Wisconsin Closing Certificate For Fiduciaries

Description

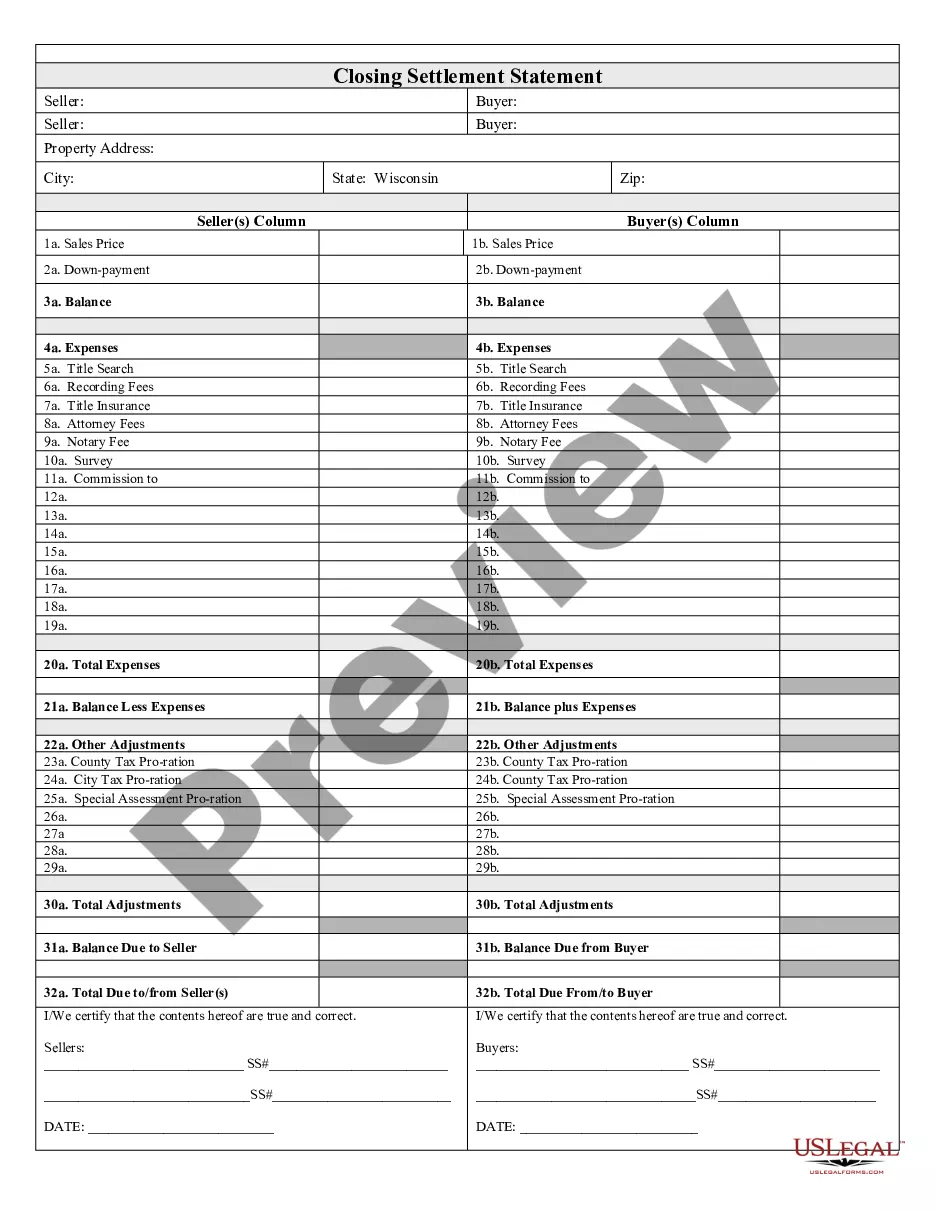

How to fill out Wisconsin Closing Statement?

Individuals frequently connect legal documentation with something intricate that solely a specialist can handle.

In a specific sense, it's accurate, as preparing the Wisconsin Closing Certificate For Fiduciaries requires considerable knowledge of subject matters, including state and local laws.

Nonetheless, with US Legal Forms, processes have become easier: pre-prepared legal forms for any personal and business needs pertinent to state statutes are gathered in a single digital library and are now accessible to all.

Choose a subscription plan that aligns with your needs and budget. Create an account or Log In to proceed to the payment section. Complete your subscription payment via PayPal or use your credit card. Select the format for your document and hit Download. You can either print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once acquired, they remain saved in your profile. You can access them anytime you require through the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current documents categorized by state and purpose, allowing for a quick search for the Wisconsin Closing Certificate For Fiduciaries or any other specific form.

- Users who have previously registered with an active subscription must sign in to their account and select Download to retrieve the form.

- New users to the platform must first create an account and subscribe before they can download any files.

- Here’s a step-by-step guide on how to obtain the Wisconsin Closing Certificate For Fiduciaries.

- Scrutinize the content on the page closely to ensure it meets your requirements.

- Review the form description or look at it through the Preview feature.

- If the previous document isn't satisfactory, search for another sample using the Search field above.

- When you identify the correct Wisconsin Closing Certificate For Fiduciaries, click Buy Now.

Form popularity

FAQ

A closing certificate is an important legal document that confirms the completion of a fiduciary's duties in handling an estate. Specifically, for those dealing with the Wisconsin closing certificate for fiduciaries, this document verifies that all necessary steps have been taken to settle the financial affairs of the deceased. It provides assurance to beneficiaries and creditors that the fiduciary has acted properly and in accordance with Wisconsin law. You can easily obtain this certificate through platforms like USLegalForms, which offer comprehensive resources for fiduciaries.

Certain entities and individuals can be exempt from Wisconsin withholding, including tax-exempt organizations and residents with specific income thresholds. It is important for fiduciaries to identify whether they qualify for an exemption, as it can impact their reporting process. Utilizing a platform like US Legal Forms can simplify obtaining the necessary documentation, including the Wisconsin closing certificate for fiduciaries.

An irrevocable trust in Wisconsin is established when the grantor relinquishes all control over the trust assets. This means that the assets typically cannot be altered or withdrawn by the grantor after creation. Understanding this concept is crucial for fiduciaries, as it affects tax implications and eligibility for a Wisconsin closing certificate for fiduciaries.

A grantor trust is a specific type of trust where the grantor maintains control over the assets and is responsible for paying taxes on income generated by the trust. In contrast, a general trust may separate these responsibilities. Understanding the distinction helps fiduciaries navigate their obligations effectively, particularly when securing a Wisconsin closing certificate for fiduciaries.

In Wisconsin, trusts are governed by a set of laws that guide their creation and administration. Key among these rules is the need for a written trust document that specifies the terms and beneficiaries. Additionally, fiduciaries are often required to obtain a Wisconsin closing certificate for fiduciaries to assure proper management of trust assets and compliance with state regulations.

Fiduciaries must file a return if the estate or trust generates any taxable income or meets specific revenue thresholds. This requirement ensures that all income is accounted for and taxed appropriately. Consulting tools such as USLegalForms can provide clarity on required filings and streamline the process for obtaining necessary certificates.

A 1041 tax return must be filed by estates and trusts that have any taxable income, or when gross income exceeds $600. Additionally, any fiduciary responsible for managing a trust must ensure this filing is completed. Utilizing platforms like USLegalForms can help facilitate the process and ensure all necessary forms are properly filled out.

Yes, Wisconsin recognizes grantor trusts, which allow the grantor to retain control over the assets in the trust. Income generated by grantor trusts is typically reported on the grantor’s personal tax return. If you're managing a grantor trust, it’s important to understand its implications for filing a fiduciary tax return.

The purpose of a fiduciary tax return is to report the income, deductions, and credits related to the trust or estate being managed. This return helps ensure that the income is appropriately taxed and distributed according to regulations. By filing this return, you demonstrate compliance with Wisconsin tax laws, which is essential for obtaining a closing certificate for fiduciaries.

Closing a trust in Wisconsin involves several steps, including settling all debts and distributing the remaining assets to beneficiaries. You should prepare a final accounting of the trust, and obtain a closing certificate if necessary. USLegalForms can provide templates and guidance to help you through this process efficiently.