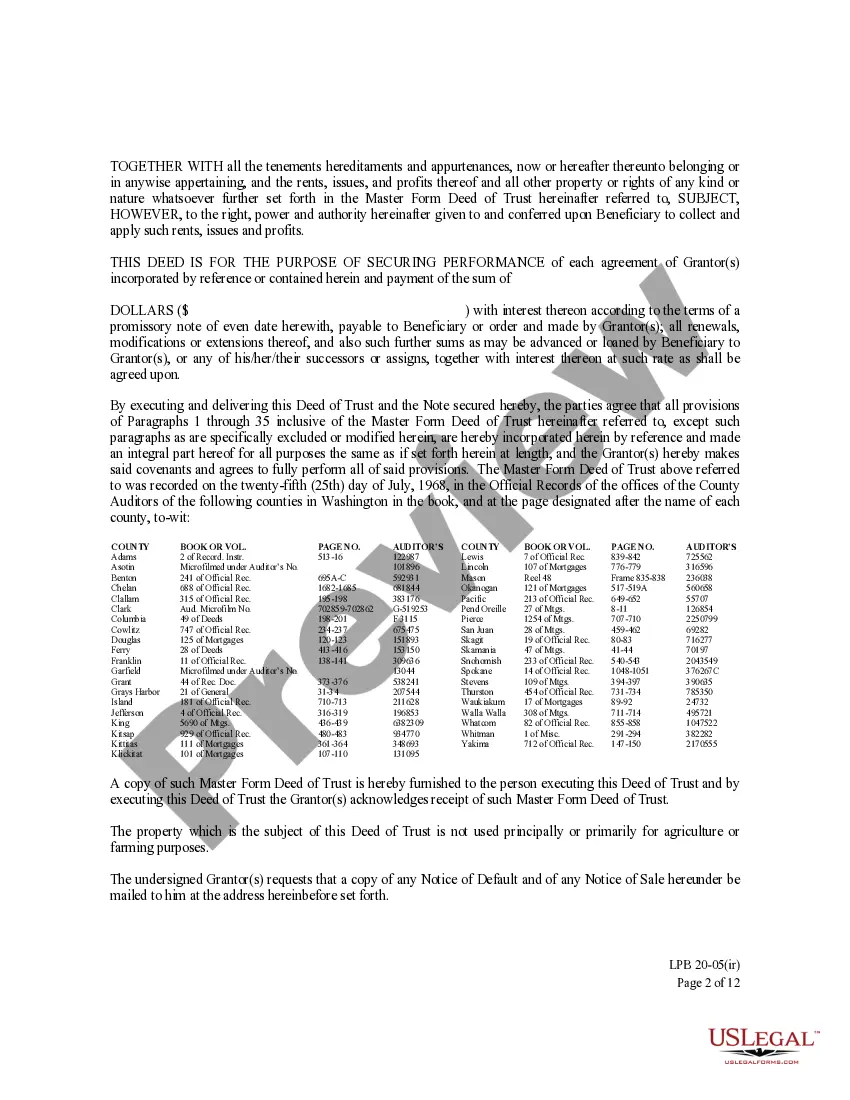

This is an official Washington form for use in land transactions, a Deed of Trust [Short Form and Attachment] (with individual and representative acknowledgments).

Washington Deed Trust With Assignment Of Rents

Description

How to fill out Washington Deed Trust With Assignment Of Rents?

Bureaucracy requires exactness and correctness.

If you don't routinely handle forms like the Washington Deed Trust With Assignment Of Rents, it might cause some misunderstanding.

Selecting the appropriate sample from the outset will guarantee that your documentation submission proceeds smoothly and avoids any hassles of resending a file or repeating the same task from the start.

If you are not a registered user, locating the necessary sample may require a few additional steps: Find the template using the search function. Ensure the Washington Deed Trust With Assignment Of Rents you found is suitable for your state or county. Open the preview or review the description that includes the details on the use of the template. If the result corresponds to your search, click the Buy Now button. Choose the correct option from the available pricing plans. Log In to your account or create a new one. Complete the purchase using a credit card or PayPal. Save the document in your preferred format. Obtaining the correct and updated samples for your documentation is a matter of minutes with an account at US Legal Forms. Eliminate bureaucratic worries and enhance your efficiency in handling forms.

- You can always discover the suitable sample for your documentation in US Legal Forms.

- US Legal Forms is the largest online collection of forms, housing over 85 thousand samples across diverse subject matters.

- You can acquire the latest and most applicable version of the Washington Deed Trust With Assignment Of Rents by simply searching on the site.

- Locate, save, and download templates in your account or verify the description to ensure you have the right one available.

- With an account at US Legal Forms, you can gather, store in one location, and navigate through the templates you've saved for easy access.

- When on the site, click the Log In button to sign in.

- Then, move to the My documents page, where your documents are organized.

- Review the descriptions of the forms and download the ones you need at any time.

Form popularity

FAQ

In Washington state, the statute of limitations on a deed of trust is typically six years from the date of default. This means that a lender has six years to initiate foreclosure proceedings if the borrower fails to meet their obligations. Knowledge of this timeframe is crucial for both lenders and borrowers to ensure they act within the legal limits. For more detailed information, you can explore resources available on the UsLegalForms platform, which can guide you through related legal matters.

Transferring a deed to a trust in Washington state involves creating a new deed that designates the trust as the property owner. This document needs to be signed and then recorded at the county auditor's office to ensure legal recognition. It is essential to follow proper procedures to avoid complications later. A well-structured Washington deed trust with assignment of rents can simplify this transfer process.

In Washington state, trusts do not need to be registered, making them a flexible option for estate planning. While the trust itself remains private, the assets within it can still be managed according to the terms laid out in the trust document. However, proper documentation is necessary to ensure that the property transfers are recognized. Consider implementing a Washington deed trust with assignment of rents for clearer management.

Yes, a trust can hold title to real property in Washington state. When a property is transferred into a trust, the trust becomes the legal owner, meaning the trustee manages the property on behalf of the beneficiaries. This arrangement can enhance asset protection and facilitate estate planning. Using a Washington deed trust with assignment of rents can optimize these benefits.

To transfer property into a trust in Washington state, you first need to ensure that the trust document is properly established. Then, prepare a new deed to transfer the property rights to the trust. You must record the deed with the county auditor to make the transfer official. This process can benefit from incorporating a Washington deed trust with assignment of rents.

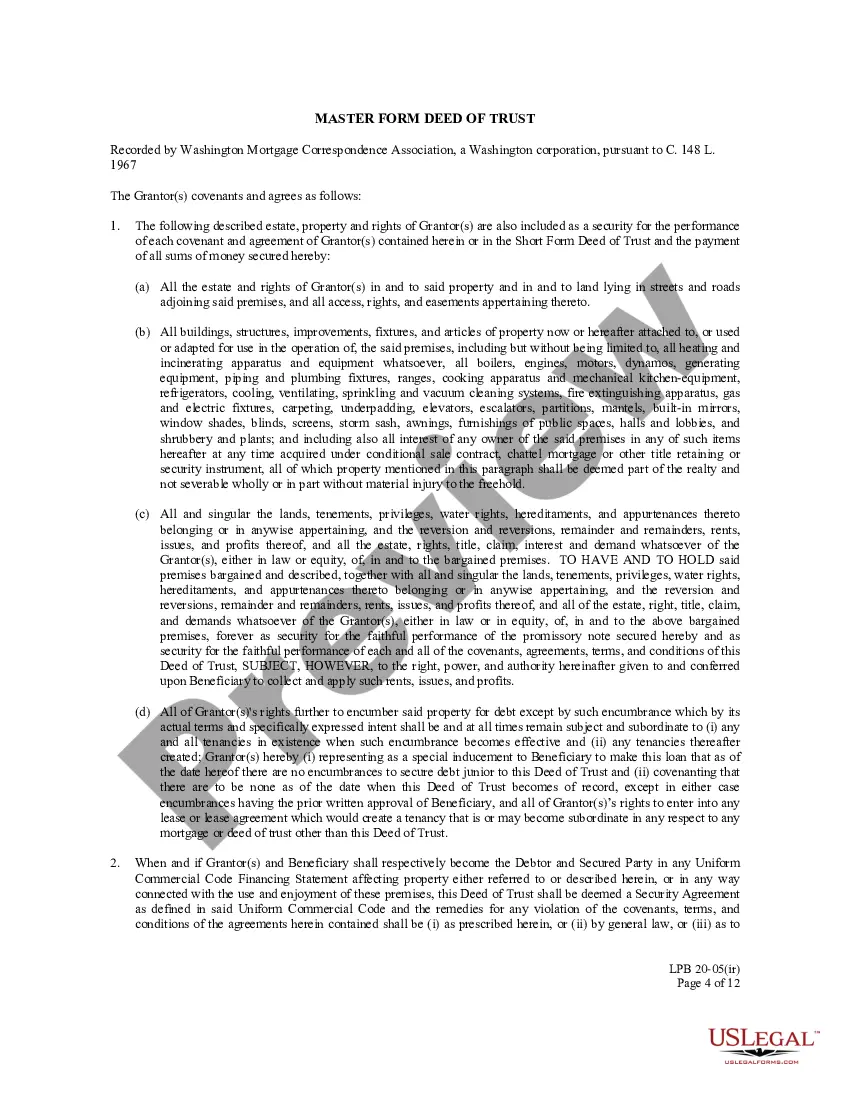

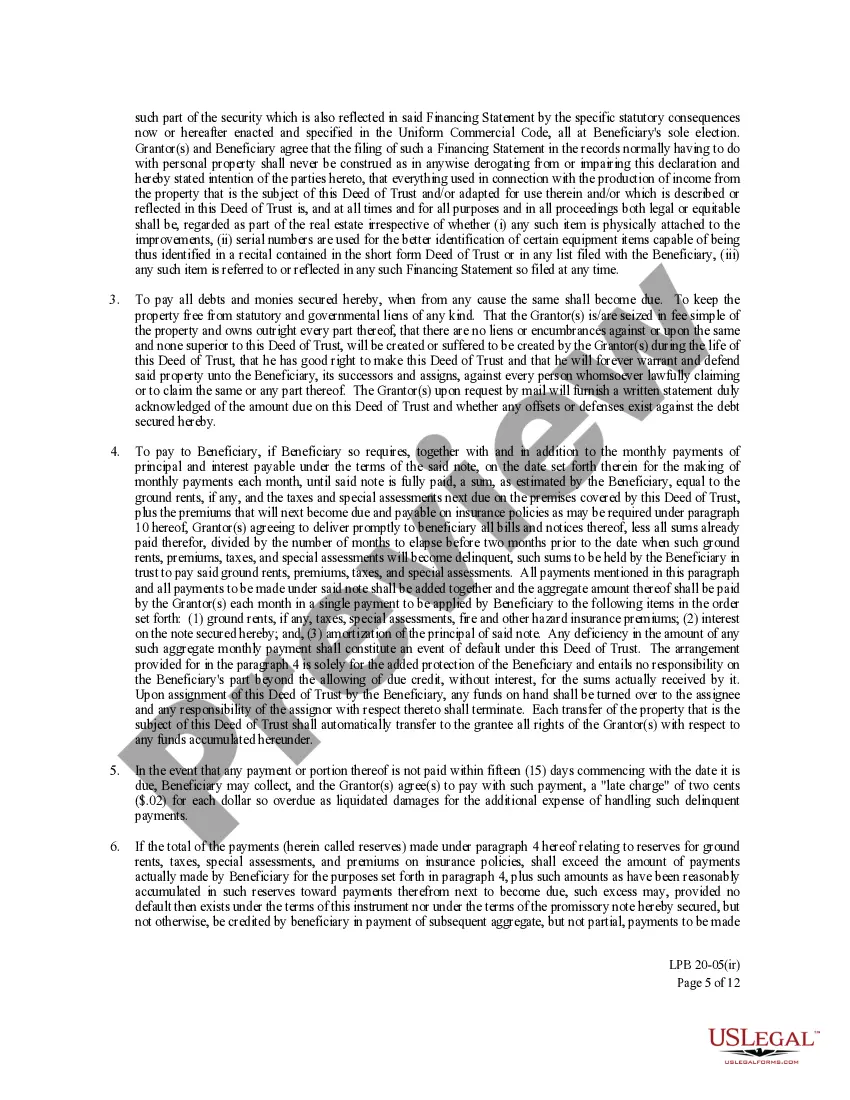

A deed of trust in Washington state serves as a security instrument that connects borrowers, lenders, and third-party trustees. It allows a lender to hold a lien on property until the debt is repaid. Essentially, this legal document provides a framework for the eventual transfer of property in the event of default. Understanding the Washington deed trust with assignment of rents is crucial for securing your investment.