Trust Vs Will For Property

Description

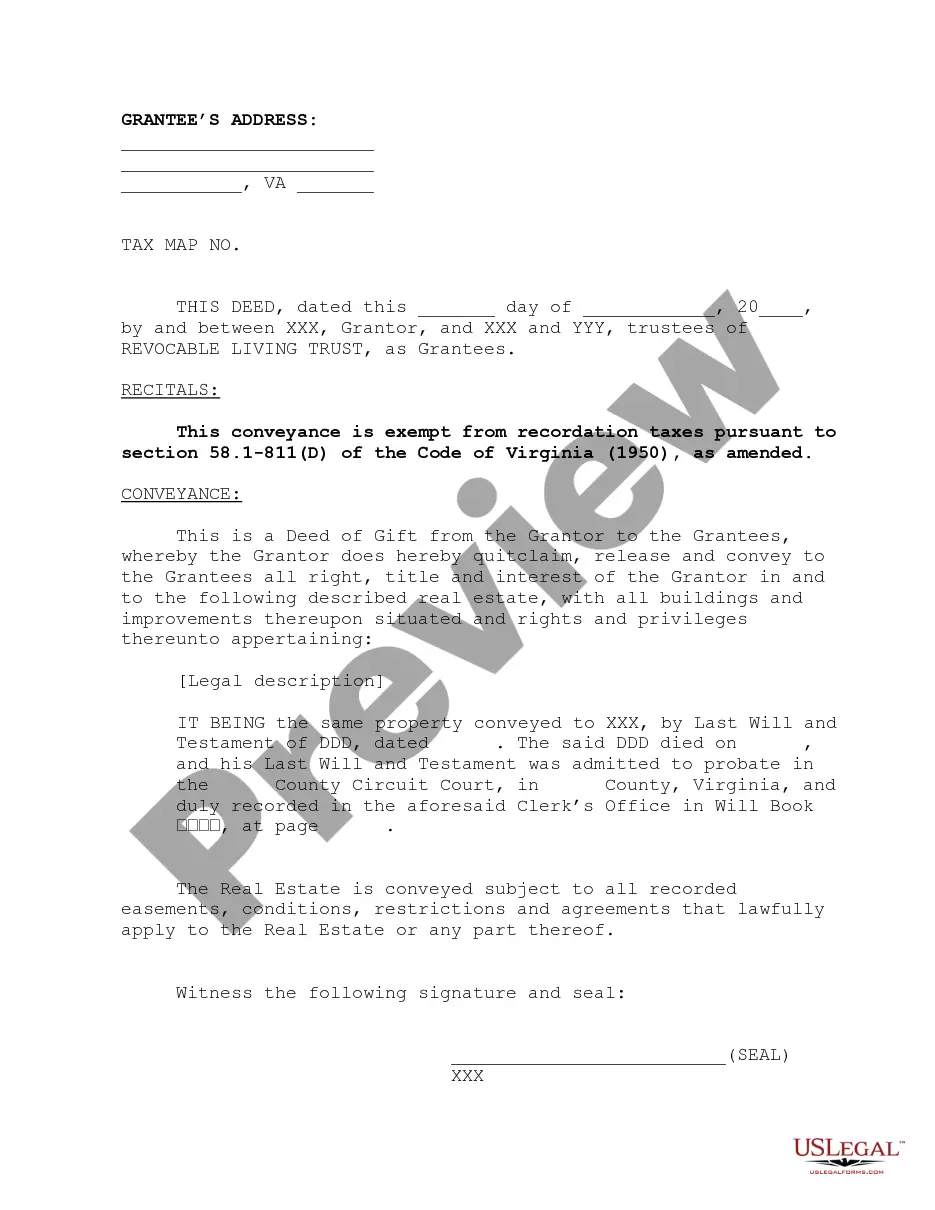

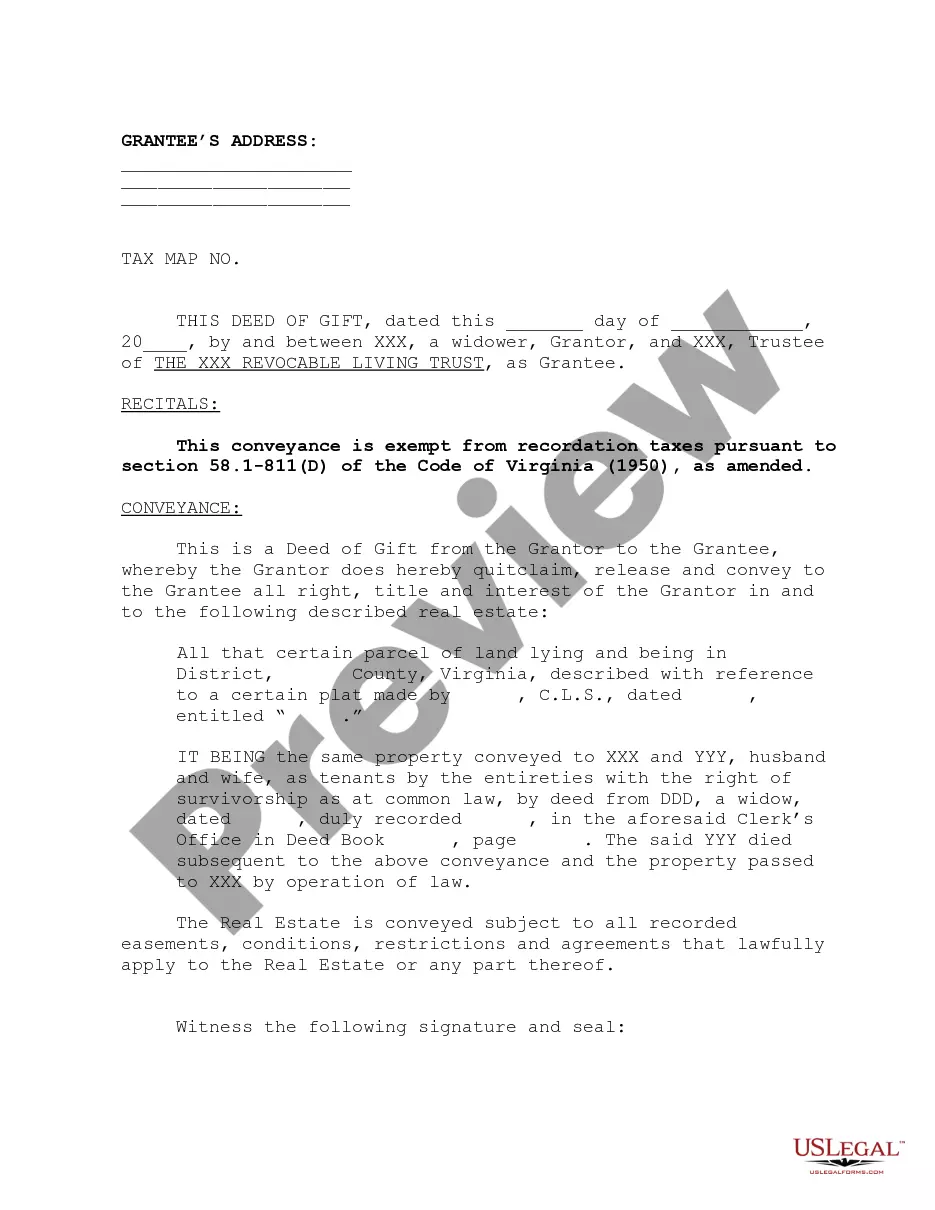

How to fill out Virginia Deed Of Gift To Trust Of Property Left By Previous Will?

- Begin by logging into your US Legal Forms account if you are a returning user. Ensure your subscription is active; renew it if necessary.

- If you are new to our service, start by reviewing the available form descriptions. Take time to confirm that the document aligns with your needs and complies with your local laws.

- Search for other templates as needed. If you find inconsistencies in the form, utilize the Search tab to locate the correct document.

- Once you have found the appropriate form, proceed to purchase it by selecting your preferred subscription plan and registering for an account.

- Complete your purchase using a credit card or PayPal for seamless access to the library.

- Download your selected form to your device. You can always access it later through the 'My Forms' section of your account.

In conclusion, choosing between a trust vs will for property is an important decision, and US Legal Forms is here to assist you every step of the way. Our extensive library ensures you can find the right forms quickly.

Take charge of your estate planning today—explore US Legal Forms for all your legal documentation needs!

Form popularity

FAQ

Opting for a trust makes sense when you want to ensure that your assets are managed according to your wishes without court involvement. This is particularly useful if you have minor children, complex financial situations, or wish to avoid probate. In the discussion of trust vs will for property, a trust often provides a clearer pathway for your property distribution.

Placing your house in a trust can lead to loss of control, as the trustee then manages the property. Additionally, there may be upfront costs and administrative duties involved in setting up the trust, which can be a disadvantage. It's important to weigh these factors carefully when thinking about trust vs will for property.

Generally, individuals with assets exceeding $100,000 may find a trust beneficial. Trusts can minimize taxes and provide specific instructions on how your property should be managed, making them suitable for those with more complex estates. As you evaluate trust vs will for property, consider your unique financial situation and estate planning goals.

Choosing a trust over a will can provide greater control over your property after you pass. Trusts allow for quicker distribution of assets, avoiding the lengthy probate process associated with wills. Additionally, a trust can offer privacy by keeping your estate details out of the public record, which is a significant advantage when considering trust vs will for property.

There are several reasons why a trust may not be suitable for everyone. If your estate is relatively small, the costs and complexities of setting up a trust may outweigh the benefits. Additionally, some individuals may prefer the straightforward nature of a will, especially if their wishes for property distribution are uncomplicated. Ultimately, in the trust vs will for property debate, your unique situation should guide your decision.

Using a trust instead of a will helps you maintain greater control over your property. Unlike wills, trusts take effect immediately upon creation, allowing for asset management during your lifetime. You can specify detailed instructions for how your property should be handled, while a will may leave your estate to go through probate. Therefore, in the trust vs will for property conversation, trusts offer a more proactive approach.

A trust offers several advantages over a simple will, particularly for property management. With a trust, your assets can avoid the lengthy and costly probate process, allowing for a smoother transition. Additionally, trusts provide more control over how and when your beneficiaries receive their inheritances. In the debate of trust vs will for property, trusts often stand out for their ability to protect assets and ensure privacy.

You should consider using a trust instead of a will when you want to avoid probate or want to manage your property during your lifetime and after your death. Trusts typically provide more flexibility in asset management compared to wills, allowing you to address specific needs, such as caring for minor children or beneficiaries with special needs. Choosing a trust for your property ensures that your wishes are followed clearly, making it a sensible option in the trust vs will for property discussion.

One common mistake parents make when setting up a trust fund is failing to clearly outline their intentions for the distribution of assets. Without a detailed plan, beneficiaries might face confusion or even conflict after the parents' passing. Additionally, overlooking the need for regular reviews and updates of the trust can lead to outdated provisions that no longer align with the family's needs. Being proactive can help prevent issues related to trust vs will for property.

Many people choose a trust over a will for various reasons. One major advantage of a trust is that it allows for more control over how and when your property is distributed after your death. Unlike a will, a trust bypasses the lengthy probate process, providing quicker access to assets for your beneficiaries. This feature makes trusts particularly appealing for those looking to manage their estate efficiently in the context of trust vs will for property.