Tenant Failure Use With The Application

Description

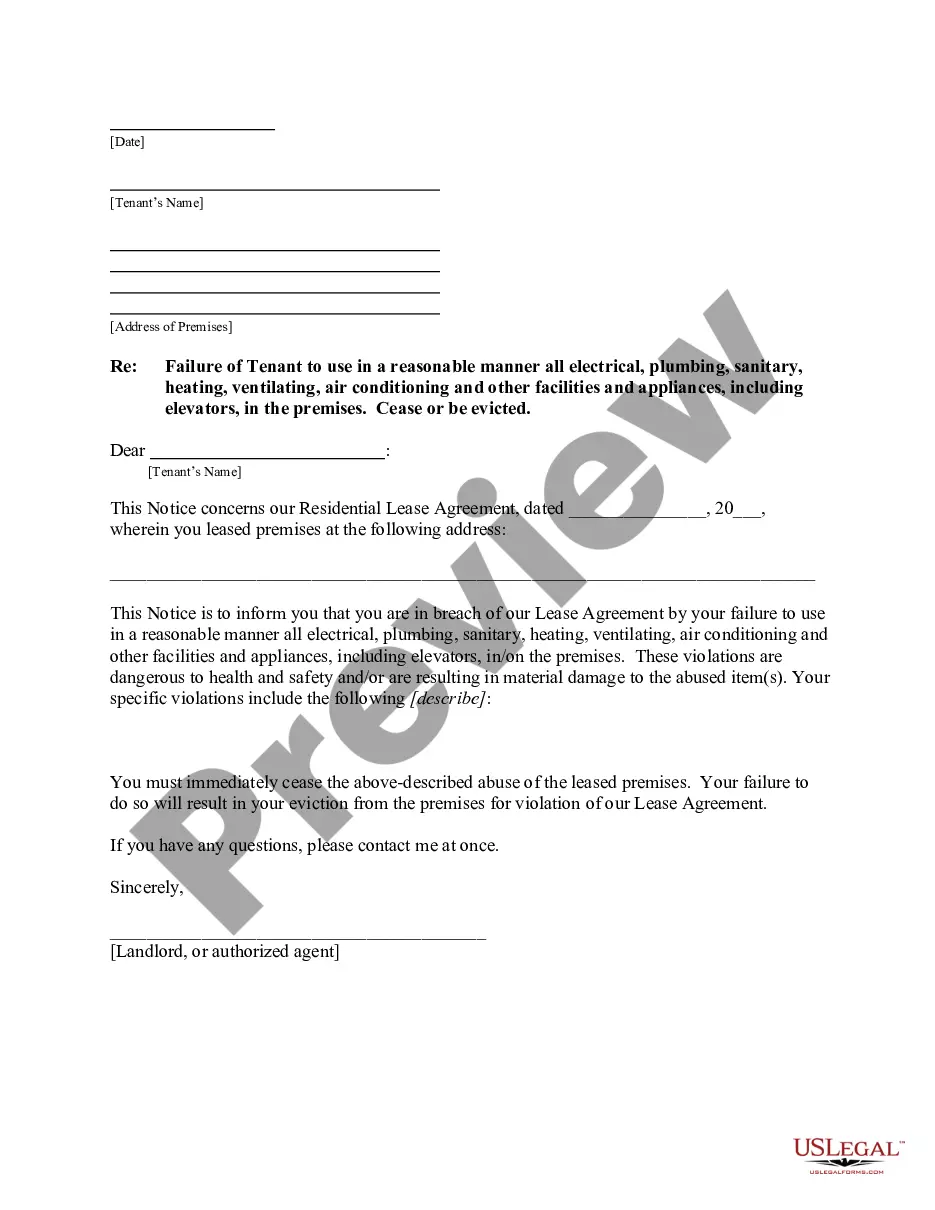

How to fill out Vermont Letter From Landlord To Tenant For Failure To Use Electrical, Plumbing, Sanitary, Heating, Ventilating, Air Conditioning And Other Facilities In A Reasonable Manner?

- Log into your existing US Legal Forms account. Ensure your subscription is active; renew if necessary to avoid interruptions.

- Browse or use the search feature to find the specific form template relevant to your tenant matter, ensuring it aligns with local jurisdiction requirements.

- Select the appropriate document and proceed to purchase. Choose a subscription plan that best fits your needs and create your account for access.

- Complete your purchase by providing payment details. Options include credit card or PayPal.

- Download the completed document. Access it anytime through the 'My Forms' section in your profile and complete your forms at your convenience.

By using US Legal Forms, you gain access to a collection that far exceeds competitors, making your legal process not only simple but also efficient.

Empower your legal standing today. Get started with US Legal Forms to secure your tenant documentation and ensure compliance!

Form popularity

FAQ

Addressing noncompliance from a tenant involves clear communication and adherence to legal processes. First, review your lease agreement to identify any violations related to tenant failure use with the application. Communicate the issue to your tenant, giving them a chance to rectify the situation. If they fail to comply, consider legal action by utilizing resources from US Legal Forms to draft the needed notices and documents.

To evict a tenant swiftly, start by understanding your state's laws regarding tenant eviction. Begin the process by serving a formal notice of eviction based on tenant failure use with the application, ensuring you follow legal requirements. If the tenant does not comply, file an eviction lawsuit with your local court. Using platforms like US Legal Forms can simplify this process by providing the necessary legal documents to ensure everything is done correctly.

A landlord may decline an application for numerous reasons, including low credit scores or inconsistent employment history. Tenant failure use with the application becomes a critical factor in assessing potential risks for landlords. Previous evictions or references that do not check out can also lead to a decline. Offering additional documentation to clarify any concerns can be beneficial.

When applying for an apartment, avoid discussing any negative past rental experiences or financial difficulties. Mentioning issues related to tenant failure use with the application can raise red flags for landlords. Instead, focus on your stability, reliability, and reasons for moving. Presenting yourself positively can create a better impression and increase your chances of approval.

Landlords might reject an application due to various factors such as poor credit history, lack of sufficient income, or negative rental references. Tenant failure use with the application often signals to landlords that you might pose a higher risk. Understanding these reasons can help applicants present stronger, more complete submissions. Being proactive in addressing potential issues can increase your chances of approval.

If one tenant fails referencing, it can complicate the approval process for the entire group applying for the rental. Landlords often consider tenant failure use with the application a significant risk, which may lead to rejection. In such cases, it might help to provide additional supporting documents for the other tenants. This approach can strengthen the overall application despite one tenant's issues.

Rental applications can be denied for various reasons, and statistics show that around one in three applications experience denial. Many landlords consider tenant failure use with the application as a key factor in their decision-making process. Common reasons include low credit scores or insufficient income. It's crucial to understand these factors to enhance your chances of approval.

Red flags on a rental application often include inconsistent income information, previous evictions, or a history of late payments. It's essential to be transparent about your rental history to avoid tenant failure use with the application. Additionally, a large number of applications submitted in a short period may concern landlords. Addressing these issues up front can help you present a stronger application.

To improve a bad rental history, start by paying off any outstanding debts or late fees associated with past leases. Then, focus on building a positive rental record by ensuring timely rent payments and respectful behavior in your next rental. If tenant failure use with the application has impacted you, consider discussing your history openly with potential landlords. Remember, platforms like US Legal Forms can assist you in navigating lease agreements and creating a new beginning.

'Blacklisted' refers to a tenant being marked as unreliable or problematic due to previous tenant failure use with the application. This designation usually results from missed payments, eviction notices, or lease violations. Being blacklisted negatively impacts a tenant's ability to secure future rentals, as landlords and property managers will likely see this information in tenant screening reports. It is essential to maintain a good rental history to avoid such consequences.