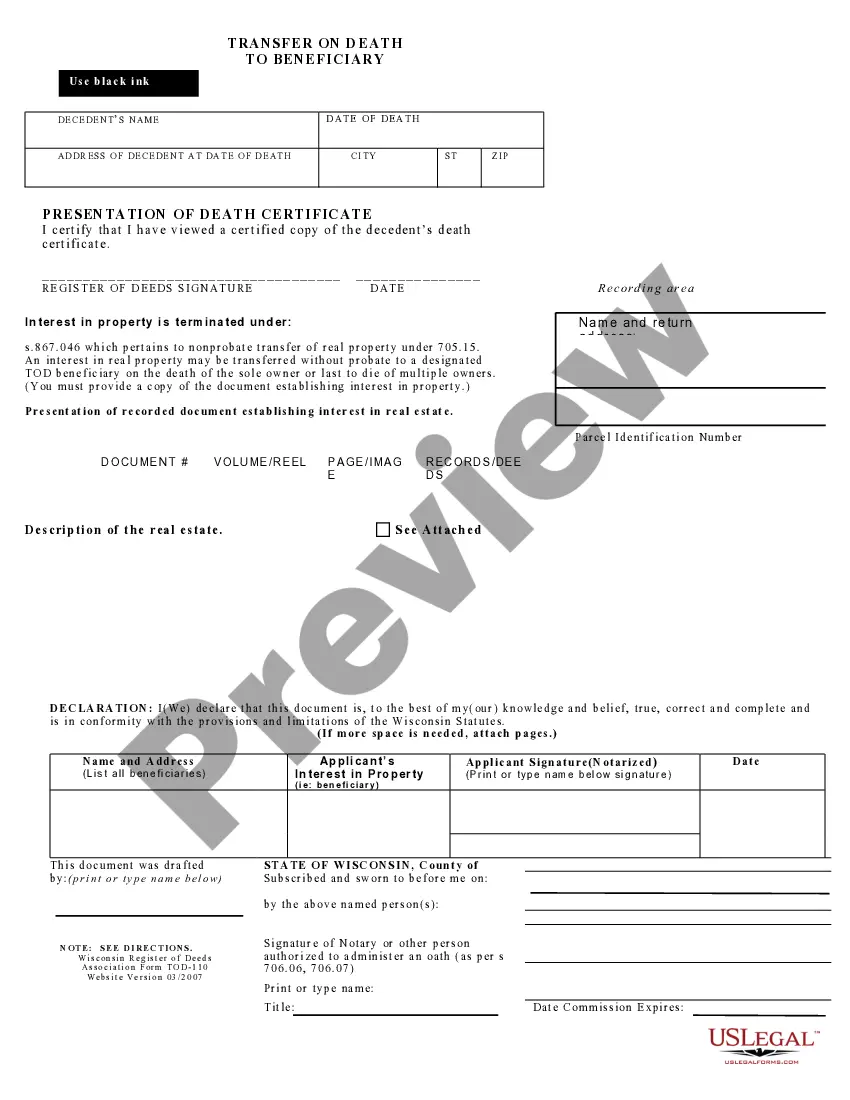

Tod Transfer On Death

Description

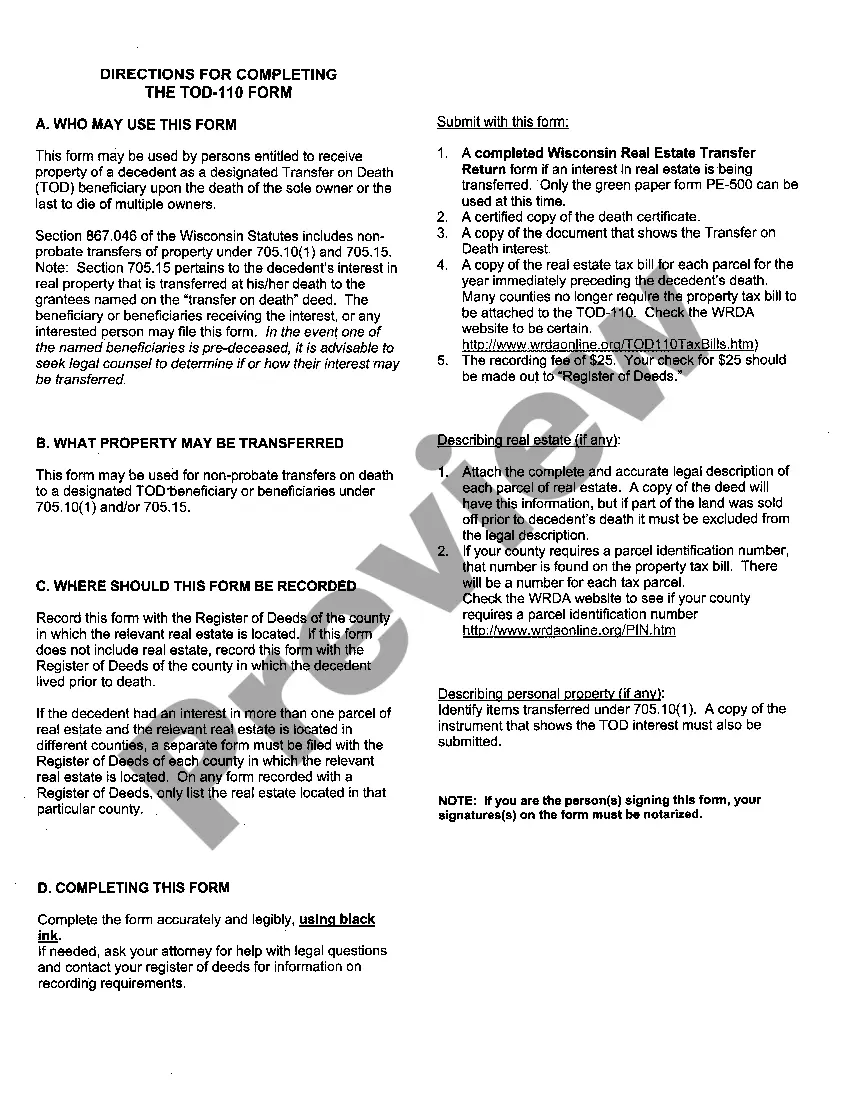

How to fill out Wisconsin Transfer On Death Or TOD To Beneficiary - Official Form Used To Record Beneficiary's Interest Following Death Of Grantor?

- If you're a returning user, log into your account and check your subscription status. If it's valid, proceed to download your required form by clicking the Download button.

- For new users, start by selecting the correct form. Review the Preview mode and description to confirm it aligns with your needs and local jurisdiction.

- If you need a different template, utilize the Search tab to find alternatives that are applicable to your situation.

- Once you find the suitable document, click on the Buy Now button and select a subscription plan that meets your requirements.

- Enter your payment information, either through your credit card or PayPal, to complete your purchase.

- Finally, download your form and save it on your device. You can always access it later from the My Forms section of your profile.

US Legal Forms enables quick execution of legal documents with its robust form collection that surpasses competitors in quantity and quality.

Make your legal journey effortless by leveraging US Legal Forms today. Start exploring your options and take control of your document needs!

Form popularity

FAQ

TOD accounts can be a good idea for individuals looking to avoid probate and ensure a seamless transfer of assets to loved ones. They provide a quick and efficient way to pass on property or accounts without the lengthy legal processes typical of probate. Ultimately, assessing your financial situation and discussing options with a professional can help determine if a TOD transfer on death aligns with your estate planning goals.

A TOD transfer on death designates a specific asset to pass directly to a named individual upon your death, while a beneficiary typically refers to a person named in a will or trust who receives benefits from your estate. The key difference lies in the process; a TOD avoids the need for probate, allowing for a quicker transfer of assets. By understanding these nuances, you can better manage your estate planning needs.

You do not necessarily need a lawyer to set up a TOD transfer on death. Many states allow individuals to complete this process independently by filling out the necessary forms. However, seeking legal advice can be beneficial to ensure that all your wishes are clearly documented and legally binding, minimizing the risk of disputes among your heirs.

One notable disadvantage of a TOD transfer on death is that it may not cover all potential taxes owed upon death, which can lead to unexpected costs for your heirs. Additionally, if you have not updated the TOD designation after significant life changes, such as marriage or divorce, it may not reflect your current wishes, leading to complications. Ultimately, it is essential to review and update your TOD instructions regularly to avoid future misunderstandings.

Choosing between a TOD transfer on death and naming a beneficiary often depends on your specific situation. The benefit of a TOD is its ability to transfer assets automatically upon death, while a beneficiary designation may apply to broader accounts, such as life insurance policies. In some cases, a combination of strategies may be the most effective way to achieve your estate planning goals.

Yes, a TOD account helps you avoid probate since the asset directly transfers to the beneficiary upon your death. This means that the asset does not have to go through the lengthy and often complicated probate process, saving time and potential legal fees for your loved ones. By utilizing a transfer on death designation, you streamline the process significantly.

A TOD transfer on death does not inherently avoid inheritance tax. The transfer itself takes place outside of probate but may still be subject to estate taxes depending on the overall value of your estate. It is vital to consult with an estate planning professional to understand how a TOD will impact any inheritance tax obligations.

While a transfer on death offers several benefits, there are some disadvantages to consider. For instance, a TOD does not provide any tax benefits, and the asset can still be subject to creditor claims. Furthermore, the designated beneficiary may not be able to access the asset until your death, which could lead to potential conflicts if they need access sooner.

The term transfer on death (TOD) refers to a designation you can make on certain assets, such as real estate or bank accounts. When you put a TOD clause in place, those assets automatically transfer to your chosen beneficiary upon your death. This specification helps streamline the asset transfer process and avoids potential complications.

If your spouse dies and the house is solely in their name, the property may need to go through probate if there is no transfer on death deed. This can delay the process of transferring the house to their heir. However, if you have a TOD transfer on death in place, the transfer occurs without the need for probate, making it a smoother process for you.