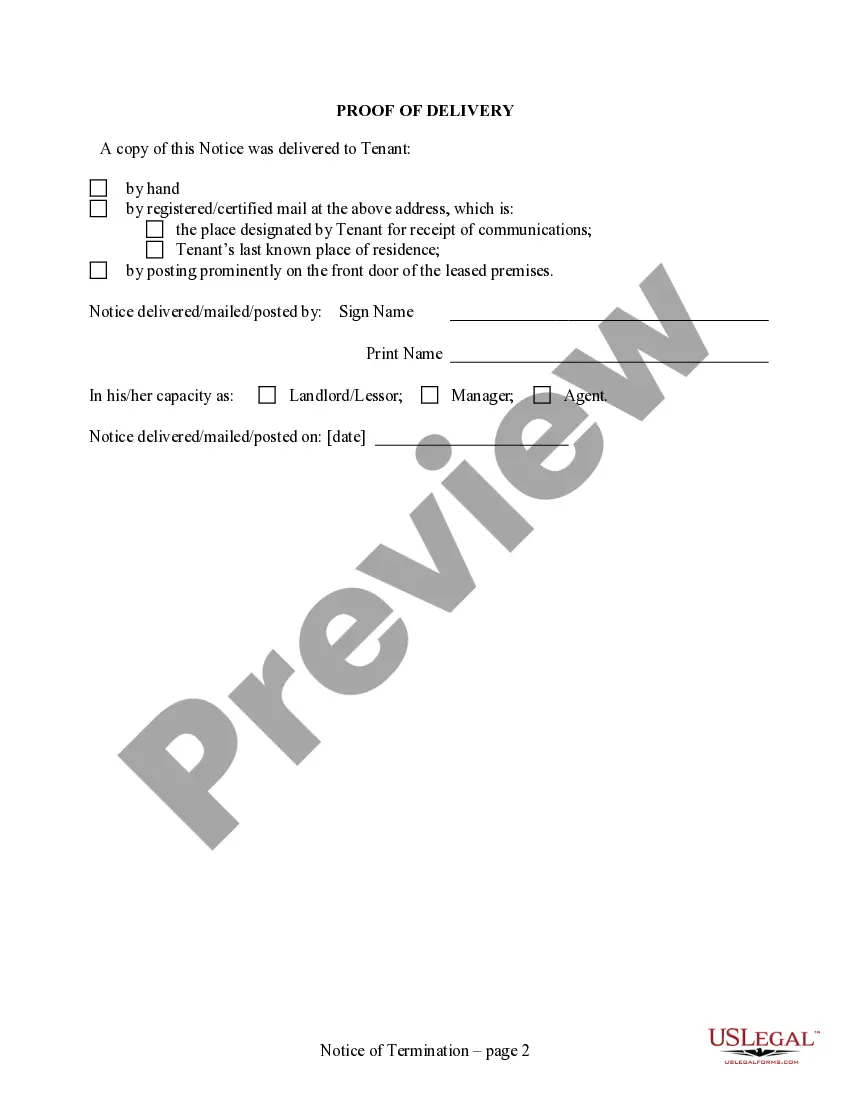

This 28 Day Notice to Terminate Month to Month Lease - No Right to Cure form is for use by a Landlord to terminate a month-to-month residential lease. "Residential" includes a house, apartment or condo. Unless a written agreement provides otherwise, the Landlord does not have to have a reason for terminating the Lease in this manner, other than a desire to end the lease. A month-to-month lease is one which continues from month-to-month unless either party chooses to terminate. Unless a written agreement provides for a longer notice, 28 days notice is required prior to termination in this state. The notice must be given to the Tenant within at least 28 days prior to the termination date. The form indicates that the Landlord has chosen to terminate the lease, and states the deadline date by which the Tenant must vacate the premises. For additional information, see the Law Summary link.

Notice Termination Form For Employee Purchases

Description

How to fill out Wisconsin 28 Day Notice To Terminate Month To Month Lease - No Right To Cure - Residential?

Handling legal documents and processes can be a lengthy addition to your day.

Notice Termination Form For Employee Purchases and similar forms generally necessitate looking for them and figuring out how to complete them accurately.

Consequently, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and useful online directory of forms readily available will be extremely beneficial.

US Legal Forms is the top online resource for legal templates, offering over 85,000 state-specific documents and various tools to help you finalize your paperwork swiftly.

Is it your first time using US Legal Forms? Register and create an account in a few minutes to gain access to the form catalog and Notice Termination Form For Employee Purchases. Then, follow the instructions below to complete your form.

- Explore the collection of relevant documents accessible with just one click.

- US Legal Forms provides state- and county-specific templates available for download at any time.

- Safeguard your document management processes by employing a quality service that enables you to prepare any form in minutes without extra or hidden fees.

- Simply Log Into your account, find Notice Termination Form For Employee Purchases, and obtain it instantly in the My documents section.

- You can also access forms you have downloaded before.

Form popularity

FAQ

360 Legal Forms can take care of all of your personal, business, and real estate needs. Enjoy 24/7 access to our full library of forms created by lawyers. to sign too. Sign online and allow other parties to do the same.

To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.

New Hampshire, NH State Income Taxes. New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return.

You may file this return and pay the tax due online by logging on to .revenue.nh.gov/. If the net balance due is less than $1.00, do not pay but still file the return. If you file online, you do not need to mail the return to NH DRA.

The public's right to know what its government is doing is a fundamental part of New Hampshire's democracy. New Hampshire's Constitution and the Right-to-Know law ensure that the public has reasonable access to meetings of public bodies and to governmental records.

New Hampshire has no personal income tax, which means Social Security retirement benefits are tax-free at the state level. Income from pensions and retirement accounts also go untaxed in New Hampshire. On top of that, there is no sales tax, estate tax or inheritance tax here.

Individuals: Individuals who are residents or inhabitants of New Hampshire for any part of the tax year must file a return if they received more than $2,400 of gross interest and/or dividend income for a single individual or $4,800 of such income for a married couple filing a joint New Hampshire return.

Public Records The government must respond to requests within five business days. Certain records are exempt from disclosure, but New Hampshire courts generally assume everything is available to the public unless the governmental agency proves otherwise.