Rent Verification Form For Mortgage

Description

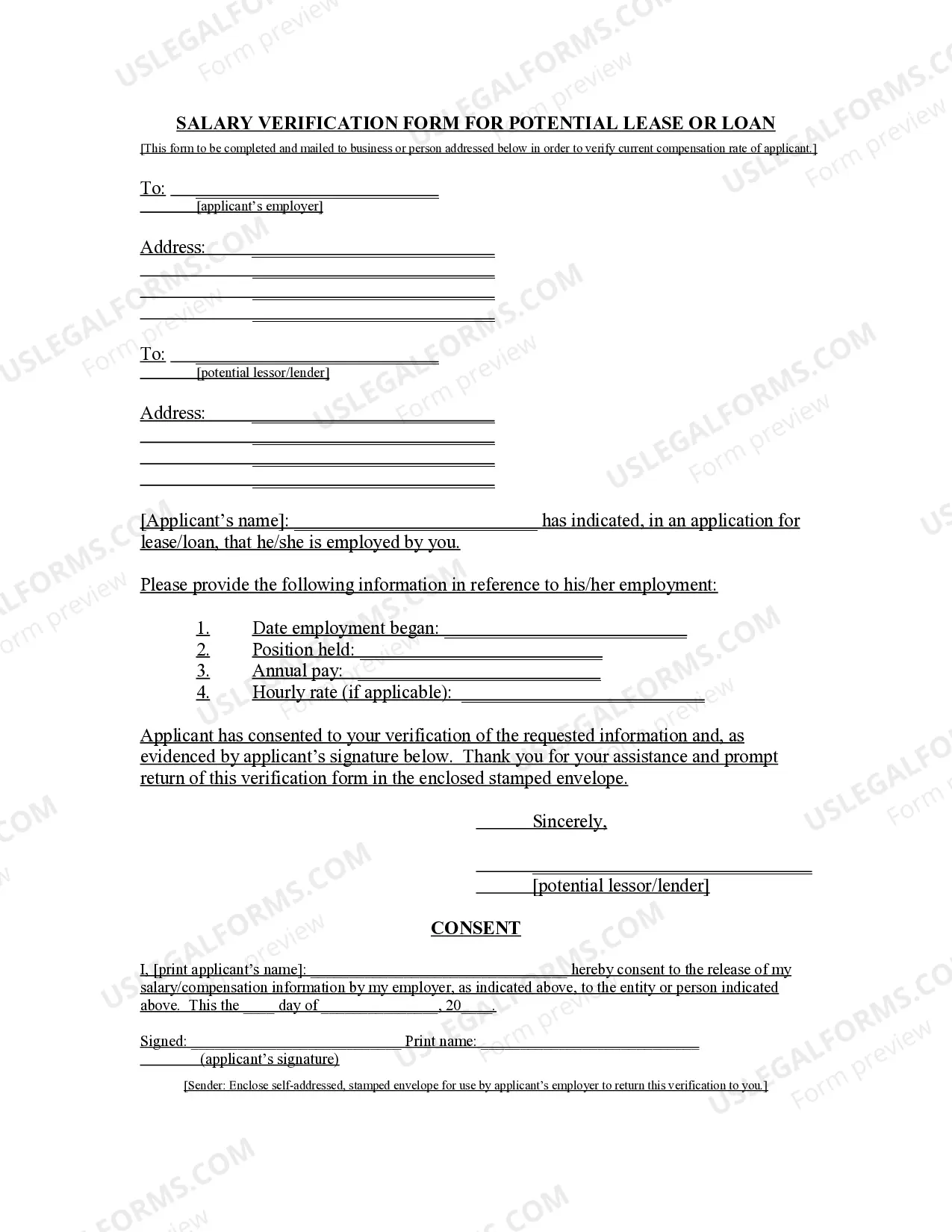

How to fill out Washington Salary Verification Form For Potential Lease?

The Rental Confirmation Document For Mortgage displayed on this site is a versatile legal framework crafted by expert attorneys in compliance with both federal and local statutes and regulations.

For over 25 years, US Legal Forms has delivered individuals, enterprises, and lawyers with more than 85,000 confirmed, state-specific documents for any commercial and personal requirement.

Subscribe to US Legal Forms to have verified legal templates available for all of life's situations.

- Search for the form you require and examine it.

- Browse through the file you looked for and preview it or analyze the document description to ensure it meets your needs. If it doesn't, utilize the search bar to locate the suitable one. Click Buy Now once you have found the template you need.

- Select and Log In to your account.

- Choose the pricing package that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the fillable template.

- Select the format you wish for your Rental Confirmation Document For Mortgage (PDF, DOCX, RTF) and save the template onto your device.

- Complete and sign the document.

- Print the template to fill it out by hand. Alternatively, use an online multi-purpose PDF editor to quickly and accurately fill out and sign your document with a legally-recognized electronic signature.

- Re-download your documents when necessary.

- Utilize the same document again at any time. Access the My documents section in your account to re-download any forms you previously saved.

Form popularity

FAQ

Limitations: Requires adherence to trust document's instructions on asset assignments. Joint assets, including certain IRAs and retirement plans, cannot be placed into a one-person trust. No complete tax avoidance: Total avoidance of taxes is rarely possible with living trusts, though there may be ways to reduce them.

The Disadvantage of a Revocable Living Trust Expansive: Creating a revocable living trust can be more expensive than a simple will due to legal fees and document preparation. Complexity: Managing a trust requires ongoing paperwork and record-keeping, which can be burdensome and time-consuming.

A revocable trust can be modified while the Grantor is alive. Revising the terms of a trust is known as ?amending? the trust. An amendment is generally appropriate when there are only a few minor changes to make, like rewording a certain paragraph, changing the successor trustee, or modifying beneficiaries.

The two basic types of trusts are a revocable trust, also known as a revocable living trust or simply a living trust, and an irrevocable trust. The owner of a revocable trust may change its terms at any time.

So, now you know that the Trust Maker holds the most power before the Trust is established, but the Trustee holds the most power after the Trust is established. And you also know that in many cases, during your lifetime you have both roles.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

WILL A LIVING TRUST AVOID PROBATE? Yes, but under current Connecticut law, not entirely. If assets are properly placed in trust before death, the living trust ?bypasses? probate as no proceedings are now necessary to pass title on death.