Liability Protection For Llc

Description

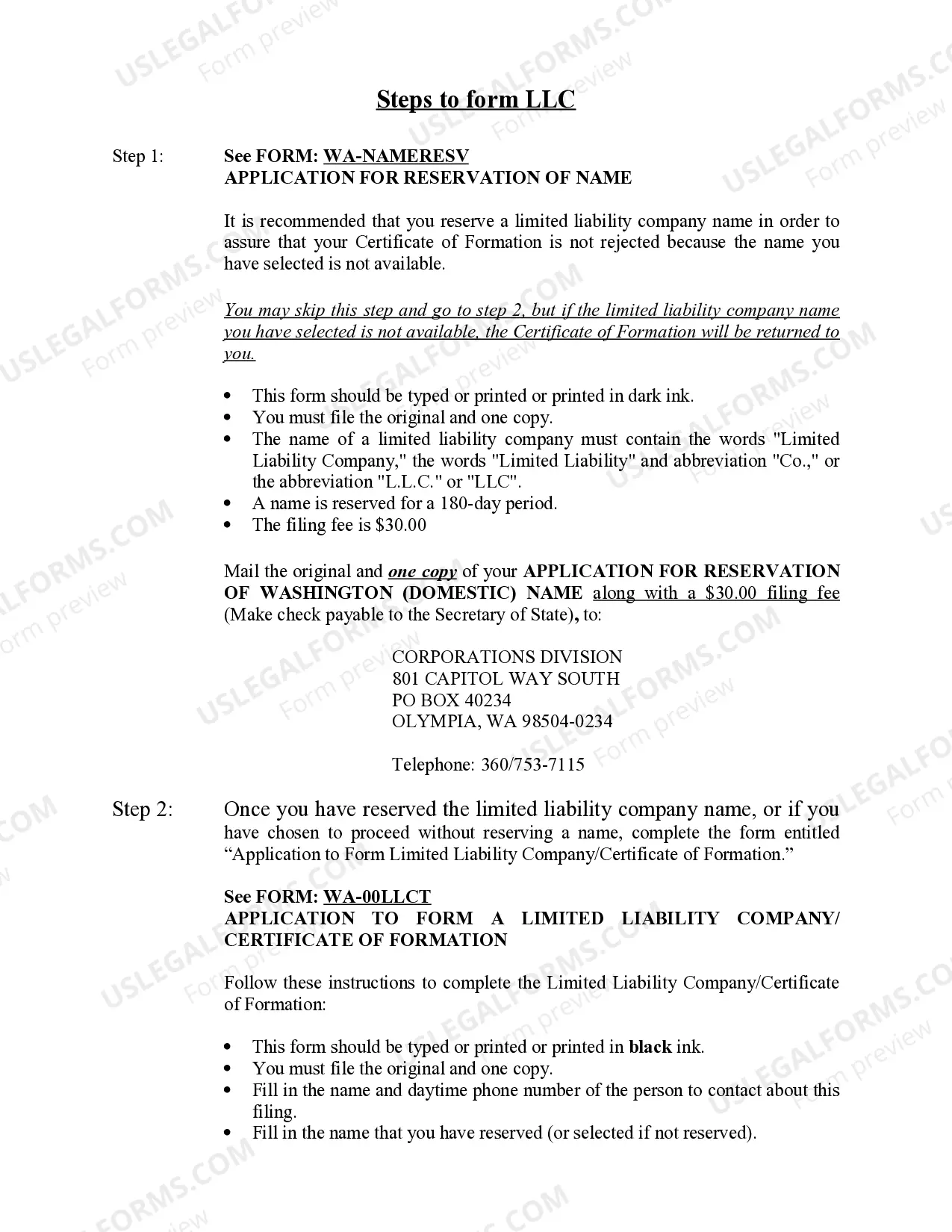

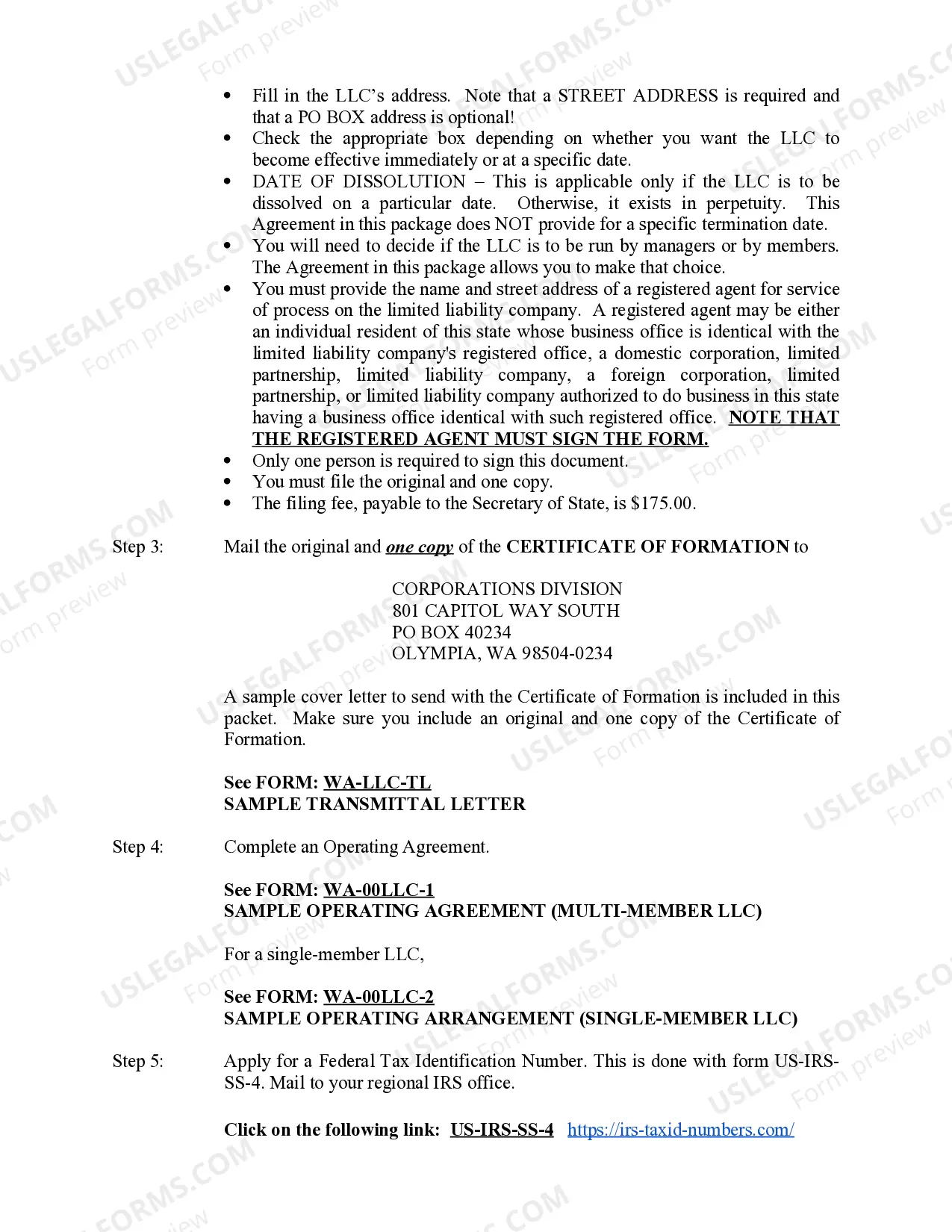

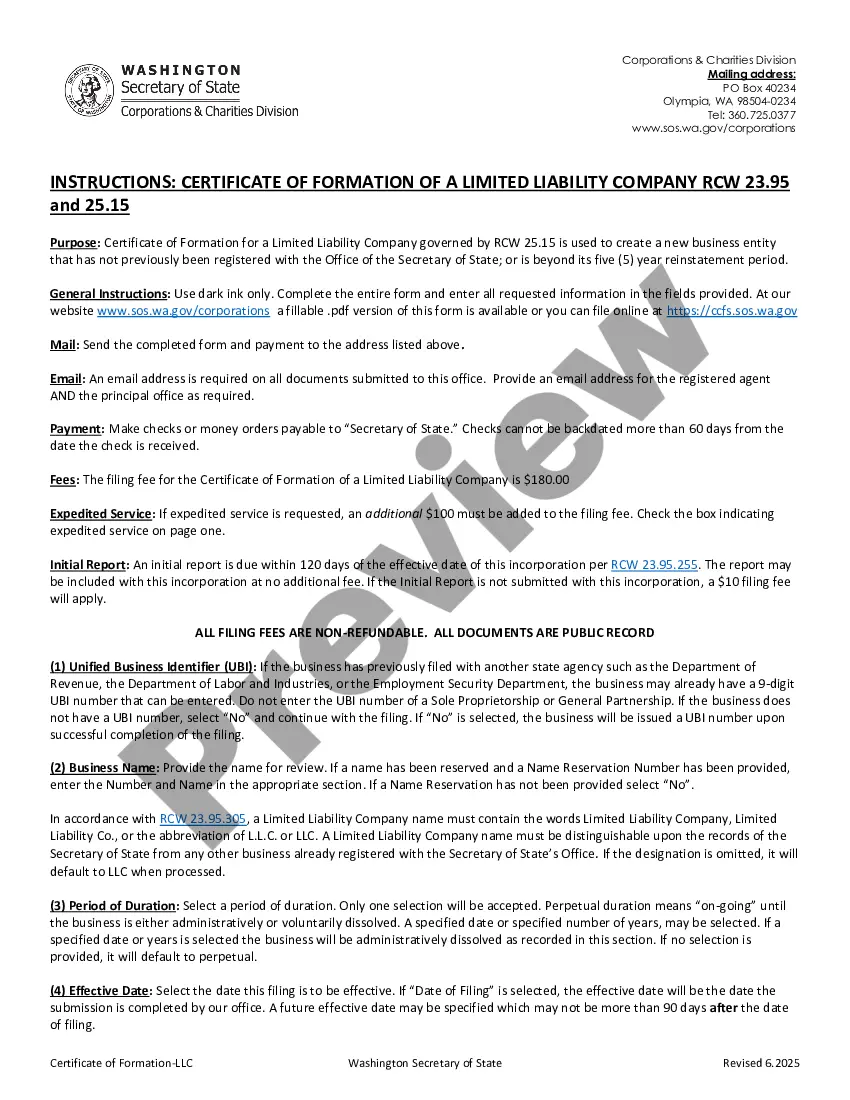

How to fill out Washington Limited Liability Company LLC Formation Package?

- Log in to your US Legal Forms account if you’ve used the service before. If you’re new, create an account to start.

- Navigate to the Preview mode to review the descriptions of available forms. Ensure that you select one that aligns with your business requirements and complies with local regulations.

- Utilize the Search feature if you need to find a different template. Look for any discrepancies before proceeding.

- Choose the document you need and click on the Buy Now button. Select a subscription plan that fits your needs and register your account for full access.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Once the transaction is successful, download your form to your device. It will also be accessible anytime in the My Forms section of your profile.

Following these steps ensures that you receive comprehensive liability protection for your LLC. With US Legal Forms, not only do you benefit from a diverse selection of documents, but you also gain access to premium legal experts who can assist you in completing them accurately.

Take control of your business’s legal needs today! Sign up with US Legal Forms and access the resources you need for effective liability protection.

Form popularity

FAQ

Liability protection in an LLC refers to the legal safeguard that ensures that the owners’ personal assets are generally protected from the company's debts and legal issues. This means that if the LLC faces bankruptcy or legal action, the owners are typically not personally liable. It's essential for business owners to structure their entity as an LLC, as this liability protection for LLC helps maintain financial security while operating their business.

The benefits of LLC liability primarily include the protection of personal assets, allowing business owners to pursue entrepreneurship without risking their savings or property. Moreover, forming an LLC can enhance credibility with customers and suppliers, as it demonstrates a formal business structure. Additionally, LLCs often enjoy flexibility in management and taxation, further promoting business success.

An example of a limited liability company (LLC) would be a small landscaping business owned by a few partners. Each partner in the LLC benefits from liability protection for LLC, meaning their personal assets are typically not at risk should the business face lawsuits or debts. This structure allows them to operate while enjoying the reassurance that their personal finances are shielded.

The liabilities of an LLC generally include debts, contracts, and obligations that the company undertakes during its operations. These could range from loans, unpaid bills, or legal judgments. The LLC structure offers liability protection for LLC members, safeguarding personal assets from most of these business liabilities, thus promoting a safer business environment.

An example of an LLC liability includes debts that your business incurs, such as loans or contracts. If the LLC fails to repay these debts, creditors can seek payment from the LLC's assets, but they generally cannot go after your personal assets. This is where liability protection for LLC comes into play, ensuring that your personal finances remain secure in case of business issues.

The liability protection of an LLC refers to the legal shield that separates personal assets from business liabilities. This means that if your LLC faces lawsuits or debts, your personal possessions, such as your home and savings, are generally safe. This structure allows entrepreneurs to take calculated risks without jeopardizing their personal finances. For more details and resources, you can explore the offerings of uslegalforms, which help clarify and solidify your understanding of liability protection for LLC.

In an LLC, the company itself generally bears the liability, protecting its owners from personal responsibility for business debts. This means that members or managers usually do not risk their personal assets due to business actions. However, it is essential to maintain proper separation between personal and business finances to ensure this liability protection for LLC remains intact. When properly structured, the LLC protects its members effectively.

Yes, obtaining liability insurance for your LLC is a wise decision. It provides an added layer of security in the event of legal claims or disputes. Since liability protection for LLC can vary, this insurance can help protect your personal assets from potential business liabilities. Therefore, considering liability insurance is crucial for your peace of mind.

Yes, an LLC does provide personal protection to its members from personal liability for business debts and lawsuits. This is one of the main reasons many entrepreneurs opt for an LLC structure. However, for optimal protection, it is vital to follow best practices, such as maintaining a clear separation between personal and business activities. By doing this, you can better leverage the liability protection for LLC that it offers.

Typically, as an LLC owner, you are not personally responsible for business debts. This crucial distinction offers significant peace of mind, as your personal assets usually remain safeguarded from creditors. However, any personal guarantees you make or illegal activities could risk your personal liability. To fully enjoy the benefits of liability protection for LLC, always maintain compliance with state laws.