Virginia Foreign Corporation Registration Withdrawal

Description

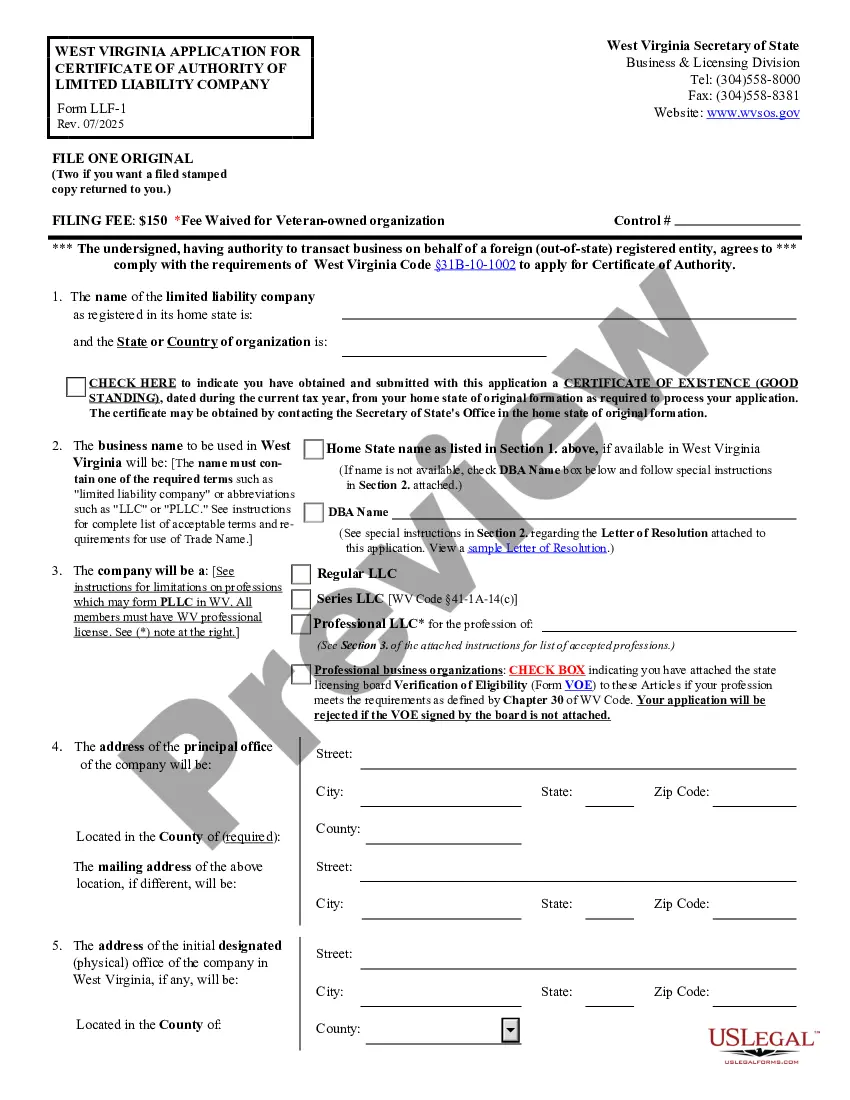

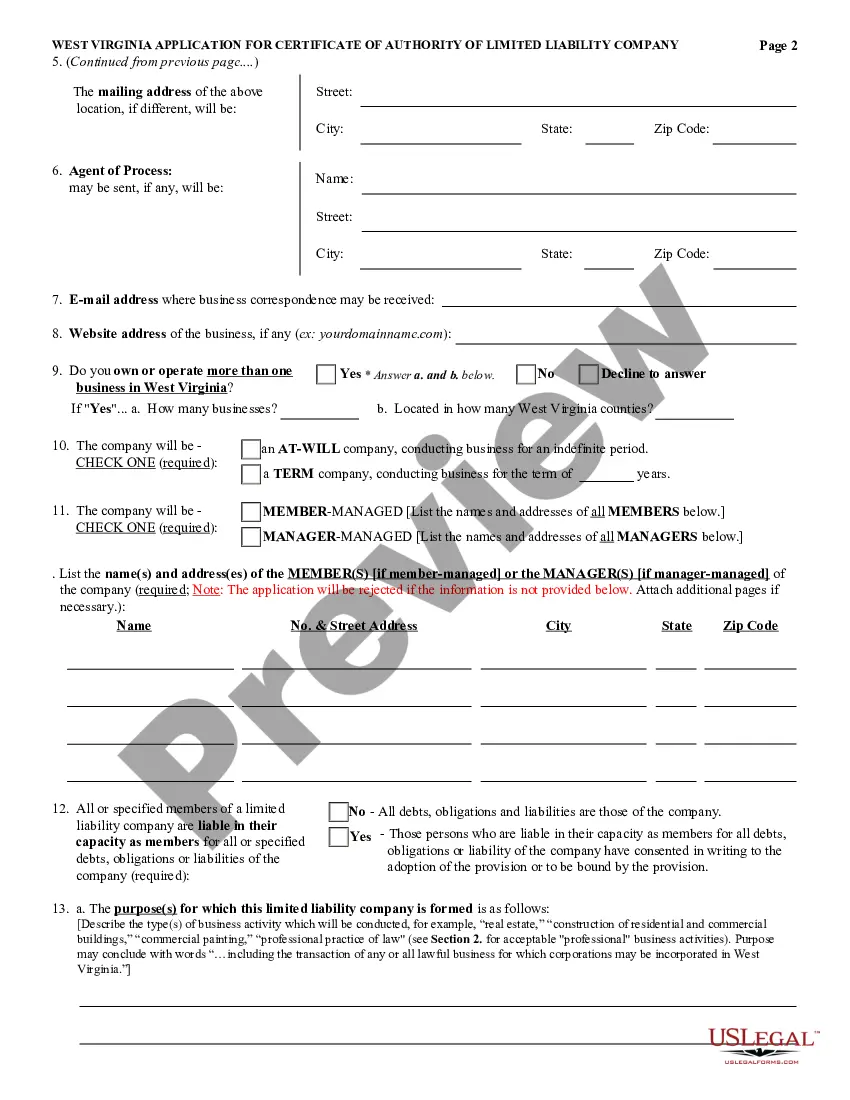

How to fill out West Virginia Registration Of Foreign Corporation?

Individuals often link legal documentation with complexity that only an expert can manage.

In a certain regard, this is accurate, as creating a Virginia Foreign Corporation Registration Withdrawal necessitates significant knowledge of subject matter criteria, encompassing state and county regulations.

Nonetheless, with US Legal Forms, everything has become more user-friendly: pre-prepared legal documents for any personal and business scenario tailored to state laws are compiled in a single online repository and are now accessible to all.

All templates in our collection are reusable: once obtained, they remain saved in your profile. You can access them anytime through the My documents tab. Explore all advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current documents categorized by state and purpose, making it easy to search for Virginia Foreign Corporation Registration Withdrawal or any other specific template in mere minutes.

- Existing users with an active subscription must Log In to their account and click Download to retrieve the form.

- New users will have to establish an account and subscribe before downloading any documentation.

- Here is a detailed guide on how to secure the Virginia Foreign Corporation Registration Withdrawal.

- Examine the content of the page carefully to ensure it meets your needs.

- Review the form description or validate it through the Preview feature.

- If the previous one is unsatisfactory, locate another sample using the Search bar in the header.

- Press Buy Now when you find the appropriate Virginia Foreign Corporation Registration Withdrawal.

- Choose a pricing plan that aligns with your needs and budget.

- Create an account or Log In to advance to the payment screen.

- Complete payment for your subscription using PayPal or a credit card.

- Select the format for your document and click Download.

- Print your document or upload it to an online editor for easier completion.

Form popularity

FAQ

The VA code 13.1 920 outlines the process for withdrawing a foreign corporation's registration in Virginia. This statute specifies the necessary steps and requirements for a corporation that wishes to officially terminate its status as a registered foreign entity. Understanding this code is essential for any business considering Virginia foreign corporation registration withdrawal, as compliance is crucial to avoid penalties. By using platforms like uslegalforms, you can simplify the withdrawal process and ensure you meet all legal obligations.

Shutting down a business in Virginia involves filing the appropriate dissolution documents with the state. You must settle all debts and notify creditors before filing. Completing the necessary forms correctly will allow for an efficient Virginia foreign corporation registration withdrawal, ensuring compliance with state laws.

To officially close an LLC, you must file Articles of Cancellation with the Virginia State Corporation Commission. This form formally signals the end of your LLC’s operations. Following this process correctly will ensure a smooth Virginia foreign corporation registration withdrawal.

An inactive LLC cannot legally conduct business in Virginia. Once it becomes inactive, it is not in good standing, meaning it cannot enter contracts or engage in transactions. If you're looking to reactivate or shut down an inactive LLC, consider the steps involved in the Virginia foreign corporation registration withdrawal process.

To obtain a certificate of authority in Virginia, you need to file an application with the State Corporation Commission. This certificate allows your foreign corporation to conduct business in Virginia legally. Having this document is essential for smoother operations, especially when considering Virginia foreign corporation registration withdrawal.

To cancel your LLC in Virginia, you must submit the Articles of Cancellation to the Virginia State Corporation Commission. Ensure all business debts are resolved before filing. This action initiates the Virginia foreign corporation registration withdrawal and formally ends your LLC’s legal status.

To cancel an inactive LLC in Virginia, you should file Articles of Cancellation. This form notifies the state that you wish to dissolve the LLC and officially stop business operations. It's crucial to ensure that there are no remaining business obligations or debts before proceeding with the Virginia foreign corporation registration withdrawal.

To dissolve a corporation in Virginia, you need to file Articles of Dissolution with the Virginia State Corporation Commission. You must ensure that all outstanding debts are settled and notify shareholders and the IRS. Once your submission is approved, the Virginia foreign corporation registration withdrawal process will be completed.

Closing a corporation in Virginia involves filing articles of dissolution with the State Corporation Commission. Before doing this, ensure you settle all debts and obligations of the corporation. Follow up by notifying all stakeholders and distributing any remaining assets. If you need assistance with the forms and legal steps, US Legal Forms offers resources that can simplify the closure process.

To qualify or register a foreign business entity in Virginia, you need to submit an application with the State Corporation Commission. Essential documents include a certificate of good standing from your home state, along with the appropriate fees. This process ensures that your business complies with Virginia laws, paving the way for smooth operations. For detailed guidance and forms, US Legal Forms can help you navigate this process effectively.