Wisconsin Transfer Of Deed

Description

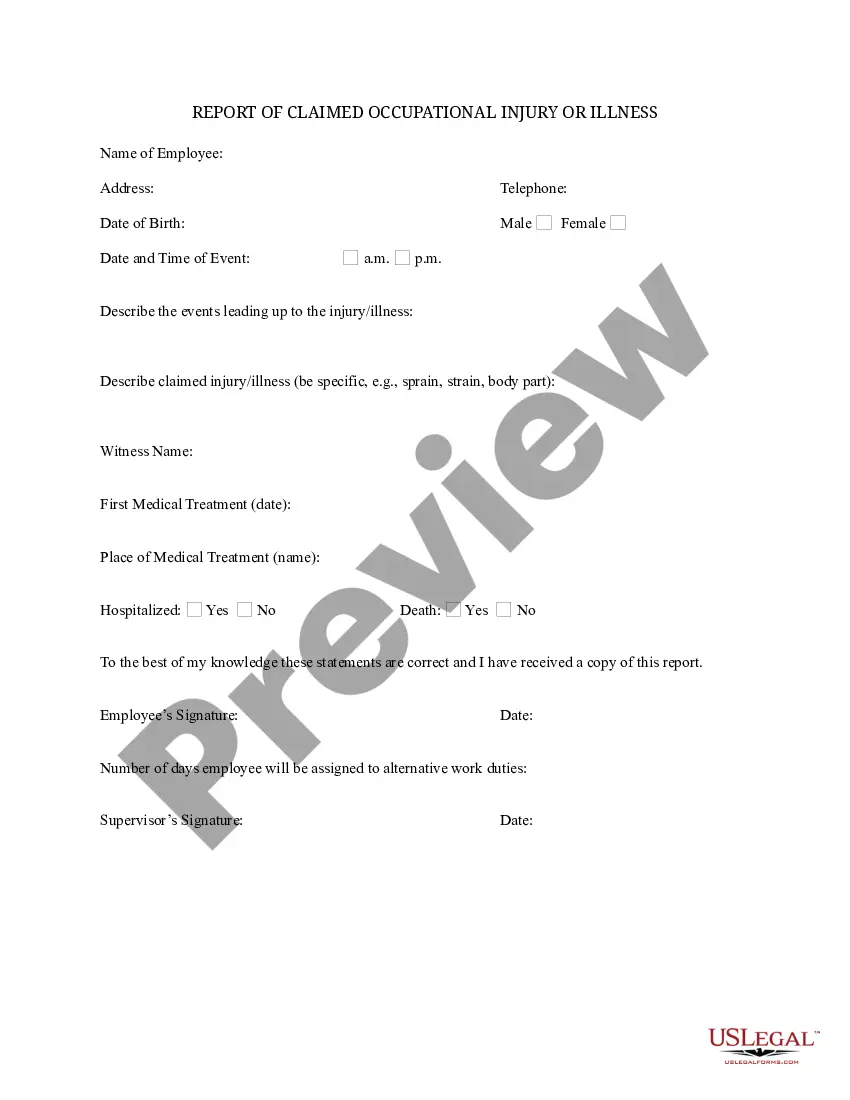

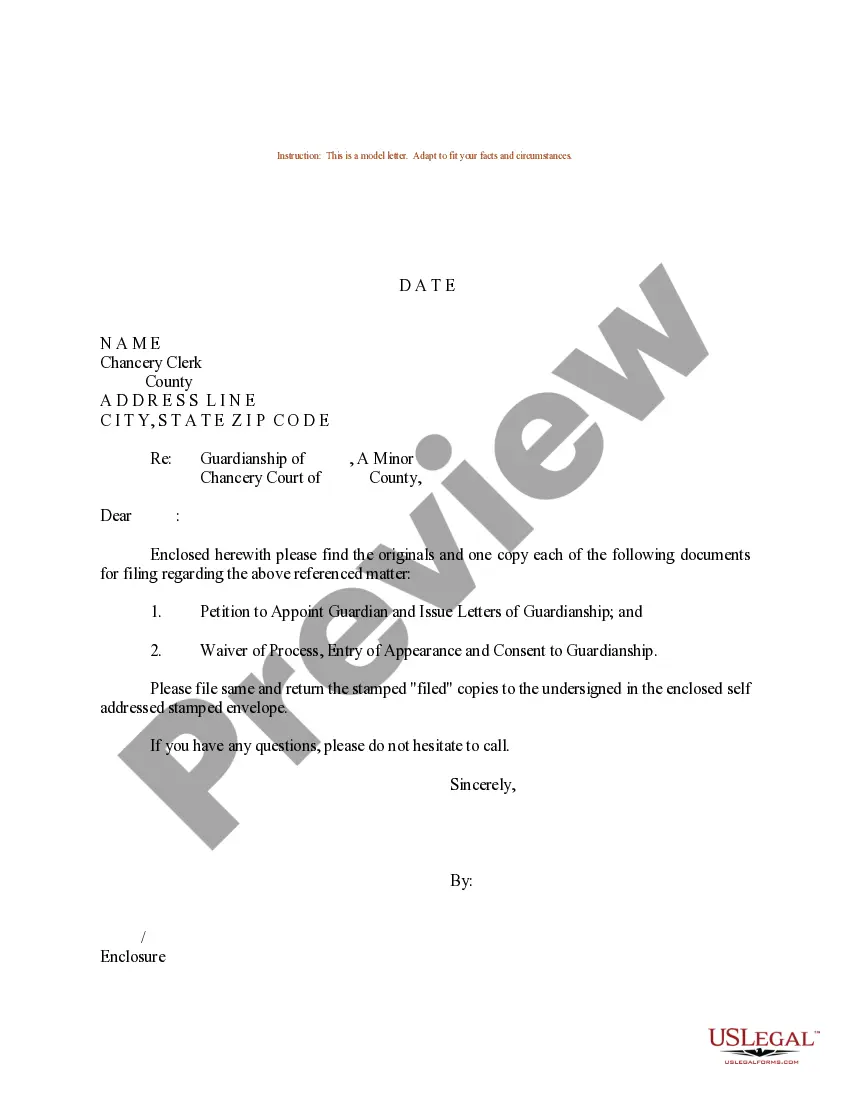

How to fill out Wisconsin Transfer On Death Deed Or TOD - Beneficiary Deed From Two Individuals To An Individual?

Whether for business purposes or for personal matters, everybody has to handle legal situations sooner or later in their life. Completing legal papers requires careful attention, starting with picking the correct form template. For example, if you pick a wrong version of a Wisconsin Transfer Of Deed, it will be turned down when you submit it. It is therefore crucial to have a dependable source of legal documents like US Legal Forms.

If you have to obtain a Wisconsin Transfer Of Deed template, stick to these easy steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Check out the form’s information to ensure it fits your case, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong document, go back to the search function to find the Wisconsin Transfer Of Deed sample you require.

- Get the template when it matches your requirements.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved templates in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the correct pricing option.

- Finish the profile registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Select the file format you want and download the Wisconsin Transfer Of Deed.

- After it is saved, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never need to spend time searching for the right template across the internet. Make use of the library’s easy navigation to get the right form for any occasion.

Form popularity

FAQ

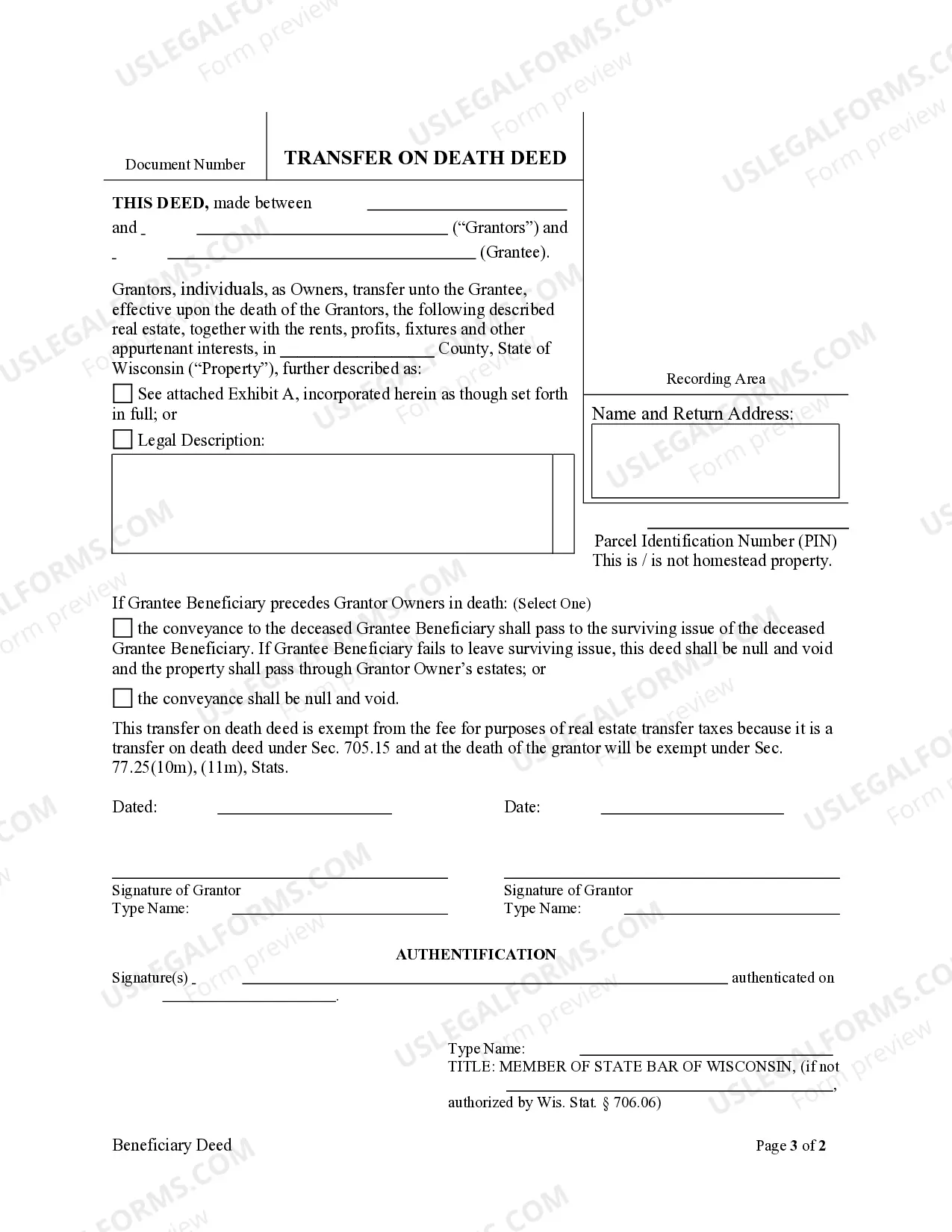

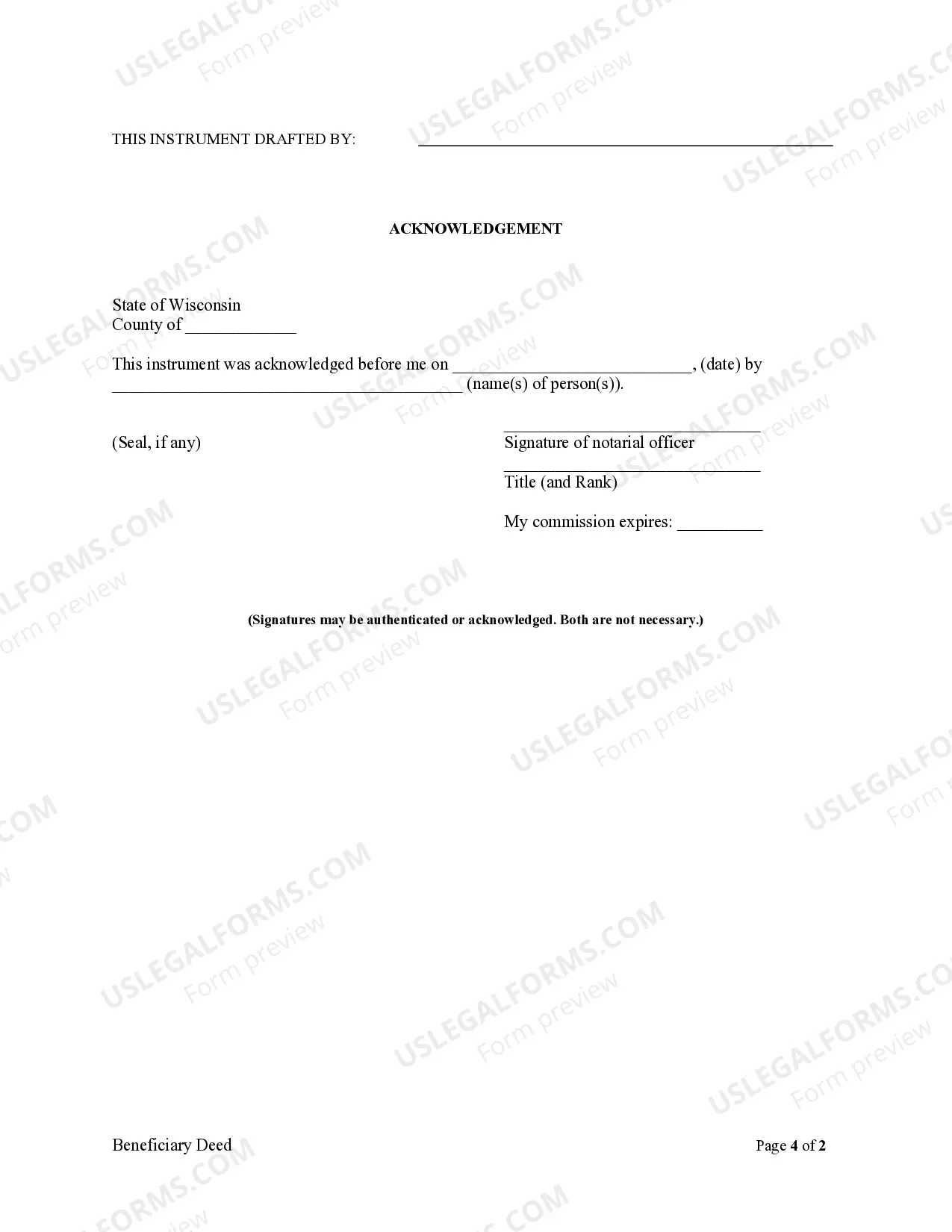

The Grantors (current owners) must sign the deed before a notary public. 2. Go to the Wisconsin Department of Revenue's E-Return website at and complete an E-Return (eRETR). Most of the information you need for the eRETR comes from your property tax statement and the new deed.

The Wisconsin real estate transfer fee (RETF) is imposed upon the grantor (seller) of real estate at a rate of $3.00 per $1,000 of value. The determination of the "value" of real estate for purposes of the fee depends upon the type of transfer being conducted.

A deed and an Electronic Wisconsin Real Estate Transfer Return (eRETR) must be completed to convey title to real estate. If you need additional information in regards to your inquiry you will have to consult with a title company or an attorney. You can also contact the Register of Deeds at (608) 266-4141.

You must sign the TOD designation and get your signature notarized, and then record (file) the designation with the county register of deeds before your death. Otherwise, it won't be valid. You can make a Wisconsin designation of transfer on death beneficiary with WillMaker.

Legal instruments such as warranty deeds, quit claim deeds, etc., that convey title from one property owner to a new owner, are usually drafted by attorneys, or paralegals or legal secretaries under the supervision of an attorney.