Wisconsin Public Lien For File

Description

Form popularity

FAQ

An intent to lien form in Wisconsin serves as a preliminary notice, indicating the creditor's intention to file a lien. This document helps to alert property owners about potential claims before formalizing a lien. It is an important step in the process of legally securing payment and can enhance your position when pursuing debts. For assistance in managing this process, consider utilizing US Legal Forms for easy access to the required documents.

In Wisconsin, you must file a lien within six months after the last service or materials were provided. Missing this deadline can result in losing your right to file the Wisconsin public lien for file. This timeframe is essential to maintain the ability to claim your rightful payments. Using a platform like US Legal Forms can simplify the lien filing process, ensuring you meet all deadlines.

In Wisconsin, a public lien generally remains valid for a period of six years from the date it is filed. This timeframe allows creditors to assert their rights if they have unpaid debts. After six years, the lien can become invalid unless it is renewed. Therefore, it is crucial to manage your Wisconsin public lien for file efficiently to ensure your rights remain protected.

To find out if there is a lien on a property in Wisconsin, you can start by checking public records at the local county clerk's office or through online databases. Searching these records can provide critical information about any existing liens. If you're interested in filing a Wisconsin public lien for file, you can also consult resources like USLegalForms for assistance in navigating these records more efficiently.

Filing a lien in Wisconsin typically involves completing necessary paperwork and submitting it to the appropriate county office. The timeline can vary, but many filings are processed within a few business days. If you are considering a Wisconsin public lien for file, using platforms like USLegalForms can simplify the process and help ensure your submission meets all legal requirements.

Yes, Wisconsin is a lien holder state, which means that certain creditors can place a lien on a property to secure payment. This process allows lenders or service providers to protect their financial interests. If you're looking to understand the specifics of filing a Wisconsin public lien for file, it's essential to know how these liens function within the legal framework.

The lien law in Wisconsin defines how liens are created, enforced, and discharged. It provides the framework for various types of liens, including mortgage and mechanic's liens. Familiarizing yourself with these laws can enhance your understanding and management of any Wisconsin public lien for file.

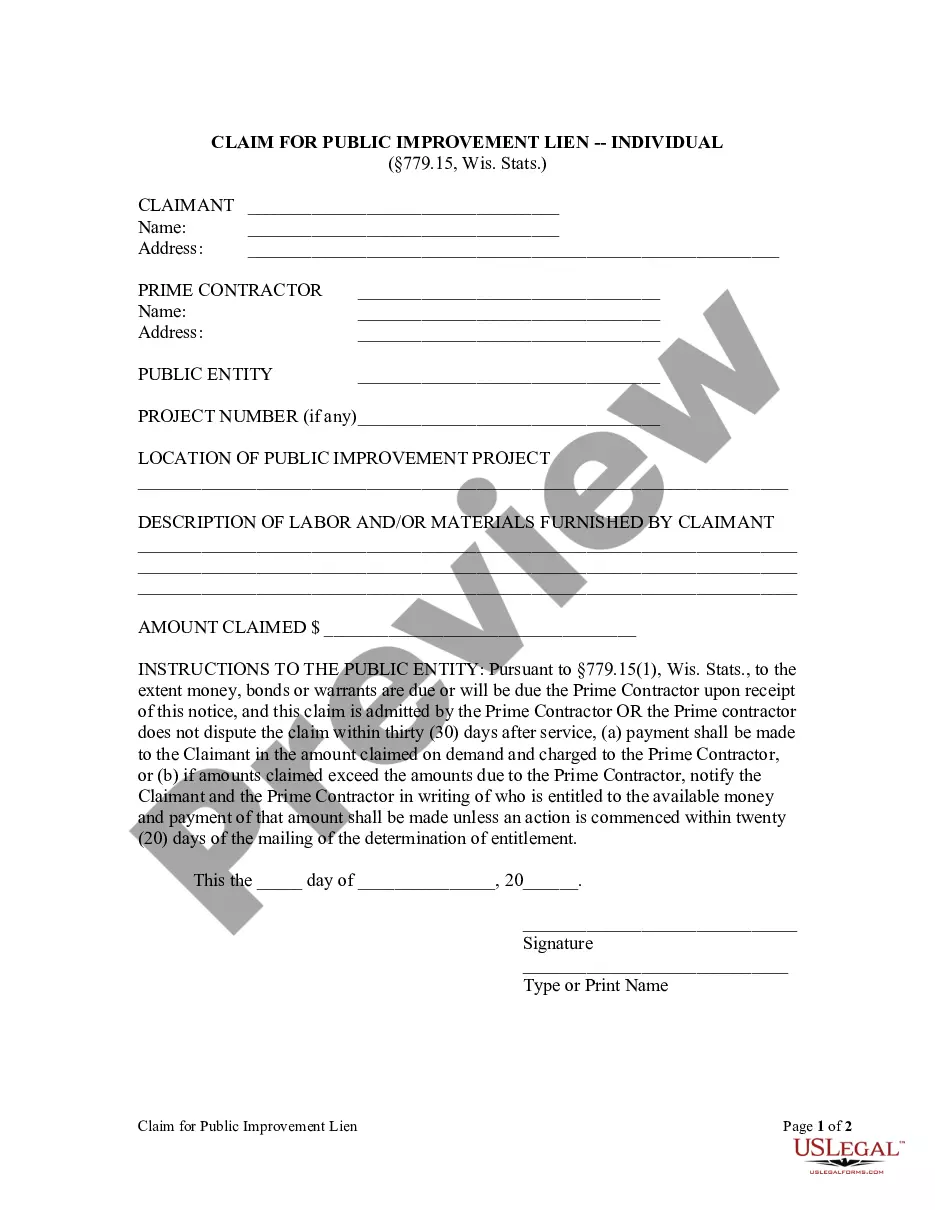

To file a lien in Wisconsin, you must complete a lien statement and submit it to the appropriate county register of deeds. Ensure that all necessary information is accurately provided to avoid delays. Utilizing UsLegalForms can streamline this process for your Wisconsin public lien for file.

In Wisconsin, a judgment is enforceable for 20 years. This long duration gives creditors ample time to collect the owed amounts. This knowledge is especially useful when considering any Wisconsin public lien for file related to judgments against properties.

Yes, liens do expire in Wisconsin after a set period unless they are renewed. Typically, a lien remains enforceable for 10 years. Understanding the expiration can help you manage your financial agreements better and keep track of your Wisconsin public lien for file.