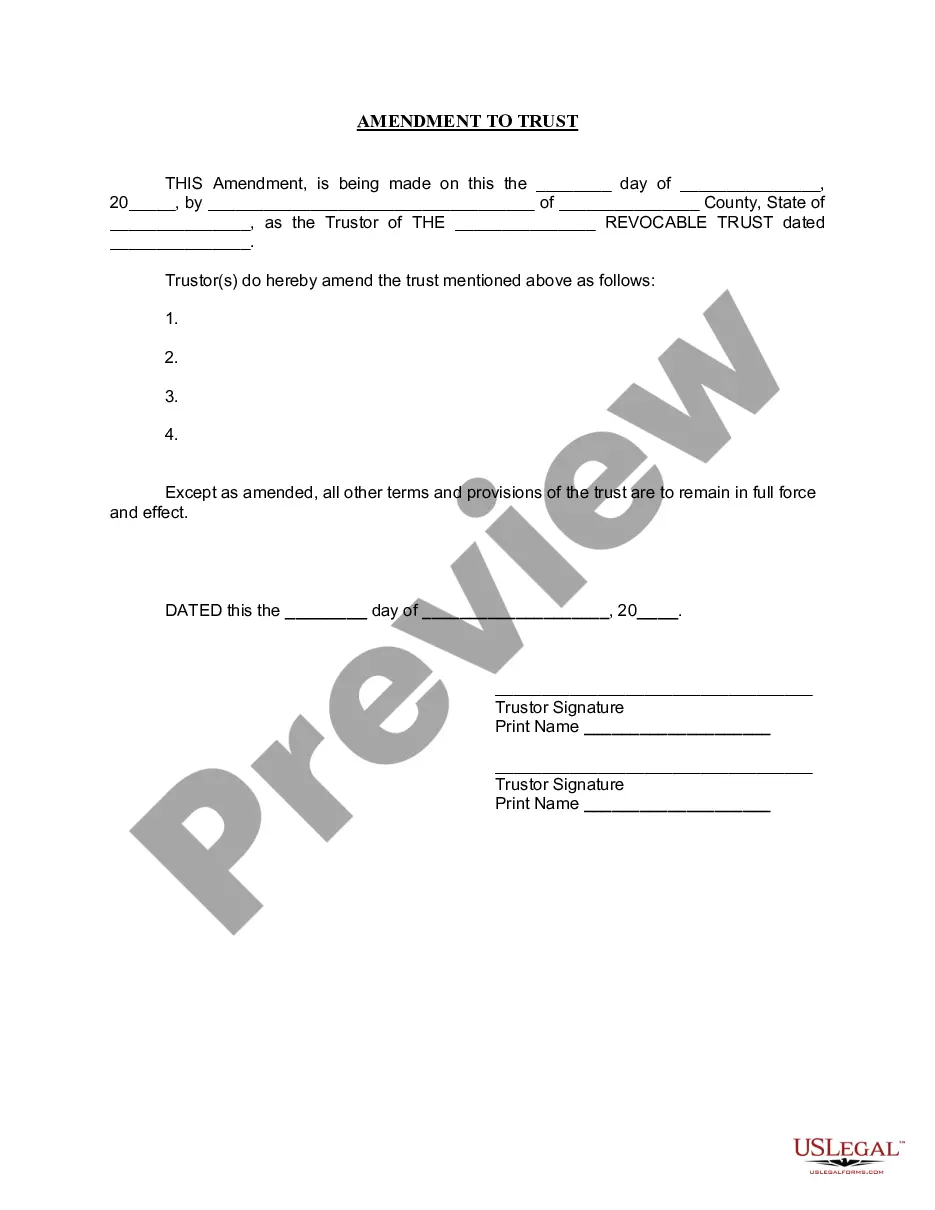

Wisconsin Irrevocable Trust Form

Description

Form popularity

FAQ

Yes, you can prepare your own Wisconsin irrevocable trust form if you feel confident in understanding the legal requirements. However, consider that trust documents require careful wording and specific provisions to be effective. Using a service like US Legal Forms can simplify this process, offering templates that ensure you cover all necessary points without added stress. It's always wise to review your documents with a legal professional to ensure they meet your needs.

There are specific scenarios where a Wisconsin irrevocable trust form becomes essential. First, if you wish to protect your assets from creditors, an irrevocable trust can shield your wealth. Second, it helps in estate tax reduction, allowing your beneficiaries to inherit more without heavy taxation. Lastly, it provides a structured way to manage your assets for your heirs, ensuring they are used as you intended.

To register a trust in Wisconsin, you need to complete the Wisconsin irrevocable trust form, which outlines the terms and details of the trust. After the form is prepared and signed by the grantor, it's advisable to consult a legal professional for the registration process. Using platforms like uslegalforms can streamline the creation of your trust and ensure proper compliance with Wisconsin regulations.

Form 8453 is typically used for electronic filing of Form 1041, giving authorization for the electronic submission. This form acts as a declaration that the income reported on Form 1041 is accurate. If you are completing a Wisconsin irrevocable trust form and choose to file electronically, understanding the use of Form 8453 is crucial.

Not all trusts are required to file IRS Form 1041. Generally, irrevocable trusts that generate income must file this form, while revocable trusts often do not need to file until they become irrevocable. If you are setting up a Wisconsin irrevocable trust form and anticipate income generation, you will likely need to file Form 1041.

Yes, certain trusts do file IRS Form 709, especially when there are gifts made to the trust that exceed the gift tax exclusion amount for the year. This form is required to report these taxable gifts. If you’re establishing a Wisconsin irrevocable trust form and plan to make gifts, you should familiarize yourself with Form 709 and how it applies to your situation.

To file for an irrevocable trust, you generally need IRS Form 1041, which reports the income and expenses of the trust. Additionally, if you have made gifts to the trust that exceed the annual exclusion amount, you may also need to file Form 709. It’s essential to manage these forms properly to avoid any complications, and uslegalforms can assist you in this area.

Filing an irrevocable trust involves several steps, starting with preparing the trust document itself. Once you have your Wisconsin irrevocable trust form, you need to obtain an EIN from the IRS. After that, you’ll file any necessary tax forms, such as Form 1041, annually. Consider using uslegalforms to guide you through the paperwork and ensure compliance.

For an irrevocable trust, you typically need to file IRS Form 1041. This form is used to report income, deductions, and taxes for the trust. You must also ensure that the trust has its own Employer Identification Number (EIN) to file Form 1041 accurately. If you're looking to create a Wisconsin irrevocable trust form, you can find resources for this process on platforms like uslegalforms.

Yes, you can set up an irrevocable trust for yourself. This type of trust allows you to transfer assets out of your estate, which can help with tax planning and asset protection. However, keep in mind that once you establish an irrevocable trust, you cannot change or revoke it without the consent of the beneficiaries. For more guidance, the US Legal Forms platform offers a comprehensive Wisconsin irrevocable trust form that can help simplify the process.