Washington State Child Support Table With 50/50 Custody

Description

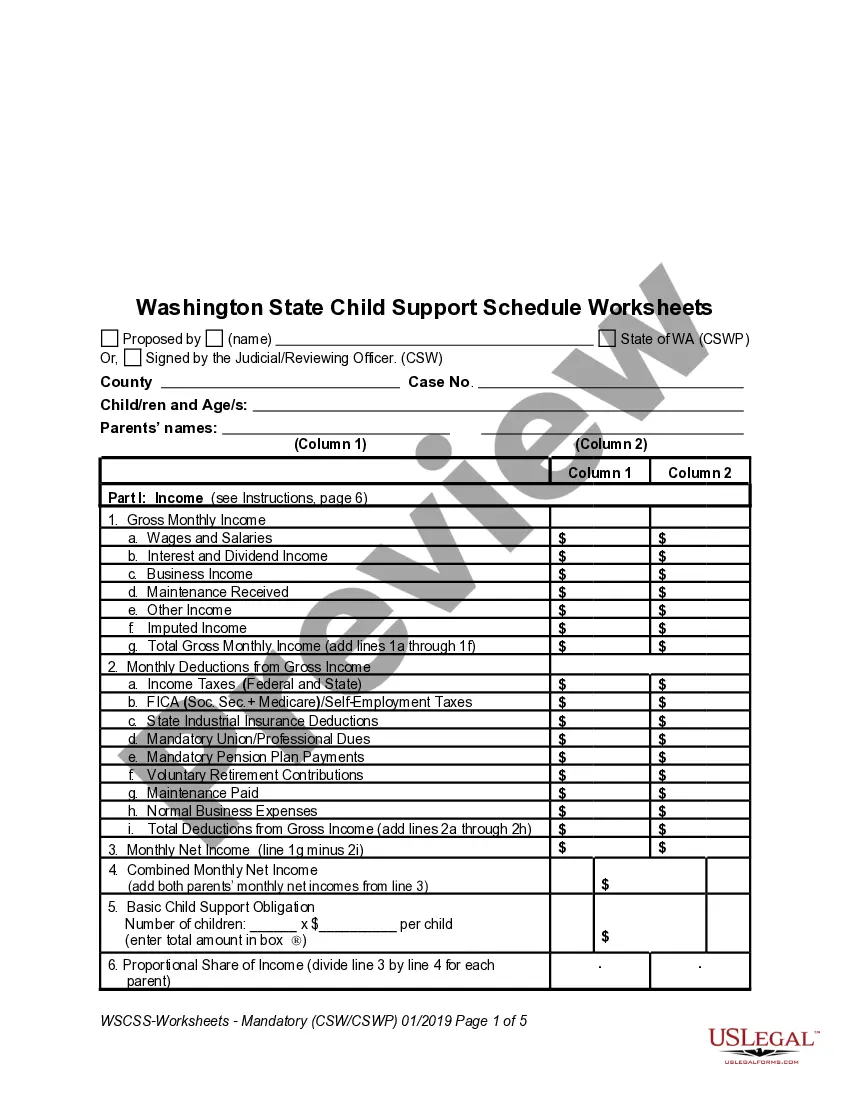

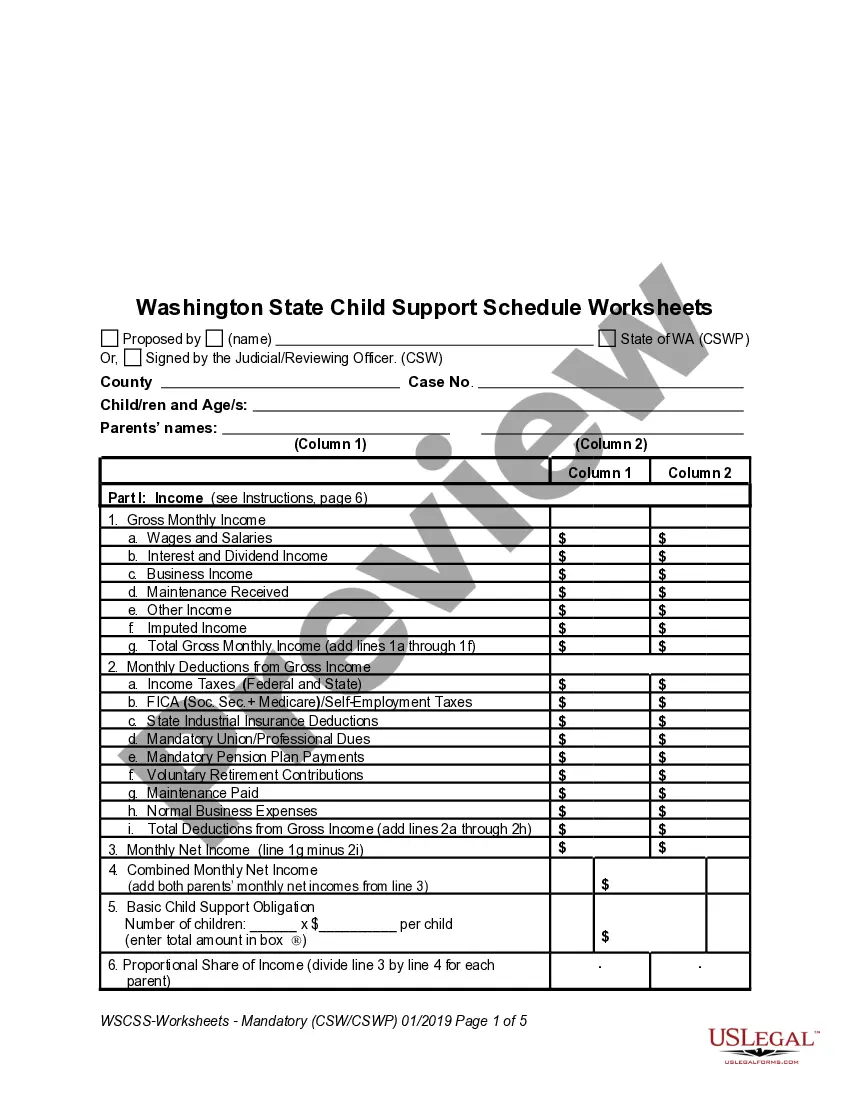

How to fill out Washington Child Support Schedule?

How to locate professional legal documents that comply with your state regulations and create the Washington State Child Support Table With 50/50 Custody without hiring an attorney.

Numerous online services provide templates to address various legal matters and formalities. However, it may require time to identify which of the available samples meet both practical needs and legal standards for you.

US Legal Forms is a reliable service that assists you in finding official paperwork designed according to the latest updates in state law, helping you save on legal fees.

If you do not have an account with US Legal Forms, follow the instructions below: Carefully examine the webpage you have accessed to confirm that the form meets your requirements. To achieve this, utilize the form description and preview options if available. If necessary, search for another sample using the header specifying your state. When you find the correct document, click the Buy Now button. Choose the most suitable pricing plan, then Log In or create an account. Select your payment option (by credit card or through PayPal). Choose the file format for your Washington State Child Support Table With 50/50 Custody and click Download. The acquired documents remain in your possession: you can always access them in the My documents section of your profile. Sign up for our platform and create legal documents independently like a skilled legal professional!

- US Legal Forms is not a typical web library.

- It consists of over 85,000 verified templates for various business and life situations.

- All documents are categorized by field and state for a quicker and more convenient search.

- Moreover, it integrates with powerful tools for PDF editing and eSignature, allowing users with a Premium subscription to swiftly complete their documents online.

- You will need minimal time and effort to acquire the required paperwork.

- If you already have an account, Log In and verify that your subscription is active.

- Download the Washington State Child Support Table With 50/50 Custody using the associated button next to the file name.

Form popularity

FAQ

Filling out a check for child support involves several key steps. First, write the date on the check, followed by the payee's name, who is receiving the payment. Enter the amount in both numbers and words to prevent any confusion. Lastly, include a note in the memo line indicating this payment corresponds to the Washington state child support table with 50/50 custody, which clarifies the purpose of the payment.

Calculating child support in Washington state involves using the Washington state child support table with 50/50 custody to determine the amount based on each parent's income and time spent with the child. You can find helpful calculators and resources online to guide you through the process. It's also beneficial to familiarize yourself with the guidelines set forth by the Washington State Department of Social and Health Services. If you need assistance, platforms like US Legal Forms can help simplify the calculation process and provide necessary legal documents.

Many studies show that children can benefit from 50/50 custody arrangements. This setup allows them to maintain strong relationships with both parents, fostering emotional security and stability. Additionally, children often feel less stress when both parents are involved equally in their lives. Reviewing the Washington state child support table with 50/50 custody can help you understand the financial implications of such arrangements, ensuring that your child's needs are met.

To obtain 50/50 custody in Washington state, you and your co-parent must demonstrate that shared parenting is in the best interest of your child. It helps to develop a clear parenting plan that outlines each parent's responsibilities and time with the child. You may need to negotiate terms with your co-parent, or use mediation to reach an agreement. Consulting the Washington state child support table with 50/50 custody can aid in understanding how support calculations will work under joint custody arrangements.

While 50/50 custody has many advantages, it can also present challenges. Transitioning between two homes may be stressful for some children, and parents must communicate effectively to make it work. Understanding the Washington state child support table with 50/50 custody can help navigate any potential financial disputes that arise, ensuring a smoother process.

In Washington state, the calculation for child support is based on a percentage of the non-custodial parent's income. Typically, this ranges from 20% to 35%, depending on how many children there are and other factors. Knowing how the Washington state child support table with 50/50 custody works can help you anticipate and plan for these financial obligations.

Research suggests that children often thrive in a 50/50 custody setup. This arrangement fosters a sense of security as they have access to both parents equally. Additionally, the Washington state child support table with 50/50 custody helps mitigate financial burdens, allowing families to invest more in children’s upbringing, which can lead to better outcomes.

Many experts believe that a 50/50 custody arrangement provides a stable environment for children. It allows them to maintain strong relationships with both parents, which is crucial for their emotional well-being. Moreover, the Washington state child support table with 50/50 custody ensures that financial responsibilities are shared, alleviating stress for all involved.

The average child support payment for one child in Washington varies based on the parents' combined incomes and specific circumstances. Generally, the Washington state child support table with 50/50 custody provides a guideline for determining these payments. On average, payments can range from a few hundred to over a thousand dollars per month. Each family's situation will dictate the exact figures, so it's advisable to consult with a legal professional for precise estimates.

Claiming dependents while having 50/50 custody can be done by following the agreement outlined in your parenting plan. Parents can alternate claiming the child on tax returns each year or agree to claim different children if there are multiple. The Washington state child support table with 50/50 custody is a useful resource to understand the financial implications of these claims. Consulting with a tax professional can help clarify the best approach.