Washington Limited Liability Company Without A Written Operating Agreement

Description

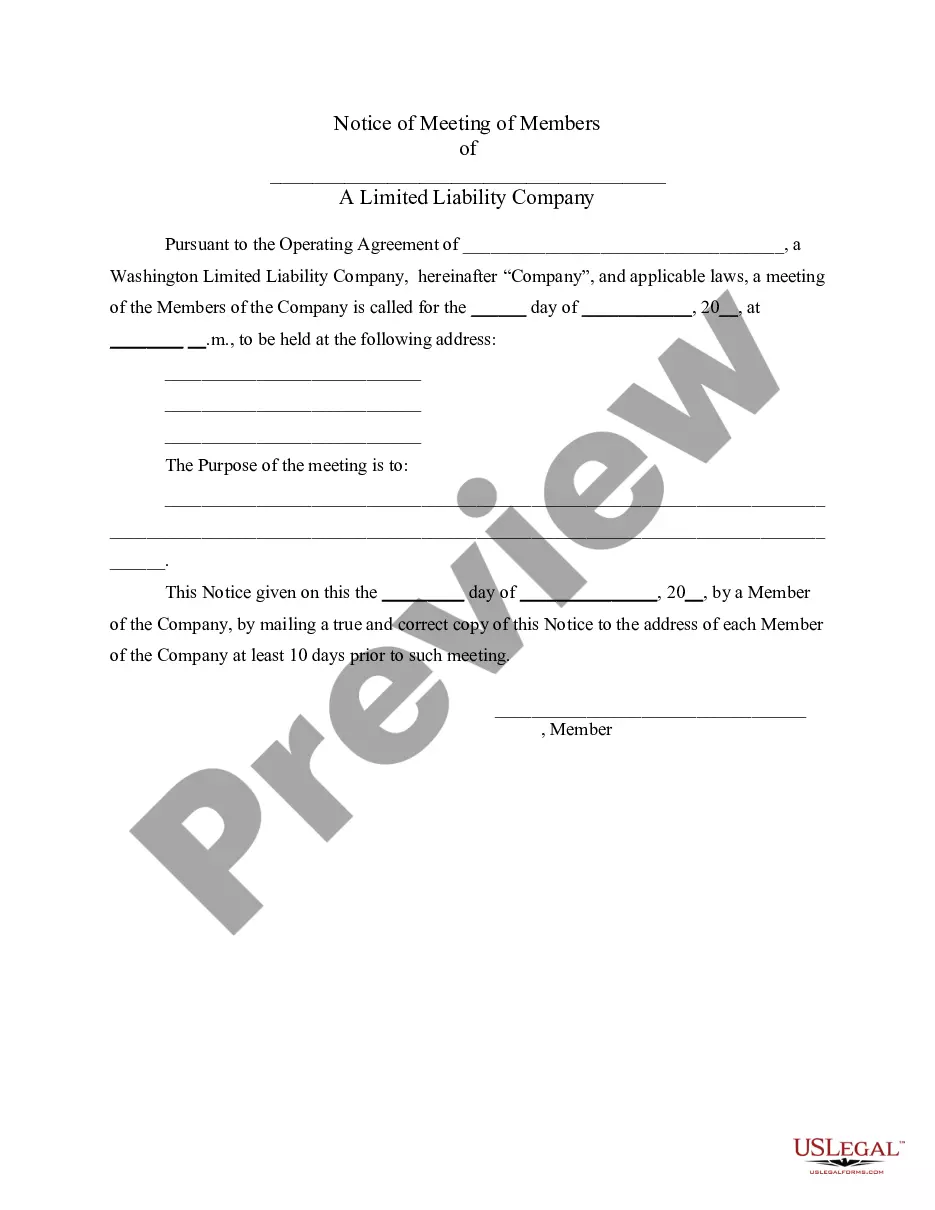

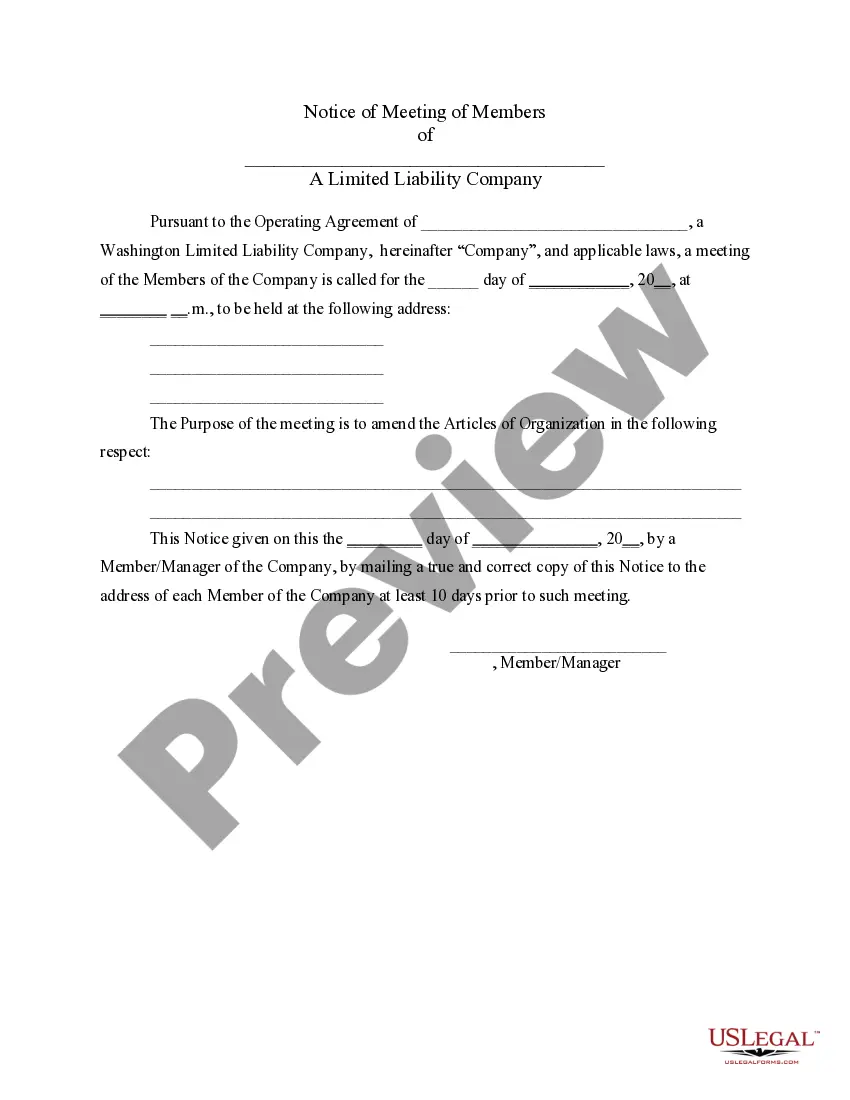

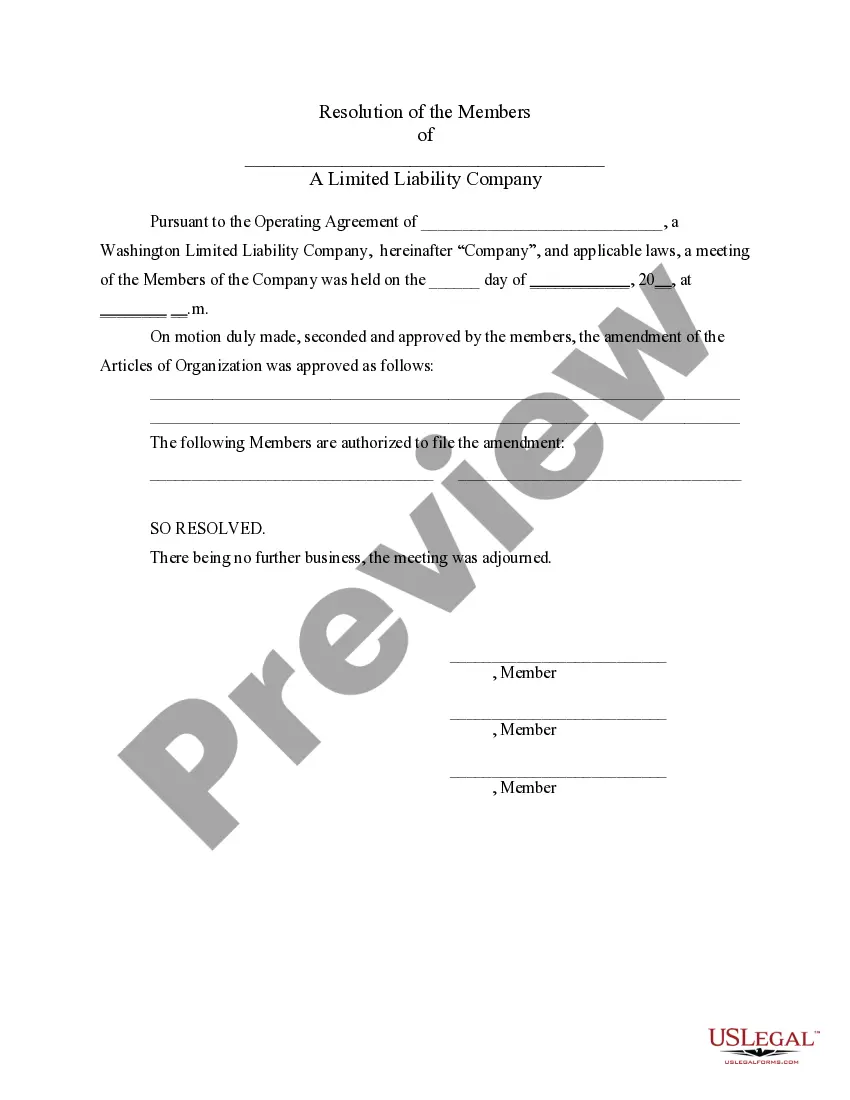

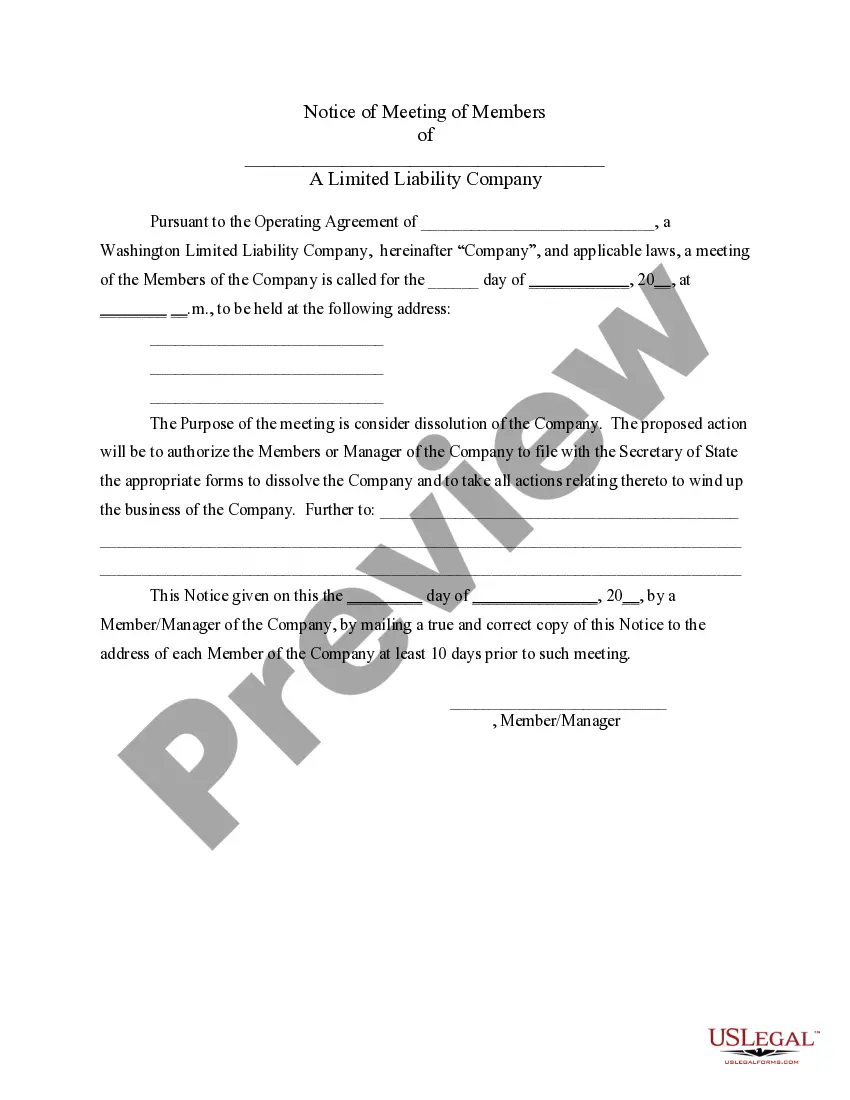

How to fill out Washington LLC Notices, Resolutions And Other Operations Forms Package?

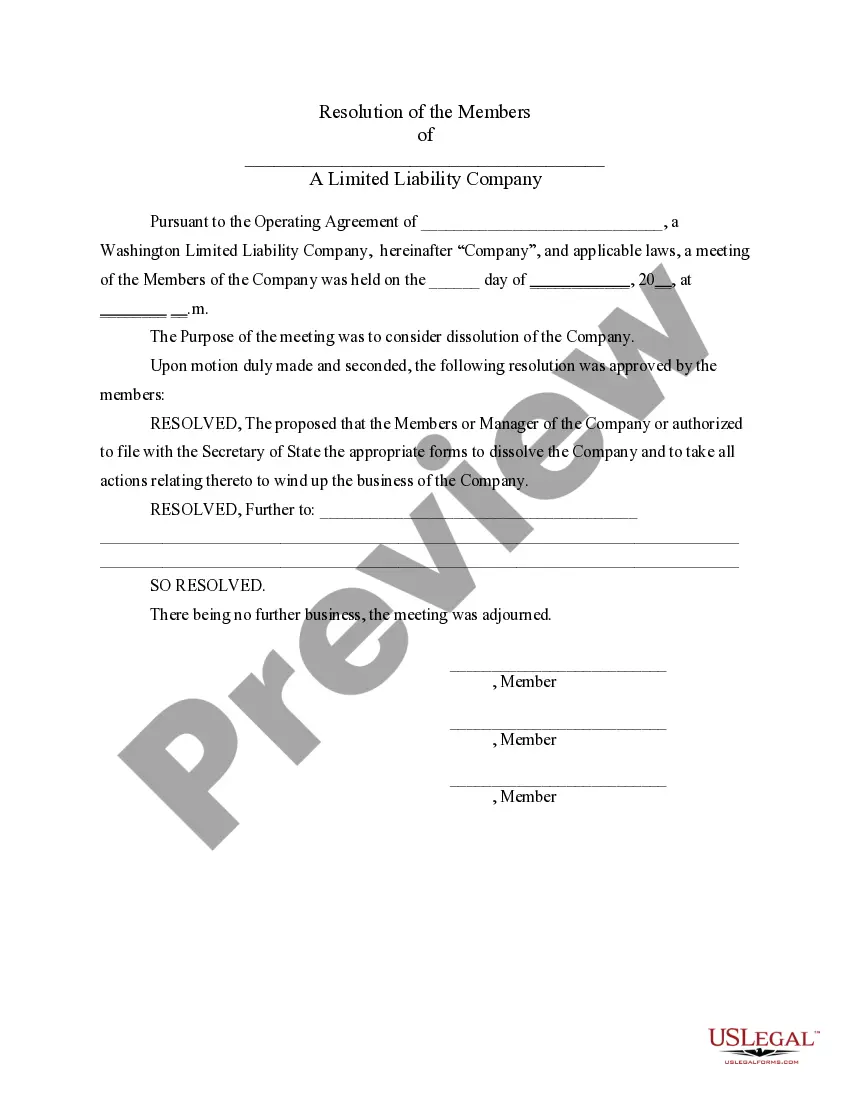

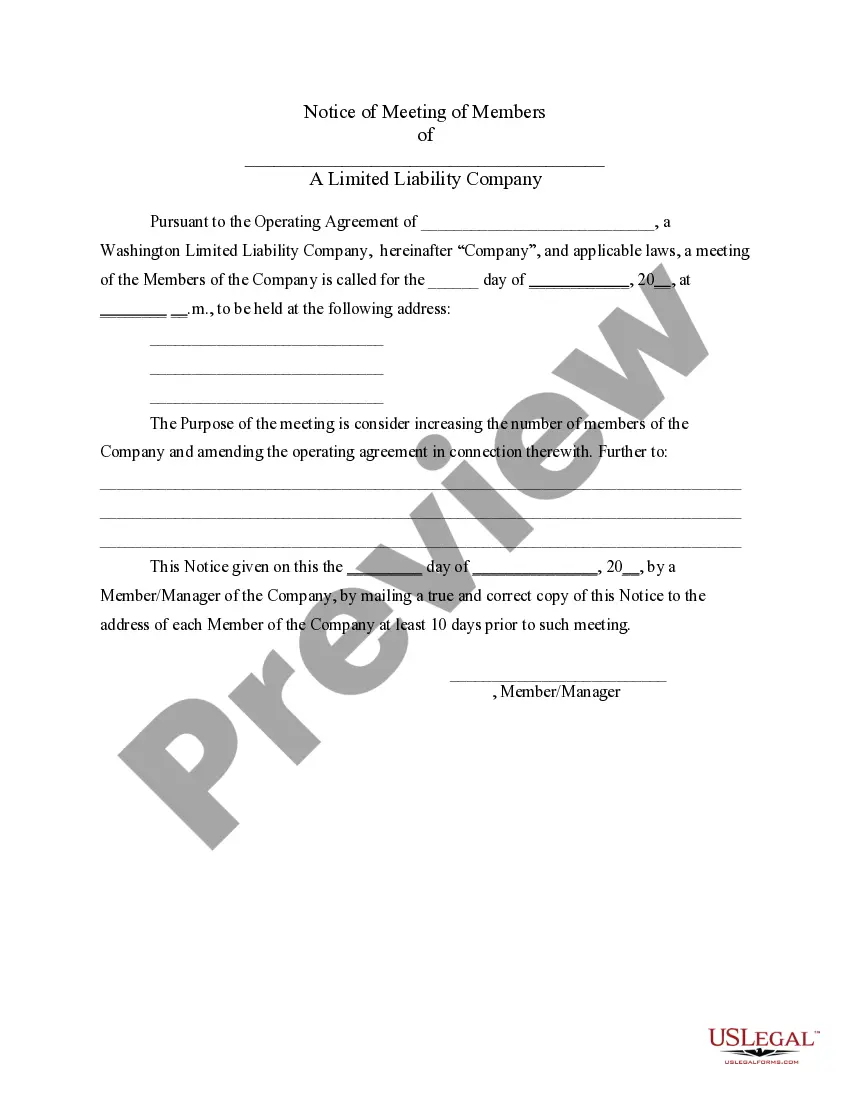

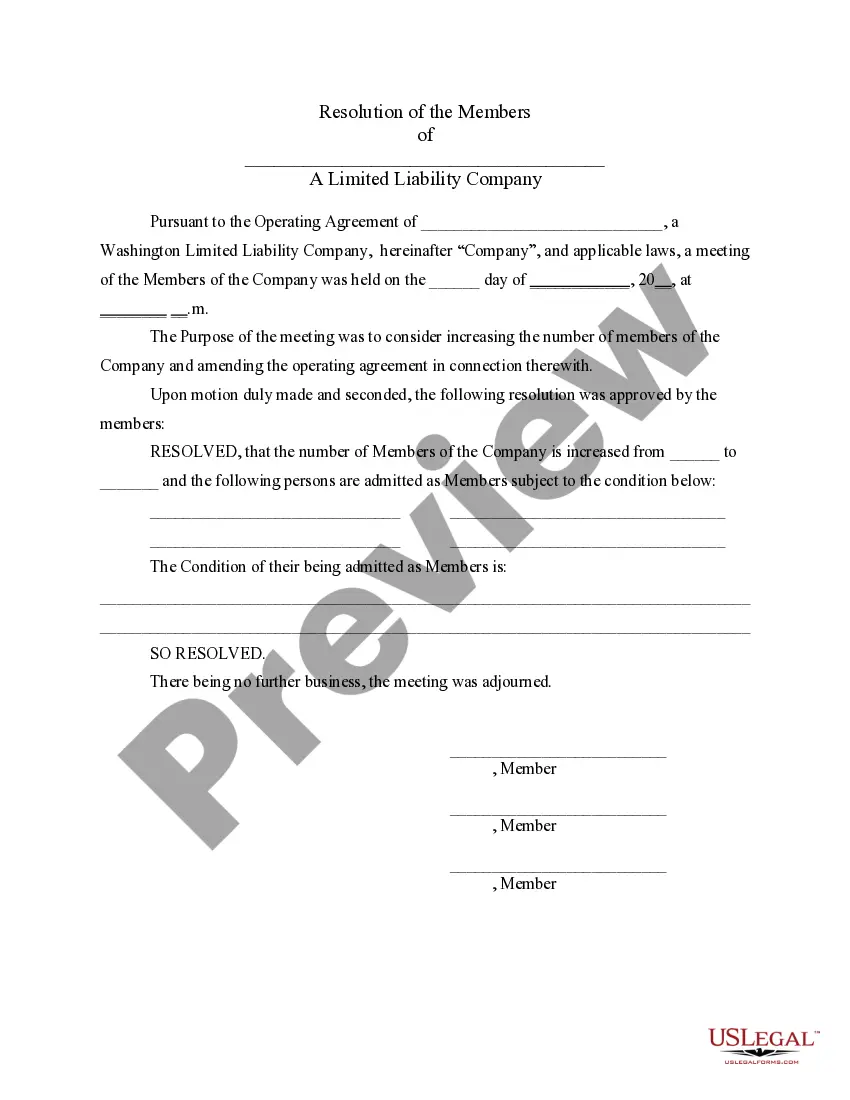

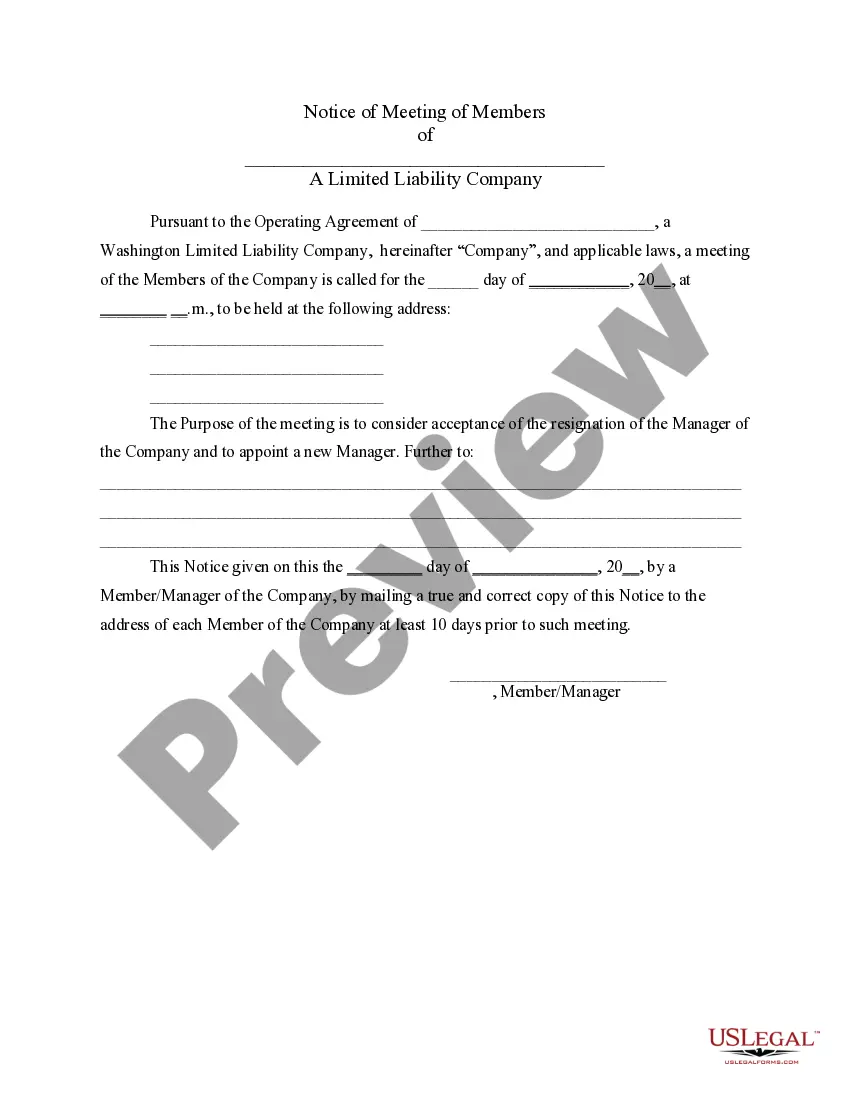

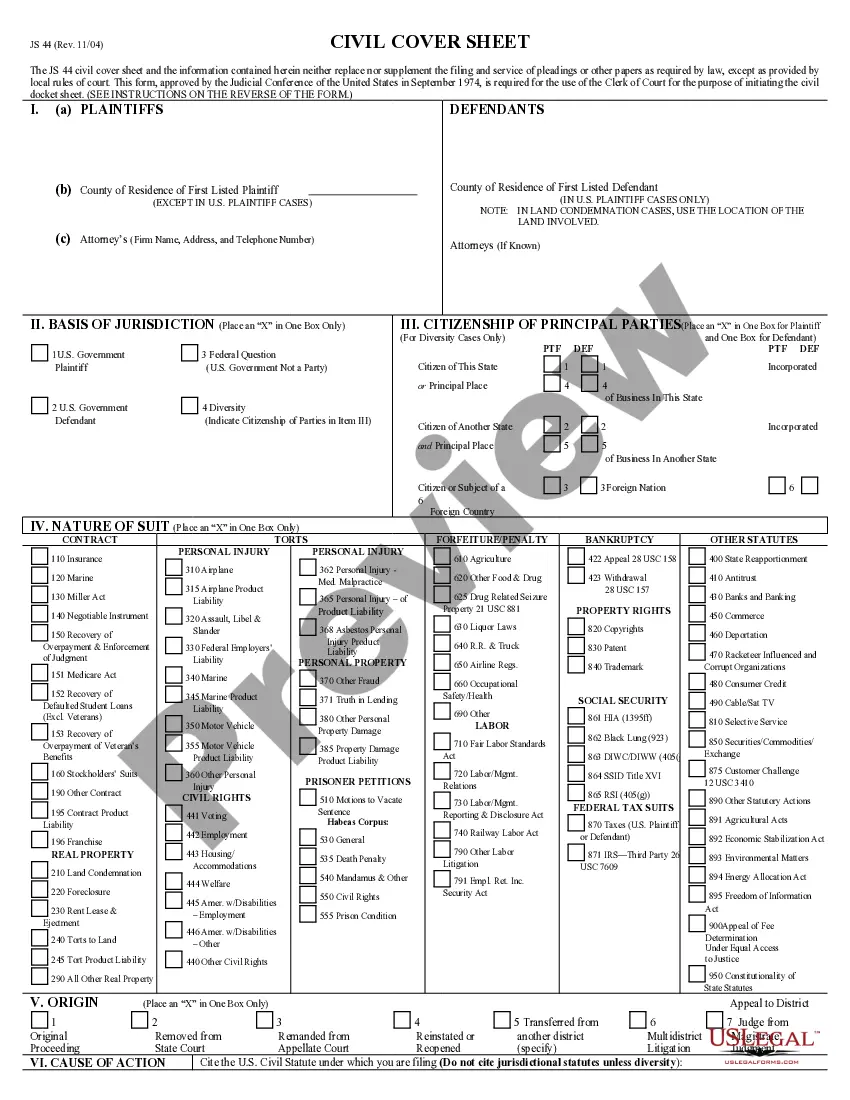

The Washington Limited Liability Company Without A Written Operating Agreement visible on this page is a reusable legal framework crafted by expert attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal experts with more than 85,000 validated, state-specific documents for any business and personal circumstances. It’s the fastest, simplest, and most dependable method to acquire the materials you require, as the service guarantees bank-level data security and anti-malware safeguards.

Select the format you prefer for your Washington Limited Liability Company Without A Written Operating Agreement (PDF, Word, RTF) and download the file to your device.

- Search for the document you need and examine it.

- Browse the sample you looked for and preview it or review the form description to ensure it meets your needs. If not, employ the search function to discover the correct one. Click Buy Now once you have found the template you require.

- Register and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

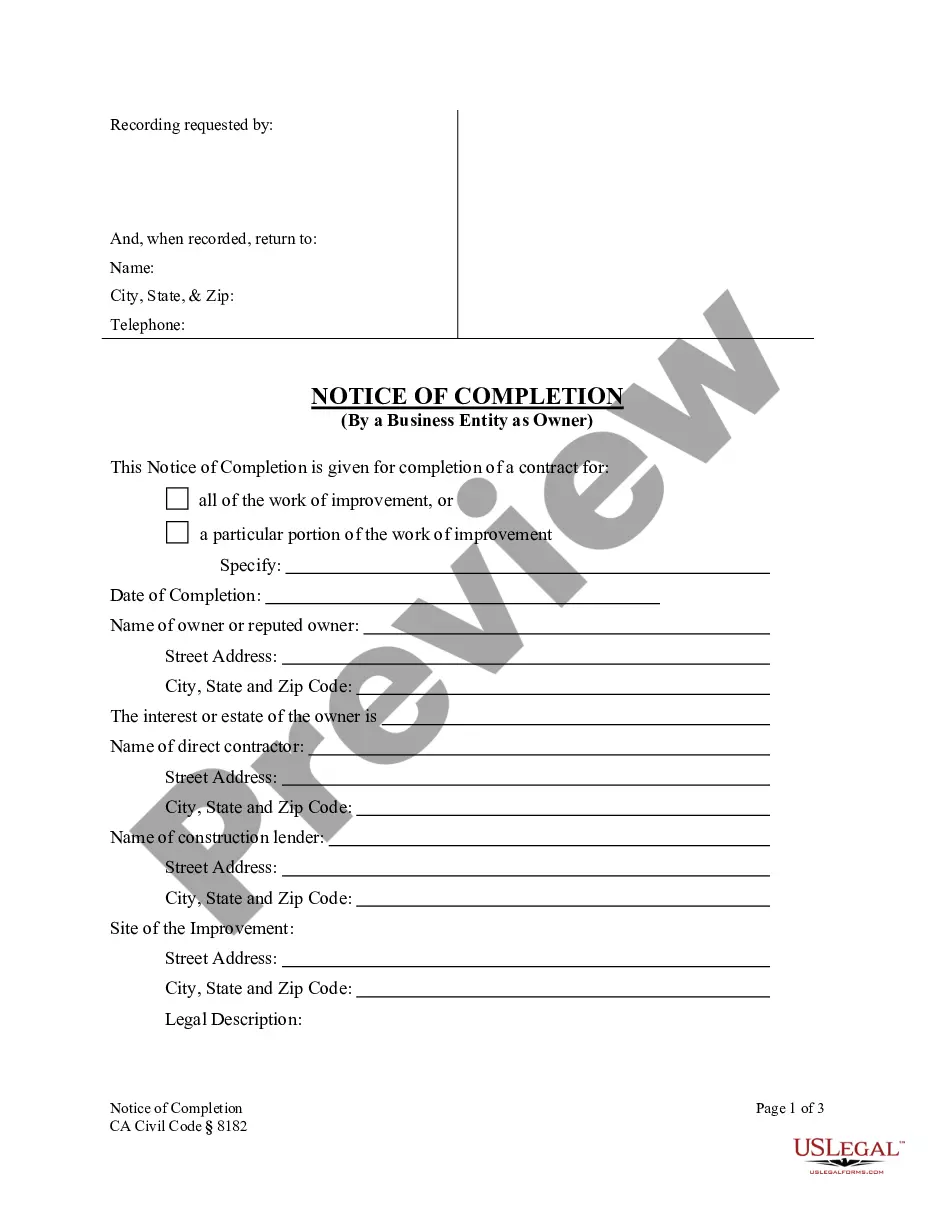

To file for a Washington limited liability company without a written operating agreement, you will first need to choose a unique name for your LLC that complies with state regulations. Next, complete the Articles of Organization form and submit it to the Washington Secretary of State, either online or by mail. Once your application is approved, you will receive your Certificate of Formation, officially establishing your LLC. Remember, while having a written operating agreement is not mandatory, it can greatly benefit your business by outlining management structure and member responsibilities.

To form an LLC in Washington, you must file articles of organization with the Secretary of State, pay the $180 filing fee, and have at least one member. You must have a registered agent and physical street address in Washington for your LLC.

member LLC can choose to be taxed as a corporation or disregarded as an entity separate from its owner, essentially treated as a sole proprietorship (a husband and wife, who are owners of an LLC and share in the profits, can file as a single member if they reside in a Community Property State such as ...

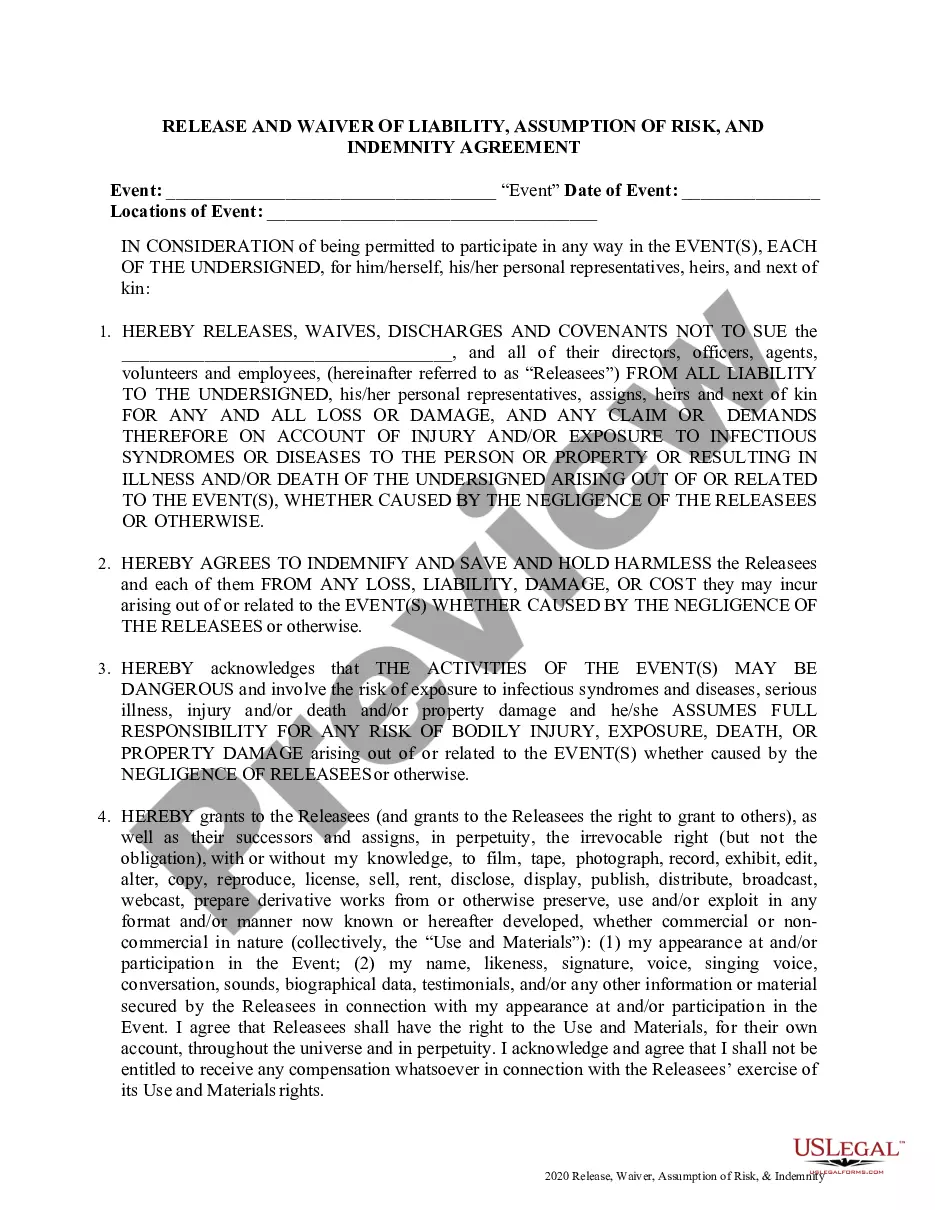

Washington state doesn't legally require an LLC to adopt a written operating agreement. However, a written operating agreement is important for proving ownership and limited liability status. It can also help you resolve disputes.

Always consult with your attorney to get answers to your questions regarding your LLC. Step 1: Draft and Sign an LLC Operating Agreement. ... Step 2: Get a Federal Tax ID (EIN) ... Step 3: Get a Business License. ... Step 4: File the Statement of Information. ... Step 5: Open a Business Bank Account.

Whether you are just forming your new Washington business, or if your business is already formed, you can be your own registered agent in Washington State.