Power Of Attorney Form Vermont For Irs

Description

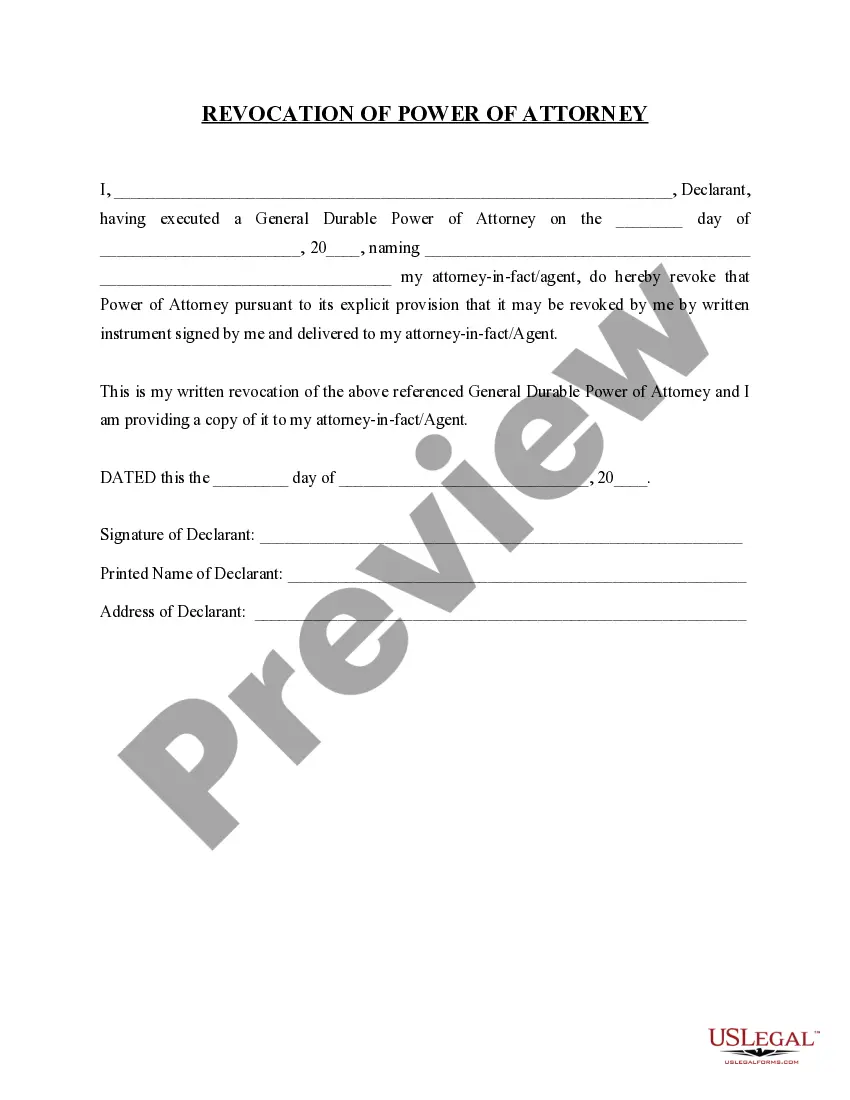

How to fill out Vermont Revocation Of General Durable Power Of Attorney?

Bureaucracy necessitates exactness and precision.

Unless you engage with completing forms like the Power Of Attorney Form Vermont For Irs regularly, it may result in some confusion.

Choosing the appropriate sample from the outset will ensure that your document submission proceeds smoothly and avoids any hassles of resending a document or repeating the same work entirely from scratch.

If you are not a registered user, finding the necessary sample may require a few extra steps.

- You can consistently discover the suitable sample for your paperwork at US Legal Forms.

- US Legal Forms represents the largest online collection of forms with over 85 thousand samples across various subject matters.

- You can obtain the most recent and relevant version of the Power Of Attorney Form Vermont For Irs by merely searching it on the website.

- Identify, store, and save templates in your profile or consult the description to confirm you have the accurate one at your disposal.

- With an account at US Legal Forms, it is feasible to purchase, compile in one location, and navigate through the templates you save to access them with just a few clicks.

- When on the website, click the Log In button to sign in.

- Then, head to the My documents page, where your document list is kept.

- Browse through the form descriptions and save any you need at any time.

Form popularity

FAQ

You can safely upload and submit your client's third-party authorization forms: Form 2848, Power of Attorney and Declaration of Representative PDF. Form 8821, Tax Information Authorization PDF.

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.

Attach a copy of Forms W-2, W-2G and 2439 to the front of Form 1040. Also attach Forms 1099-R if tax was withheld. Use the coded envelope included with your tax package to mail your return. If you did not receive an envelope, check the section called "Where Do You File?" in your tax instruction booklet.

If your return is signed by a representative for you, you must have a power of attorney attached that specifically authorizes the representative to sign your return.

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.