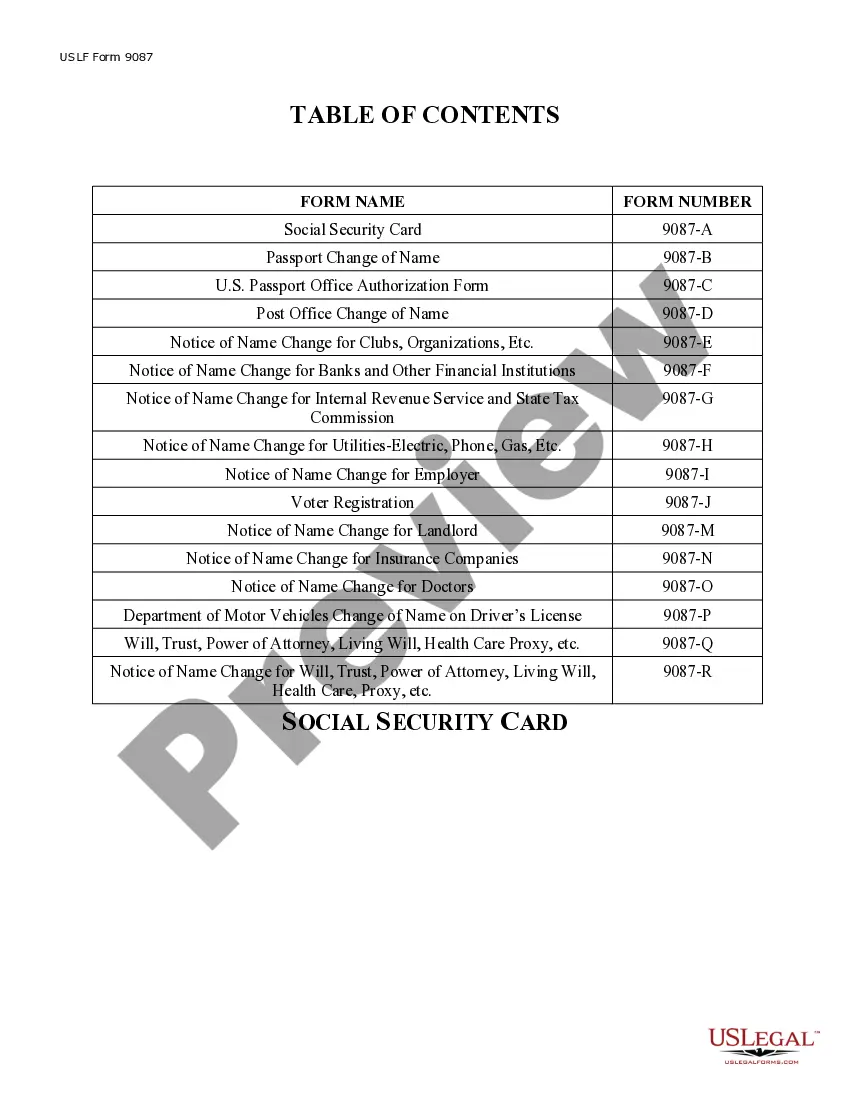

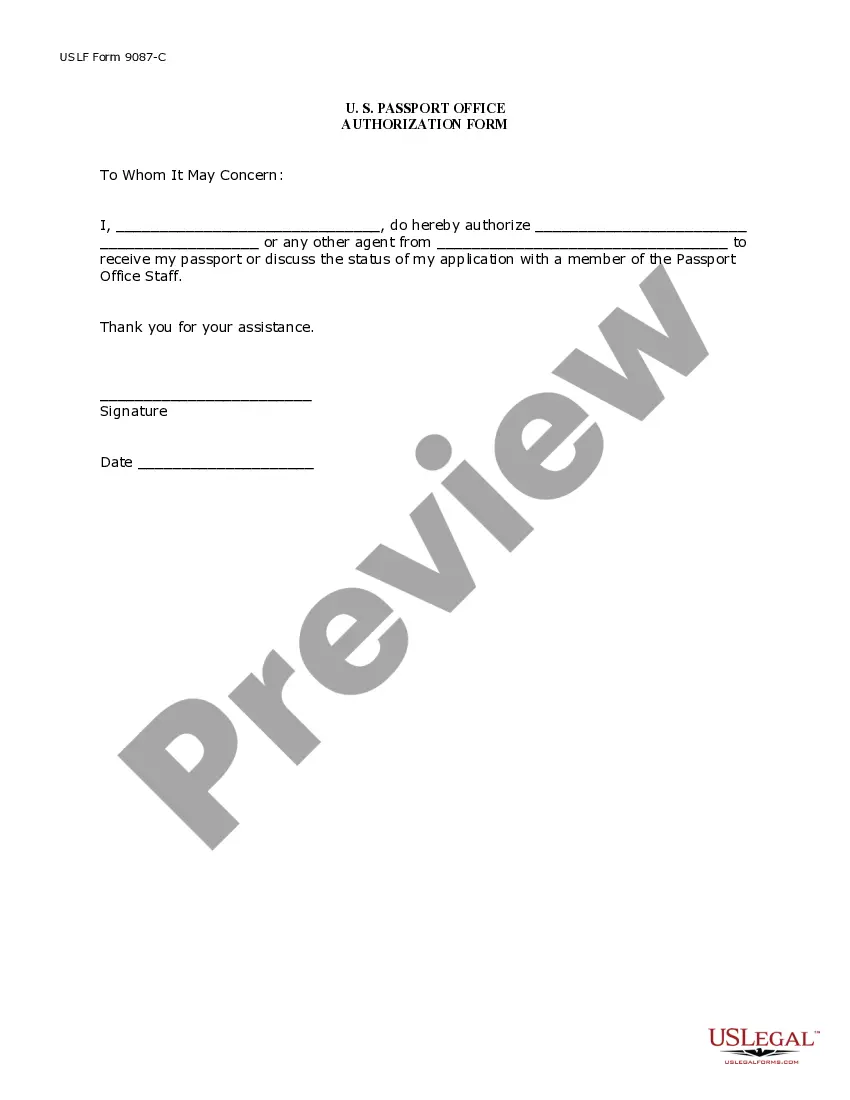

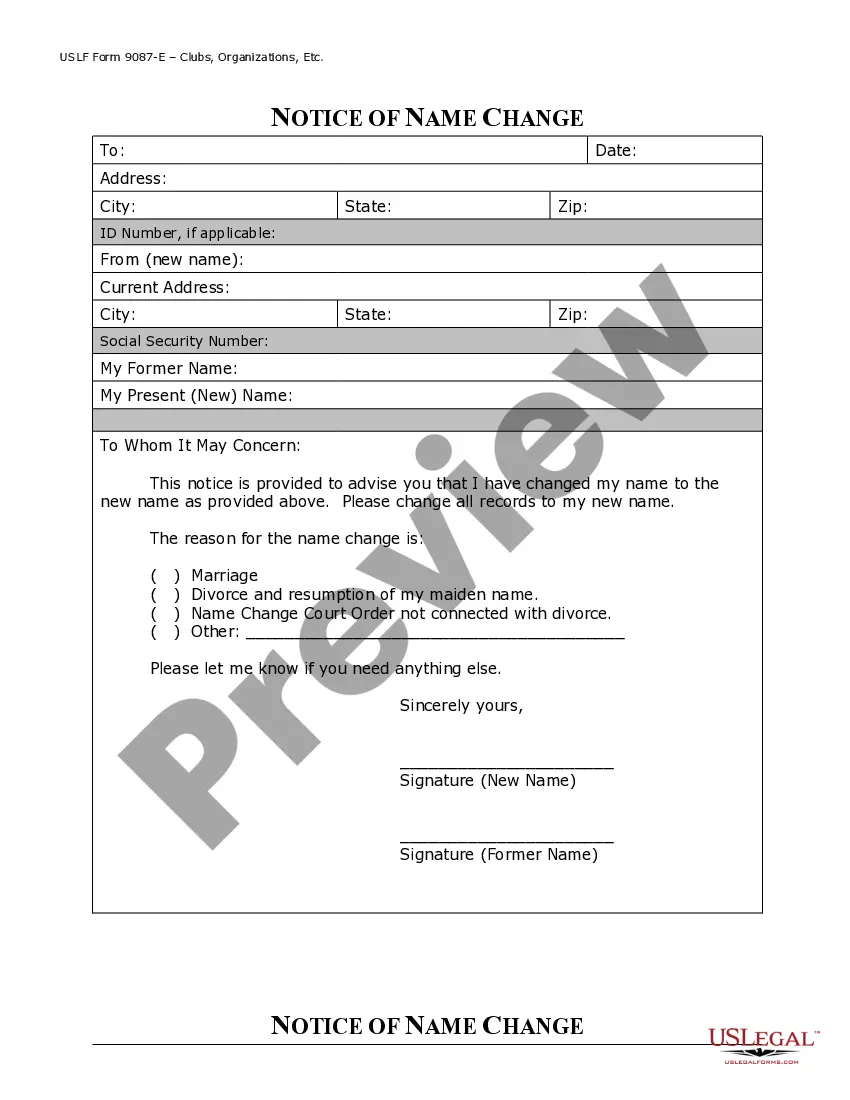

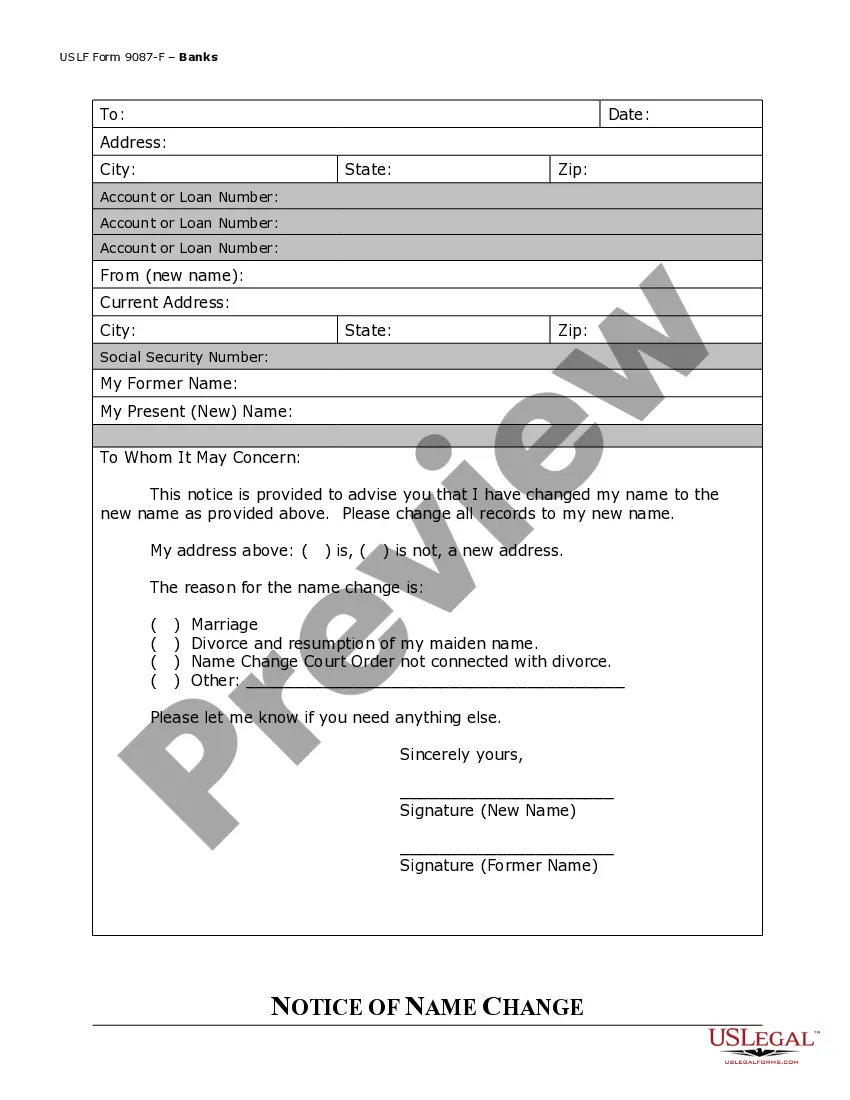

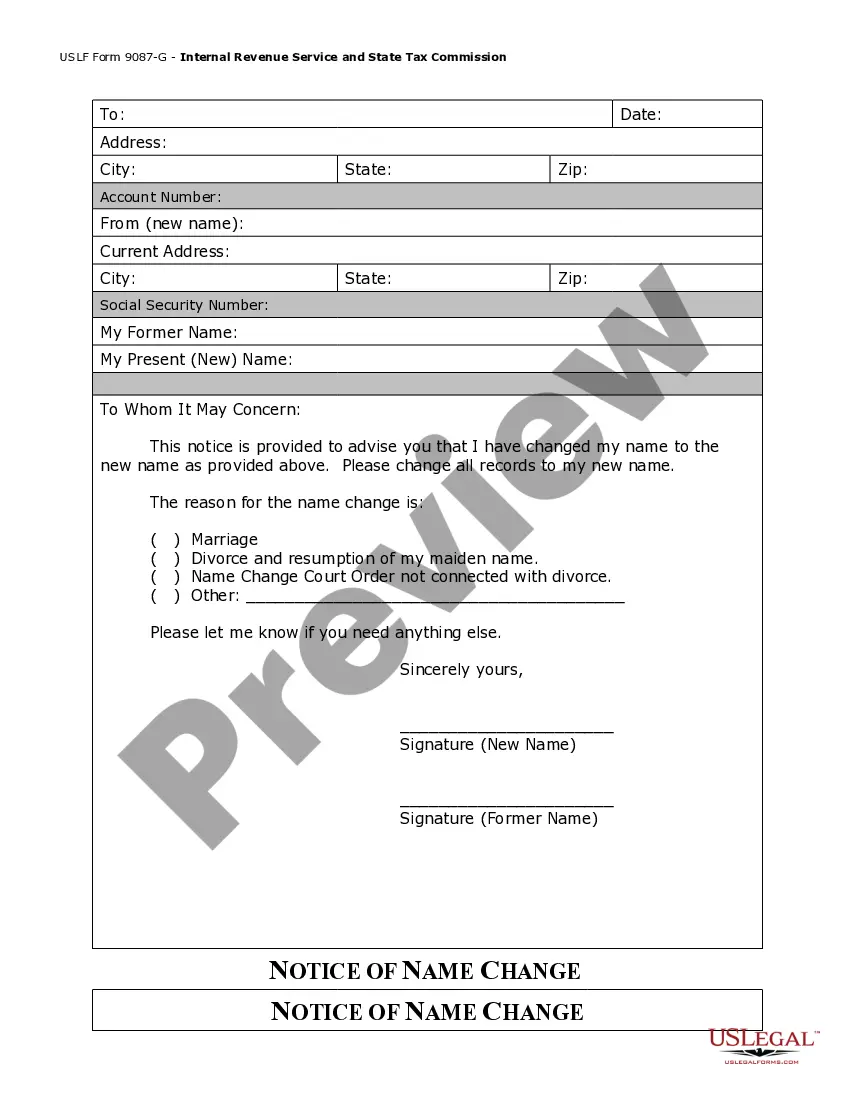

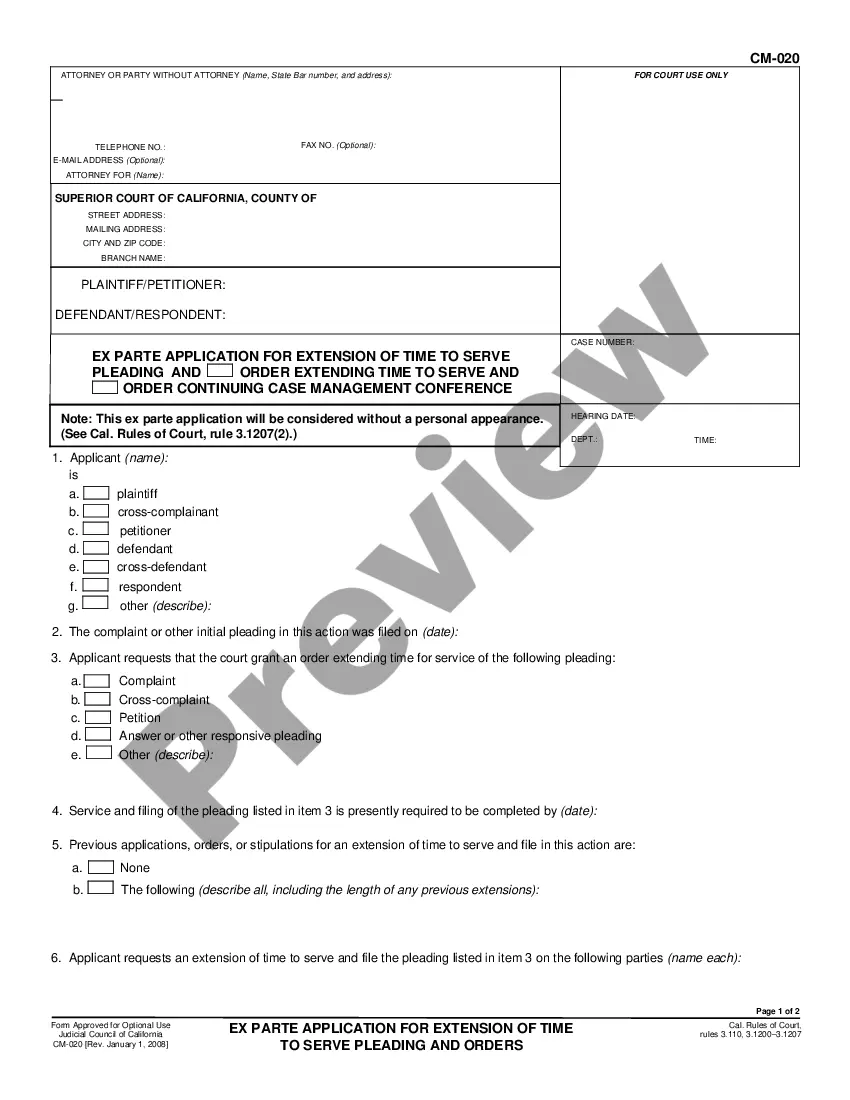

This Name Change Notification Package - Brides, Court Order Name Change, Divorced, Marriage form is an extensive package containing forms and instructions for notifying government agencies and others of a name change. Forms and instructions included for Passport, Social Security Card, Voter Registration, Employer, Banks and other Financial Institutions, Clubs and Organizations, Drivers License, Post Office, Insurance Companies, IRS, State Tax Commission, etc. It also contains forms for changing contracts, wills and other legal documents.

Wisconsin Name Change With Irs

Description

Form popularity

FAQ

To change your name with the Wisconsin Department of Revenue, complete the appropriate form and submit it along with your updated identification documents. This process is vital for updating your tax records and ensuring your Wisconsin name change with IRS is accurately reflected everywhere. USLegalForms can provide you templates to facilitate this process smoothly.

You can find all necessary forms on the official Wisconsin Department of Revenue website. They provide a comprehensive library of forms to assist you with tax filings and other inquiries. For folks dealing with a Wisconsin name change with IRS, ensure to download the correct forms relevant to your situation.

If you have questions about state withholding, you can email the Wisconsin Department of Revenue at DORWithholding@wisconsin. They respond promptly to inquiries and provide guidance concerning various tax-related matters, including your Wisconsin name change with IRS.

You can contact the Wisconsin Internal Revenue Service at 1-800-829-1040. When you call, be prepared to provide your tax details and any relevant information to ensure a smooth conversation. This number connects you with both federal and state inquiries regarding your Wisconsin name change with IRS.

To change your name in Wisconsin, you must file a petition with your local circuit court for a name change. This process typically requires a hearing, during which you must explain your reasons for the change. After obtaining a court order, you can notify the IRS and other agencies of your new name. US Legal Forms can offer assistance and necessary documents to help you navigate this process efficiently.

Closing your Wisconsin sales tax account entails submitting a final sales tax return to the Department of Revenue. Complete the form accurately, report all sales, and clear any outstanding tax obligations. This process helps prevent future liabilities. To make the process easier, you may find useful templates and guidance on the US Legal Forms platform.

In Wisconsin, sales tax exemptions do not generally expire unless the specific exemption law states otherwise. However, it is essential to regularly review your exemption status and document your eligibility to avoid complications. If you undergo a Wisconsin name change with IRS, be sure to update your exemption status if needed to reflect your new name.

Changing your LLC name in Wisconsin requires you to file a Certificate of Amendment with the Wisconsin Department of Financial Institutions. Ensure that your new name complies with state name availability requirements, and remember to update relevant documents and licenses. The process is simple, and US Legal Forms can provide templates and guides to assist you in making the change smoothly.

Shutting down a business in Wisconsin involves several steps, including filing articles of dissolution with the state and settling any outstanding debts. You must notify your employees, cease operations, and cancel any licenses and permits associated with your business. Utilizing the resources provided by US Legal Forms can streamline the dissolution process and ensure you complete all required paperwork accurately.

To close a Wisconsin sales tax account, you need to complete a final sales tax return and submit it to the Wisconsin Department of Revenue. Be sure to report any taxes due and include the reason for closing the account. Additionally, if you have collected sales tax, remit those funds to avoid penalties. For a thorough process, consider visiting the US Legal Forms platform for the necessary forms and guidance.