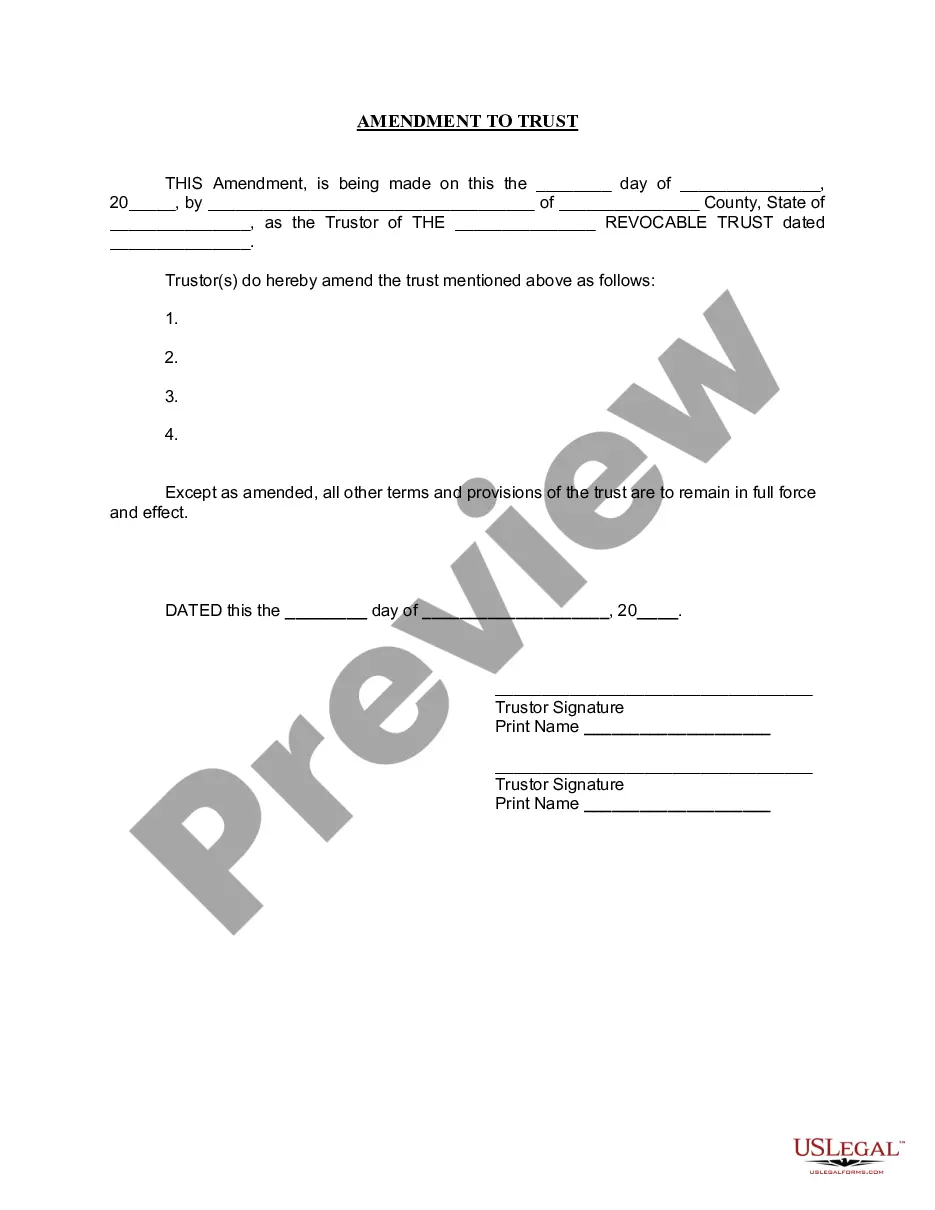

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Wisconsin Trust Certification Form

Description

Form popularity

FAQ

To complete a Wisconsin trust certification form, start by gathering necessary details about the trust, including the names of the trustees and beneficiaries. Next, fill out the form with accurate information, ensuring that all required sections are completed. After filling out the form, have it signed by the trustee, and consider having it notarized for added legal protection. Finally, submit the form as required by Wisconsin law to ensure it is valid and recognized.

The primary form you'll need to file for a trust is IRS Form 1041 if the trust has income. However, additional forms may be required based on specific circumstances, such as state regulations. For Wisconsin residents, the Wisconsin trust certification form can be a useful resource to ensure all components of trust filing are in order.

Not all trusts are required to file IRS Form 1041. Specific conditions dictate whether a trust must submit this form, such as the trust generating income or having taxable events. To navigate these regulations effectively, leveraging the Wisconsin trust certification form as part of your strategy is key.

To register a trust in Wisconsin, you first need to create a trust document, outlining the terms and conditions of the trust. After that, you can file the necessary documents with the local county register of deeds. Using the Wisconsin trust certification form can streamline this registration process, providing legal clarity and support.

For most trusts, IRS Form 1041 is the standard tax return form that needs to be filed. This form reports the income generated by the trust and determines the taxes owed. For those in Wisconsin, combining this knowledge with the Wisconsin trust certification form will help ensure compliance with state and federal requirements.

Form 709 is for gift tax returns and is generally filled out when a trust makes certain gifts. Not every trust must file this form, but if it’s involved in gifting above the exclusion limit, it does. To ensure you meet your obligations and manage your trust efficiently, a comprehensive understanding of the Wisconsin trust certification form could be beneficial.

The IRS Form 8453 is used by fiduciaries to authenticate and submit certain tax returns electronically. This form is particularly relevant for trusts filing returns, as it provides consent for e-filing while confirming the information is accurate. If you are navigating the complexities of trust taxation in Wisconsin, utilizing the Wisconsin trust certification form alongside IRS documentation can simplify the filing process.

To obtain your trust certificate, start by drafting a trust certification document that summarizes the trust details. You can use a Wisconsin trust certification form from platforms like USLegalForms, which simplifies the process and ensures you meet legal standards. Once completed, you can present the certificate to institutions to prove your authority as the trustee and to execute trust transactions.

A certificate trust works by providing a concise summary of the trust's key information that can be shared with third parties. This certificate allows the trustee to access funds and manage assets without revealing the entire trust document. To create this certificate, you can use a Wisconsin trust certification form, streamlining the process and ensuring compliance with Wisconsin laws.

The purpose of a certificate of trust is to provide verification of the trust’s validity while protecting the privacy of the trust’s terms. This document assures third parties, such as financial institutions, that the trustee has the authority to manage the trust’s assets. Utilizing a Wisconsin trust certification form allows you to efficiently create this certificate to facilitate property transactions and other trust-related activities.