Close Wisconsin Withholding Account

Description

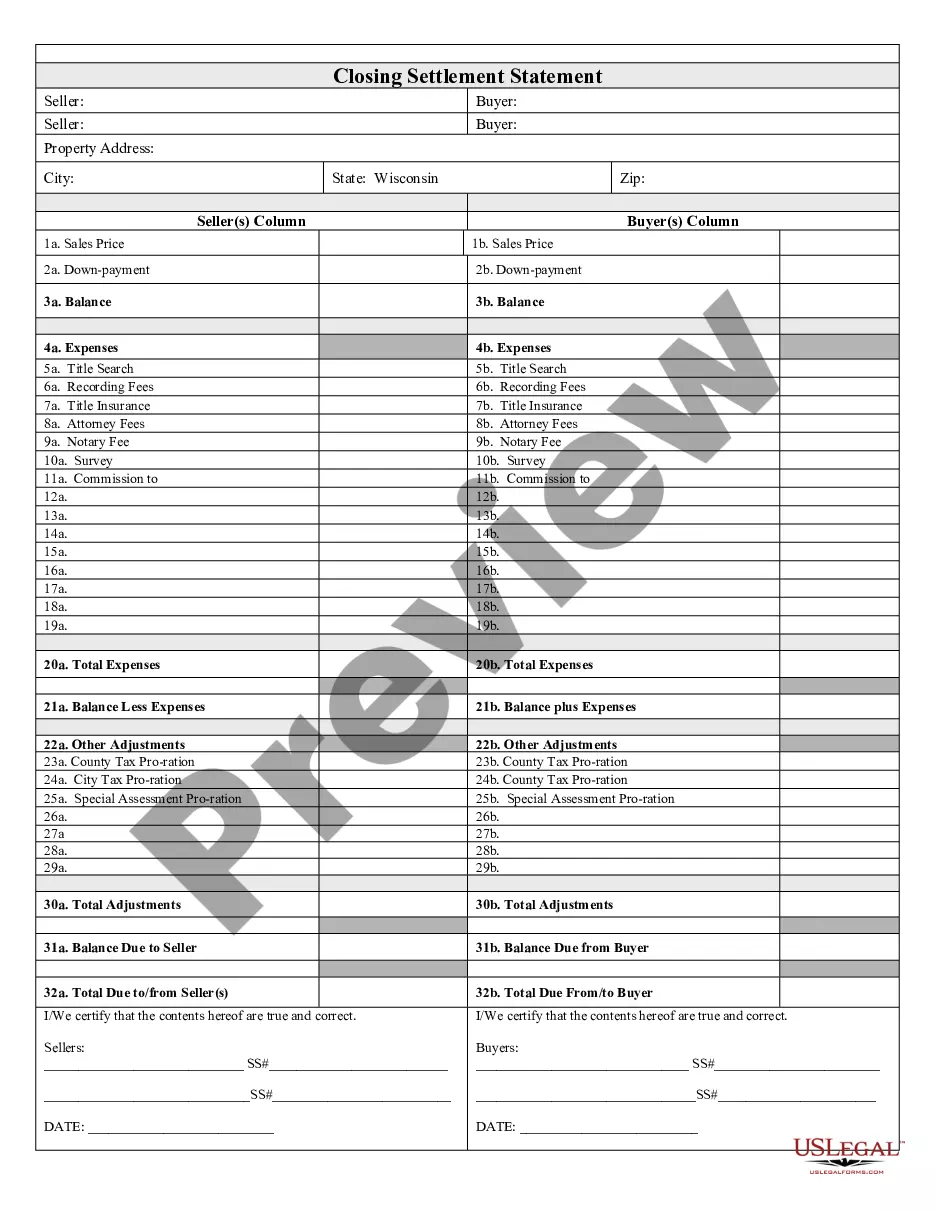

How to fill out Wisconsin Closing Statement?

Creating legal documents from the ground up can frequently be intimidating. Certain situations may require extensive research and significant financial investment. If you’re looking for a simpler and more cost-effective method of producing Close Wisconsin Withholding Account or any other forms without unnecessary obstacles, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can promptly access state- and county-specific templates meticulously prepared for you by our legal experts.

Utilize our website whenever you require reliable and trustworthy services through which you can swiftly find and download the Close Wisconsin Withholding Account. If you’re already familiar with our services and have previously established an account, simply Log In to your account, find the form, and download it or retrieve it at any later time in the My documents section.

Don’t have an account? No worries. It only takes a few minutes to create one and browse the library. However, before you rush to download Close Wisconsin Withholding Account, consider these suggestions.

US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- Review the document preview and descriptions to ensure you are looking at the correct form.

- Verify that the form you choose meets the requirements of your state and county.

- Select the most appropriate subscription plan to obtain the Close Wisconsin Withholding Account.

- Download the document. Then complete, sign, and print it.

Form popularity

FAQ

Wisconsin WT-4 Instructions Complete the section labeled ?Figure your total withholding exemptions below?. Step 1 is a guideline for how many exemptions you would like to claim. If you know how many exemptions you would like to claim please list the number on Line 1 box d. Please sign and date the form and return.

LINE 3: Exemption from withholding ? You may claim exemption from withholding of Wisconsin income tax if you had no liability for income tax for last year, and you expect to incur no liability for income tax for this year.

Wisconsin requires employers to withhold state personal income tax (PIT) from their employees' wages and remit the amounts withheld to the Department of Revenue. Wisconsin has reciprocal withholding agreements with Illinois, Indiana, Kentucky, and Michigan.

You must notify us when you: Close your business, No longer have a withholding liability, or. Need a new Wisconsin withholding number as the result of a change in business entity. ... Complete Close Account (under I want to...) ... Email DORWithholdingTax@wisconsin.gov, or. Call (608) 266-2776.

Wisconsin WT-4 Instructions Complete the section labeled ?Figure your total withholding exemptions below?. Step 1 is a guideline for how many exemptions you would like to claim. If you know how many exemptions you would like to claim please list the number on Line 1 box d. Please sign and date the form and return.