Revocation Living Trust With A Trustee

Description

How to fill out Virginia Revocation Of Living Trust?

- Log in to your US Legal Forms account or create a new account if you're a first-time user.

- Search for the 'Revocation Living Trust' form in the extensive library.

- Once you find the correct form, check the preview and description to ensure it meets your state regulations.

- If needed, explore additional templates using the Search tab to find the most suitable option.

- Click on the 'Buy Now' button, select your preferred subscription plan, and register your account.

- Complete your purchase securely using your credit card or PayPal.

- Finally, download the revocation form to your device for completion.

In conclusion, US Legal Forms empowers you to efficiently manage your estate planning needs with a comprehensive collection of legal documents. By following these simple steps, you can easily revoke a living trust while ensuring all requirements are met.

Don't hesitate—visit US Legal Forms today to start managing your legal documents with ease!

Form popularity

FAQ

To remove trustees, start by reviewing your revocation living trust with a trustee for specific instructions about removal. Prepare a formal document that states your intention to remove the trustee. Depending on your state laws, you may need to provide notice to the trustee and potentially the beneficiaries as well. For additional guidance, consider using platforms like US Legal Forms to create the necessary documents efficiently.

Yes, a trustee can be removed from a revocable trust. This flexibility is one of the primary benefits of having a revocation living trust with a trustee. You must carefully follow the procedures set forth in the trust agreement. Always consider seeking legal advice to ensure the process aligns with your wishes and state laws.

To remove a trustee from a revocable living trust, you should first check the provisions laid out in your trust document. If it permits removal, you'll need to document your decision and notify the trustee officially. After removing the trustee, update any necessary documents to reflect this change. Following these steps helps maintain the integrity of your revocation living trust with a trustee.

Changing a trustee in a revocation living trust with a trustee can be straightforward. Generally, the process involves following the instructions in the trust document itself. You'll typically need to prepare a document that officially removes the current trustee and appoints a new one. This change ensures that the trust operates smoothly according to your wishes.

Trustees cannot revoke a trust unless the terms of the trust allow for such action or if they have the explicit permission of the trustor. In a revocation living trust with a trustee, this typically means the trustor retains the right to modify or revoke the trust during their lifetime. It's advisable to clarify these powers within the trust document to prevent disputes among heirs.

A trust may be considered invalid for reasons like the absence of the requisite formalities, such as the lack of a trust document or improper signing. Moreover, if the trustor was not of sound mind at the time of its creation, this can also lead to invalidation. Thus, understanding the nuances of a revocation living trust with a trustee is vital to ensure your intentions are honored.

A trust can be declared void if it lacks essential elements, such as a clear purpose, identifiable beneficiaries, or is not executed in compliance with legal requirements. This situation can arise with a poorly drafted revocation living trust with a trustee, making it essential to follow legal guidelines. Working with experts ensures that your trust is valid and enforceable.

The 5 year rule for trusts pertains to the tax treatment of distributions from certain types of trusts, particularly those that hold assets for a beneficiary. Under this rule, assets must be distributed within five years for the beneficiary to avoid tax implications. This is especially relevant when considering a revocation living trust with a trustee, as it can influence how you structure asset distribution.

A trust can be terminated in several ways, including the expiration of its term, the achievement of its purpose, or through revocation by the trustor. Understanding these methods is crucial, especially when managing a revocation living trust with a trustee. By knowing how a trust can be dissolved, you can better plan your estate and ensure your wishes are fulfilled.

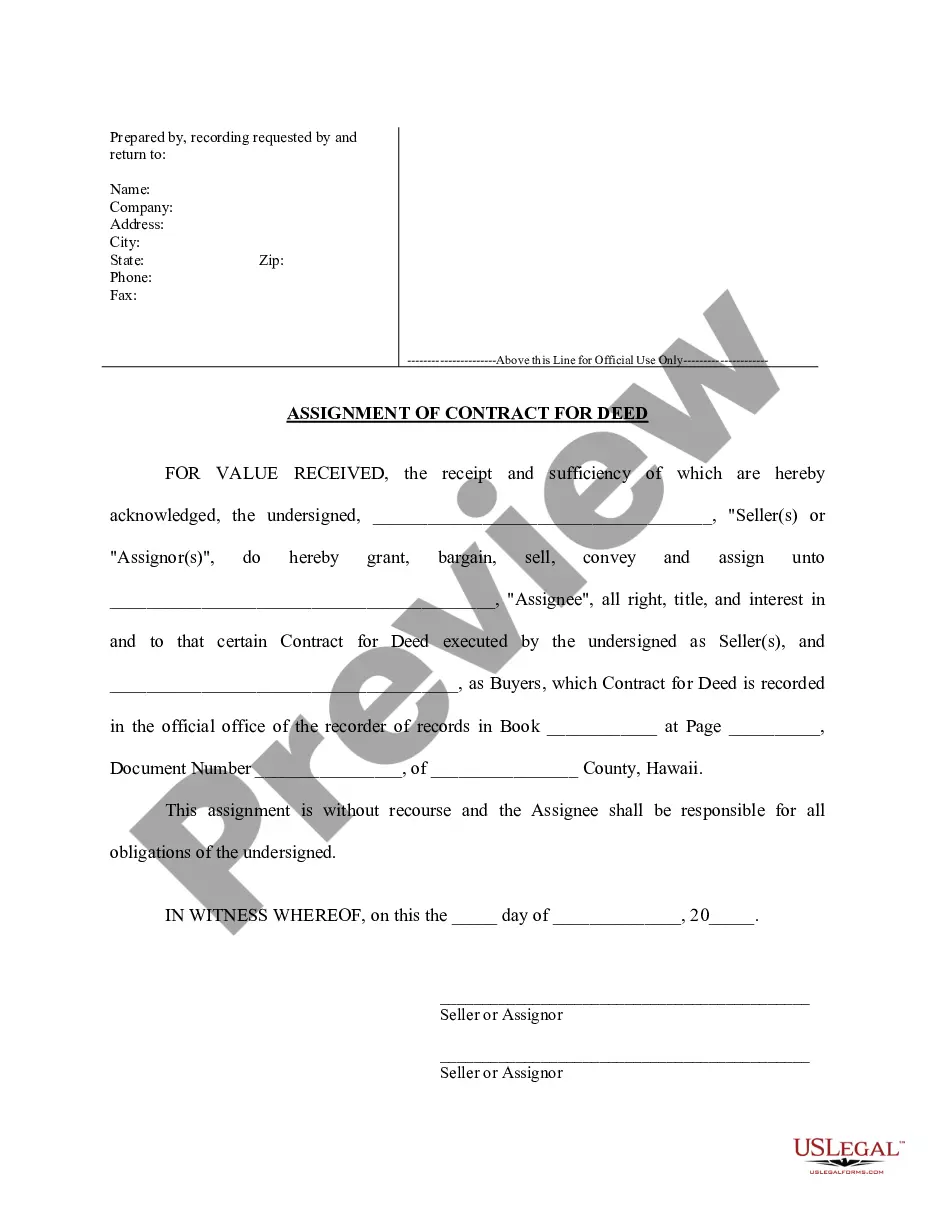

A sample of revocation living trust with a trustee typically includes a formal statement declaring the intention to revoke the trust. This document should clearly identify the original living trust, stating the name of the trust and its date of creation. Additionally, it may specify the trustee and any relevant beneficiaries, ensuring transparency in the revocation process. Using a reliable platform like US Legal Forms can assist you in crafting this legal document accurately, providing you with peace of mind during the transition.