Homestead Explained

Description

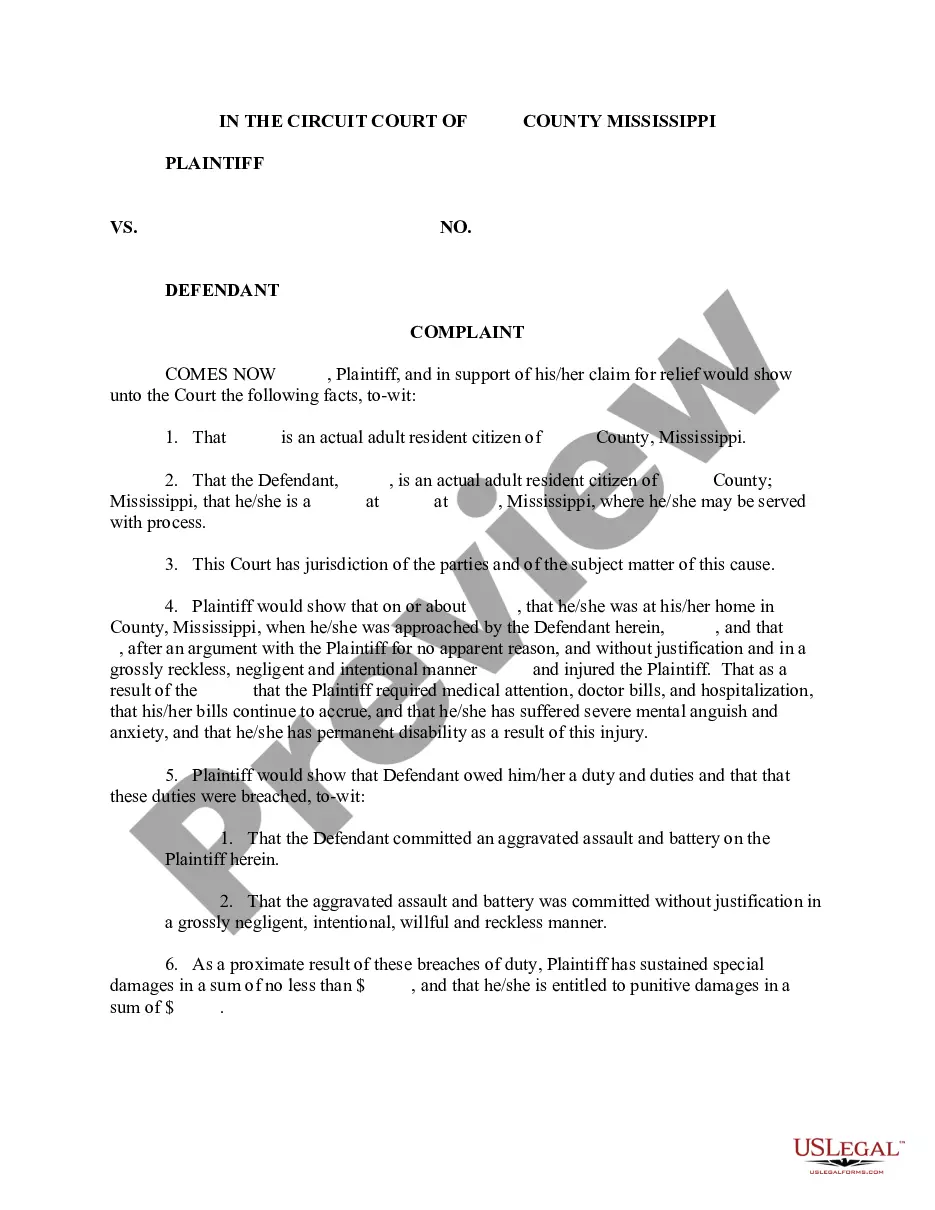

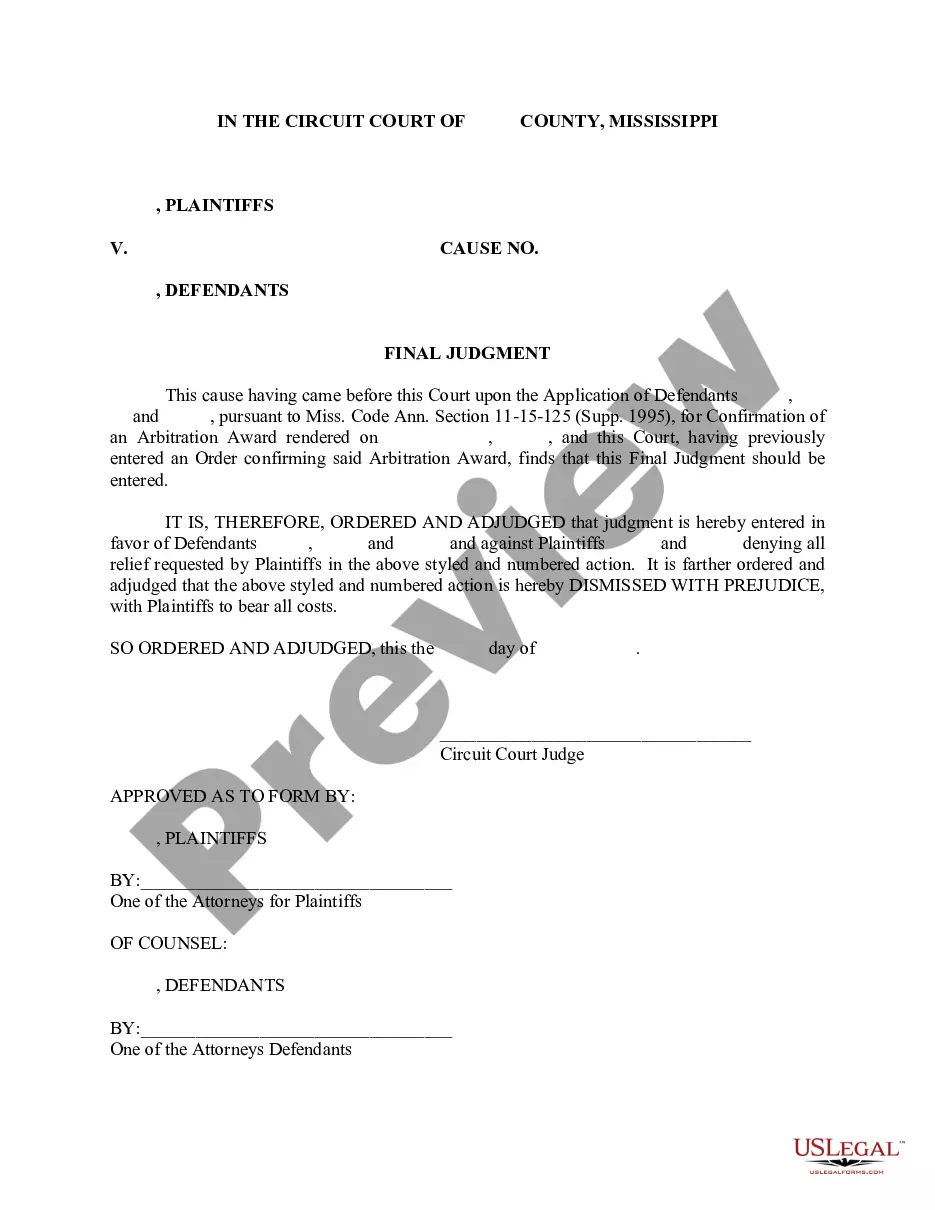

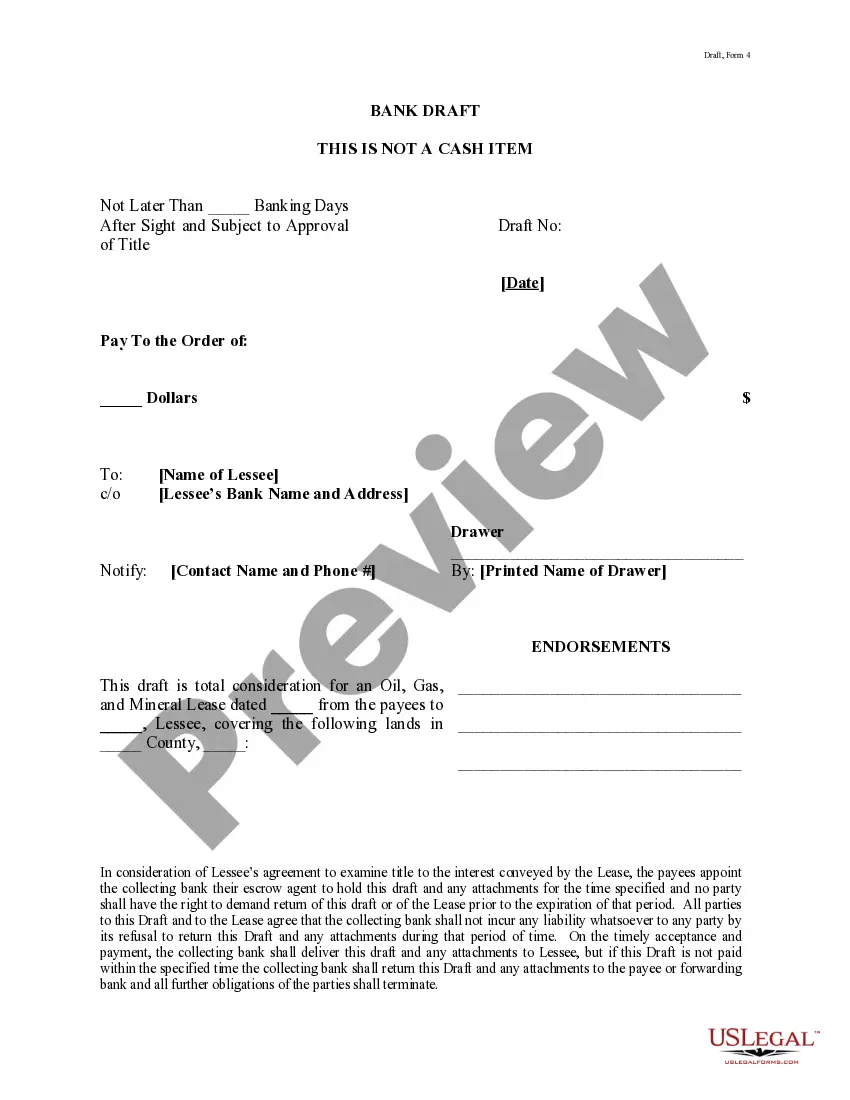

How to fill out Virginia Homestead Deed For Single - Home?

It’s clear that you cannot transform into a legal authority instantly, nor can you understand how to swiftly compose Homestead Explained without possessing a dedicated array of expertise.

Assembling legal documents is a lengthy process necessitating specific education and abilities. So why not entrust the creation of the Homestead Explained to the experts.

With US Legal Forms, one of the most extensive legal document repositories, you can access a variety of materials ranging from court documents to templates for in-office correspondence. We recognize how vital compliance and observation of federal and local statutes and regulations are. That’s why, on our platform, all forms are geographically specific and current.

Select Buy now. Once the transaction is completed, you can obtain the Homestead Explained, fill it out, print it, and send or mail it to the relevant individuals or organizations.

You can revisit your documents from the My documents tab at any time. If you’re an existing customer, you can simply Log In, and find and download the template from the same tab.

- Commence with our platform and acquire the document you require in just minutes.

- Locate the document you seek using the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if Homestead Explained is what you’re looking for.

- Initiate your search again if you require any other document.

- Register for a complimentary account and select a subscription plan to buy the template.

Form popularity

FAQ

To claim a homestead exemption in California, you must file a simple application with your local county assessor's office. This process typically involves providing proof of residency and other relevant documentation. By taking these steps, you can potentially lower your property taxes significantly. If you need specific forms or detailed instructions, consider using US Legal Forms, which simplifies the application process for you.

The point of a homestead is to protect your primary residence from creditors while also providing property tax relief. This legal concept helps homeowners maintain stability and security in uncertain financial times. Essentially, it creates a designated safe space for you and your family, ensuring you can stay in your home even during difficulties. To learn more about how it works and its benefits, you can explore the resources available on US Legal Forms.

While the homestead offers protections and tax benefits, there are some drawbacks to consider. First, you may face restrictions when selling your home, as some states require you to maintain residency to keep those benefits. Additionally, in certain situations, a homestead exemption might limit your property’s overall equity. Understanding these aspects is crucial, and US Legal Forms can provide valuable insights to navigate these complexities.

While a homestead declaration may not be strictly necessary in Nevada, it can offer valuable protections. Homestead explained highlights that this declaration gives your home a layer of security against certain legal claims. It serves as a safeguard during financial distress. If you're considering this option, uslegalforms can guide you through the process.

Eligibility for the homestead credit generally requires residency in the state and ownership of a primary home. Homestead explained means that this credit can provide property tax benefits for qualifying homeowners. Specific criteria may vary by state, so it's crucial to review the local regulations. Platforms like uslegalforms can help you determine your eligibility.

A declaration of homestead is not a deed, but it is closely related. Homestead explained includes the idea that a declaration is a recorded document indicating your intent to claim a portion of your property as a homestead. This protects your home from forced sale in case of financial difficulties. For further clarity, consider checking resources available on uslegalforms.

To protect your home in Nevada, filing a declaration of homestead may be beneficial. Homestead explained refers to a legal procedure that helps shield your primary residence from certain creditors. However, it's not always necessary. You can always consult legal resources like uslegalforms for guidance on whether it fits your situation.