Wa State Annual Meeting Minutes With Secretary Of State

Description

Form popularity

FAQ

Your Washington Annual Report can be filed online or by mail. However, if you file by mail, you'll need to contact the Secretary of State's office and request to have a paper form mailed to you. To File Online: On the state website, go to the Annual Reports page.

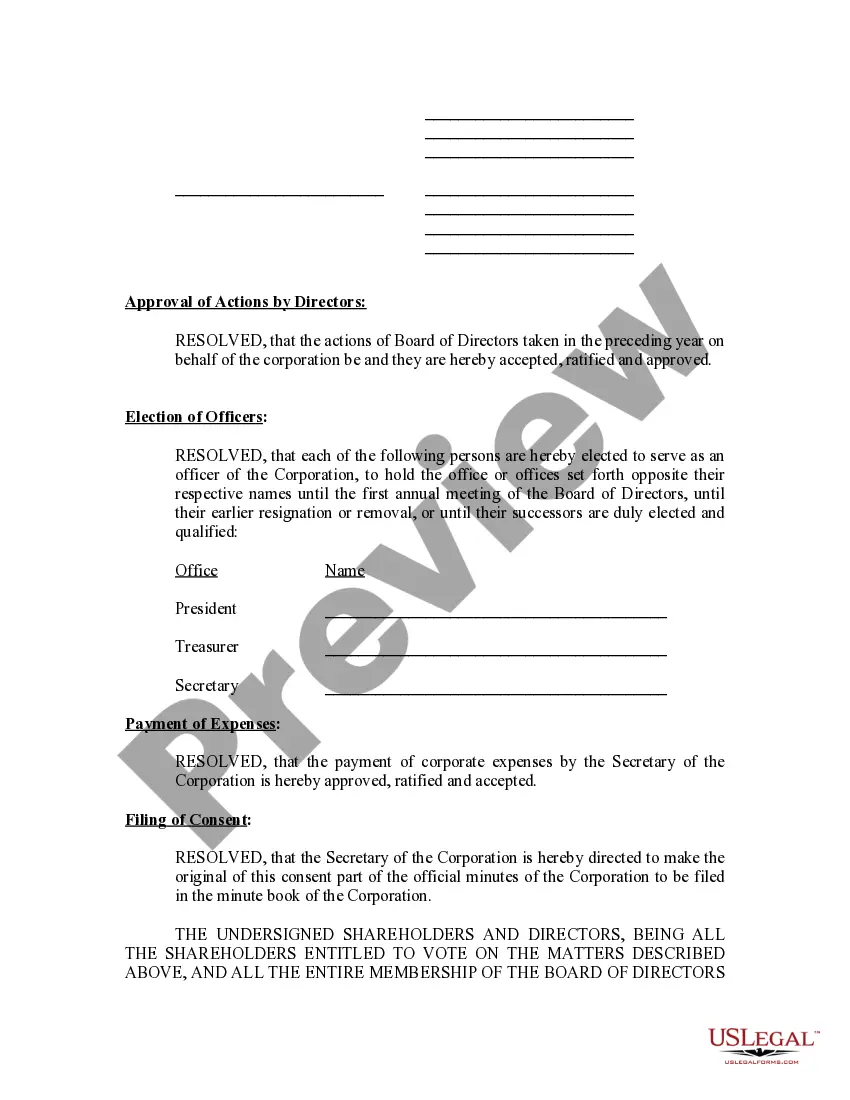

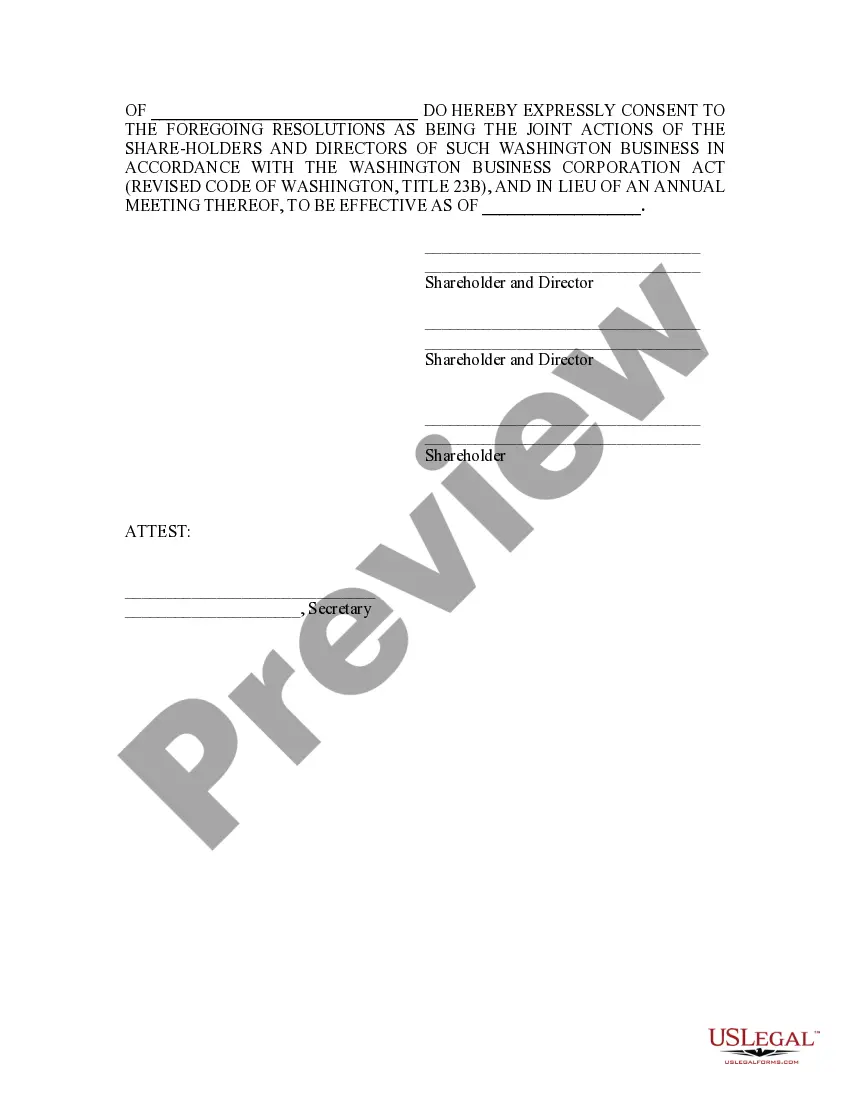

State requirements for keeping meeting minutes Most states require that corporations hold regular shareholder meetings and keep minutes of such meetings. While S corporation meeting minutes are not required to be filed with the state, you should keep copies of meeting minutes with your corporate books and records.

An Annual Report may be filed within 180 days before the expiration date. Visit our Corporations and Charities Filing System landing page and log in to your account. Once logged in, select ?Business Maintenance Filings? from the navigation bar on the left side, then select ?Annual Report?.

Information captured in an LLC's annual meeting minutes usually includes: The meeting's date, time, and location. Who wrote the minutes. The names of the members in attendance. Brief description of the meeting agenda. Details about what the members discussed. Decisions made or voting actions taken.

Though these minutes do not need to be filed with the state and can instead be kept with your corporate records, they are important documents for protecting your limited liability status and keeping track of the votes and decisions made by your business. In other words, meeting minutes keep you compliant.