Expiring Twenty Deadline For Tax Filing

Description

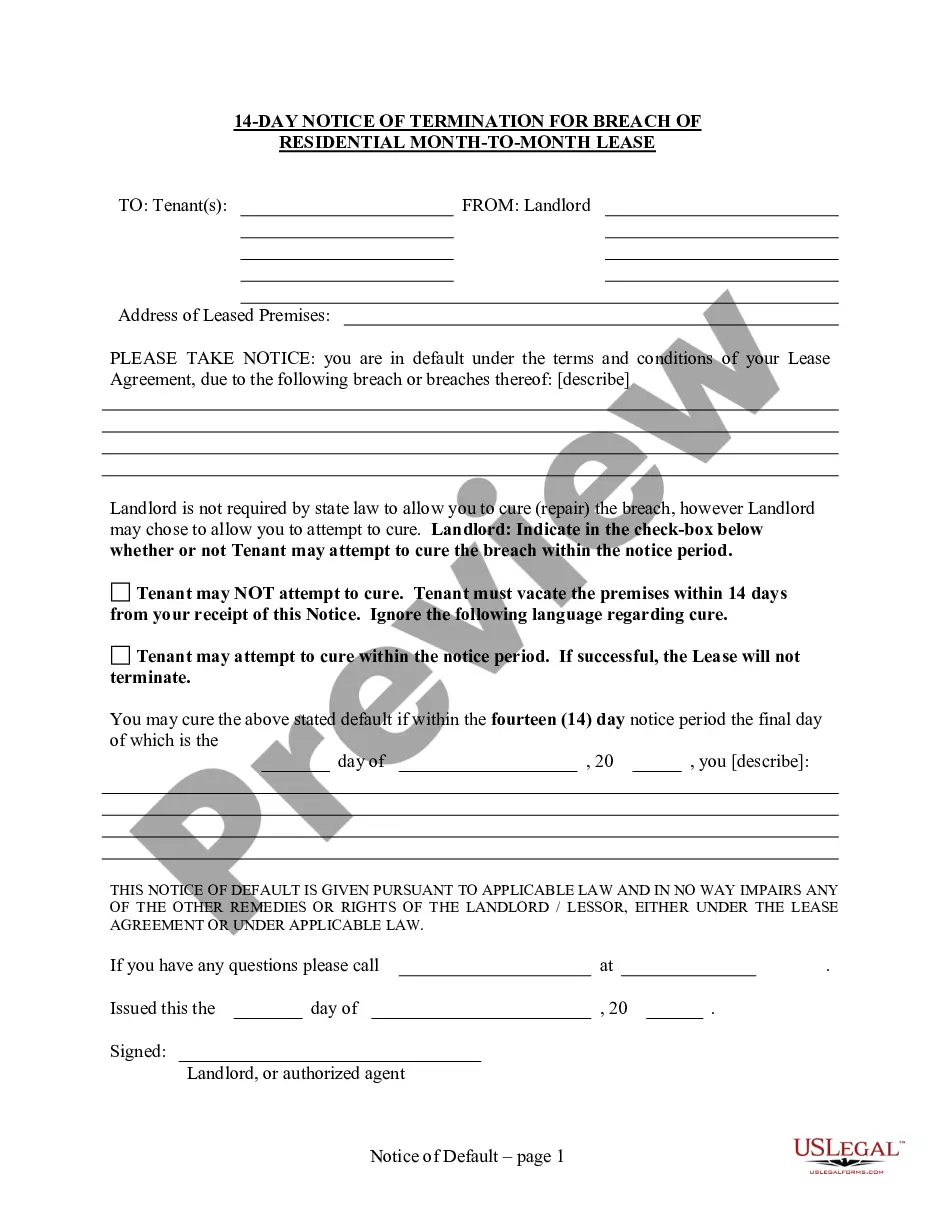

How to fill out Wisconsin 28 Day Notice To Terminate Month To Month Lease - No Right To Cure - Residential?

- If you're an existing user, log in to your account to access and download your required form template. Confirm your subscription is active. If it's expired, renew it as per your payment plan.

- For first-time users, begin by browsing through the extensive form collection. Check the Preview mode and form descriptions to confirm it matches your needs and local jurisdiction.

- If necessary, utilize the Search tab above to find alternative templates. Ensure the selected form suits your requirements before proceeding.

- After selecting the appropriate document, click on the Buy Now button and choose your subscription plan. Don’t forget to create an account for library access.

- Complete your purchase by entering your credit card information or using your PayPal account to process the subscription.

- Once payment is confirmed, download your form to your device, and you can access it anytime from the My Forms section in your profile.

US Legal Forms empowers users with a robust library of over 85,000 legally compliant forms, making it the go-to service for both individuals and attorneys needing legal documents.

Don't miss out on the opportunity to efficiently handle your tax filing before the deadline. Start using US Legal Forms today for a hassle-free experience.

Form popularity

FAQ

Filing your taxes after the expiring twenty deadline for tax filing can lead to penalties and increased interest on taxes owed. You might receive a notice from the IRS, prompting additional action. It’s crucial to file as soon as you can to minimize complications. Utilize US Legal Forms for detailed guidance and support in completing your tax return efficiently.

Yes, you can still file your tax return after the expiring twenty deadline for tax filing, but be aware of penalties and interest. The key is to submit your return promptly to reduce these charges. Filing even late can help you secure refunds or avoid further complications. US Legal Forms offers resources to assist you in this process.

If you file your return after the expiring twenty deadline for tax filing, the IRS may impose penalties and interest on any amount due. This could lead to additional financial strain over time. It's essential to file as soon as possible to minimize these potential costs. Consider using platforms like US Legal Forms to help you navigate the late filing process smoothly.

If you file your taxes late and are due a refund, you won’t face a penalty for late filing. However, you still need to file your return to receive your refund. It’s always best to adhere to the expiring twenty deadline for tax filing to avoid unnecessary delays.

When you file an extension, the IRS grants you an additional six months, bringing your deadline to October 15. This extension allows you to gather necessary documents and ensure accurate filing. Remember, though, the original payment deadline remains, highlighting the importance of planning around the expiring twenty deadline for tax filing.

No, the IRS extension typically does not go beyond October 15. Once you file for an extension, you have until this date to submit your completed tax return. Missing the expiring twenty deadline for tax filing can lead to penalties, so it’s important to stay informed.

Yes, you can file for an IRS extension after April 18, but you will need to file Form 4868. This allows you to extend your deadline for submitting your tax return. However, it’s important to note that this extension does not change your payment deadline, which is still set to the expiring twenty deadline for tax filing.

You can still file your taxes electronically after the April 18 deadline, but you may face limitations. Some e-filing services close after the deadline, but others remain open for late submissions. Keep in mind that the expiring twenty deadline for tax filing means that you need to act quickly to avoid penalties. Platforms like UsLegalForms can provide resources to help with this.

There is no defined 'too late' to file a return, but the longer you wait, the larger the penalties become. The expiring twenty deadline for tax filing advises that you should file as soon as possible to minimize costs. You risk losing your refund if you wait too long. Consider using UsLegalForms to file your return quickly and correctly.

Missing the tax filing deadline can lead to penalties and interest on unpaid taxes. The expiring twenty deadline for tax filing means you may face fees based on how late you file. Your refund may also be delayed if you are due one. To mitigate issues, consider filing as soon as possible, and tools like UsLegalForms can assist.