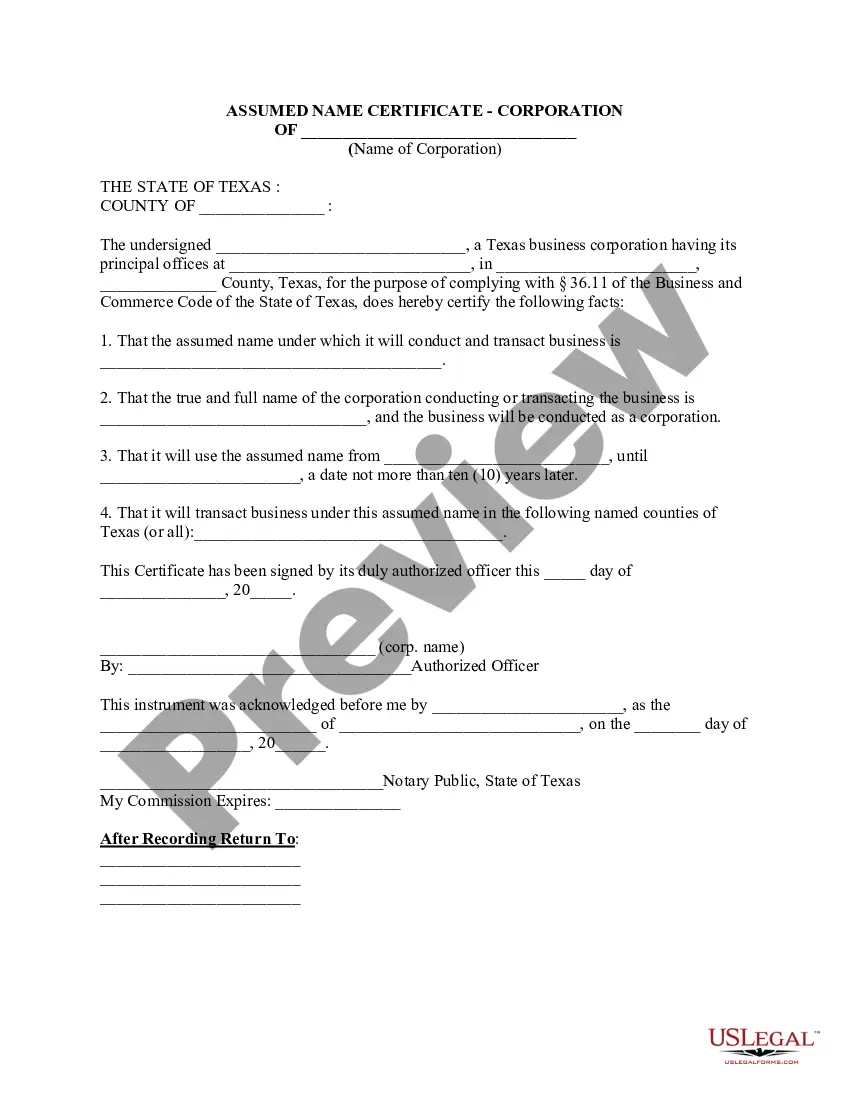

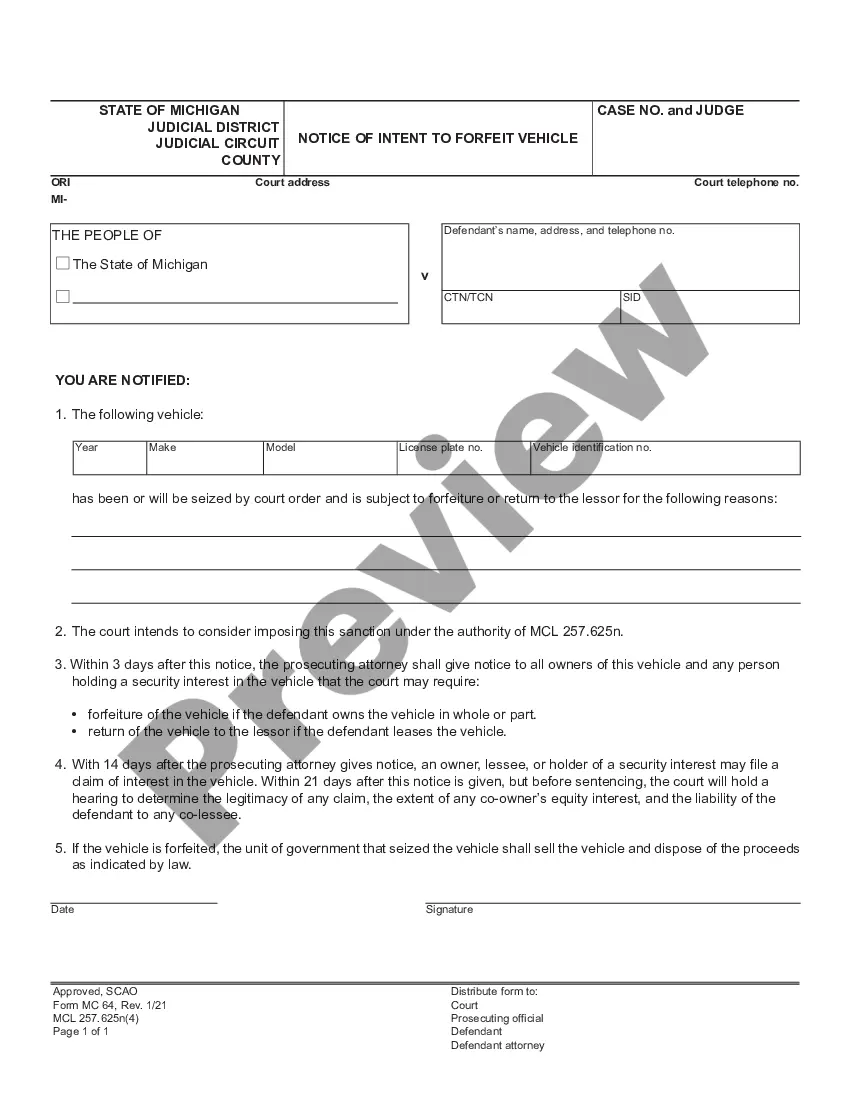

This Operating Agreement is used in the formation of any Limited Liability Company. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

Vermont Llc Operating Agreement With S Corp Election

Description

How to fill out Vermont Limited Liability Company LLC Operating Agreement?

When you have to formulate the Vermont Llc Operating Agreement With S Corp Election in line with your local state's statutes and regulations, there may be several alternatives to choose from.

There's no requirement to review every document to ensure it meets all the legal standards if you are a US Legal Forms member.

It is a trustworthy service that can assist you in acquiring a reusable and current template on any topic.

Obtaining properly drafted official documents becomes simple with US Legal Forms. Additionally, Premium users can also benefit from the advanced integrated features for online PDF editing and signing. Give it a chance today!

- US Legal Forms is the most extensive online collection with a library of over 85k ready-to-use documents for corporate and personal legal situations.

- All templates are confirmed to conform to each state's laws.

- Therefore, when downloading the Vermont Llc Operating Agreement With S Corp Election from our site, you can be assured that you possess a legitimate and up-to-date document.

- Accessing the essential sample from our platform is very easy.

- If you already have an account, simply Log In to the system, verify your subscription is active, and save the chosen file.

- Subsequently, you can visit the My documents tab in your profile and get access to the Vermont Llc Operating Agreement With S Corp Election whenever you wish.

- If it’s your first time using our library, please follow the guidelines below.

Form popularity

FAQ

How are S corps taxed? S corps don't pay corporate income taxes, so there is not really an S corp tax rate. Instead, the company's individual shareholders split up the income (or losses) amongst each other and report it on their own personal tax returns.

If you want your LLC to be taxed as an S corporation, you need to file IRS Form 2553, Election by a Small Business Corporation. If you file Form 2553, you do not need to file Form 8832, Entity Classification Election, as you would for a C corporation. You may use online tax filing, or can file by fax or mail.

And, once it has elected to be taxed as a corporation, an LLC can file a Form 2553, Election by a Small Business Corporation, to elect tax treatment as an S corporation.

Vermont does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.

The income of S-Corporations, Partnerships and Limited Liability Companies attributable to Vermont passes through to the shareholders, partners, or members and is taxed at the individual or corporate income tax rate. Each shareholder, partner, or member must also file a Vermont Income Tax return.