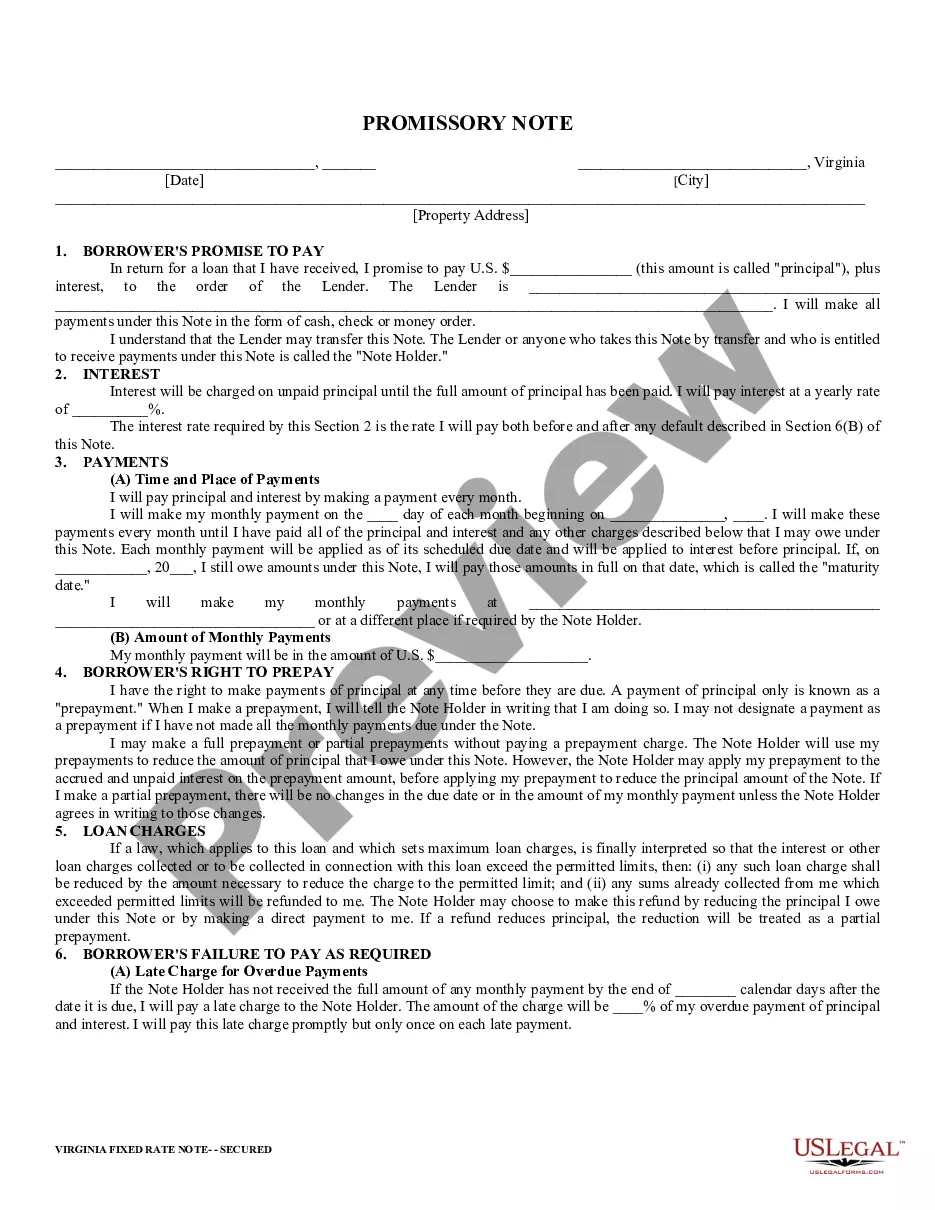

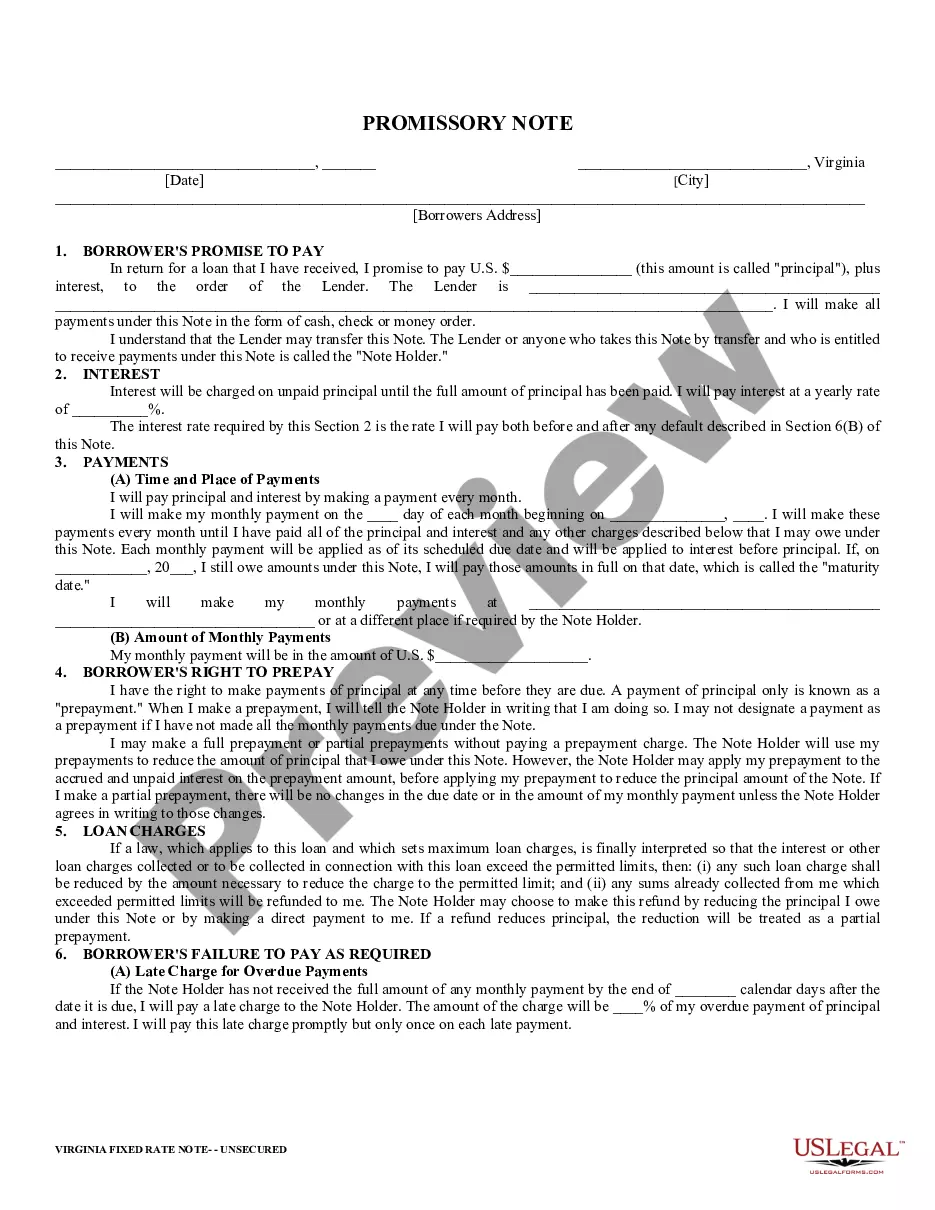

Virginia Promissory Note Contract For Rental

Description

How to fill out Virginia Secured Promissory Note?

There's no longer a requirement to squander hours searching for legal documents to satisfy your local state prerequisites.

US Legal Forms has gathered all of them in a single location and streamlined their availability.

Our website offers over 85,000 templates for any business or personal legal situations organized by state and usage area.

Using the search bar above, you can look for another sample if the current one does not meet your needs.

- All forms are properly drafted and verified for accuracy, so you can trust in acquiring a current Virginia Promissory Note Contract For Rental.

- If you are acquainted with our service and already possess an account, verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documents whenever needed by accessing the My documents tab in your profile.

- If you have never utilized our service before, the process will require a few additional steps to finalize.

- Here's how new users can find the Virginia Promissory Note Contract For Rental in our directory.

- Examine the page content meticulously to ensure it contains the sample you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

There is no legal requirement for most promissory notes to be witnessed or notarized in Virginia (promissory notes related to real estate must be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

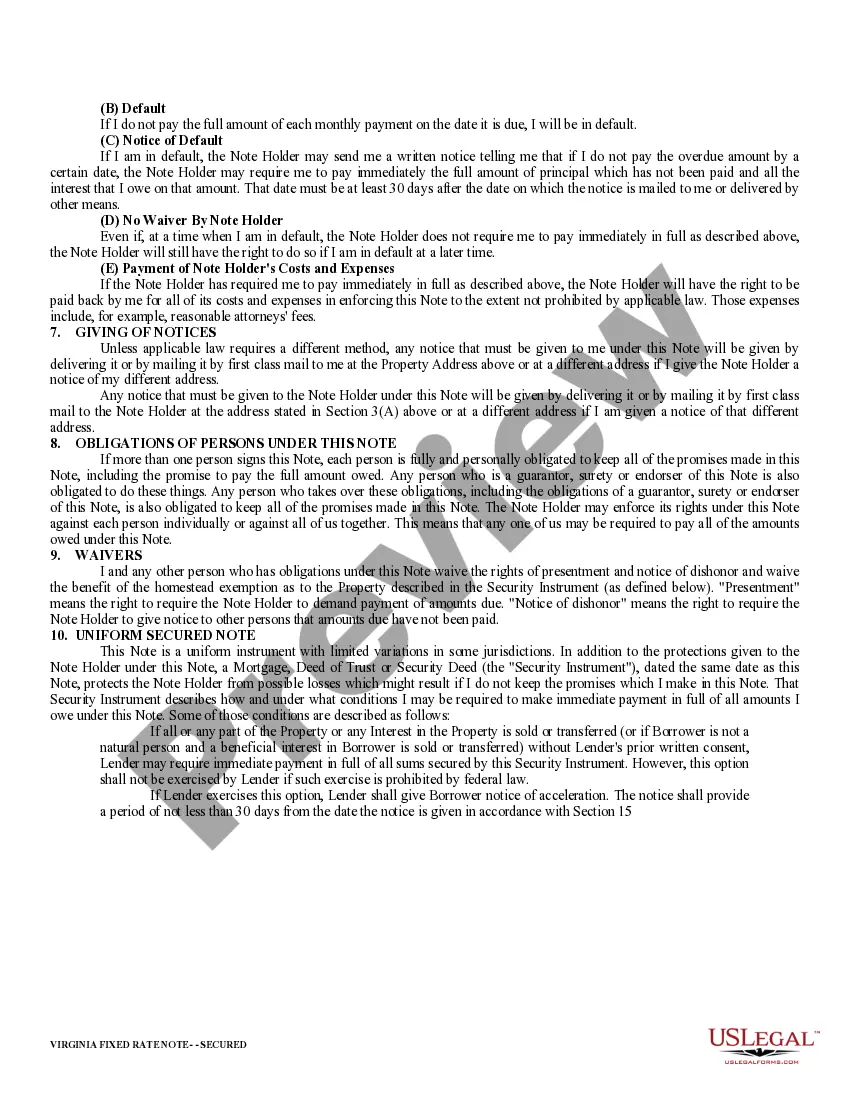

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.