Estate Receipt And Release Form

Description

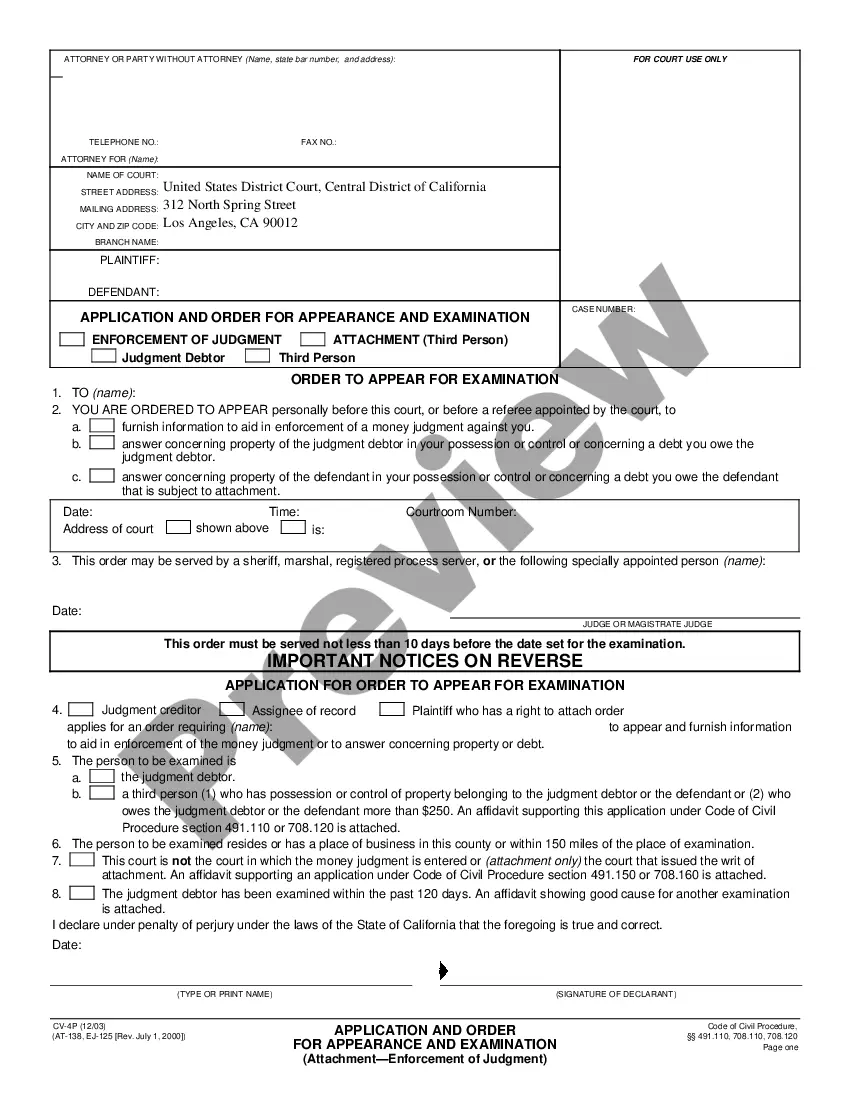

How to fill out Wisconsin Estate Receipt - Informal - Formal?

Bureaucracy necessitates exactness and correctness.

If you do not handle completing documents like Estate Receipt And Release Form regularly, it could lead to some misunderstandings.

Choosing the appropriate sample from the outset will guarantee that your document submission proceeds smoothly and avert any hassles of resubmitting a document or performing the same task entirely from the beginning.

If you are not a registered user, locating the necessary sample would entail a few additional steps: Locate the template using the search bar. Ensure the Estate Receipt And Release Form you’ve found is applicable to your state or region. Open the preview or view the description that includes the details on the usage of the sample. If the result aligns with your search, click the Buy Now button. Choose the appropriate option from the suggested pricing plans. Log In to your account or create a new one. Complete the transaction using a credit card or PayPal account. Acquire the form in your desired format. Securing the correct and updated samples for your paperwork is a matter of moments with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your work with forms.

- You can always find the correct sample for your paperwork in US Legal Forms.

- US Legal Forms is the largest online forms repository that provides over 85 thousand samples across various subjects.

- You can easily acquire the latest and most suitable version of the Estate Receipt And Release Form by simply searching it on the site.

- Find, save, and download templates in your account or refer to the description to confirm you have the right one available.

- With an account at US Legal Forms, you can obtain, consolidate in one place, and browse through the templates you save to access them within a few clicks.

- When on the website, click the Log In button to sign in.

- Then, go to the My documents page, where your forms list is kept.

- Review the description of the forms and download the ones you require at any time.

Form popularity

FAQ

North Carolina has no separate state estate tax, inheritance tax nor gift tax. Close the estate. Close the estate bank account after all debts are paid and assets are distributed. Once all claims against the estate have been satisfied, file a final accounting with the probate court and ask that the estate be closed.

A release provides protection to the trustee in a scenario where the beneficiary later decides to sue the trustee. The trustee can use the release to show that the beneficiary released the trustee of any legal claims the beneficiary might later bring.

A Receipt, Release, Refunding and Indemnification Agreement is a probate tool that allows the executor to distribute estate funds to a beneficiary with the promise from the beneficiary to return the funds if it later turns out they were distributed in error.

A Receipt and Release Agreement is the means by which a beneficiary of an estate may acknowledge receipt of the property to which he is entitled, and agree to release the executor from any further liability with respect thereto.