Llc Company Meaning

Description

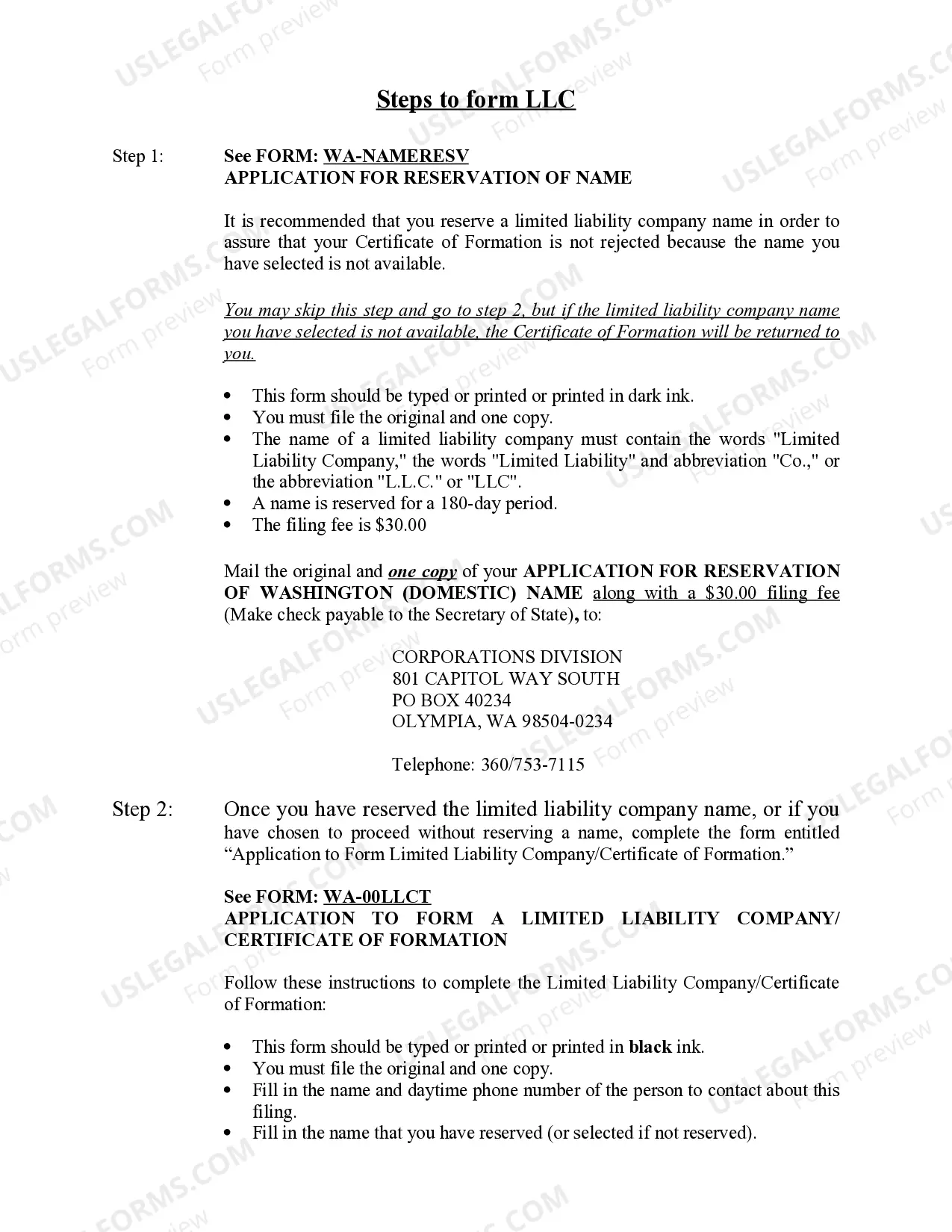

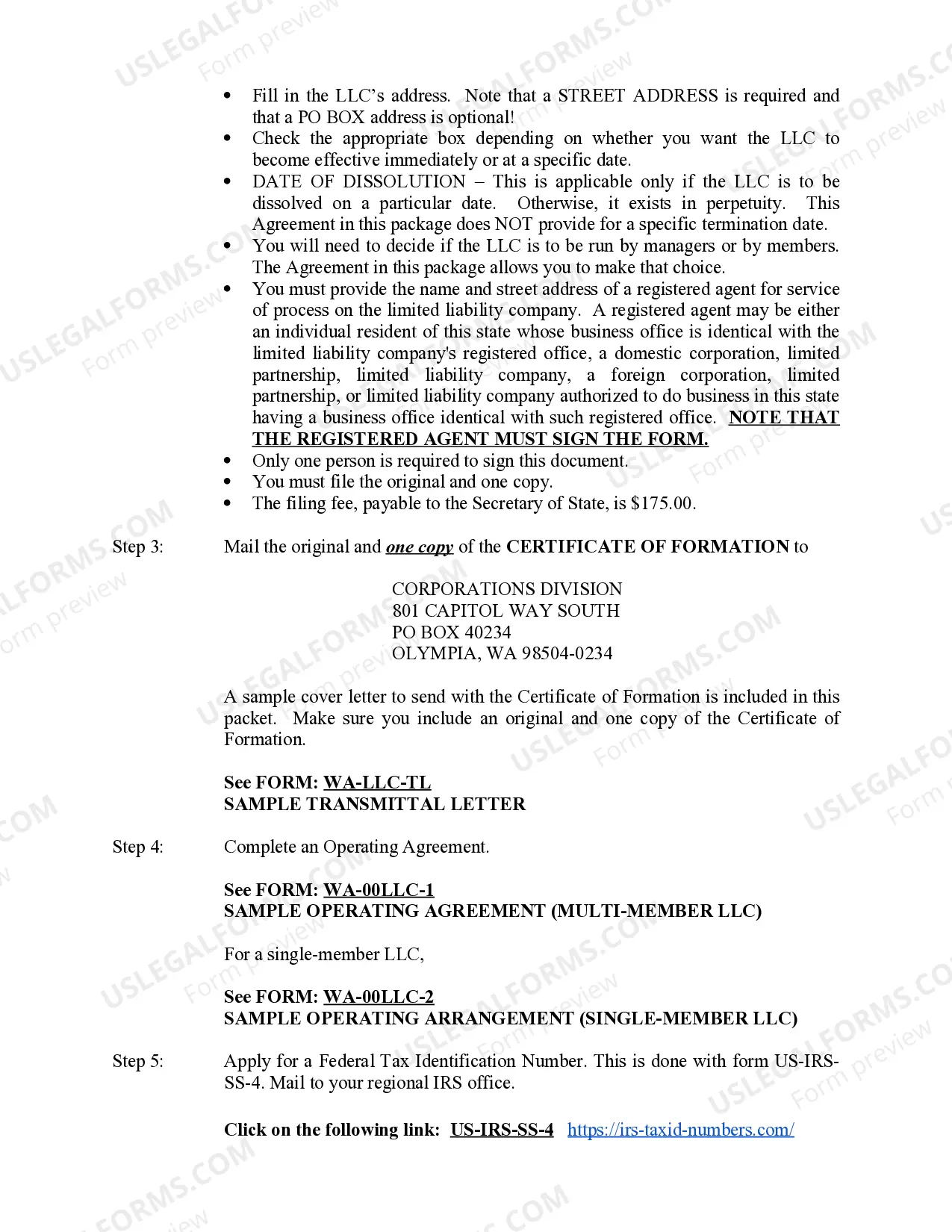

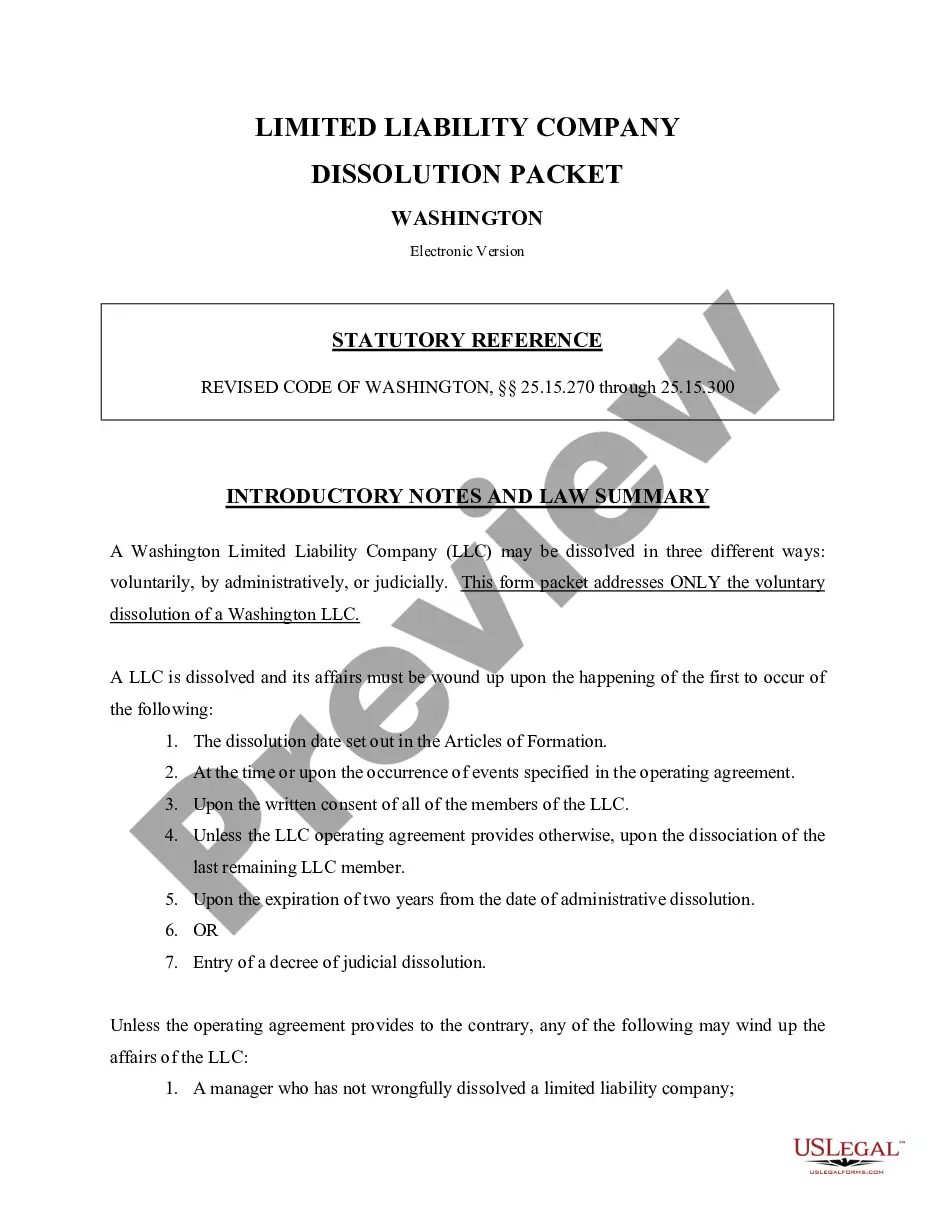

How to fill out Washington Limited Liability Company LLC Formation Package?

- Log into your US Legal Forms account if you're a returning user. Ensure your subscription is active to access necessary documents.

- For first-time users, begin by searching for the specific LLC form. Use the Preview mode to verify compatibility with your local jurisdiction requirements.

- If the desired form isn't suitable, utilize the search feature to find a better match.

- Select the form by clicking 'Buy Now' and choose an appropriate subscription plan.

- Complete the payment using your credit card or PayPal account to finalize your purchase.

- Once the transaction is complete, download the form directly to your device. You can retrieve it anytime via the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys by providing a vast library of over 85,000 legal forms, making it easier to execute necessary legal documents accurately.

With its robust collection of forms, US Legal Forms stands out by offering a comprehensive array at competitive prices. Start your LLC formation process today by accessing their library!

Form popularity

FAQ

The primary purpose of an LLC is to provide liability protection for its owners, which means personal assets are shielded from business debts and lawsuits. This structure also allows for pass-through taxation, potentially lowering the overall tax burden on the owners. The LLC company meaning also encompasses flexibility in management and fewer compliance requirements compared to corporations. This makes the LLC particularly appealing for small business owners.

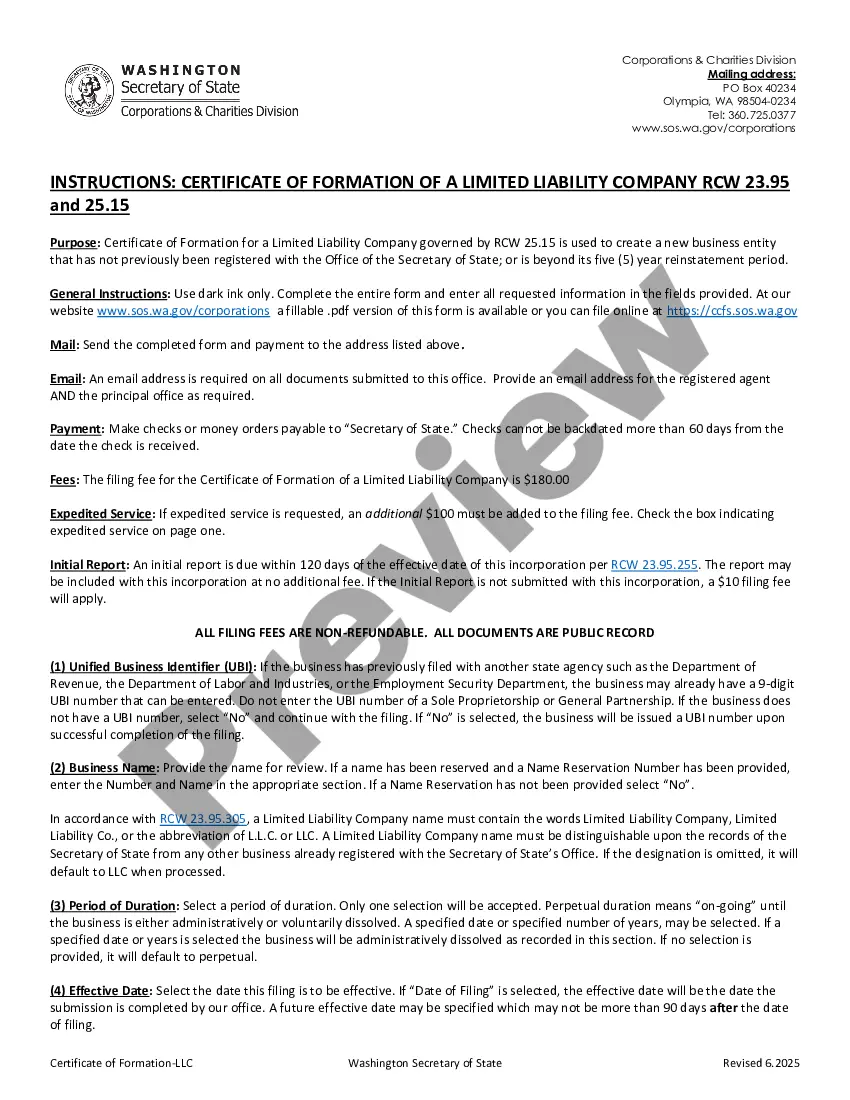

To understand LLC company meaning, you should start by recognizing that LLC stands for Limited Liability Company. This business structure combines the advantages of a corporation and a partnership. It provides liability protection for its owners while allowing flexible tax treatment. To establish one, you typically need to file Articles of Organization with your state and draft an operating agreement.

Filing an LLC means officially registering your business as a Limited Liability Company with the state. This process grants your business its legal identity, providing liability protection and other benefits. Understanding the Llc company meaning requires grasping this foundational step that safeguards your personal assets and shapes your business operations.

Failing to file taxes for your LLC can lead to severe consequences, including financial penalties and potential loss of the LLC's legal status. Compliance with tax regulations is essential, as it reinforces the integrity of the Llc company meaning. If you face challenges with filing, resources like US Legal Forms can help guide you through the process.

A single owner LLC is typically treated as a 'disregarded entity' for tax purposes, meaning it does not file separately. Instead, the owner reports business income and expenses on their personal tax return using Schedule C. This connection is vital for understanding the Llc company meaning in the context of tax obligations and benefits.

While an LLC offers several benefits, such as limited liability and flexibility, there are downsides to consider. One downside is that, in some states, LLCs face higher annual fees and taxes compared to other business structures. Understanding the Llc company meaning includes recognizing these potential costs that could affect your business's overall financial health.

Yes, you can file your LLC separately from other business entities you may have. This process ensures that your LLC maintains its distinct legal status, which is key in understanding the Llc company meaning. Additionally, filing separately can help streamline your accounting and protect your personal assets.

While an LLC cannot entirely avoid taxes, it can minimize tax liabilities through strategic planning. Owners can take advantage of deductions and credits available to businesses, such as business expenses and health insurance premiums. Additionally, understanding the LLC company meaning can guide you in compliance while legally optimizing your tax situation.

The pros of an LLC include limited liability protection, tax flexibility, and operational simplicity. However, some cons involve the potential for self-employment taxes on income and varying state regulations that might affect formation and maintenance. Grasping the full LLC company meaning helps you weigh these aspects before making a business structure decision.

An LLC can provide significant tax benefits, as it allows profits and losses to pass through directly to the owner's personal tax returns, avoiding double taxation. Furthermore, LLCs can elect to be taxed as an S-corporation, potentially lowering self-employment taxes. Understanding the LLC company meaning can lead to various tax advantages that help you keep more of your earnings.