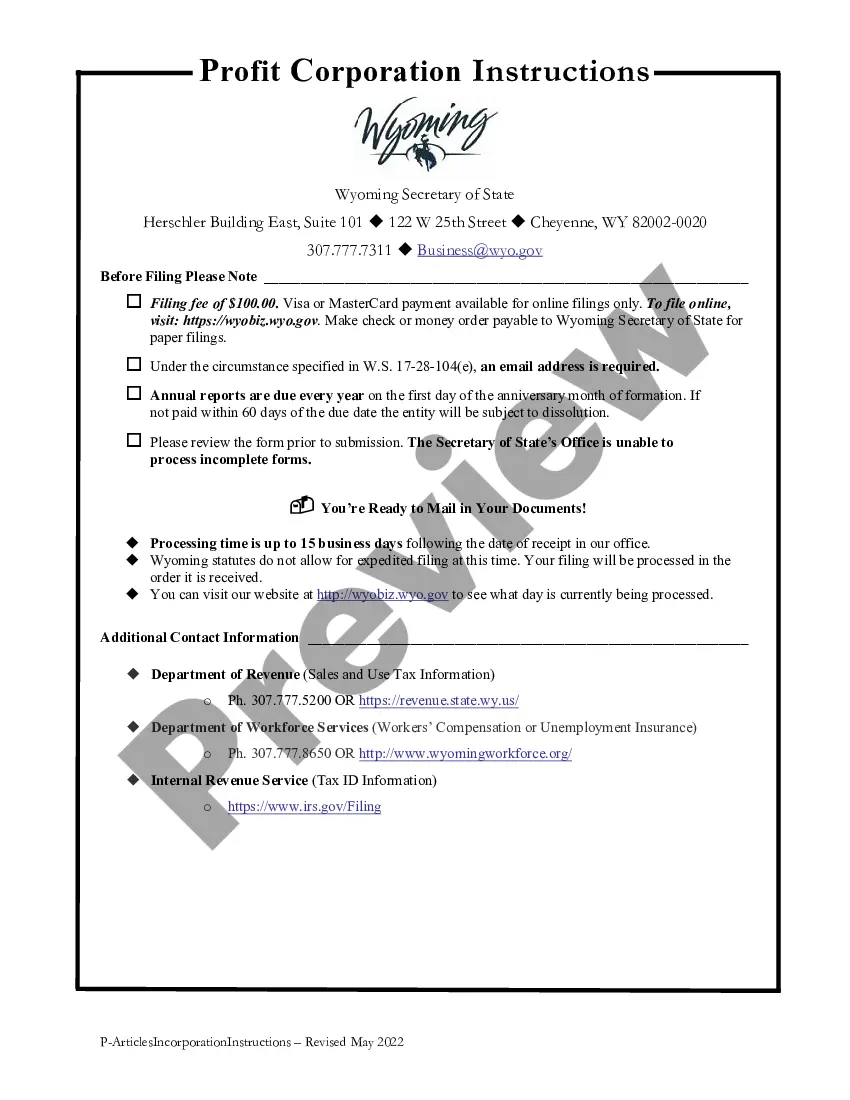

To start a corporation in Wyoming, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State. You can file this document online or by mail. The articles cost $100 to file.

It costs $199 to incorporate your business in Wyoming for the first year. Subsequent years will require a $52 annual report and our $59 Wyoming registered agent service. Every $199 corporation includes: State Filing Fee.

While in most other states, income derived from pass-through entities like partnerships, LLCs, and S-corporations are subject to the state's personal income tax, and C-corporations are subject to its corporate tax, Wyoming has no personal income tax or corporate income tax.