Transfer By Affidavit Wisconsin Process

Description

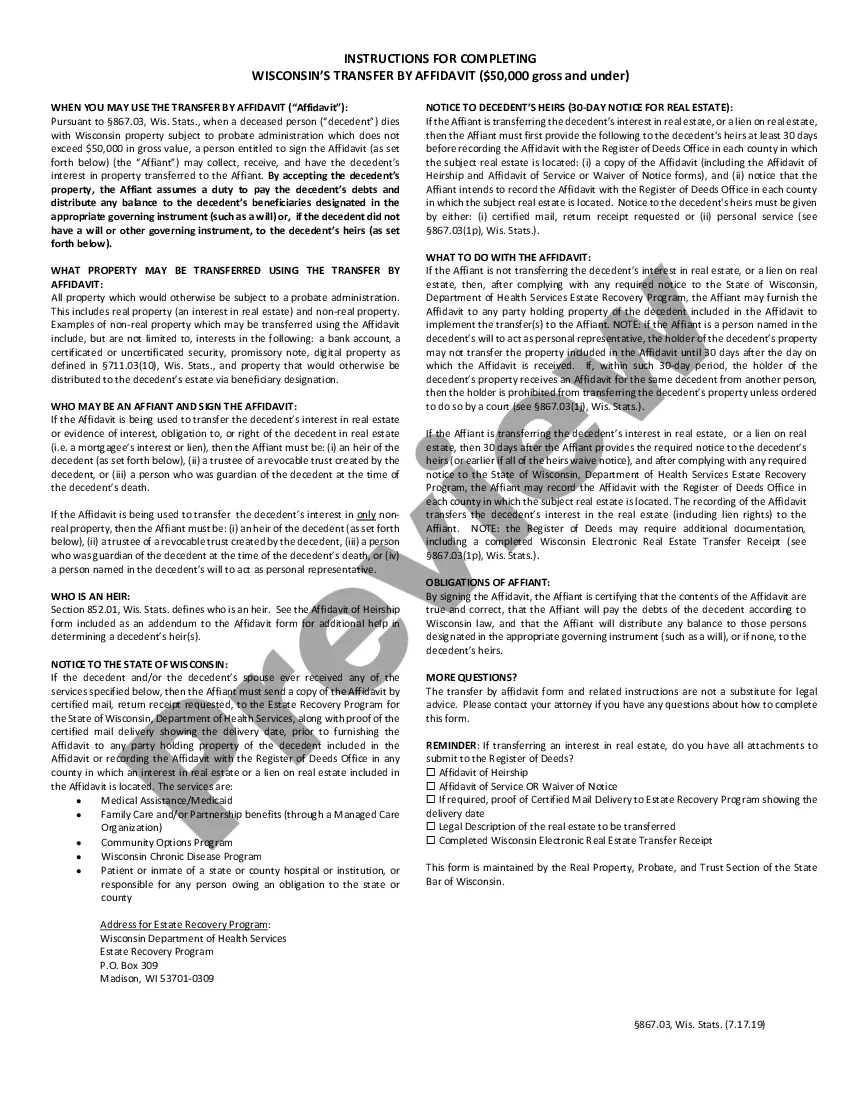

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

The Transfer By Affidavit Wisconsin Procedure you view on this page is a reusable legal template created by professional attorneys in compliance with federal and state laws and guidelines.

For over 25 years, US Legal Forms has supplied individuals, organizations, and lawyers with more than 85,000 authenticated, state-specific forms for any business and personal situation. It’s the quickest, easiest, and most reliable method to acquire the documents you require, as the service ensures bank-grade data security and anti-malware safeguards.

Choose the format you desire for your Transfer By Affidavit Wisconsin Procedure (PDF, Word, RTF) and download the sample onto your device.

- Search for the document you require and examine it.

- Browse through the sample you looked for and preview it or check the form description to confirm it meets your requirements. If not, utilize the search function to find the suitable one. Click Buy Now once you have found the template you need.

- Register and sign in.

- Select the pricing option that works for you and set up an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

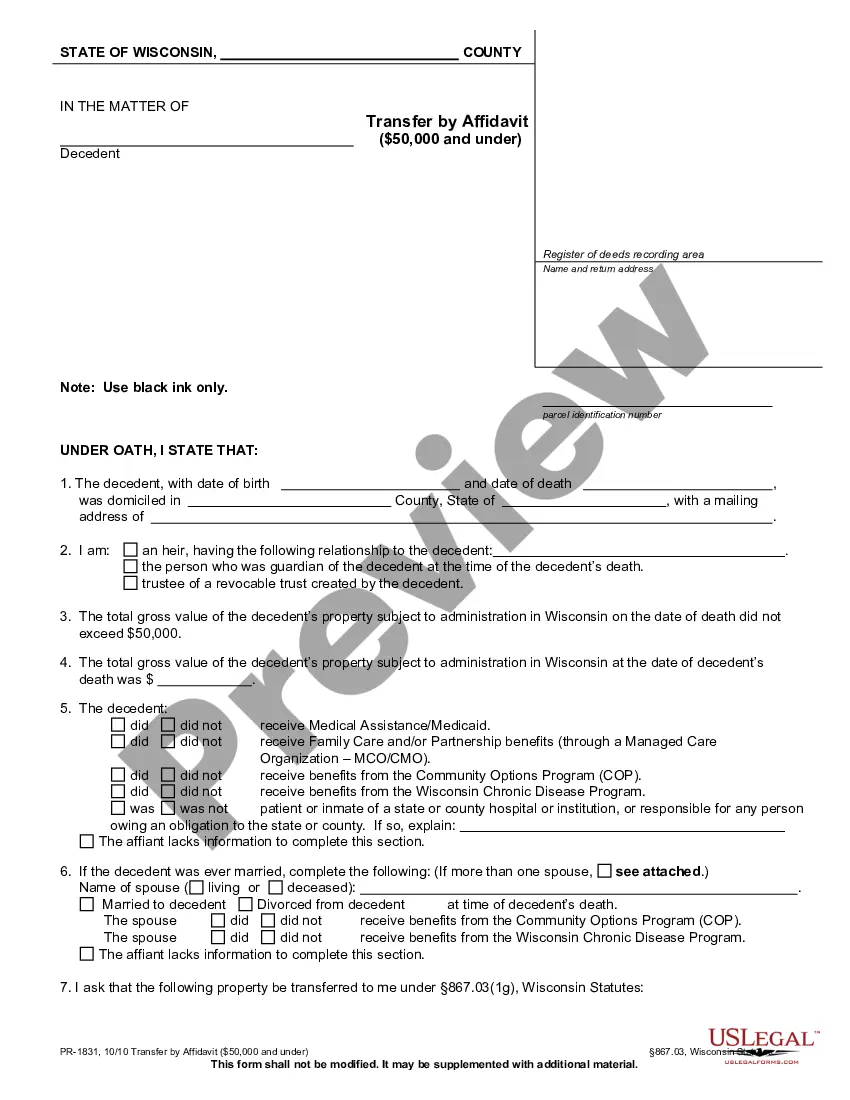

Transfer by Affidavit ($50,000 and under) Any heir, trustee, or person who was guardian, may collect and transfer the solely owned assets by completing an affidavit in duplicate. The original form Wisconsin Court System website must be sent via certified mail to the Wisconsin Department of Health and Family Services.

A Wisconsin small estate affidavit, also known as a Transfer by Affidavit, helps heirs, successors and beneficiaries of estates valued at $50,000 or less receive what they are entitled to more quickly than through traditional means.

The Transfer by Affidavit process may be used to close a person's estate when the deceased had $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.

A deed and an Electronic Wisconsin Real Estate Transfer Return (eRETR) must be completed to convey title to real estate. If you need additional information in regards to your inquiry you will have to consult with a title company or an attorney. You can also contact the Register of Deeds at (608) 266-4141.

Form PR-1831 - Transfer By Affidavit ($50,000 And Under) is a probate form in Wisconsin. To transfer decedent's assets not exceeding $50,000 (gross) to an heir, trustee of trust created by decedent, or person who was guardian of the decedent at the time of the decedent's death for distribution.