Transfer Affidavit Valued Form Michigan

Description

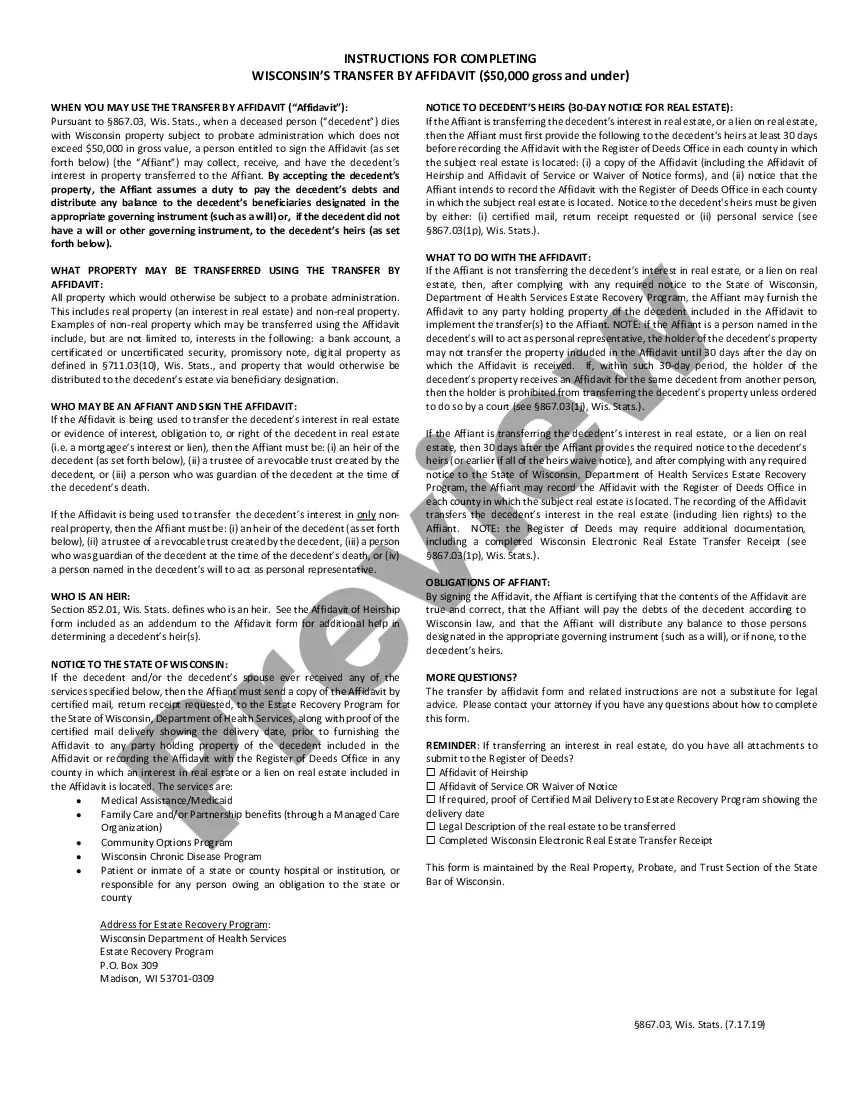

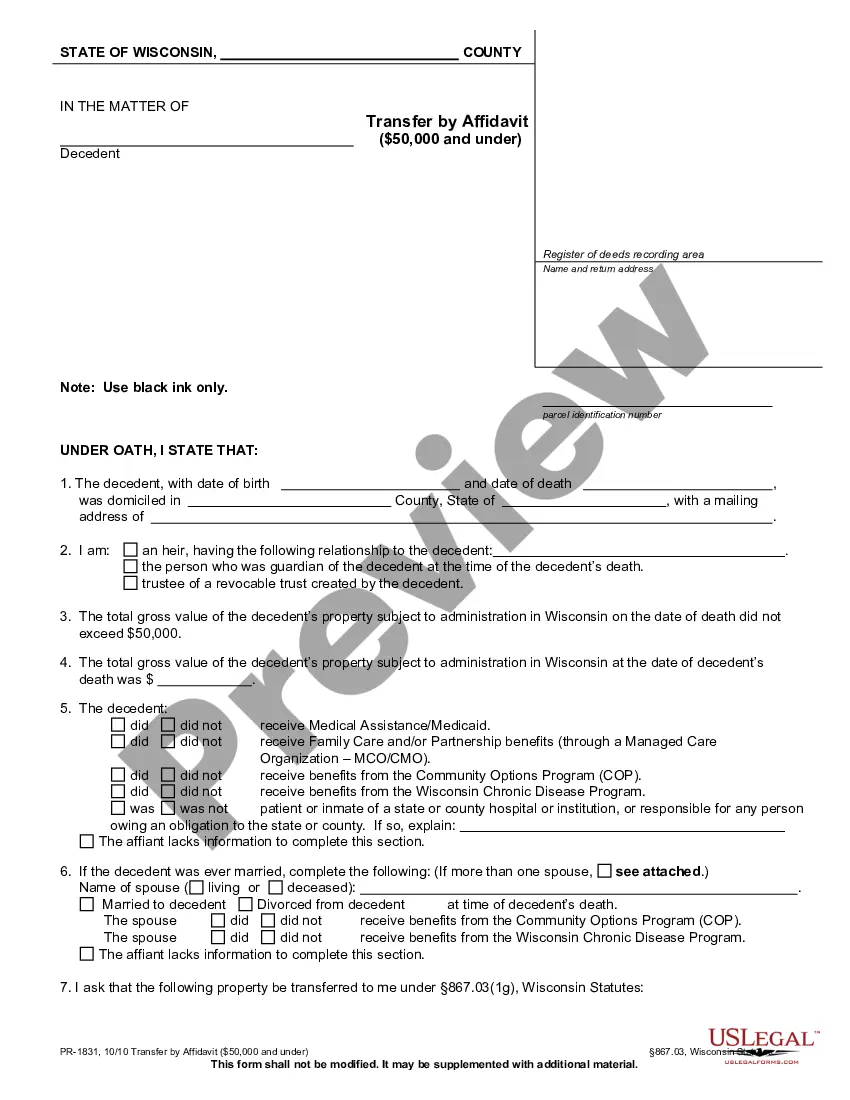

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

Drafting legal documents from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more cost-effective way of creating Transfer Affidavit Valued Form Michigan or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual collection of more than 85,000 up-to-date legal forms addresses virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-specific templates diligently prepared for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can easily find and download the Transfer Affidavit Valued Form Michigan. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Transfer Affidavit Valued Form Michigan, follow these tips:

- Check the form preview and descriptions to ensure that you have found the form you are looking for.

- Check if form you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to get the Transfer Affidavit Valued Form Michigan.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and turn form execution into something simple and streamlined!

Form popularity

FAQ

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

State Law requires a Property Transfer Affidavit to be filed whenever real estate is transferred (even if you are not recording a deed).

The Property Transfer Affidavit is used to inform the assessor of the transfer (sale, inheritance, etc.) of property. The Property Transfer Affidavit is a result of the Proposal A reforms which 'caps', or limits, the rate of increase of your property's "taxable value" (the value used to calculate your tax bill).

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

Real Estate Transfer Tax Valuation Affidavit The tax is based on the value of the real property transferred and is collected at the time the contract or instrument of conveyance is submitted for recording. ?Value? means the current or fair market worth in terms of legal monetary exchange at the time of the transfer.