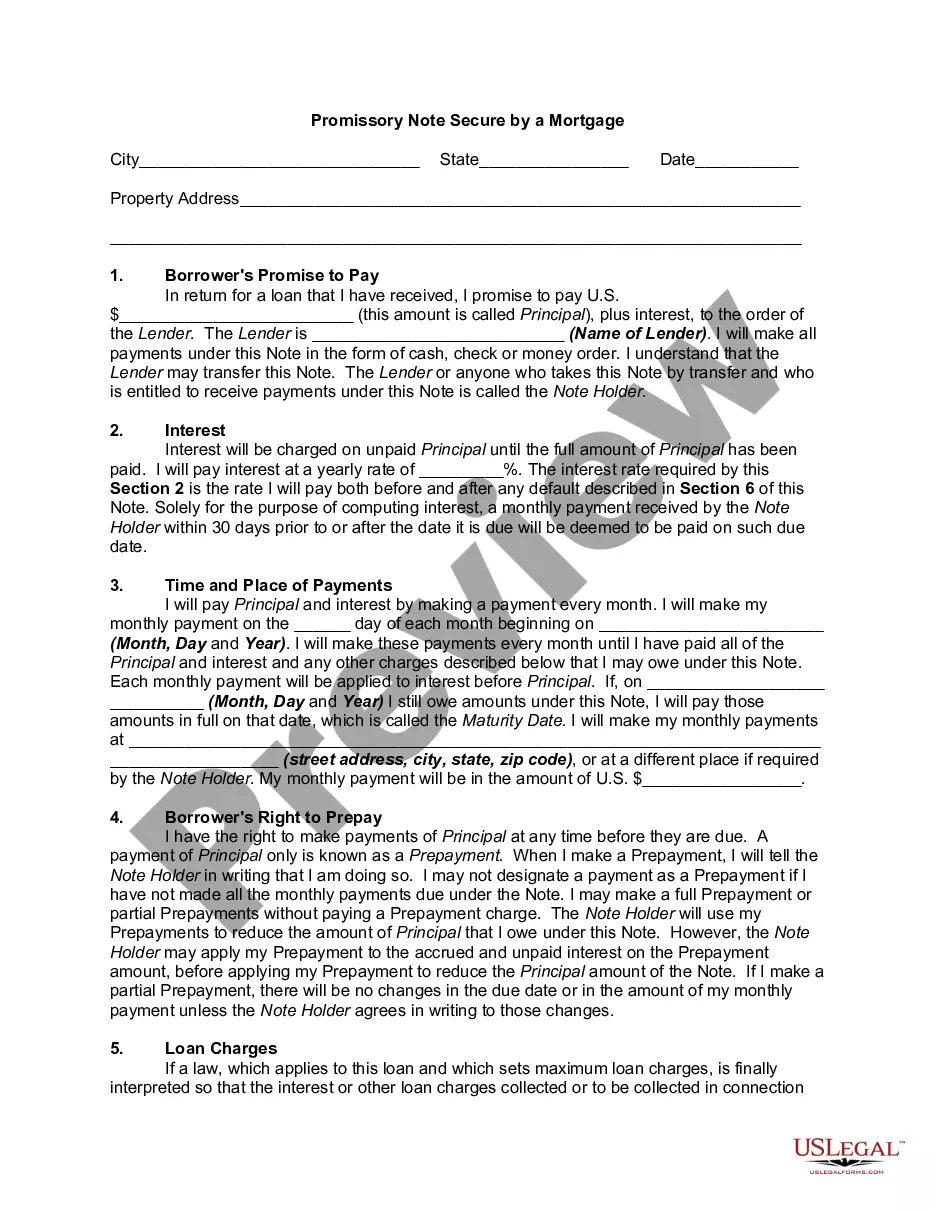

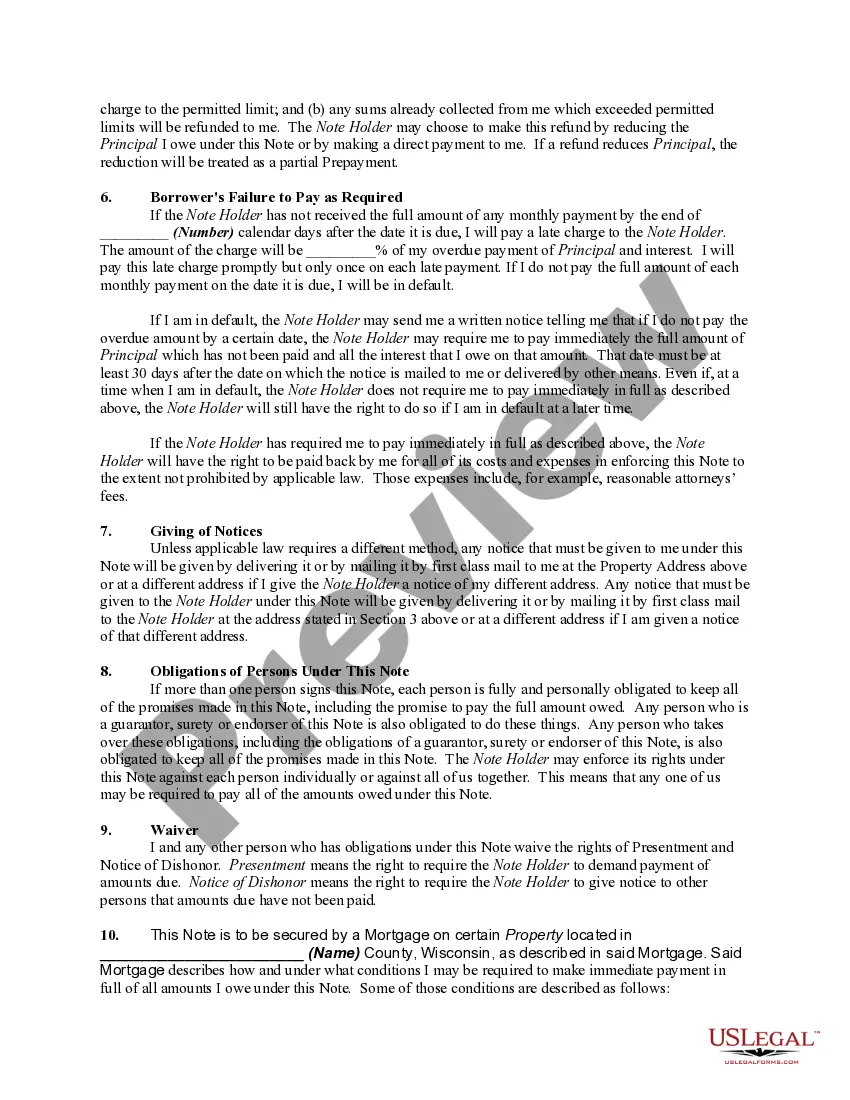

Mortgage Note Example With Bank

Description

How to fill out Wisconsin Promissory Note Secure By A Mortgage?

Utilizing legal templates that adhere to federal and state regulations is crucial, and the internet presents a multitude of choices to select from.

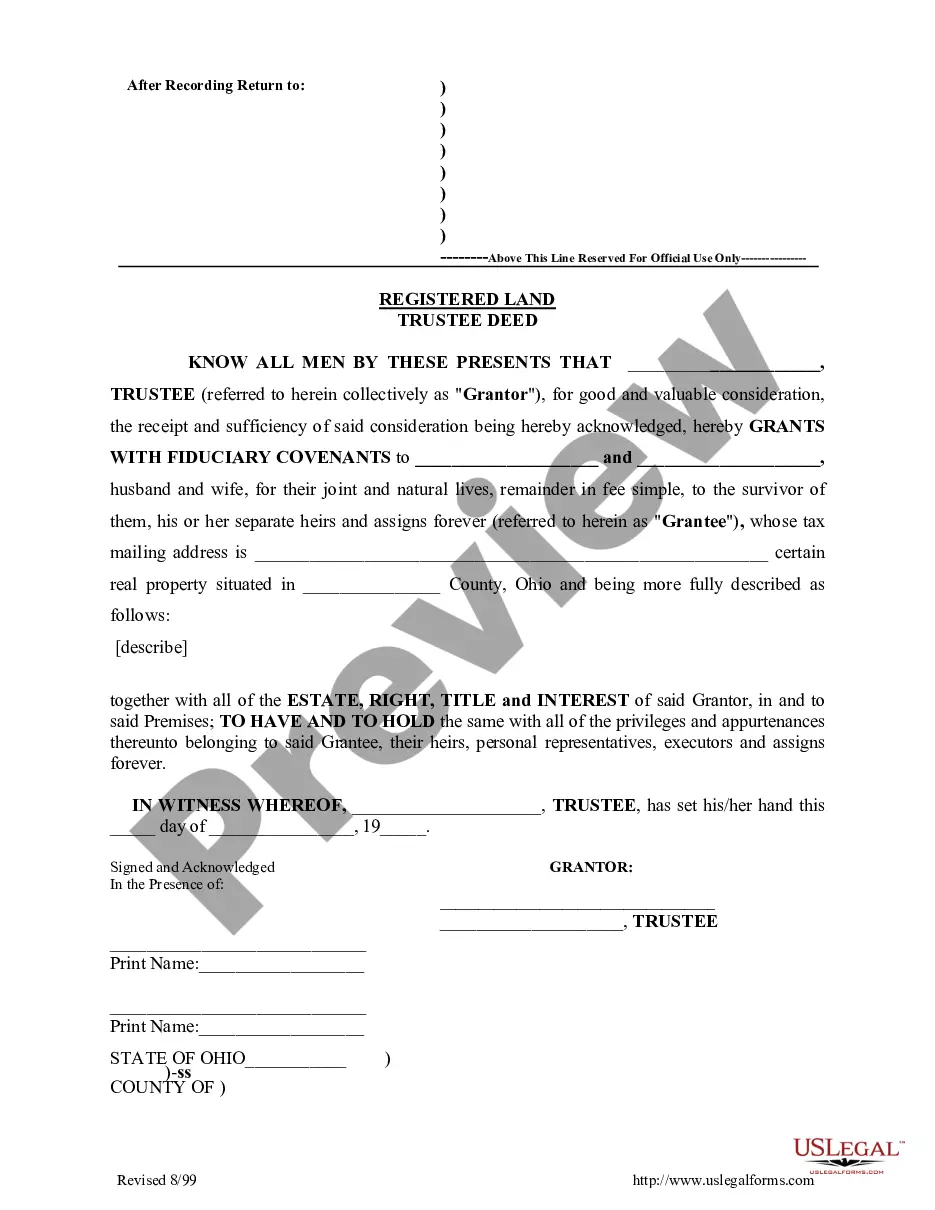

However, what is the purpose of squandering time searching for the properly drafted Mortgage Note Example With Bank template online if the US Legal Forms digital library has already compiled such documents in one location.

US Legal Forms is the largest virtual legal repository with more than 85,000 fillable templates created by attorneys for various business and personal situations. They are straightforward to navigate with all files classified by state and intended use. Our experts keep pace with legislative changes, ensuring that your documentation is current and compliant when obtaining a Mortgage Note Example With Bank from our platform.

- Evaluate the template using the Preview function or via the text description to ensure it meets your requirements.

- Search for another template using the search tool at the top of the page if necessary.

- Press Buy Now once you’ve identified the appropriate form and choose a subscription option.

- Establish an account or Log In and process your payment through PayPal or a credit card.

- Choose the suitable format for your Mortgage Note Example With Bank and download it.

Form popularity

FAQ

The following are taxes and fees applicable for probate: The state probate tax is 10 cents per $100 of the estate value at the time of death. The local probate tax is 3.33 cents (1/3 of 10 cents) per $100 of the estate value at the time of death.

A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

The tax is assessed at the rate of 10 cents per $100 on estates valued at more than $15,000, including the first $15,000 of assets. For example, the tax on an estate valued at $15,500 is $15.50. Localities may also impose a local probate tax equal to 1/3 of the state probate tax.

Download and complete the appropriate probate forms here for the Probate Registries. You will find these as editable PDFs in sections based on whether or not Inheritance Tax is to be paid. Including PA1P, PA1A, PA2, PA3, PA4 and IHT217.

In Virginia, any estate valued at greater than $50,000 at the time of the owner's passing must go through the probate procedure.

Again, it's critical to consult with an experienced probate attorney who can clarify legal statutes and recommend the best path forward based on your unique circumstances. Most of the time, you will be required to go through the probate process in Virginia.

The Principal Probate Registry or any district office provides the forms required to apply for a grant of probate. They should be requested as soon after the will has been found as possible so that the executors can complete them as the inventory process progresses.

One way is to execute and fund a trust. If all of your assets are in a trust, they will pass through your trust instead of undergoing the probate process. Another way to avoid probate is to add beneficiary designations or ?transfer on death? or ?payable on death? designations on your bank accounts and other assets.