Transfer on Death to Beneficiary Official Form - Wisconsin - Individual to Individual: This is an official form issued by the Wisconsin Register of Deeds Association for use by persons entitled to receive property of a decedent as a designated transfer on death beneficiary upon the death of the sole owner or the last to die of multiple owners. It must be recorded with the Register of Deeds of the county in which the real estate is located. This is NOT the transfer on death deed. this form is used to submit to the recorder of deeds. The supporting documents needed to show the interest that the beneficiary is entitled to based on a transfer on death instrument.

Wisconsin Tod Form With Decimals

Description

How to fill out Wisconsin Transfer On Death Or TOD To Beneficiary - Official Form Used To Record Beneficiary's Interest Following Death Of Grantor?

Legal managing can be mind-boggling, even for the most skilled experts. When you are searching for a Wisconsin Tod Form With Decimals and don’t have the a chance to spend trying to find the correct and updated version, the processes could be stressful. A robust online form library might be a gamechanger for everyone who wants to manage these situations successfully. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms available anytime.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any needs you may have, from individual to enterprise documents, in one location.

- Use innovative resources to accomplish and deal with your Wisconsin Tod Form With Decimals

- Access a resource base of articles, guides and handbooks and materials related to your situation and needs

Help save time and effort trying to find the documents you will need, and employ US Legal Forms’ advanced search and Review tool to get Wisconsin Tod Form With Decimals and get it. For those who have a membership, log in to the US Legal Forms profile, look for the form, and get it. Take a look at My Forms tab to view the documents you previously saved and to deal with your folders as you can see fit.

If it is your first time with US Legal Forms, register an account and acquire unrestricted usage of all advantages of the platform. Here are the steps to take after downloading the form you need:

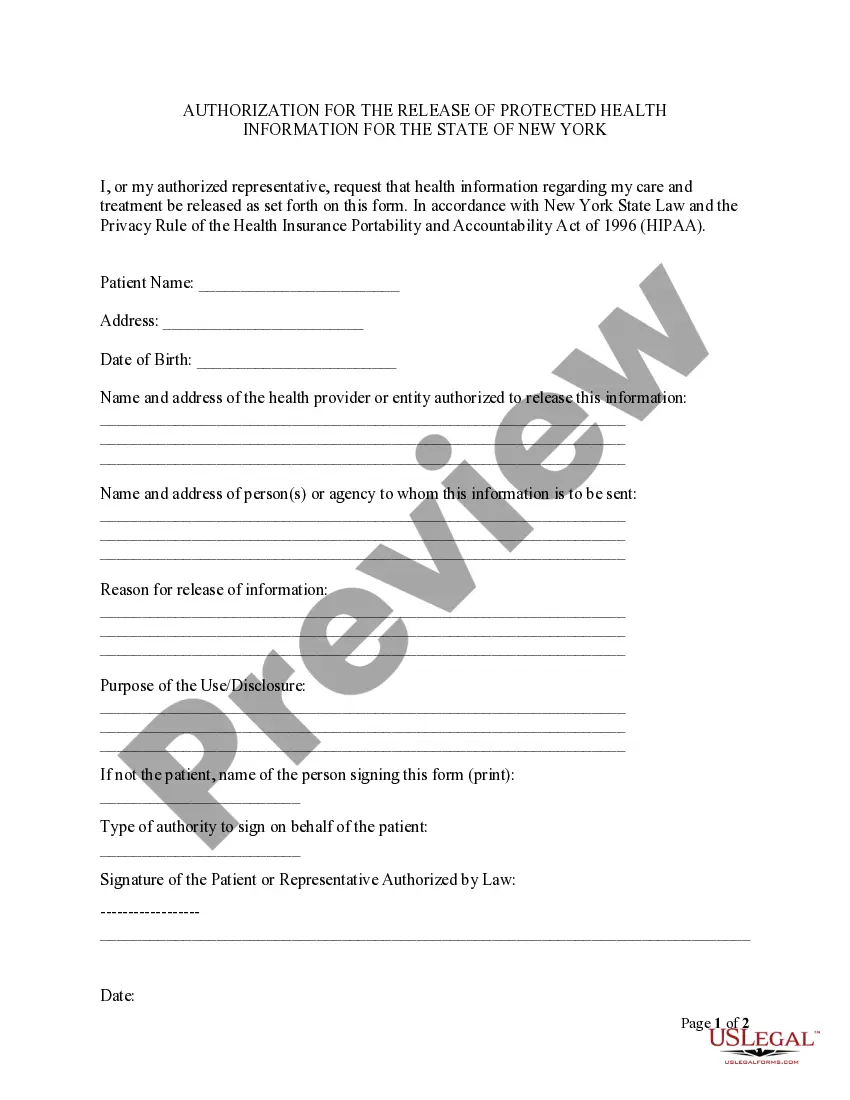

- Confirm this is the right form by previewing it and reading its description.

- Ensure that the sample is accepted in your state or county.

- Choose Buy Now once you are ready.

- Select a subscription plan.

- Find the format you need, and Download, complete, eSign, print out and deliver your document.

Benefit from the US Legal Forms online library, supported with 25 years of expertise and reliability. Transform your daily document administration in to a easy and user-friendly process right now.

Form popularity

FAQ

A Wisconsin TOD deed must include: The name of the property owner or owners whose interest a TOD deed will transfer; The TOD beneficiary's name; and. A statement that the transfer only becomes effective upon the owner's death.

Hear this out loud PauseTransfer fee due The grantor of real estate must pay a real estate transfer fee at the rate of 30 cents for each $100 of value or fraction thereof on every conveyance not exempted or excluded under state law (sec. 77.22(1), Wis.

The deed could get complicated, and its validity contested if it is not recorded correctly or if the legal criteria are not met. If there is no provision for a contingent beneficiary, the transfer on the death deed is rendered ineffective if the named beneficiary passes away before the property owner.

And while the process may vary slightly from state to state, there are some general, basic steps to follow. Get Your State-Specific Deed Form. Look up the requirements for the state the property is in. ... Decide on Your Beneficiary. ... Include a Description of the Property. ... Sign the New Deed. ... Record the Deed.

Hear this out loud PauseA Wisconsin designation of TOD beneficiary, or ?transfer on death deed,? is used to name a person or entity who will receive ownership of a property once the current owner passes away.