Lease Example

Description

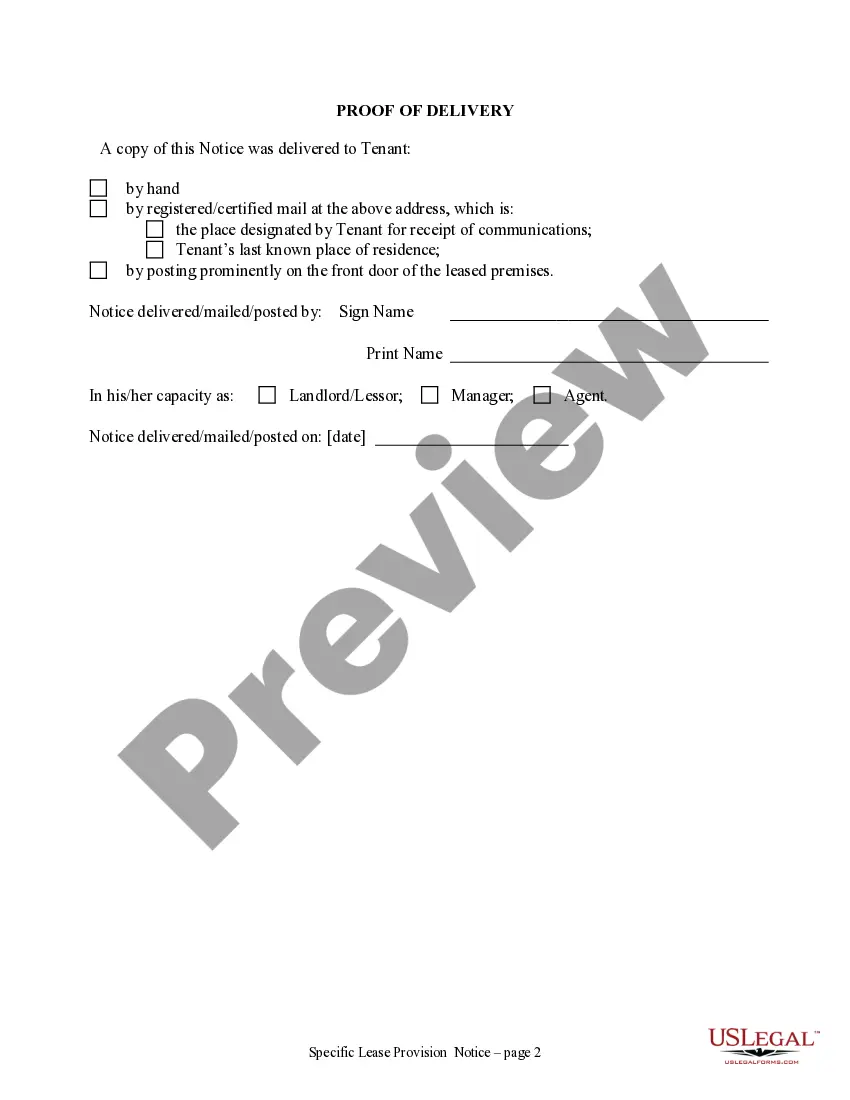

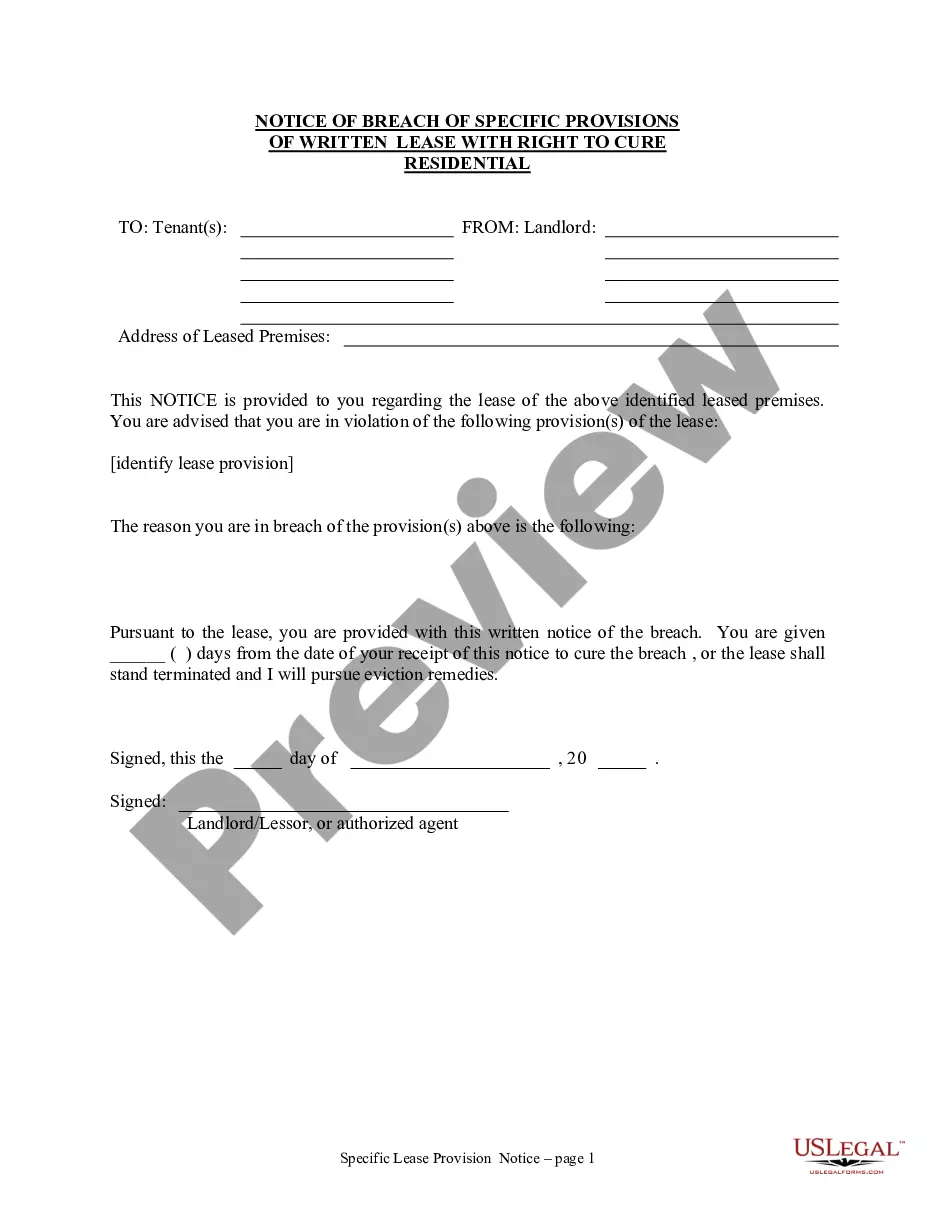

How to fill out Washington Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With Right To Cure For Nonresidential Property From Landlord To Tenant?

- If you're a returning user, log in to your account and locate the necessary lease example from the library. Ensure your subscription is up to date; if not, renew according to your payment plan.

- If you’re new to US Legal Forms, start by reviewing the Preview mode and form details to verify that the lease example aligns with your local jurisdiction requirements.

- If the selected lease example doesn't meet your needs, utilize the Search tab to find a more appropriate template.

- Once you find the right lease example, click the Buy Now button and select the subscription plan that works for you; you will need to create an account to access the extensive library.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Finally, download your lease example to your device and find it later in the My Forms section of your profile.

With US Legal Forms, you gain access to a vast library of over 85,000 legal documents that are not only easy to fill but also editable. This service empowers both individuals and legal professionals to efficiently manage their legal needs.

Get started today to experience the convenience of having all your legal form requirements met in one place. Sign up now for access!

Form popularity

FAQ

Yes, you can write your own lease. However, it’s important to ensure that your lease includes critical elements such as rental amount, lease duration, and responsibilities of both parties. To avoid common pitfalls, consider using a lease example as a guide. If you need a comprehensive solution, uslegalforms offers various templates to help you create a legally sound lease that meets your needs.

Yes, you can write your own lease agreement, but it’s essential to ensure it meets legal requirements and adequately protects your rights. Using a lease example can help you understand what to include in your document. Additionally, consider using resources like US Legal Forms for templates that can guide you in drafting a comprehensive and legally sound lease agreement.

While it is not mandatory to hire a lawyer to write a lease, consulting one can be beneficial, especially for complex situations. A lease example can provide a solid foundation for creating your own lease, ensuring you cover all necessary terms. However, if your lease involves unique conditions or potential disputes, legal advice can help you navigate those complexities more effectively.

Yes, landlords can create their own leases as long as they comply with local laws and regulations. A custom lease allows landlords to specify terms that suit their rental property. However, it’s wise to refer to a reliable lease example to ensure that your lease includes all necessary clauses and protects your interests. Platforms like US Legal Forms can provide templates and guidelines for crafting effective lease agreements.

Yes, a handwritten lease agreement can be legally binding, provided it includes all essential elements such as the names of the parties, rental amount, and lease duration. However, it is advisable to ensure that the terms are clear and understandable. Using a standard lease example can help prevent misunderstandings and enforceability issues. Consider consulting a legal professional for further assurance on your specific situation.

A lease term is the specific period outlined in a rental agreement during which the tenant can occupy the leased property. This term dictates both the duration of the lease and the rights and responsibilities of both parties. Knowing the lease term helps you plan your finances and understand when you may need to make a decision regarding future rentals.

A lease term example would be a commercial lease agreement that lasts for five years, with the option to renew at the end. This structure gives both the landlord and the tenant security and predictability in their rental arrangement. Understanding lease terms is vital, as they define the length of use and financial responsibility associated with the property.

Among many options, the most popular lease term in residential rentals is typically one year. This duration strikes a balance between commitment for landlords and flexibility for tenants. However, lease terms can vary widely based on individual needs and market trends, so it’s essential to review different options before making a decision.

Per lease term refers to the duration outlined in a lease agreement during which the lessee can use the property. It specifies when the lease starts and ends and often includes payment intervals. Understanding this concept is essential, as it helps you manage your rental payments and obligations promptly within the established timeframe.

Leasing refers to the process of renting or allowing one party to use a property or asset owned by another for a defined period, in exchange for payment. It enables individuals or businesses to utilize assets without outright purchasing them. For example, leasing equipment allows a company to operate without the high initial costs of buying the equipment.