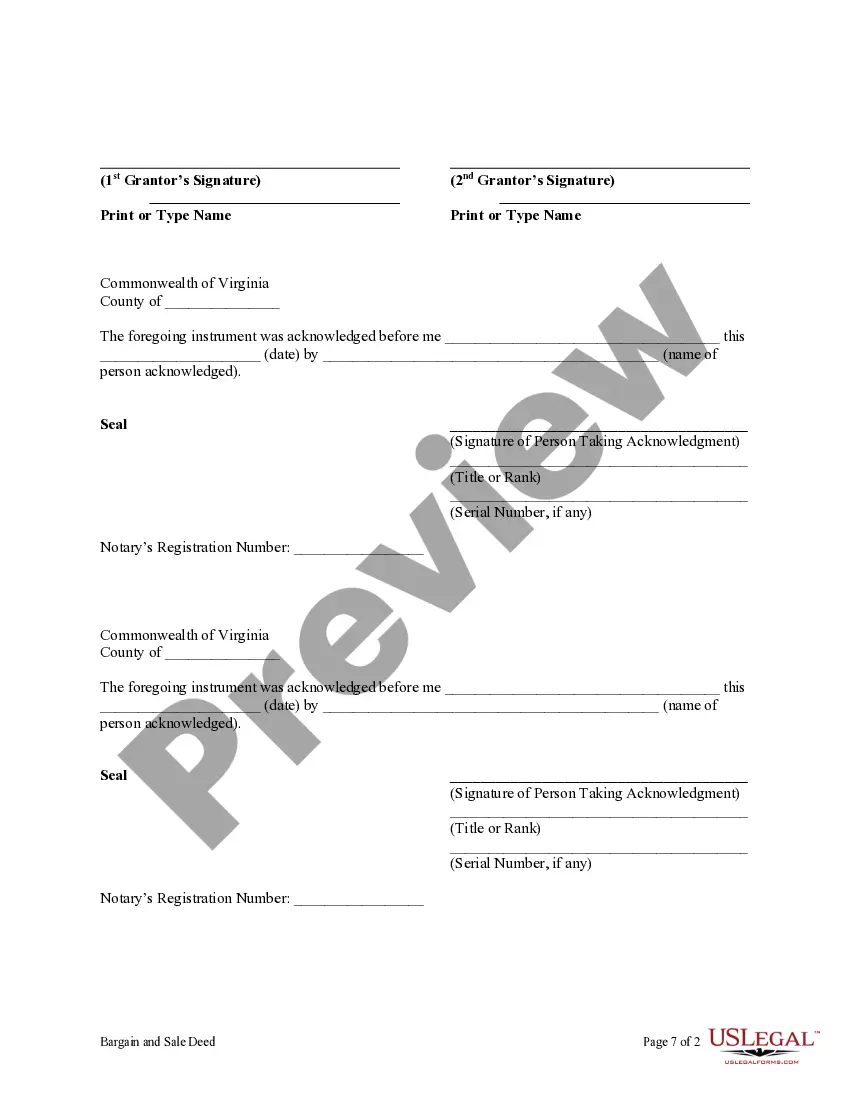

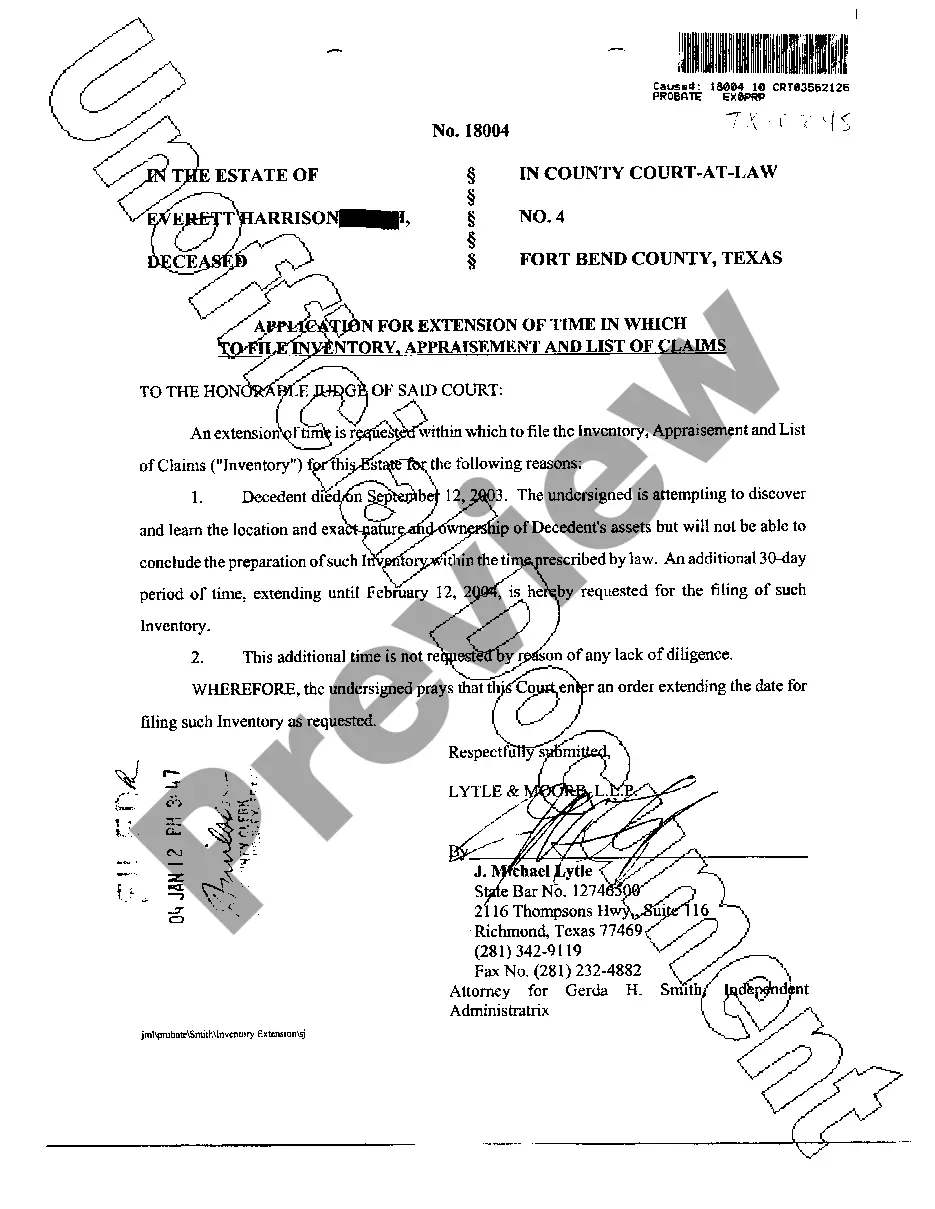

This form is a Bargain and Sale Deed where the grantors are husband and the grantees are two individuals holding title as joint tenants.

Example Of Bargain And Sale Deed

Description

How to fill out Virginia Bargain And Sale Deed - Husband And Wife To Two Individuals As Joint Tenants?

Creating legal documents from the ground up can occasionally feel quite daunting.

Some situations may require extensive research and significant financial investment.

If you’re looking for a more simple and economical method of generating Example Of Bargain And Sale Deed or any other documents without excessive hassle, US Legal Forms is consistently available to you.

Our online repository of over 85,000 current legal templates encompasses nearly every facet of your financial, legal, and personal matters.

However, before going straight to downloading the Example Of Bargain And Sale Deed, consider these recommendations: Review the form preview and details to ensure you are on the correct form. Verify that the form you choose complies with the regulations and laws of your state and county. Select the most appropriate subscription option to purchase the Example Of Bargain And Sale Deed. Download the form, then complete, sign, and print it out. US Legal Forms has a stellar reputation and over 25 years of experience. Join us today and make document completion easy and efficient!

- With just a few clicks, you can quickly access state- and county-specific forms meticulously prepared for you by our legal experts.

- Utilize our platform whenever you require dependable and trustworthy services through which you can effortlessly find and download the Example Of Bargain And Sale Deed.

- If you’re not new to our site and have previously registered with us, simply Log In to your account, find the template, and download it or re-download it anytime later in the My documents tab.

- New to registration? No problem. It takes minimal time to set it up and browse the catalog.

Form popularity

FAQ

Online Registration You can register online for new Sales and Use Tax accounts. Go to TAP and follow instructions for online registration. A packet containing your permit and information about filing your taxes will be mailed to you. Please allow two weeks to receive this information.

You can register online for new Sales and Use Tax accounts. Go to TAP and follow instructions for online registration. A packet containing your permit and information about filing your taxes will be mailed to you. Please allow two weeks to receive this information.

How much do sales tax permits cost (in 2023)? StateCostMississippi$0Missouri$0MontanaN/ANebraska$046 more rows

Mississippi ? Select ?I want to?,? then choose ?Verify a Permit Number.? Enter the permit type and ID to check permit. Missouri ? Online verification is not available. Purchaser will need to provide you with Form 149, which cannot be verified.

Some customers are exempt from paying sales tax under Mississippi law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

In Mississippi, all a business has to do is apply for and obtain their sales tax permit. They do not need to apply for a separate resale certificate. Instead, their seller's permit also functions as a Mississippi resale certificate.

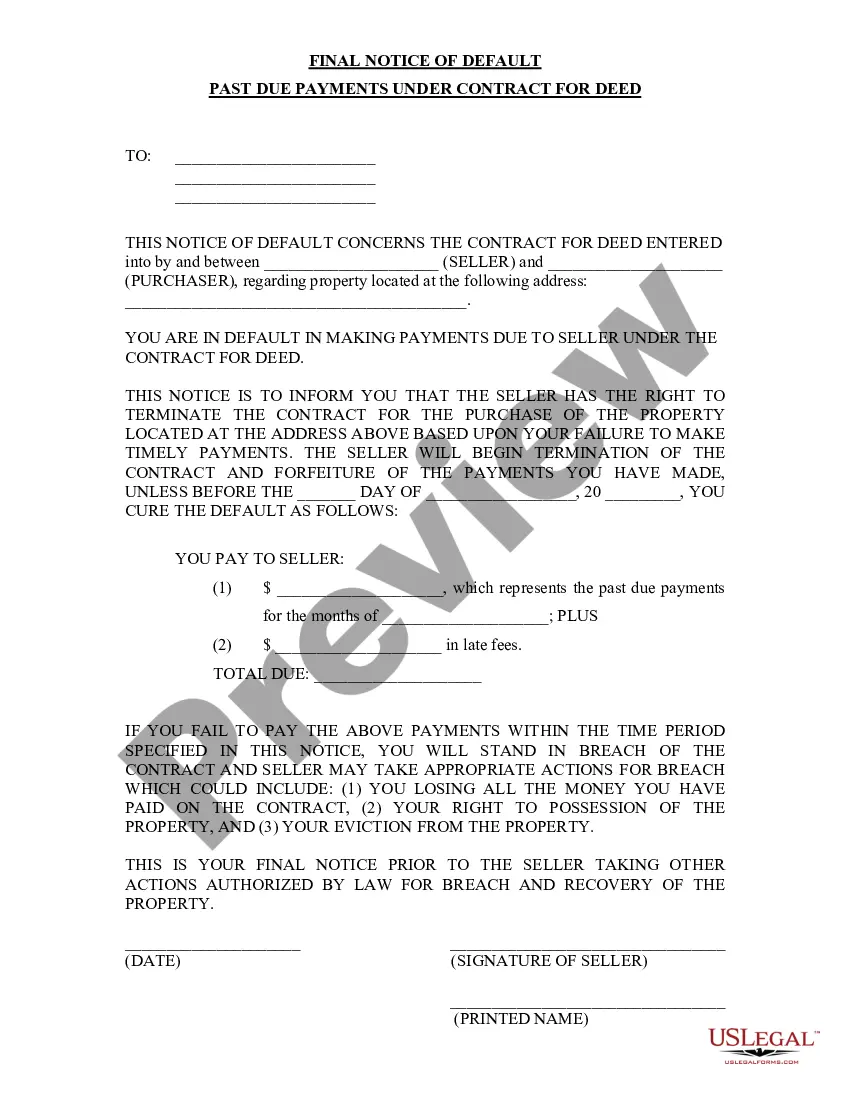

Here we'll explore what you should cover when selling your business. Name the parties. Clearly state the names and locations of the buyer and seller. ... List the assets. ... Define liabilities. ... Set sale terms. ... Include other agreements. ... Make your sales agreement digital.

In Mississippi, all a business has to do is apply for and obtain their sales tax permit. They do not need to apply for a separate resale certificate.