Vehicle Promissory Note Without Interest

Description

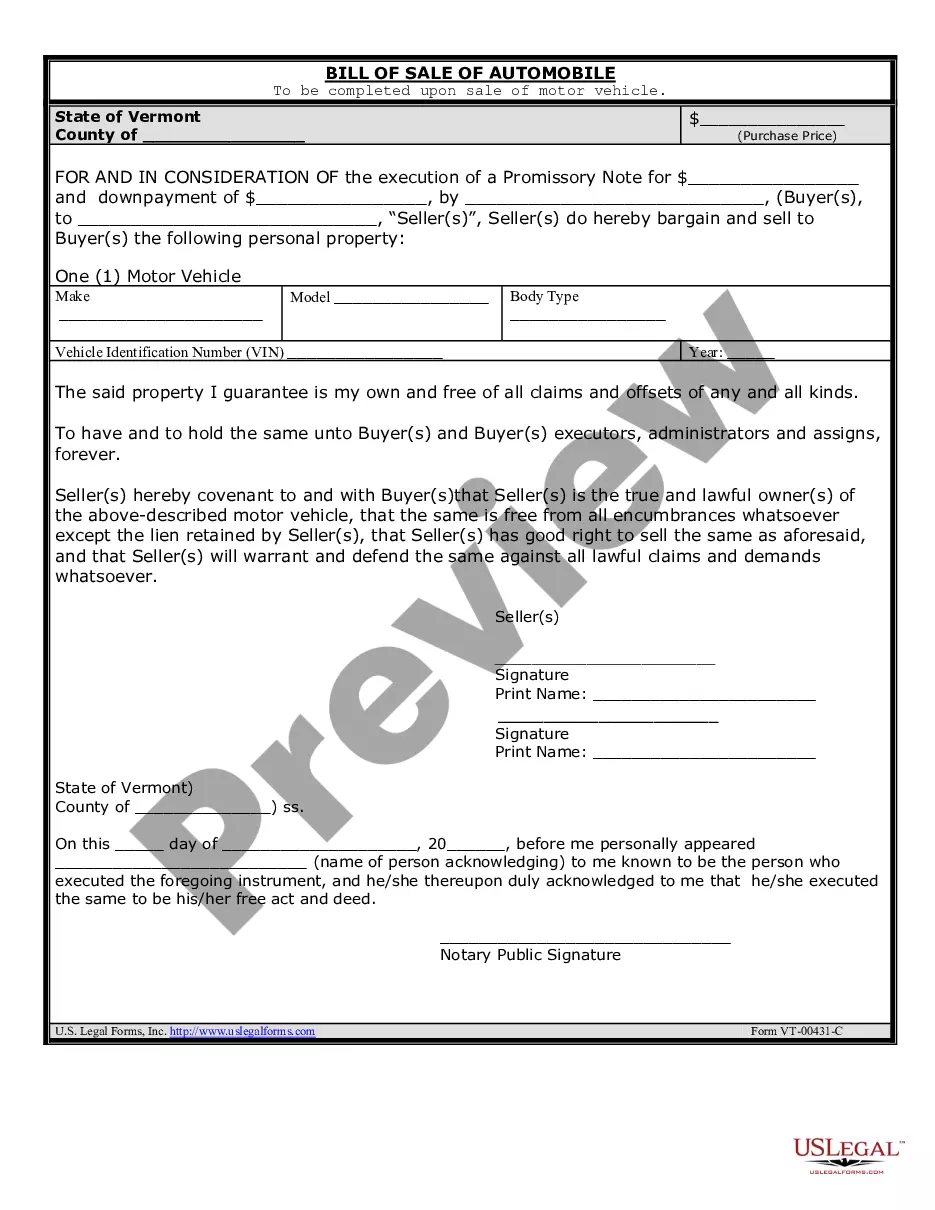

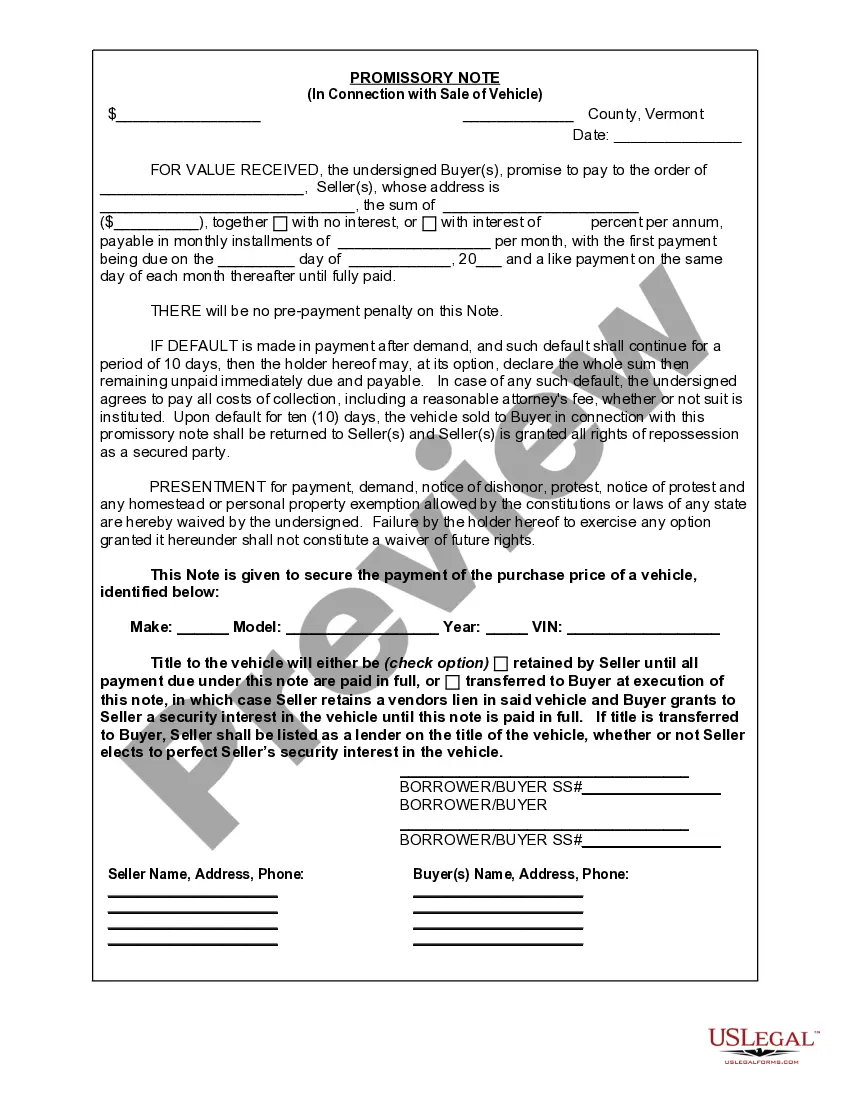

How to fill out Vermont Promissory Note In Connection With Sale Of Vehicle Or Automobile?

What is the most reliable service to acquire the Vehicle Promissory Note Without Interest and other current versions of legal documents? US Legal Forms is the solution!

It's the largest collection of legal forms for any application. Each template is expertly crafted and confirmed for adherence to federal and local regulations.

Form compliance examination. Before you acquire any template, you need to verify if it meets your application requirements and your state or county's regulations. Review the form overview and use the Preview feature if available.

- They are organized by area and state of applicability, making it easy to find what you need.

- Experienced users of the platform simply need to Log In to the system, ensure their subscription is active, and click the Download button next to the Vehicle Promissory Note Without Interest to retrieve it.

- Once saved, the template is accessible for future use within the My documents section of your profile.

- If you don’t have an account with our library yet, here are the steps to create one.

Form popularity

FAQ

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

If interest on your loan is calculated as simple interest, the formula for calculating interest begins with the total principal balance multiplied by the interest rate. For example, if the principal is $5,000 and the interest rate is 15 percent, multiply 5,000 by 0.15 to equal 750.

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

Promissory Notes are negotiable instruments issued under the Negotiable Instruments Act and can be of different types, such as with single or joint borrowers, to be paid on demand or on installments, payment to be made in a lump sum, with interest or without interest.