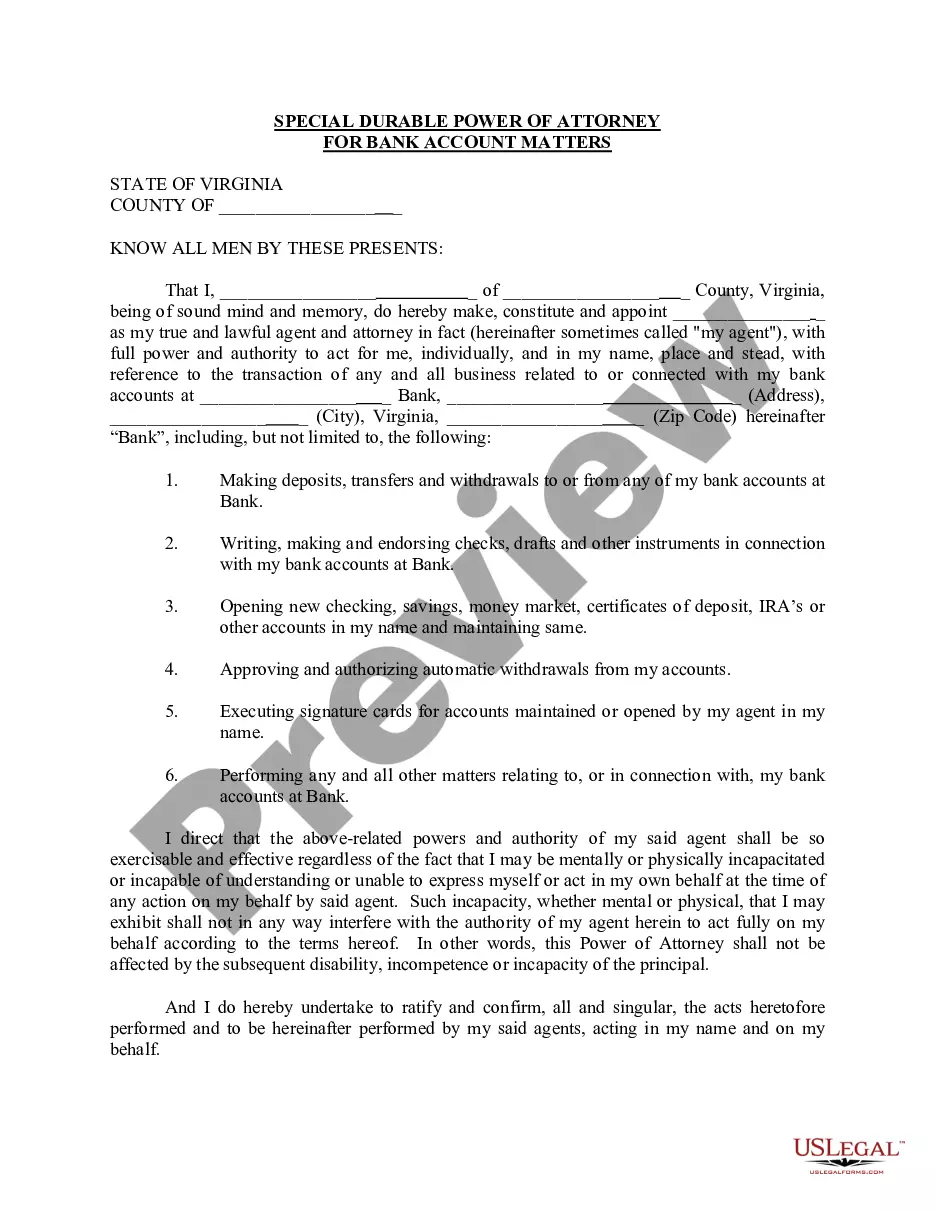

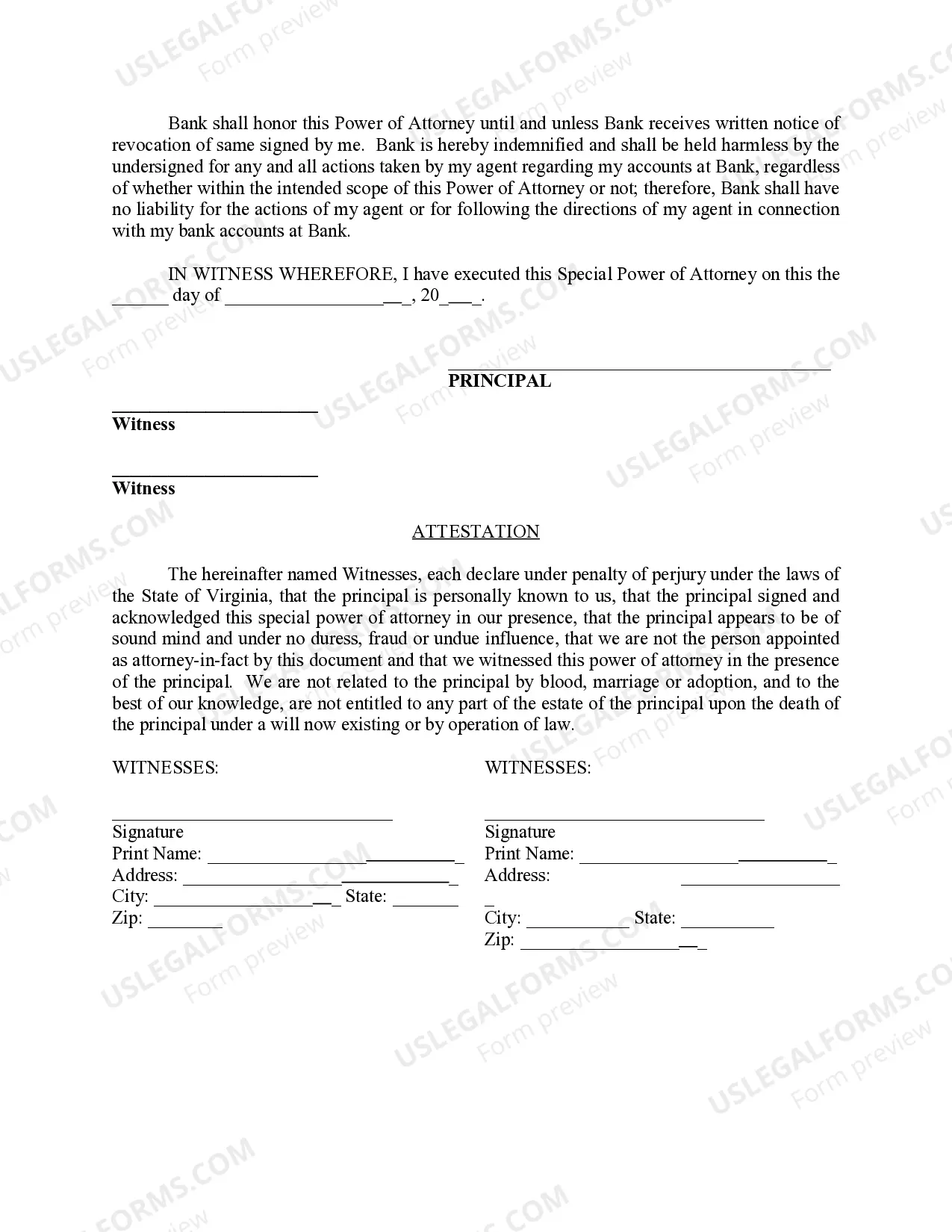

Bank Form With Account Information

Description

How to fill out Virginia Special Durable Power Of Attorney For Bank Account Matters?

- Log in to your US Legal Forms account. If you're a new user, create an account to proceed.

- Search for your desired bank form. Use the Preview mode to review descriptions carefully, ensuring the template is tailored for your jurisdiction.

- If the initial form isn't right, utilize the Search feature to find the most suitable alternative.

- Select the form you need. Click on 'Buy Now' and choose your subscription plan to gain access to the extensive library.

- Complete your purchase. Enter your payment details through credit card or PayPal to finalize your subscription.

- Download your form. Once purchased, save it to your device and access it later under 'My Forms' in your account.

With US Legal Forms, you can confidently execute legal documents quickly and accurately. Their extensive library—boasting over 85,000 fillable forms—ensures you find exactly what you need.

Don’t hesitate! Start accessing legal documents today and ensure your forms are completed correctly with the help of US Legal Forms.

Form popularity

FAQ

Filling out direct deposit information involves entering your banking details on the specified bank form with account information. Include your account number, routing number, and any additional required personal information. Double-check everything to ensure accuracy to avoid any inconvenience with fund transfers. For added ease, UsLegalForms offers templates to help you fill out these details correctly.

When asked for a bank address for direct deposit, input the address of your bank branch where your account is held. This usually includes the street address, city, state, and ZIP code. Providing this information is essential for verifying your account and ensuring there are no issues with your deposits. If you need further assistance, our UsLegalForms resource can help you complete your bank form with account information.

For direct deposit, you typically provide your bank account number, routing number, and the name of your financial institution. This information helps employers and agencies transfer funds directly into your bank account without delays. Always ensure that the bank form with account information you provide is accurate to facilitate smooth transactions. Using our UsLegalForms platform can simplify this process.

To fill in a bank form with account information, start by carefully reviewing all sections of the form. Clearly write your personal details, such as your name, address, and Social Security number. Then, accurately input the bank details, like your account number and bank routing number. Ensure all information is correct to avoid delays in processing.

You can obtain your bank account information by checking your bank statement, visiting your bank’s online portal, or contacting your bank directly. Many banks provide easily accessible account information through mobile apps or online banking services. When you need to provide a bank form with account information, making sure you have accurate details is essential for smooth transactions. Platforms like uslegalforms can assist you in managing your bank forms effectively.

To fill out your bank account details, start by gathering the required information, including your account number and routing number. Follow the prompts on the bank form with account information carefully, ensuring you enter each piece of information correctly. If you use a service like uslegalforms, simply follow their user-friendly format to complete the form quickly and easily. Make sure you review your information before submission.

In bank account details, you need to provide your account number, routing number, and the name of the bank. You might also include your full name as it appears on the account and the account type, like checking or savings. When you complete a bank form with account information, clarity and accuracy are vital to avoid any delays or issues. Always double-check your entries to minimize errors.

A bank details form is a specific type of document that requires information about your bank account and related details. This form is commonly used for transactions where you need to share your banking information securely. Using a reliable bank form with account information is essential to ensure that your financial data is reported correctly. Platforms such as uslegalforms streamline this process for users.

A bank account details form is a document that collects information about your bank account. This form typically requests your name, account number, routing number, and other relevant details. When you fill out a bank form with account information, it helps your recipient understand how to process payments or deposits accurately. You can often find these forms on banking websites or use platforms like uslegalforms for convenience.

Bank account details include essential information that identifies your bank account. Typically, this information consists of your account number, account type, and the bank's routing number. When you need to provide a bank form with account information, having these details handy ensures accuracy in transactions. It’s crucial for receiving payments or setting up direct deposits.