Limited Liability Insurance For Llc

Description

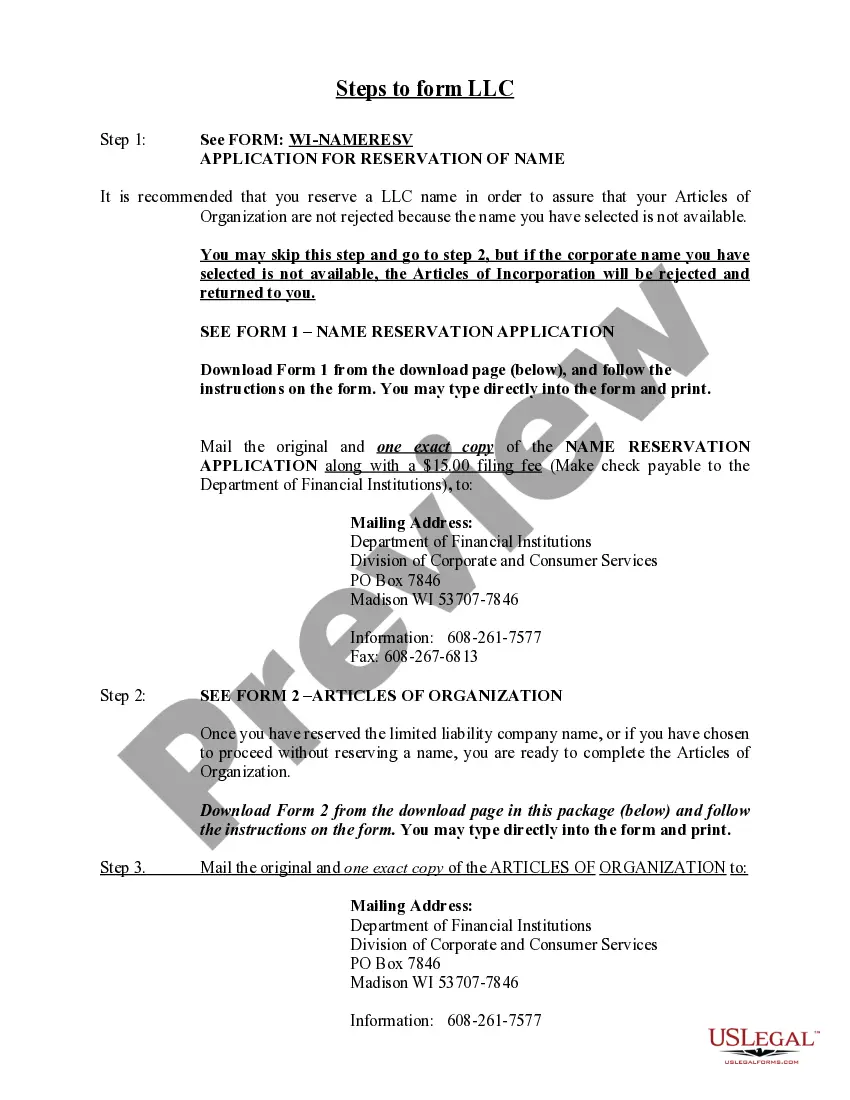

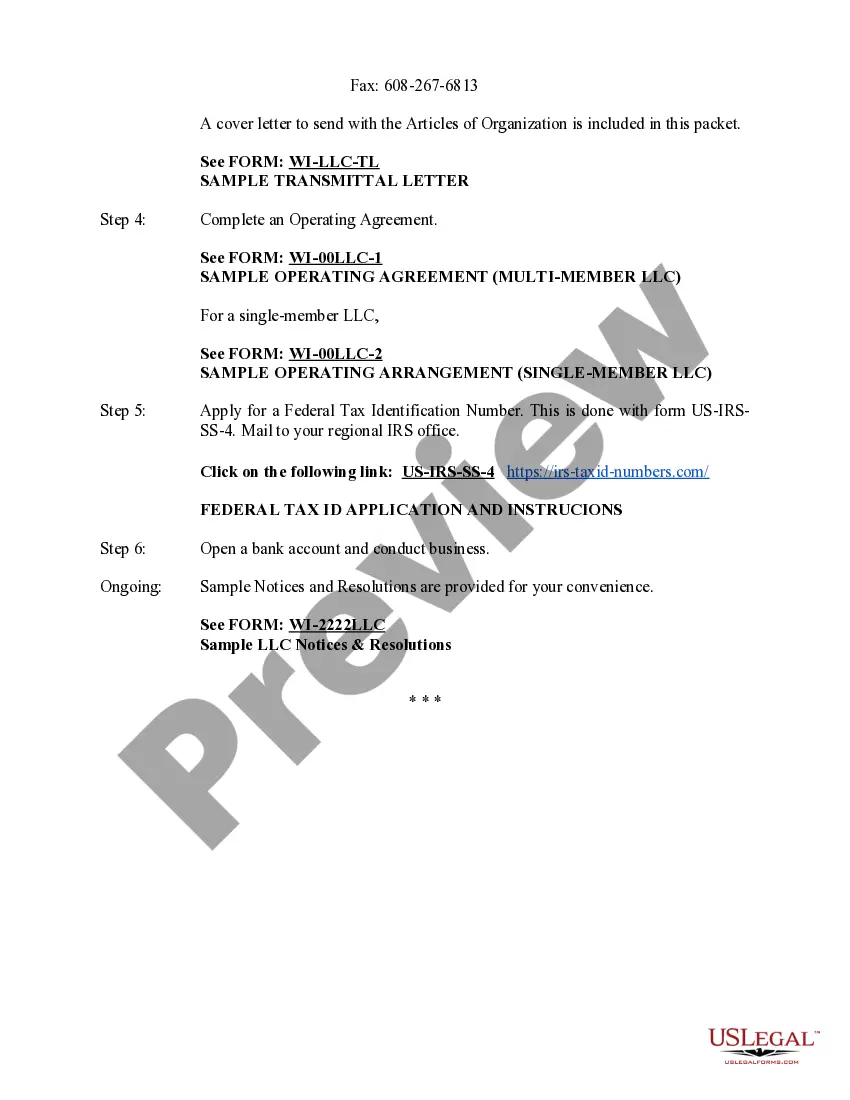

How to fill out Wisconsin Limited Liability Company LLC Formation Package?

- Log in to your existing account on US Legal Forms if you're a returning user. Check your subscription status to ensure it is active; renew if necessary.

- Preview the form you need by reading its description. Verify that it aligns with your requirements and local jurisdiction.

- If you need an alternative template, utilize the Search function to find the appropriate form.

- Select your form and click on the Buy Now option. Choose a subscription plan that fits your needs and create an account.

- Finalize your purchase by entering your payment details through credit card or PayPal.

- Download the completed form to your device and access it anytime via the My Forms section in your account.

In just a few simple steps, you can secure the legal documentation necessary for your business needs, ensuring you stay protected.

Start today with US Legal Forms and empower your business with reliable legal support! Explore our extensive library and find your documents now.

Form popularity

FAQ

Having limited liability insurance for your LLC is highly beneficial for your small business. It protects your personal and business assets from legal claims and potential lawsuits that could arise from various business activities. While not always legally required, this insurance provides peace of mind and financial security, enabling you to focus on growing your business. Platforms like US Legal Forms can assist you in understanding your insurance needs and finding the right coverage for your LLC.

Yes, you can obtain limited liability insurance for your LLC, which offers financial protection for your small business. This type of insurance helps safeguard your assets against claims arising from accidents, injuries, or negligence. Many insurance companies provide policies tailored to the unique needs of small businesses, making it easier for you to find the right coverage. Exploring options through platforms like US Legal Forms can guide you in securing the best limited liability insurance for your LLC.

Choosing to insure yourself or your LLC depends on your specific needs and concerns as a business owner. Generally, limited liability insurance for LLC is the best option since it protects both the business and your personal assets. By insuring your LLC, you ensure that personal financial resources remain secure, even if the business faces unforeseen challenges, allowing you to operate with peace of mind.

Limited liability insurance for LLC typically covers various aspects of your business's legal liabilities. This includes protection against lawsuits for bodily injury, property damage, and some types of business debt. Furthermore, it often covers legal fees associated with disputes, providing a vital financial cushion that allows you to focus on growing your business without risking personal bankruptcy.

As an LLC owner, it is essential to consider several types of insurance to adequately protect your business. You should prioritize limited liability insurance for LLC to shield your personal assets, along with general liability insurance for broader protection against risks. Depending on your industry, you may also need additional coverage, such as professional liability or workers' compensation insurance, to meet specific requirements and ensure comprehensive protection.

world example of limited liability can be seen in a situation where a restaurant operating as an LLC faces a lawsuit due to food poisoning allegations. Since the business structure is an LLC with limited liability insurance for LLC, the owner's personal assets, such as their home and personal savings, remain protected, and only the business's assets are at risk. This illustrates how limited liability effectively safeguards personal finances.

Understanding the difference between general liability and limited liability is crucial for your LLC. General liability insurance protects against lawsuits for third-party bodily injury, property damage, and advertising mistakes. In contrast, limited liability insurance for LLC not only covers these aspects but also shields your personal assets from business debts and obligations, providing a more comprehensive safety net for business owners.

An LLC should consider obtaining limited liability insurance for LLC to protect its owners' personal assets. This type of insurance helps cover legal costs and settlements related to business liabilities. Additionally, LLCs may also benefit from general liability insurance and professional liability insurance, depending on their specific operations. By choosing the right coverage, you ensure your business remains secure while minimizing personal financial risks.

An LLC does not come with automatic insurance coverage. While forming an LLC provides certain legal protections, it does not replace the need for business insurance. To truly safeguard your business, you should actively seek limited liability insurance for your LLC. This coverage is crucial for managing risks and preventing potential financial losses.

Yes, obtaining liability insurance is highly recommended even if you operate as an LLC. While the LLC structure provides personal asset protection, it does not cover all business risks. Limited liability insurance for LLCs serves as an additional safety net against lawsuits, accidents, and other business-related claims. This way, you ensure comprehensive protection for your business operations.