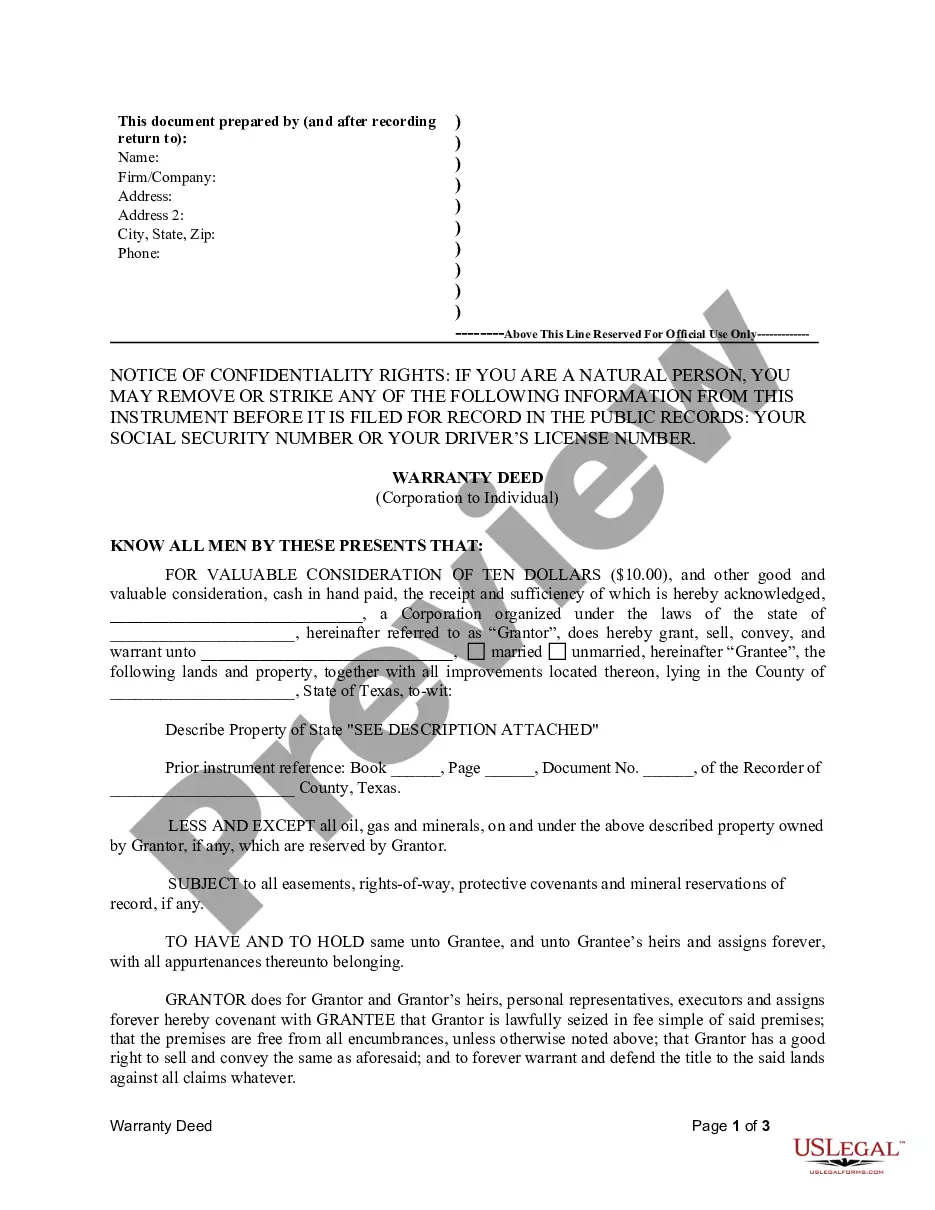

Trust Deed For Property

Description

How to fill out Washington Deed Of Trust - Amended Long Form - With Representative Acknowledgment?

- Start by visiting the US Legal Forms website. If you are a returning customer, log in to your account; otherwise, create a new account to access the full library of forms.

- Use the Preview mode to assess the trust deed form. Check the description to ensure it aligns with your requirements and complies with local jurisdiction laws.

- If you need a different form, utilize the Search tab to find the correct trust deed template. Ensure it fits your criteria before continuing.

- Select the document you wish to purchase by clicking on the Buy Now button. Choose a subscription plan that suits your needs and complete the registration process.

- Proceed to payment by entering your credit card details or opt for PayPal to finalize your purchase.

- Once your payment is confirmed, download the form to your device. You can access it anytime in the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the legal document process, providing a robust collection of forms and expert support to ensure you get precisely what you need. Take advantage of the available resources today!

Start your journey with US Legal Forms now and streamline your legal documentation process.

Form popularity

FAQ

In many jurisdictions, you are required to declare a trust deed for property, particularly to ensure proper tax compliance and asset protection. Declaration makes the trust binding and helps avoid any potential legal challenges. If in doubt, consulting resources like US Legal Forms can guide you through the declaration process effectively.

A family trust can limit flexibility, as assets placed within it are typically subject to the terms established at its creation. This means changes can be difficult to implement without a legal process. Moreover, beneficiaries may not fully understand how a trust deed for property operates, leading to potential confusion or disputes.

While trusts offer various benefits, a downside is that they can limit the immediate access to assets held within the trust. If a grantor needs funds urgently, they may face delays due to the legal structure. Additionally, a trust deed for property may require ongoing management and possible fees, which adds to the overall complexity of ownership.

One significant mistake parents make is failing to communicate their intentions clearly with their beneficiaries. This lack of communication can lead to misunderstandings and conflicts later on. A well-structured trust deed for property can help outline these intentions, but parents must ensure everyone understands the terms and purposes of the trust.

It can be beneficial for your parents to put their assets in a trust, especially if they want to manage and protect those assets for future generations. A trust deed for property can help avoid probate, ensure privacy, and provide tax advantages. However, they should consider consulting with a legal professional to evaluate their specific situation.

To get a trust deed for property, start by identifying a financial institution or lender that offers this type of agreement. You will need to complete an application and provide necessary documentation, such as proof of income and property information. Once approved, your lender will draft the trust deed, which outlines the terms and conditions. Using USLegalForms can streamline this process, providing you with access to templates and guidance.

Someone might use a deed of trust for property financing because it often offers advantages over traditional mortgages. This method typically involves fewer formalities and facilitates quicker transactions. Additionally, a deed of trust provides a clear pathway for lenders to recover their investment in case of borrower default.

When a property is held in a trust, it means that the property ownership is transferred to a trust entity. This structure separates the legal title from the beneficial interest, enabling the trust to manage the property on behalf of the beneficiaries. Essentially, the trust acts as a steward, ensuring that the property is managed according to the terms outlined in the trust deed for property.

One significant disadvantage of a trust deed for property is that it allows the lender to initiate a non-judicial foreclosure process, potentially bypassing court oversight. This process can be faster than traditional foreclosure methods. Moreover, if the borrower defaults, they may face a loss of their property without ample opportunities for remediation.