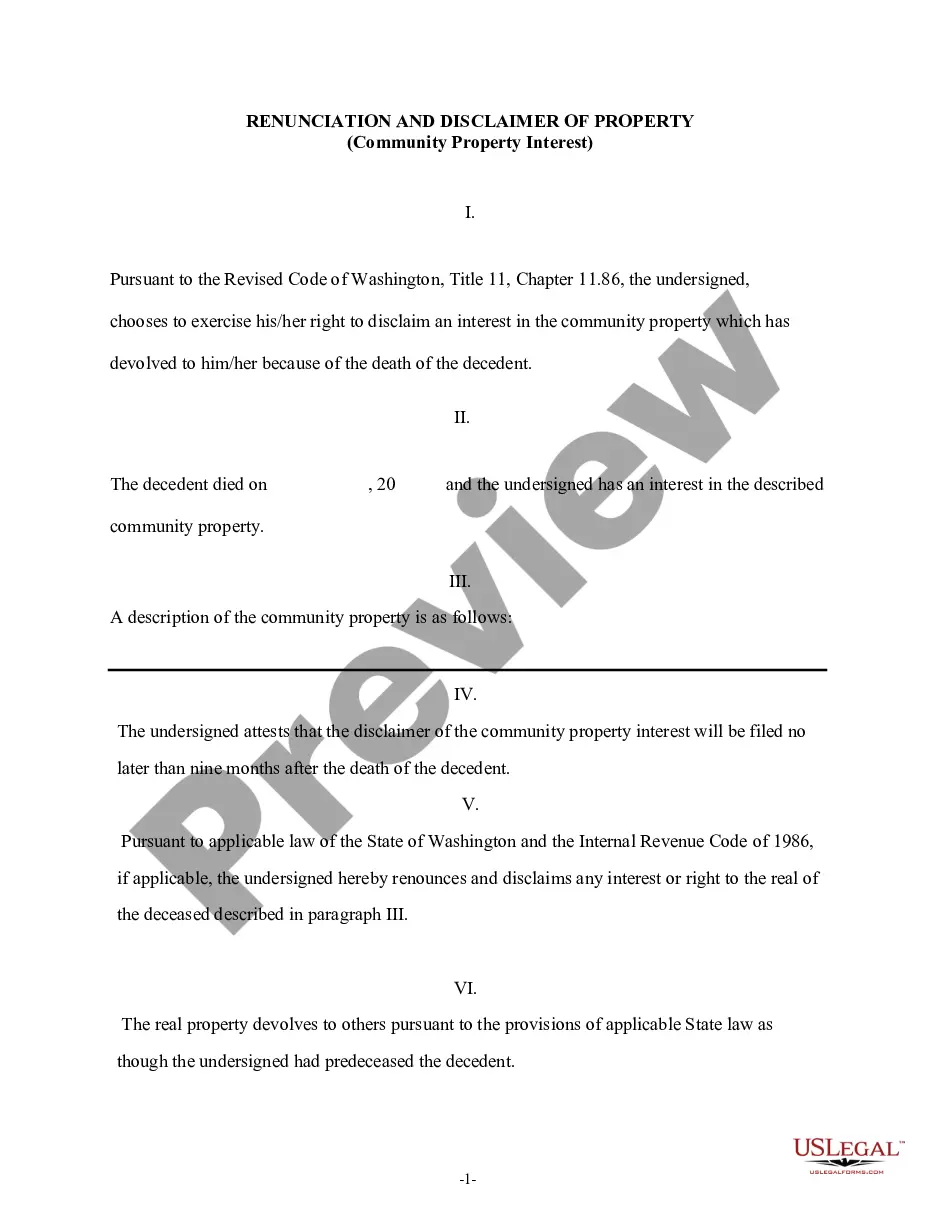

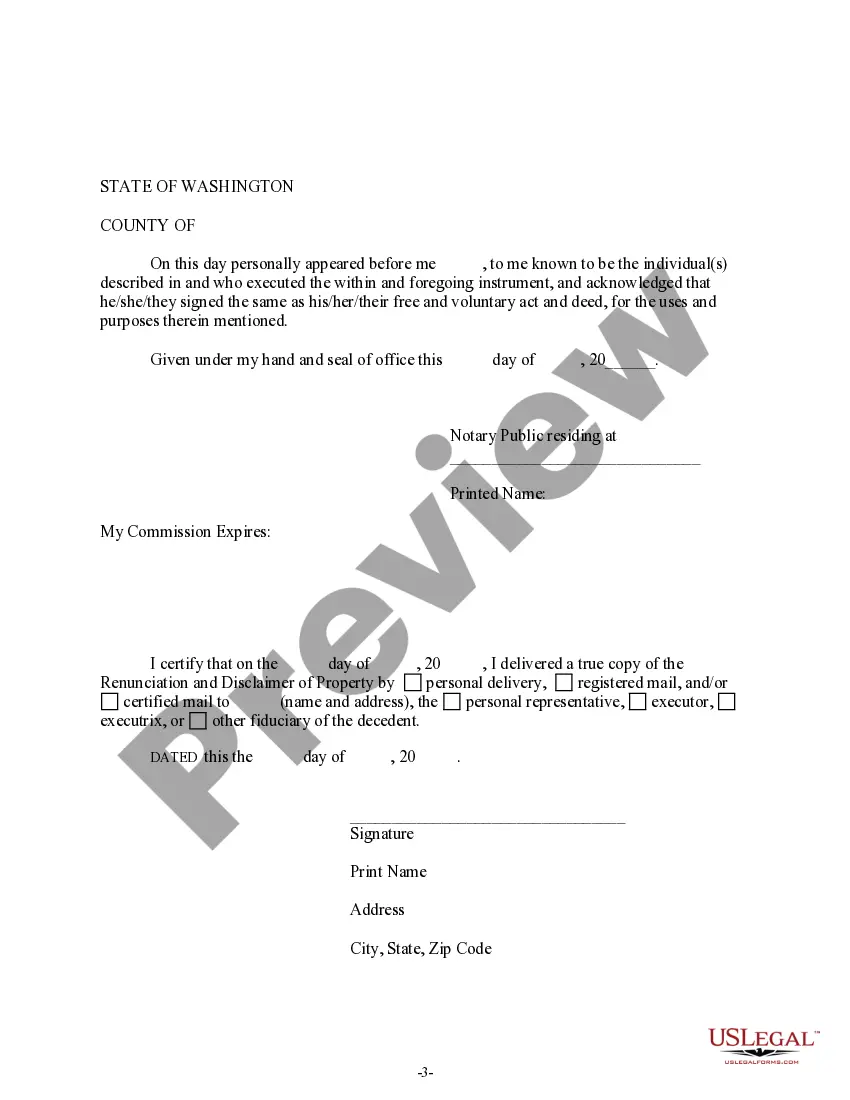

This form is a Renunciation and Disclaimer of a Community Property Interest, where the beneficiary gained an interest in the described property upon the death of the decedent, but, pursuant to the Revised Code of Washington, Title 11, Chapter 11.86, has chosen to disclaim his/her interest in the property. Therefore, the form will now pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify the delivery of the document.

Community Property With Rights

Description

How to fill out Community Property With Rights?

There’s no longer any justification to squander hours searching for legal documents to adhere to your local state laws. US Legal Forms has gathered all of them in one location and simplified their access.

Our platform provides over 85,000 templates for various business and personal legal matters categorized by state and intended use. All forms are correctly drafted and verified for legitimacy, ensuring you can confidently acquire an up-to-date Community Property With Rights.

If you are acquainted with our service and already possess an account, ensure your subscription remains valid before acquiring any templates. Log In to your account, choose the document, and click Download. You can also revisit all previously obtained documents at any time by accessing the My documents section in your profile.

Choose the file format for your Community Property With Rights and download it to your device. Print out your form to fill it out manually or upload the sample if you prefer to complete it in an online editor. Drafting formal paperwork under federal and state laws and regulations is quick and simple with our library. Try US Legal Forms today to keep your documentation organized!

- If you've never availed yourself of our service before, the procedure will require a few more steps to finalize.

- Here’s how new users can acquire the Community Property With Rights from our library.

- Thoroughly examine the page content to verify it includes the sample you need.

- To assist with this, utilize the form description and preview options if available.

- Employ the Search field above to look for another example if the current one does not fit your needs.

- Once you find the suitable template, click Buy Now next to the title.

- Select the most appropriate subscription plan and either register for an account or Log In.

- Proceed to pay for your subscription using a credit card or through PayPal to continue.

Form popularity

FAQ

Yes, married filing separately may result in more taxes withheld from your paycheck. This status often leads to a higher withholding rate due to the loss of various tax benefits. If you have community property with rights, evaluating the implications of this tax choice is crucial for managing your finances. Consider using resources like US Legal Forms for assistance in decision-making.

In California, the community property rule means that all property acquired during marriage is owned equally by both spouses. This includes income earned and debts incurred during the marriage. Understanding your rights concerning community property is vital for effective financial planning. US Legal Forms provides valuable tools to help you understand and document these rights.

Generally, filing married filing separately does not guarantee a larger refund. In many cases, this status can restrict tax benefits, leading to minimal refunds or even amounts owed. However, if you manage community property with rights effectively, you might find a suitable strategy for your situation. It’s wise to calculate both filing statuses to see which one serves you better.

Filing as married filing separately may lead to higher taxes in some situations. This filing status can limit your eligibility for certain tax credits and deductions. When you have community property with rights, it’s crucial to assess how this status affects your overall tax burden. Consulting with a tax professional is advisable to explore your options.

Yes, you need to report community property on your tax returns. When you file, list the income and expenses related to community property, as it impacts your taxable income. If you and your spouse have rights to shared property, understanding these reporting requirements is essential. Utilizing resources like US Legal Forms can help you navigate these legal obligations effectively.

Living in a community property with rights state can simplify asset division during divorce. Shared ownership often leads to a more equitable distribution of marital property. Additionally, these laws can provide financial benefits in terms of tax treatment and inheritance rights. Understanding these advantages is vital for making informed decisions about your assets.

To establish community property with rights, couples should clearly define their shared and separate assets. This often involves creating agreements that outline ownership and how property should be managed. Regularly reviewing this information and consulting an attorney about community property laws can protect both parties’ rights.

Community property with rights exists in Arizona, California, Nevada, New Mexico, Texas, Washington, Idaho, Louisiana, and Wisconsin. Each state has unique characteristics regarding community property laws, including what is considered shared or separate. Knowing your state’s laws can safeguard your interests, especially in divorce or death scenarios.

Currently, nine states uphold community property with rights in their laws. These states include California, Texas, Washington, and others. Each state has specific guidelines about how assets are owned and divided. Understanding your state’s regulations is crucial for navigating potential legal implications.

In states recognizing community property with rights, property owned prior to marriage usually remains separate. However, if you used marital funds for improvements or significant expenses related to that house, your spouse may have a claim. It’s important to document the status of your property to protect your rights. Consulting a legal expert can provide clarity tailored to your situation.