Wisconsin Tod Form For Texas

Description

How to fill out Wisconsin Transfer On Death Or TOD To Beneficiary - Official Form Used To Record Beneficiary's Interest Following Death Of Grantor?

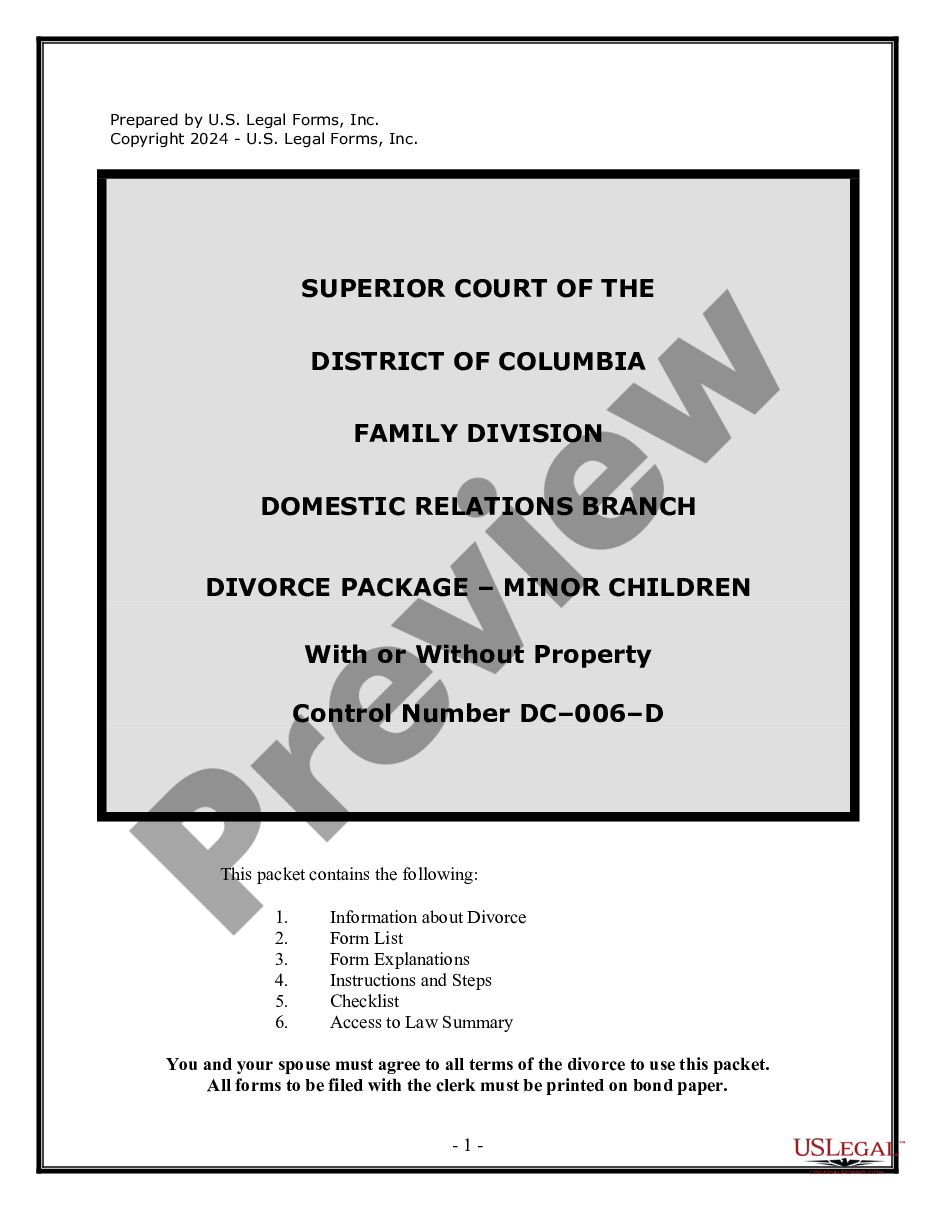

The Wisconsin Tod Form For Texas displayed on this page is a versatile legal template created by experienced attorneys in accordance with federal and state laws and regulations. For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 validated, state-specific documents for any business and personal situation. It’s the quickest, easiest, and most trustworthy method to obtain the paperwork you require, as the service ensures bank-level data protection and anti-malware safeguards.

Obtaining this Wisconsin Tod Form For Texas will require you just a few straightforward steps.

Select the format you prefer for your Wisconsin Tod Form For Texas (PDF, Word, RTF) and download the sample to your device.

- Search for the document you need and examine it.

- Browse the file you found and preview it or check the form description to confirm it meets your needs. If it doesn’t, use the search feature to find the right one. Click Buy Now once you have identified the template you require.

- Register and Log In.

- Choose the pricing plan that fits you and set up an account. Use PayPal or a credit card for a quick transaction. If you already possess an account, Log In and verify your subscription to continue.

- Acquire the editable template.

Form popularity

FAQ

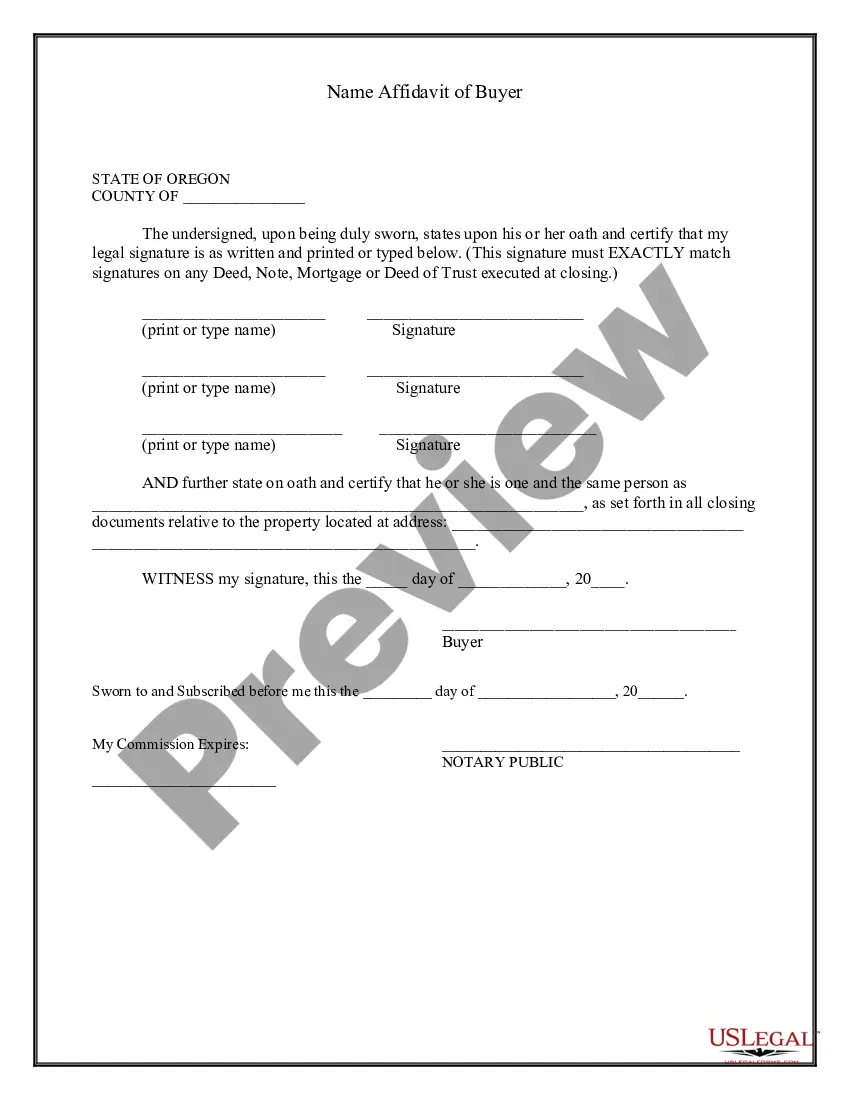

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records. ... Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

And while the process may vary slightly from state to state, there are some general, basic steps to follow. Get Your State-Specific Deed Form. Look up the requirements for the state the property is in. ... Decide on Your Beneficiary. ... Include a Description of the Property. ... Sign the New Deed. ... Record the Deed.

Some of these disadvantages are as follows: You cannot name an alternate or contingent beneficiary. There are limits and special rules for minors who are designated for Transfer On Death accounts.

A Wisconsin TOD deed must include: The name of the property owner or owners whose interest a TOD deed will transfer; The TOD beneficiary's name; and. A statement that the transfer only becomes effective upon the owner's death.

Effective September 1, 2015, Texas joined the growing number of states that allow owners of real estate to transfer property to their beneficiaries outside the probate process by creating the Texas Transfer on Death Deed. The deed works like a beneficiary designation on a retirement plan or an insurance policy.