Wi Transfer Death Tod Without Death Certificate

Description

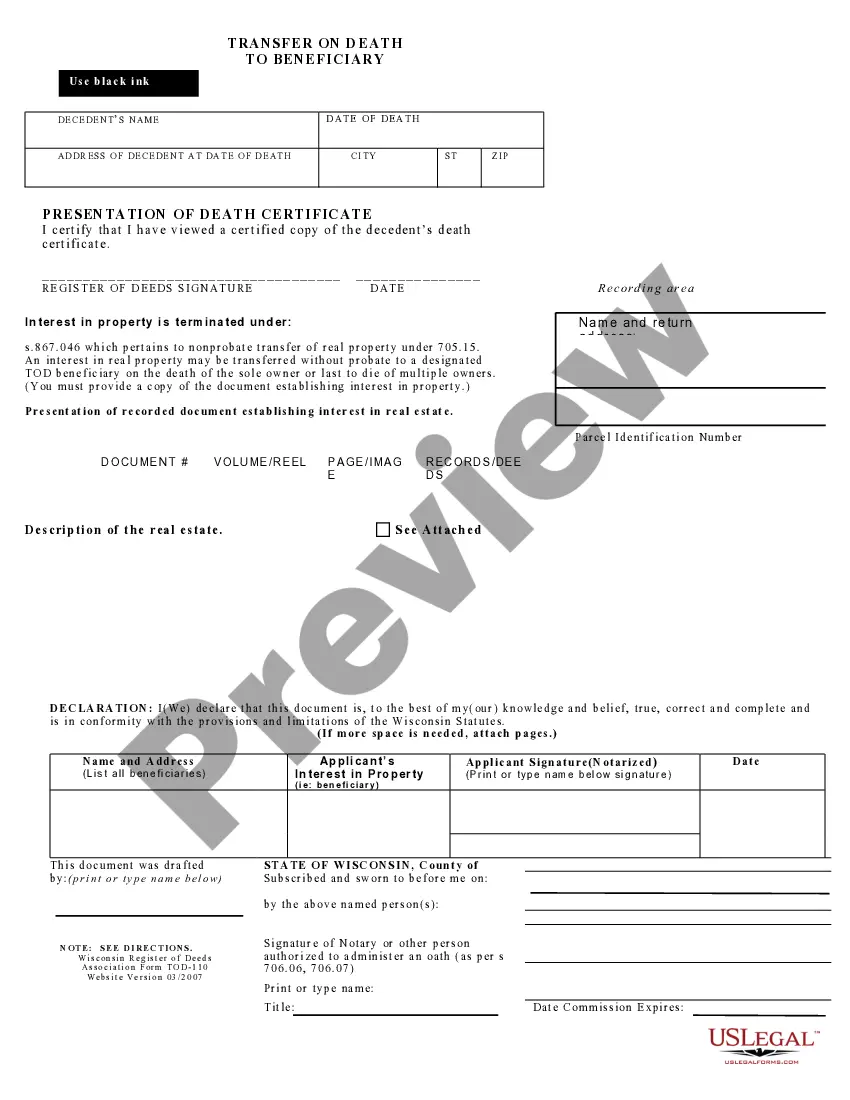

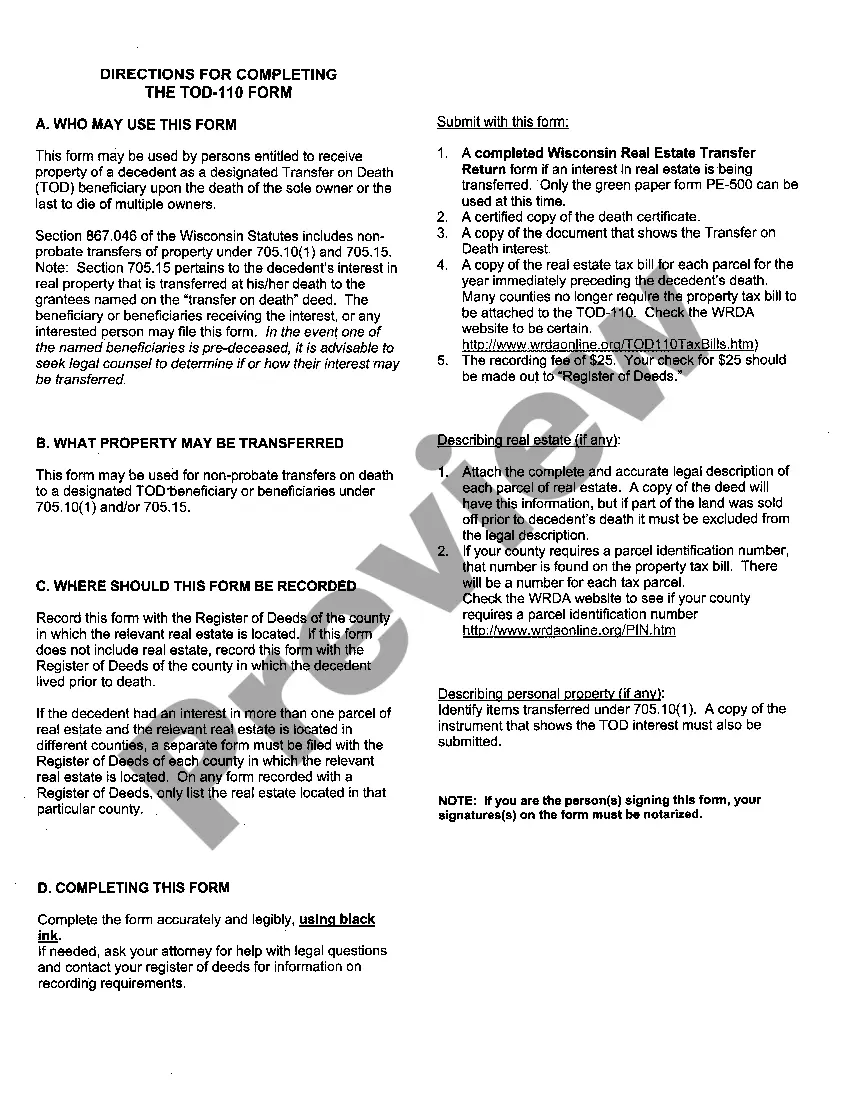

How to fill out Wisconsin Transfer On Death Or TOD To Beneficiary - Official Form Used To Record Beneficiary's Interest Following Death Of Grantor?

It’s obvious that you can’t become a law expert overnight, nor can you learn how to quickly prepare Wi Transfer Death Tod Without Death Certificate without the need of a specialized set of skills. Putting together legal documents is a time-consuming venture requiring a specific training and skills. So why not leave the creation of the Wi Transfer Death Tod Without Death Certificate to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court documents to templates for internal corporate communication. We know how crucial compliance and adherence to federal and state laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our platform and get the form you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to determine whether Wi Transfer Death Tod Without Death Certificate is what you’re searching for.

- Start your search over if you need any other template.

- Set up a free account and select a subscription option to purchase the form.

- Pick Buy now. Once the payment is through, you can download the Wi Transfer Death Tod Without Death Certificate, complete it, print it, and send or send it by post to the designated people or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

The deed could get complicated, and its validity contested if it is not recorded correctly or if the legal criteria are not met. If there is no provision for a contingent beneficiary, the transfer on the death deed is rendered ineffective if the named beneficiary passes away before the property owner.

?A transfer on death account is similar to a beneficiary designation on an insurance policy or a retirement account," said Gaye Chun, a senior wealth planner for City National Bank. ?Typically, TOD accounts are investment accounts that will transfer to the beneficiary when the account owner dies."

A Wisconsin TOD deed must include: The name of the property owner or owners whose interest a TOD deed will transfer; The TOD beneficiary's name; and. A statement that the transfer only becomes effective upon the owner's death.

A transfer on death, or TOD, is a designation that allows a creditor's assets to pass directly to their beneficiary after they die. The account owner specifies the percentage of assets each beneficiary is to receive, allowing their executor to distribute the assets without first passing through probate.

The beneficiary of the TOD may be an individual or an organization, such as a charity. Alternate or successor beneficiaries can also be named in case the first beneficiary dies. Beneficiaries of the TOD do not have access to assets until the asset owner dies.