Expiring Twenty Deadline For Tax

Description

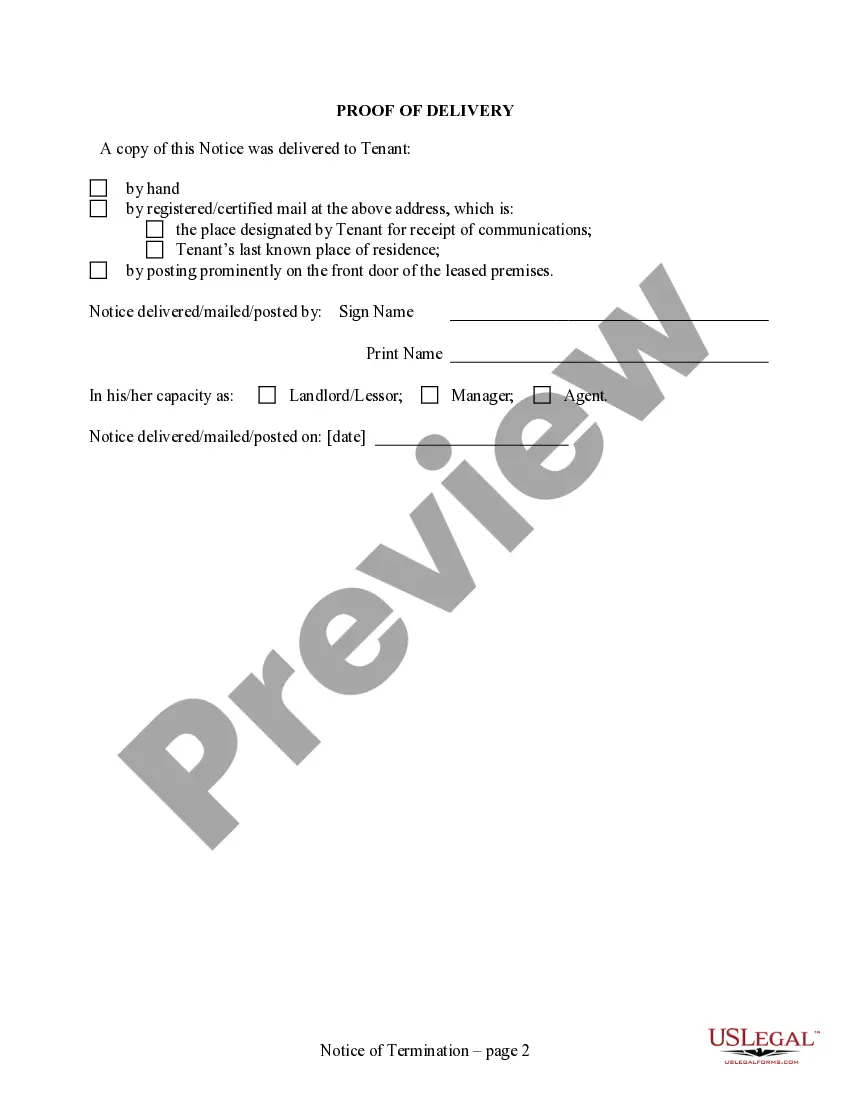

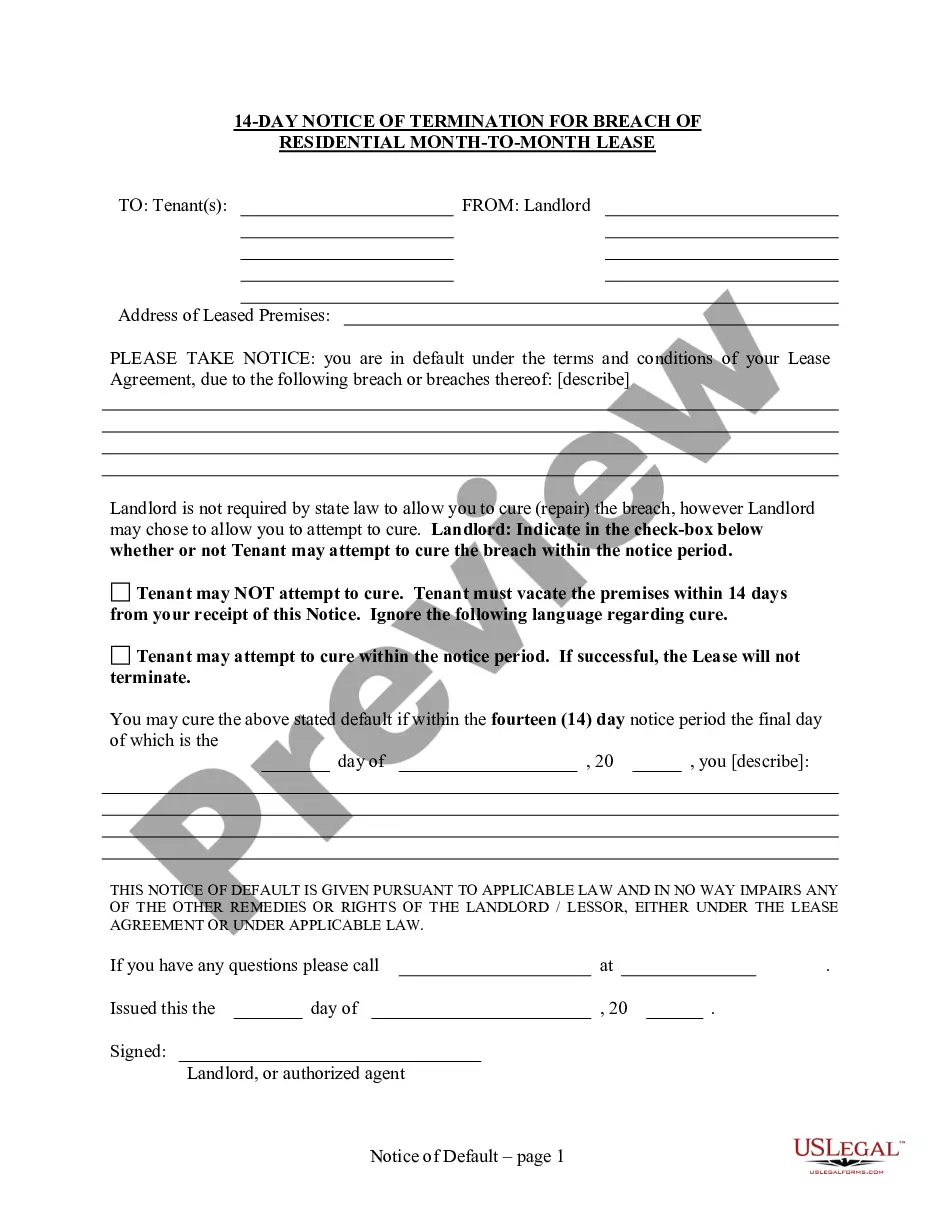

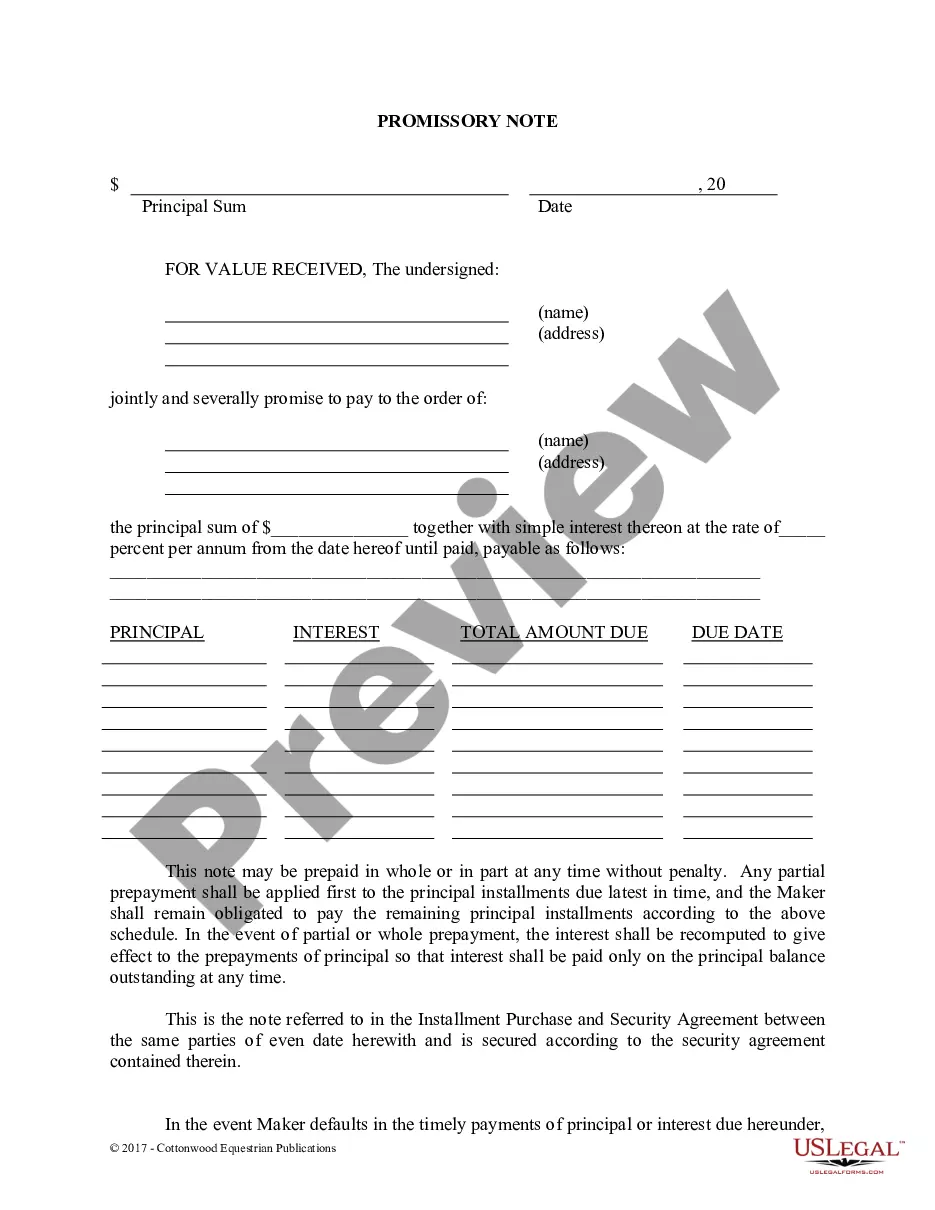

How to fill out Wisconsin 28 Day Notice To Terminate Month To Month Lease - No Right To Cure - Residential?

- If you have an existing account with US Legal Forms, log in to access your library and download the appropriate form template by clicking the Download button.

- Ensure that your subscription is up-to-date; if you've encountered any issues, renew it according to your selected payment plan.

- For first-time users, begin by reviewing the Preview mode and form description to find exactly what meets your local jurisdiction needs.

- If needed, utilize the Search tab above to explore a different template. Verify that it suits your requirements before proceeding.

- Proceed to purchase your form by clicking the Buy Now button and selecting your preferred subscription plan, while also creating an account for resource access.

- Complete your purchase using your credit card details or a PayPal account to finalize your subscription.

- Download your chosen form and save it to your device; you can also access it anytime via the My Forms menu in your profile.

Once you complete these steps, you will have the necessary forms on hand to comply with the expiring twenty deadline for tax requirements. US Legal Forms simplifies the legal documentation process, putting a robust library of over 85,000 forms right at your fingertips.

Take action today and ensure your tax documents are ready before any deadlines with US Legal Forms' easy-to-use platform.

Form popularity

FAQ

You must file your extension request before the due date of your tax return, typically by April 15. Submissions after this date generally will not be accepted. To avoid any issues, make sure to plan ahead and utilize resources like USLegalForms to streamline the tax extension process and stay within the required timeframe.

Asking for an extension after the deadline is complicated, but you can submit a reasonable cause request to the IRS. They will review your case to determine if your situation warrants an exception. However, it's crucial to act swiftly. Seek guidance from a tax expert to maximize your chances of a favorable outcome.

You can typically request an extension of up to six months, allowing you more time to file your tax return. This means your new deadline would fall around the middle of October for most taxpayers. However, remember that this extension only applies to your filing, not to any taxes owed. USLegalForms offers resources to help make this process straightforward.

Generally, you cannot request an extension after the tax deadline has passed. The IRS requires that you submit your extension request before the expiring twenty deadline for tax. However, in certain situations, you can still request a review of your case if you can show a valid reason for missing the deadline. Consulting with a tax professional can provide clarity and options.

Typically, the IRS cannot pursue collections on taxes owed after ten years from the date of assessment. However, certain factors, like filing for bankruptcy or submitting a collection due process request, might alter this timeline. Being aware of the expiring twenty deadline for tax helps you navigate your tax situation and avoid long-term complications.

The IRS statute of limitations for refunds usually allows taxpayers to request refunds for three years following the original filing date. After this period, the ability to receive refunds expires. Staying informed about the expiring twenty deadline for tax can safeguard your interests and ensure you take timely action.

The statute expiration date is the point in time after which the IRS can no longer take action regarding taxes owed. Generally, this time frame is 10 years from the date of tax assessment. It's vital to understand the expiring twenty deadline for tax to ensure you know your rights and obligations regarding past filings.

The 3 year rule for the IRS states that taxpayers have three years from the original due date of a tax return to claim any refunds. This deadline is important for those who might overlook earlier filings. By keeping track of the expiring twenty deadline for tax, you ensure that you can claim any benefits before they expire.

If you haven't filed taxes in 20 years, the IRS will likely assess your financial situation and possibly initiate enforcement actions to collect owed taxes. Additionally, any unfiled returns can lead to penalties and interest, which accumulate over time. The expiring twenty deadline for tax is crucial to your tax responsibilities, as unaddressed issues can create significant liabilities.

The refund statute expiration date refers to the time limit for taxpayers to claim any refunds from the IRS. After this point, typically three years from the original filing date, the IRS will no longer issue refunds. Understanding the expiring twenty deadline for tax can help you avoid missing out on potential refunds.