Wisconsin Promissory Note Template With Co-maker

Description

How to fill out Wisconsin Promissory Note Secure By A Mortgage?

When you are required to present the Wisconsin Promissory Note Template With Co-maker according to your local state's legislation, there can be several alternatives available.

You don't need to review each document to ensure it satisfies all the legal requirements if you are a US Legal Forms member. It's a trustworthy service that can assist you in obtaining a reusable and current template on any topic.

US Legal Forms is the most extensive online directory with a collection of over 85,000 ready-to-use documents for business and personal legal situations. All templates are confirmed to comply with each state's regulations.

Choose the most suitable pricing plan, Log In to your account, or create a new one. Pay for a subscription (PayPal and credit card options are provided). Download the template in your preferred file format (PDF or DOCX). Print the document or fill it out electronically in an online editor. Acquiring professionally drafted legal papers becomes easy with US Legal Forms. Additionally, Premium users can also take advantage of the comprehensive integrated tools for online PDF editing and signing. Give it a try today!

- Downloading the Wisconsin Promissory Note Template With Co-maker from our website ensures that you have a legitimate and current document.

- Acquiring the required template from our site is extremely straightforward.

- If you already possess an account, simply Log In to the platform, verify that your subscription is active, and save the desired file.

- In the future, you can access the My documents tab in your profile and have access to the Wisconsin Promissory Note Template With Co-maker at any moment.

- If this is your first visit to our website, please adhere to the instructions below.

- Review the recommended page and verify it meets your standards.

- Utilize the Preview mode and examine the form description if available.

- Find another template via the Search bar in the header if required.

- Click Buy Now once you locate the appropriate Wisconsin Promissory Note Template With Co-maker.

Form popularity

FAQ

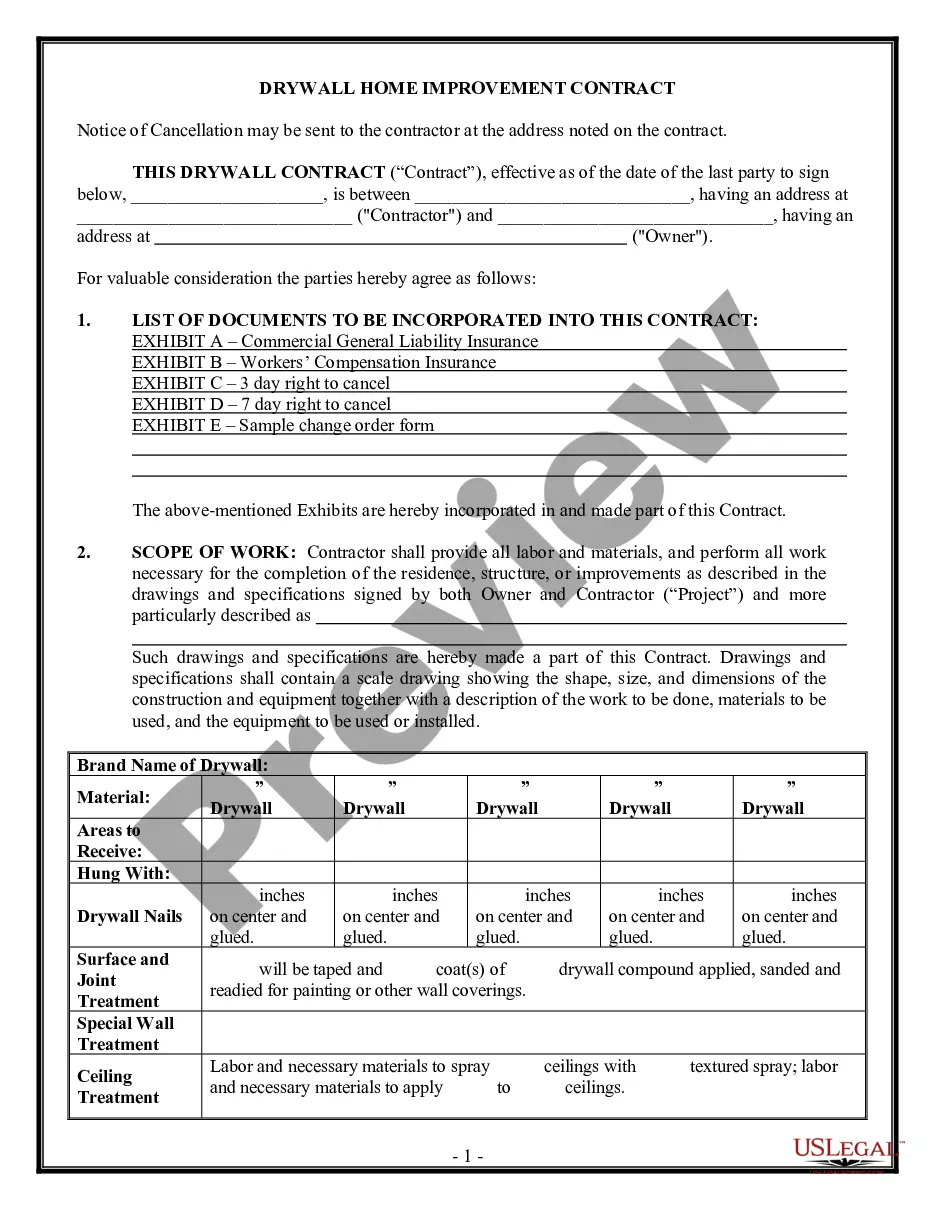

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

The promissory note is commonly only signed by the maker since the holder is not making any commitment under the note. Even in the case of a loan, the transfer of funds is separate from the note itself. It's important to note that a promissory note is not a substitute for a formal contract.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.