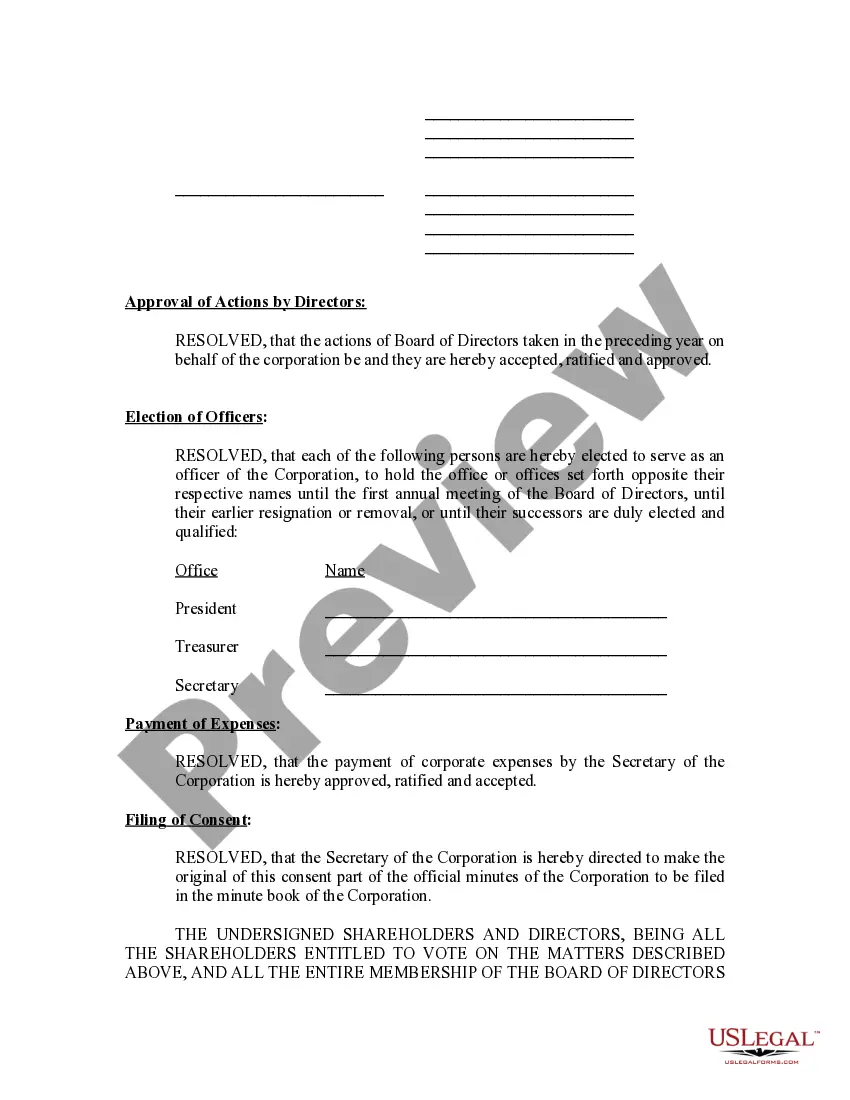

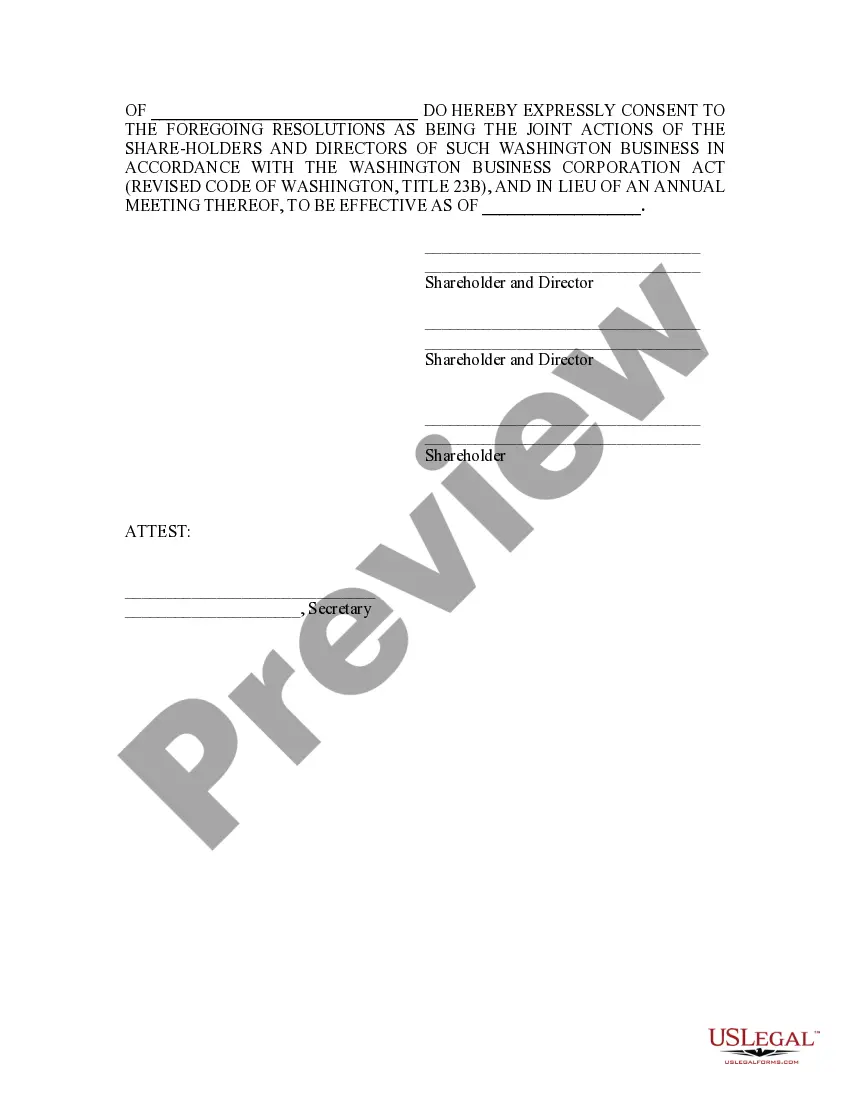

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Annual Washington Meeting Minutes For S Corp

Description

How to fill out Washington Annual Minutes?

Establishing a reliable source for the latest and most suitable legal templates is a significant part of navigating bureaucracy. Acquiring the correct legal documents requires accuracy and meticulousness, which is why it's crucial to obtain samples of Annual Washington Meeting Minutes For S Corp exclusively from reputable sources like US Legal Forms. An incorrect template can squander your time and hinder the situation you are in. With US Legal Forms, you have minimal worries. You can access and review all the specifics regarding the document's application and pertinence to your circumstances and in your locality.

Follow these steps to complete your Annual Washington Meeting Minutes For S Corp.

Eliminate the hassles that come with your legal documentation. Explore the extensive US Legal Forms library where you can find legal templates, verify their relevance to your situation, and download them instantly.

- Utilize the library navigation or search bar to find your template.

- Examine the form's details to ensure it meets the requirements of your state and county.

- Check the form preview, if available, to confirm that it is the template you need.

- If the Annual Washington Meeting Minutes For S Corp does not align with your needs, continue searching for the appropriate document.

- Once you are confident about the document's applicability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the template.

- Select the pricing plan that best fits your requirements.

- Proceed with the registration to complete your purchase.

- Conclude your purchase by selecting a payment option (credit card or PayPal).

- Choose the document format for downloading the Annual Washington Meeting Minutes For S Corp.

- Once the form is on your device, you can modify it using the editor or print it out and fill it in manually.

Form popularity

FAQ

S Corporations are not permitted in certain states, including Delaware, Nevada, and New Jersey, which can have unique tax structures. Other states may not have specific prohibitions but can impose limitations that affect S Corp status, making compliance challenging. It is important to check your state's specific regulations regarding S Corporations. For detailed guidance and assistance, consider using USLegalForms to simplify the process of maintaining Annual Washington meeting minutes for S Corp.

Yes, Washington state does recognize S Corporations. This designation allows eligible businesses to avoid double taxation on income. However, it is essential to maintain accurate records and file Annual Washington meeting minutes for S Corp to comply with state regulations. With careful management, you can enjoy tax benefits while protecting your personal assets.

Yes, meeting minutes are mandatory for S Corporations to maintain compliance with state and federal regulations. These minutes serve as legal documents that record important decisions and discussions. Properly documenting your meetings with 'annual washington meeting minutes for s corp' not only fulfills legal requirements but also promotes accountability within your organization.

The 60/40 rule for S Corporations refers to the distribution of income among shareholders. Essentially, at least 60% of the corporation's income must be derived from passive sources, while the remaining 40% can come from active business operations. Understanding this rule is vital for crafting accurate 'annual washington meeting minutes for s corp' to reflect financial performance and compliance.

To create annual corporate minutes, start by summarizing the year’s activities, highlighting important decisions made during meetings. Include financial reports and any changes to the corporate structure. This comprehensive approach will help when drafting 'annual washington meeting minutes for s corp', ensuring all necessary elements are recorded.

S Corporations must keep minutes of their Board meetings and shareholder meetings. Maintaining accurate records ensures transparency and accountability within the corporation. It's crucial to create detailed 'annual washington meeting minutes for s corp' to keep track of significant decisions and discussions.

Yes, S Corporations are typically required to hold Board meetings to discuss important corporate matters. These meetings ensure that the corporation operates within legal guidelines and maintains its corporate status. During these meetings, recording 'annual washington meeting minutes for s corp' is essential for compliance and good governance.

To write minutes for an annual general meeting, start by noting the date, time, and location of the meeting. Include a list of attendees and any absentees. Record the discussions, decisions made, and any votes taken, ensuring clarity and brevity. Incorporate the keyword 'annual washington meeting minutes for s corp' naturally to enhance SEO.

The annual requirements for an S Corp include conducting an annual meeting, maintaining accurate meeting minutes, and submitting necessary filings to the IRS. These steps are crucial to ensure legal compliance and ongoing good standing. Utilizing tools from U.S. Legal Forms can help guarantee your annual Washington meeting minutes for S Corp are properly documented.

Yes, an annual general meeting (AGM) is essential for companies, including S Corporations. The AGM provides a structured setting for stakeholders to review performance, strategize, and make informed decisions for the future. Documenting these meetings through annual Washington meeting minutes for S Corp supports accountability and transparency.