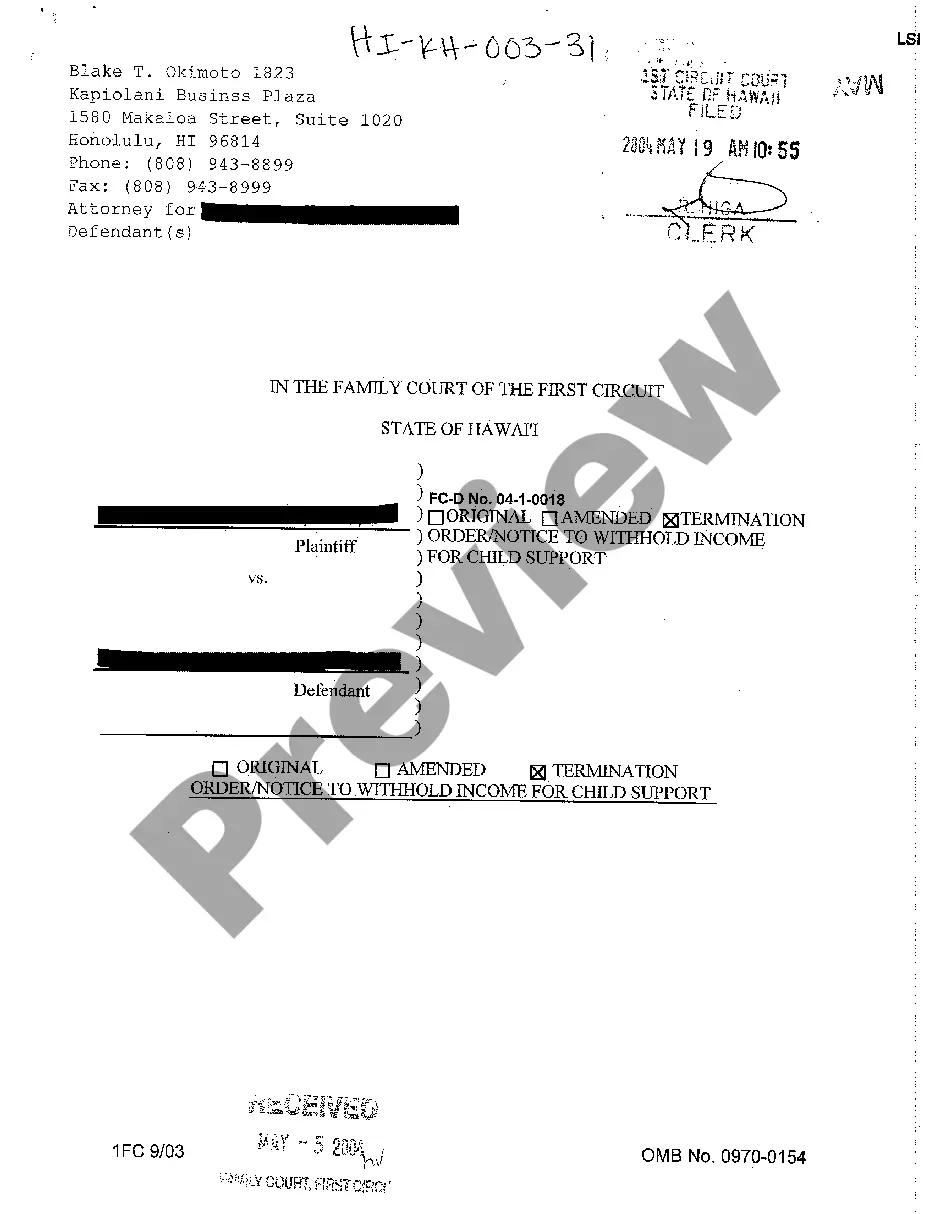

This is a form of a deed filed to claim exemption on an individual's homestead. Included in the form will be the dollar amount claimed as exempt.

Virginia Property Tax Exemption For 100 Disabled Veterans

Description

How to fill out Virginia Homestead Deed For Single - Home?

Creating legal documents from the ground up can occasionally be overwhelming. Certain situations may require extensive research and significant financial investment.

If you’re seeking a more straightforward and budget-friendly method of generating Virginia Property Tax Exemption For 100 Disabled Veterans or any other forms without unnecessary complications, US Legal Forms is always available for you.

Our online library of over 85,000 current legal forms covers nearly every area of your financial, legal, and personal affairs. With just a few clicks, you can swiftly acquire state- and county-compliant forms meticulously prepared for you by our legal professionals.

Utilize our platform whenever you need dependable services through which you can easily locate and download the Virginia Property Tax Exemption For 100 Disabled Veterans. If you’re familiar with our services and have previously created an account with us, just Log In to your account, find the form and download it immediately or re-download it whenever needed in the My documents section.

US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make form completion an effortless and streamlined process!

- Review the document preview and descriptions to ensure you have located the form you are seeking.

- Confirm that the template you choose aligns with the regulations and laws of your state and county.

- Select the appropriate subscription choice to acquire the Virginia Property Tax Exemption For 100 Disabled Veterans.

- Download the form. Then fill it out, sign it, and print it.

Form popularity

FAQ

Local Property Tax Relief for Real Estate and Motor Vehicles Most Virginia cities, counties, and towns offer some form of personal property tax relief to homeowners age 65 and older, and to homeowners with disabilities. This relief may be in the form of a tax exemption, tax deferral, or both.

Veterans with 100% VA disability are eligible for free admission and parking and admission for the pass holder and anyone needed to assist them at Virginia state parks. The pass also covers boat launch and horse trailer parking and a 50% discount on camping, swimming, shelters, and equipment rental.

To apply for a SUT exemption, veterans or spouses must submit the following to DMV: Vehicle title. Completed Purchaser's Statement of Exemption. Benefit Summary letter from the U.S. Department of Veterans Affairs stating the veteran has a 100% service-connected, permanent and total disability.

The Commonwealth of Virginia exempts the real property of a disabled veteran from taxation, including the joint real property of husband and wife, when these two criteria are met: The veteran occupies the ?real property as his or her principal place of residence.

Virginia Real Property Tax Exemption for 100% Disabled Veterans and Surviving Spouses: Virginia offers a complete property tax exemption for eligible disabled Veterans or Surviving Spouses. This exemption applies to the home that is their principal residence and up to one acre of land where the home is located.