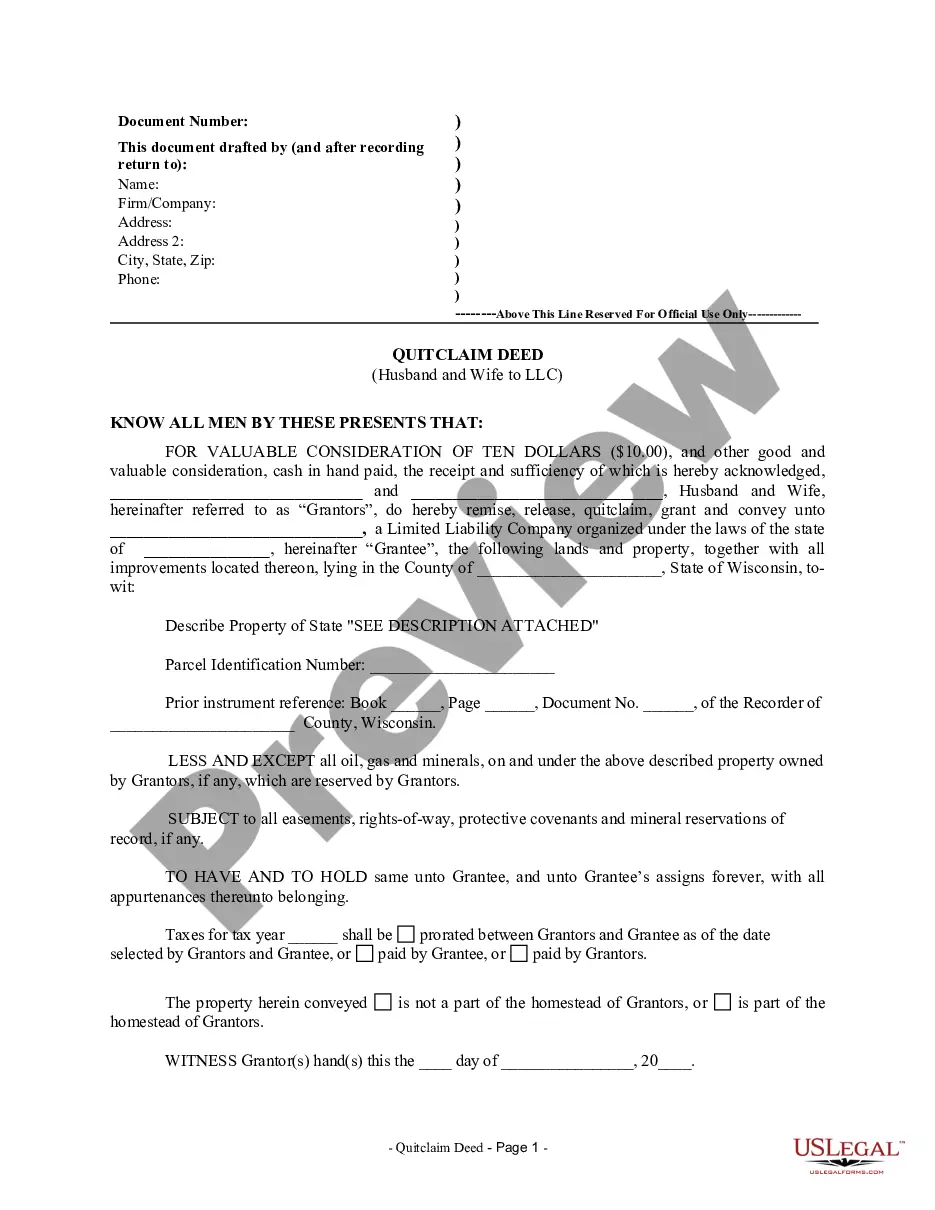

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Quit Claim Deed Form Wisconsin For Florida

Description

How to fill out Wisconsin Quitclaim Deed From Husband And Wife To LLC?

Legal papers management might be frustrating, even for the most knowledgeable professionals. When you are looking for a Quit Claim Deed Form Wisconsin For Florida and don’t get the a chance to spend looking for the correct and up-to-date version, the operations could be demanding. A strong web form catalogue might be a gamechanger for anyone who wants to deal with these situations successfully. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any demands you may have, from individual to organization papers, all in one location.

- Employ advanced resources to finish and control your Quit Claim Deed Form Wisconsin For Florida

- Gain access to a resource base of articles, tutorials and handbooks and resources highly relevant to your situation and needs

Save effort and time looking for the papers you will need, and utilize US Legal Forms’ advanced search and Review feature to locate Quit Claim Deed Form Wisconsin For Florida and download it. If you have a membership, log in to the US Legal Forms profile, search for the form, and download it. Take a look at My Forms tab to see the papers you previously downloaded as well as to control your folders as you see fit.

Should it be the first time with US Legal Forms, make a free account and have unlimited usage of all advantages of the platform. Here are the steps for taking after getting the form you want:

- Validate it is the right form by previewing it and looking at its description.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now when you are all set.

- Select a monthly subscription plan.

- Find the formatting you want, and Download, complete, sign, print and send your document.

Take advantage of the US Legal Forms web catalogue, backed with 25 years of experience and reliability. Enhance your day-to-day document administration in to a smooth and user-friendly process right now.

Form popularity

FAQ

Quitclaims are typically taxable The person giving the gift is responsible for paying tax, and the recipient doesn't have to report the gift at all. There are some exclusions, however. In 2022, one person can gift another person up to $16,000 in cash or assets in a calendar year without paying tax on the gift.

Ing to Florida Statute 695.26, a quitclaim deed must contain these certain elements: Name and address of person preparing the deed. Grantor's name and address. Grantee's name and address. Signatures of the grantors. Two witnesses for each signature/ Notary acknowledgment with signature.

A quitclaim deed is signed by the grantor but not always the guarantee, or person receiving the property.

While the act of recording a quitclaim deed makes the transfer official in public records, Florida law does not mandate such recordation for the deed's validity. However, the state does emphasize the importance of recording the transfer of ownership interest in public records to maintain an accurate chain of title.

Once the quitclaim deed is recorded, it becomes part of the public record. You may also be required to pay a filing fee or costs associated with properties that have an outstanding mortgage. If there is money being exchanged for the deed, documentary stamp taxes will also have to be paid.