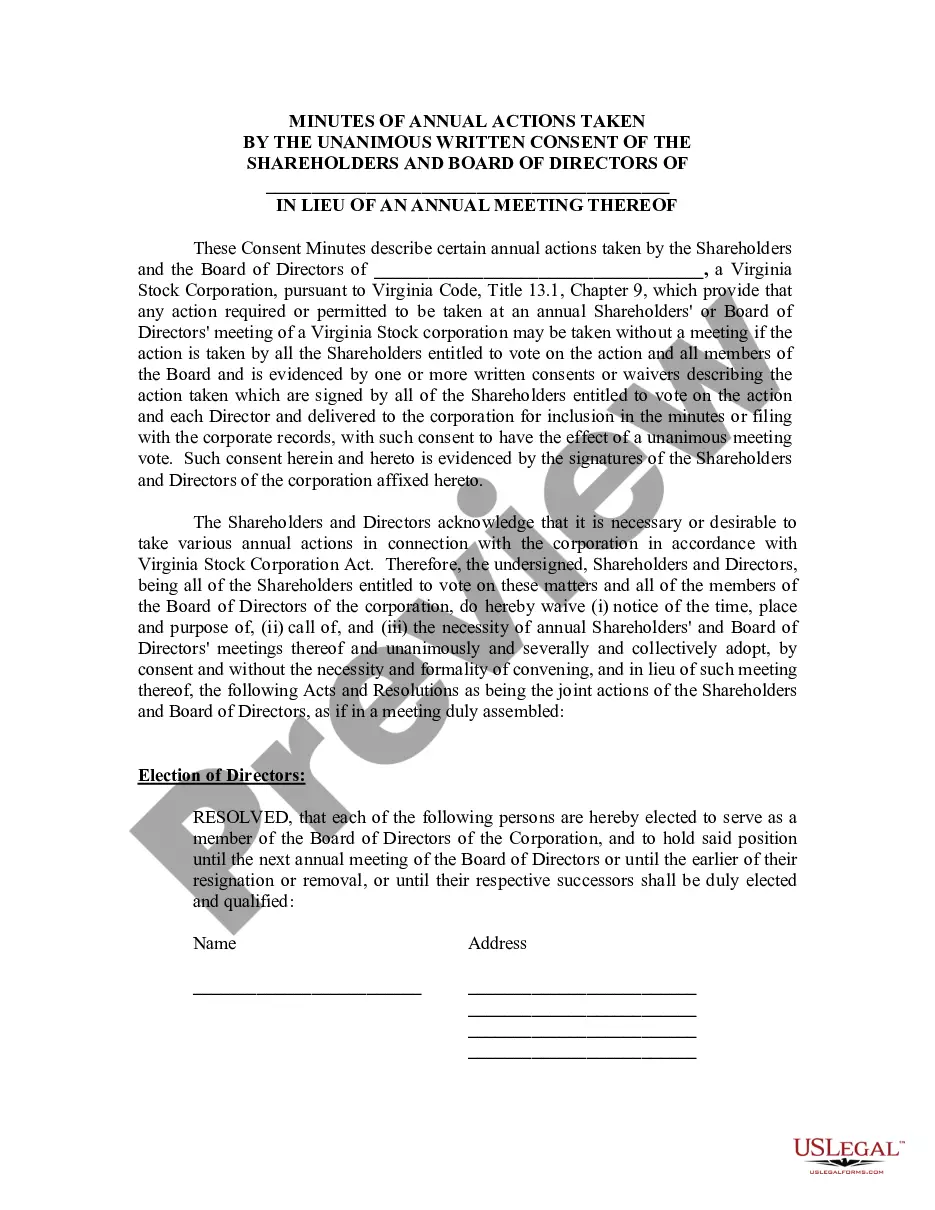

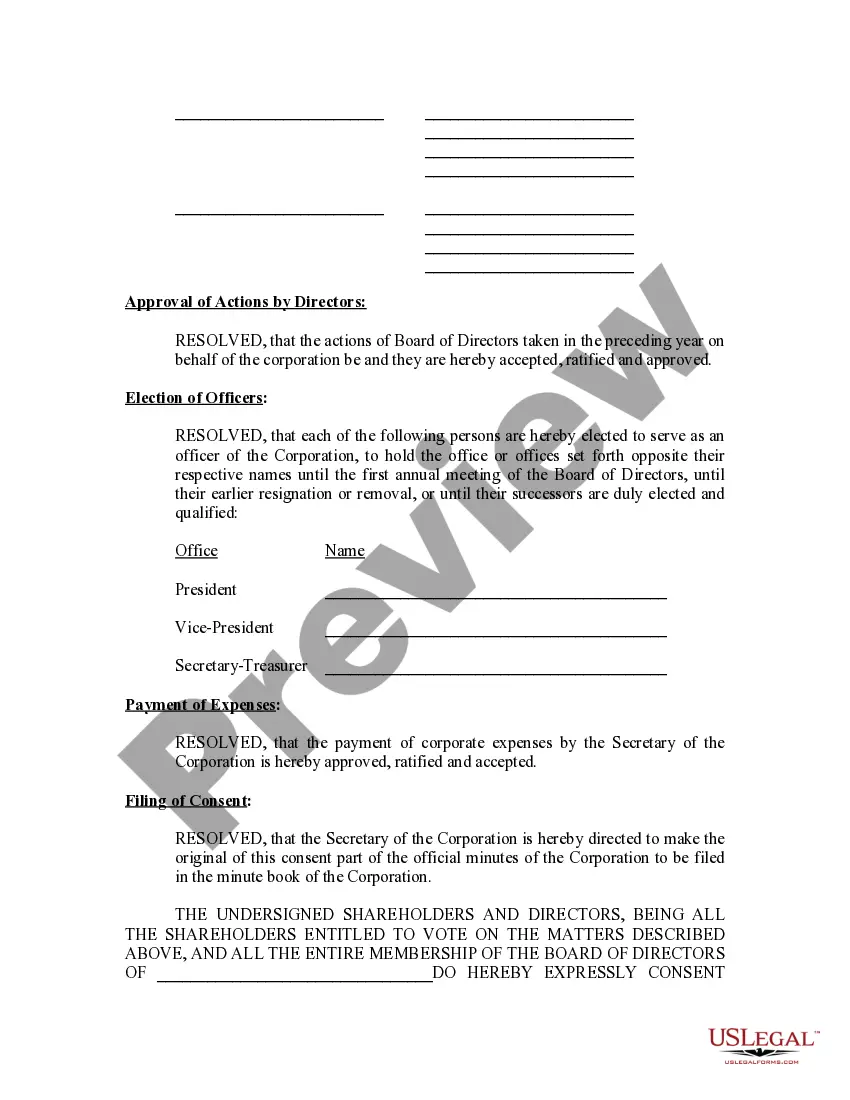

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Virginia requires all limited liability companies (LCS) operating within the state to file an annual report, which provides important information about the company's business activities, ownership, and financial health. This report helps the State Corporation Commission (SCC) to keep accurate and up-to-date records of all LCS in Virginia. The Virginia annual report for LLC serves as a mandatory filing that must be submitted by the designated registered agent on behalf of the company. It is an essential document to ensure compliance with state regulations and maintain the LLC's active status. The Virginia annual report for LLC must include various details about the company, such as the LLC's legal name, principal office address, registered agent's name and address, and the names and addresses of all members/ managers. Additionally, the report may require providing specific details, including revenue statements, financial data, employment information, and any other required disclosures. There are different types of Virginia annual reports for LLC, including: 1. Annual Report — Regular Filing: This is the standard annual report for most LCS in Virginia, where the company provides the necessary information as outlined by the state, ensuring all required fields are accurately completed. 2. Annual Report — Financial Institution Filing: In specific cases, where the LLC operates as a financial institution, additional financial details may be required. This filing would include comprehensive financial statements, profit and loss statements, balance sheets, and other relevant financial documentation. 3. Annual Report — Foreign LLC Filing: Foreign LLCs, those registered in other states, but doing business in Virginia, must file an annual report specific to their foreign status. This report ensures compliance with Virginia's rules and regulations and provides updated information about the foreign LLC's business activities and structure. Failure to file the Virginia annual report or submitting an incomplete or inaccurate report may result in penalties, fines, and potential dissolution of the LLC. It is vital for LLC owners to understand their obligations and meet the reporting deadlines to maintain their company's good standing in Virginia.